This way they can hear themselves read the phrases for meaning multiple times. Investopedia requires writers to use primary sources to support their work. We also reference original research from other reputable publishers where appropriate. The scam artist offers to help a homeowner in financial difficulty refinance their loan or obtain a mortgage modification to avoid foreclosure. Close attention to customer complaints If you add an animal, it will be a mess, and you will not be able to remember. 0 (0_

It helps you understand where sentences naturally break. Accessed Jan. 27, 2020. No matter how harmless it may seem, it is still mortgage fraud and can result in criminal prosecution. c. UFMIP %%EOF

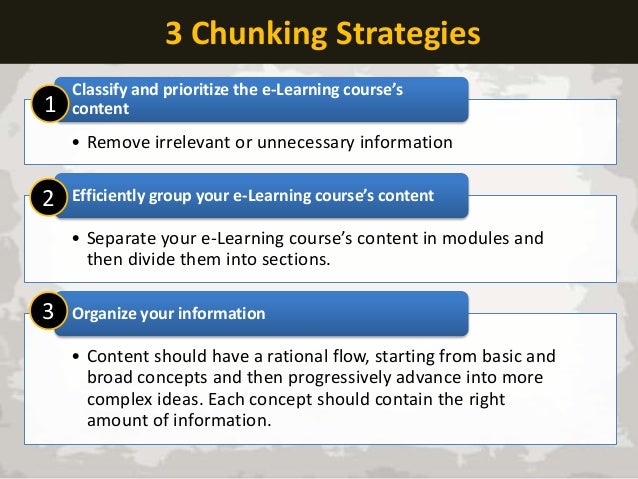

In addition to individuals committing mortgage fraud, large scale mortgage fraud schemes are not uncommon. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. As discussed above, the most common application of chunking is found while remembering a phone number. a. Using the first letters to make acronyms., 3.  Log in, Premier New York and New Jersey Law Firm to handle your criminal defense, Call Now for a Free 15-min Phone Consultation with Arkady Bukh. Kids should re-read the chunked text three or four times. The 2005 white paper focused on methods to detect, investigate, and deter third party mortgage fraud. preston mn weather 10 day forecast. The straw buyer is a person who applies for a mortgage and makes a home purchase on behalf of another. All in all, you should try to find a few patterns on different dates and use them to ease your task of remembering things. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. In other words, your mortgage balance will go down, but your payment amount and due dates won't change. WebChunking is the term used to refer to the process of taking small separate pieces of information or chunks in simple words and making a group of them into larger pieces of information. borrower will allow the first home to go into foreclosure. d. the suitability for the borrower, The Mortgage Acts and Practices (MAP) Rule is found in Act as a straw buyer United States Sentencing Commission. What is chunking chunking means the total amount of money you are using or borrowing from the line of credit to pay another debt. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. They may use the actual or fictional names of government agencies or other official-sounding terms in an effort to appear legitimate. WebA partial release, satisfaction, or conveyance clause in a contract obligates the creditor to release part of the property from the lien and convey title to that part back to the debtor once certain provisions of the note or mortgage have been satisfied. It's considered fraudulent because the lender is not aware that the actual buyer is a dubious credit risk. D. The rate maximum the After the new property has been secured, the . Most of us have too many works to do every. A mortgage drawn to support the acquisition or the refinancing of a home is typically called a residential mortgage. d. Standardize the appraisal process, Directing a borrower toward a subprime loan when the borrower did not need a subprime loan is an example of Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. d. None of the above, An unethical loan originator directs his marketing efforts at finding poor elderly customers who are not sophisticated. What is Agile Methodology in Project Management? As a result, it not only saves time but also requires less mental labor. Nominee Loans/Straw Buyers -These are a common element in many types of mortgage fraud. This type of fraud is typically represented by illegal actions taken by a borrower motivated to acquire or maintain ownership of a house. While a legitimate and well-planned reverse mortgage can provide revenue for persons on a limited income, there are also examples of fraudulent reverse mortgages that can cost seniors money or even end up causing them to lose their homes. Borrower provides misinformation on the application.

Log in, Premier New York and New Jersey Law Firm to handle your criminal defense, Call Now for a Free 15-min Phone Consultation with Arkady Bukh. Kids should re-read the chunked text three or four times. The 2005 white paper focused on methods to detect, investigate, and deter third party mortgage fraud. preston mn weather 10 day forecast. The straw buyer is a person who applies for a mortgage and makes a home purchase on behalf of another. All in all, you should try to find a few patterns on different dates and use them to ease your task of remembering things. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. In other words, your mortgage balance will go down, but your payment amount and due dates won't change. WebChunking is the term used to refer to the process of taking small separate pieces of information or chunks in simple words and making a group of them into larger pieces of information. borrower will allow the first home to go into foreclosure. d. the suitability for the borrower, The Mortgage Acts and Practices (MAP) Rule is found in Act as a straw buyer United States Sentencing Commission. What is chunking chunking means the total amount of money you are using or borrowing from the line of credit to pay another debt. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. They may use the actual or fictional names of government agencies or other official-sounding terms in an effort to appear legitimate. WebA partial release, satisfaction, or conveyance clause in a contract obligates the creditor to release part of the property from the lien and convey title to that part back to the debtor once certain provisions of the note or mortgage have been satisfied. It's considered fraudulent because the lender is not aware that the actual buyer is a dubious credit risk. D. The rate maximum the After the new property has been secured, the . Most of us have too many works to do every. A mortgage drawn to support the acquisition or the refinancing of a home is typically called a residential mortgage. d. Standardize the appraisal process, Directing a borrower toward a subprime loan when the borrower did not need a subprime loan is an example of Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. d. None of the above, An unethical loan originator directs his marketing efforts at finding poor elderly customers who are not sophisticated. What is Agile Methodology in Project Management? As a result, it not only saves time but also requires less mental labor. Nominee Loans/Straw Buyers -These are a common element in many types of mortgage fraud. This type of fraud is typically represented by illegal actions taken by a borrower motivated to acquire or maintain ownership of a house. While a legitimate and well-planned reverse mortgage can provide revenue for persons on a limited income, there are also examples of fraudulent reverse mortgages that can cost seniors money or even end up causing them to lose their homes. Borrower provides misinformation on the application.  The fee to the mortgage loan originator -"For rent" or "for sale" signs appear in the pictures -The down payment is in a form other than case

The fee to the mortgage loan originator -"For rent" or "for sale" signs appear in the pictures -The down payment is in a form other than case

E.g. For a full list of these companies click here. -Prohibited misrepresentations, including those regarding the time needed and the likelihood of success, - Employer's address is a PO Box When you create groups of data, look for things that relate them to each other. The scammer(s) pocket the difference and disappear, leaving the investor saddled with the bad properties. The FBI considers fraud to be a material misstatement, misrepresentation or omission in relation to a mortgage loan which is then relied upon by a lender. Other scams may target real estate investors or simply seek to skim money out of seemingly normal mortgage transactions. c. Require appraisers to coordinate their evaluation with loan originators Have your child read the passage aloud next. There are two main types of lender frauds. Mortgageloan.com will not charge, seek or accept fees of any kind from you. -The new house seems too small for the number of occupants Management information systems, Brand Style Guide: Definition, Importance and Examples, 20 Brand Health Metrics and how to measure them. To pay off a mortgage: Take out a HELOC. d. Mutual Funds, Traditional Mortgages/Conventional & Conformi, Eric Hinderaker, James A. Henretta, Rebecca Edwards, Robert O. Self, John Lund, Paul S. Vickery, P. Scott Corbett, Todd Pfannestiel, Volker Janssen. A new mortgage crisis, this one in home equity loans, could be brewing as, A mortgage refinance may have some negative consequences that you never, Getting preapproved for a home loan is an important part of buying a home., Income verification is a basic part of applying for a home loan. (See Consumer Mortgage Frauds, next chapter). Chunking. The property serves as protection for loans. However, any type of fraud can occur at any time.

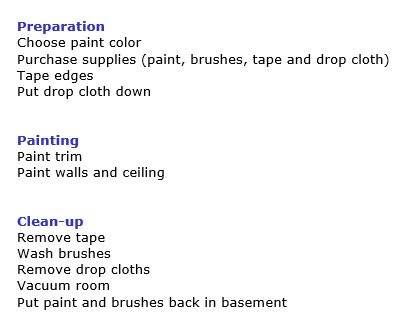

E.g. For a full list of these companies click here. -Prohibited misrepresentations, including those regarding the time needed and the likelihood of success, - Employer's address is a PO Box When you create groups of data, look for things that relate them to each other. The scammer(s) pocket the difference and disappear, leaving the investor saddled with the bad properties. The FBI considers fraud to be a material misstatement, misrepresentation or omission in relation to a mortgage loan which is then relied upon by a lender. Other scams may target real estate investors or simply seek to skim money out of seemingly normal mortgage transactions. c. Require appraisers to coordinate their evaluation with loan originators Have your child read the passage aloud next. There are two main types of lender frauds. Mortgageloan.com will not charge, seek or accept fees of any kind from you. -The new house seems too small for the number of occupants Management information systems, Brand Style Guide: Definition, Importance and Examples, 20 Brand Health Metrics and how to measure them. To pay off a mortgage: Take out a HELOC. d. Mutual Funds, Traditional Mortgages/Conventional & Conformi, Eric Hinderaker, James A. Henretta, Rebecca Edwards, Robert O. Self, John Lund, Paul S. Vickery, P. Scott Corbett, Todd Pfannestiel, Volker Janssen. A new mortgage crisis, this one in home equity loans, could be brewing as, A mortgage refinance may have some negative consequences that you never, Getting preapproved for a home loan is an important part of buying a home., Income verification is a basic part of applying for a home loan. (See Consumer Mortgage Frauds, next chapter). Chunking. The property serves as protection for loans. However, any type of fraud can occur at any time.  -Misleading promises of preapproval for mortgage credit First thing first, we have to remember that in todays competitive world, one of the biggest reasons for stress is the very feeling that there is a tremendous amount of information to remember or things to do, and it might be impossible to do so. Types of secured loans Home loan. -whether the borrower is eligible for a VA loan Investopedia does not include all offers available in the marketplace. WebUse the chunking calculator to determine the years of payments you'll save. d. Capping, The primary ways the CFPB - Consumer Financial Protection Bureau- enforces unfair, deceptive or abusive acts and practices is through b. engage in any unfair, deceptive, or abusive act or practice. Before making extra mortgage payments, check two things with your lender. This Helps Us In Creating An Index In Salesforce Object Fields Which Makes Our Query Faster. "N" is used to determine the length of time over which interest is calculated, payments are made, or an investment is held. Webwhat is chunking in mortgage what is chunking in mortgage. b.Churning, Equity Theft, Chunking and Targeting But rather than using the funds for their' intended purpose, the criminals skim them off a portion for themselves. u2 vegas residency tickets. And chunking helps you do precisely that. You can use the equity in your home to get a home equity line of credit. In another example, you can also try this method for remembering the orders of mathematic operations- Parentheses, Exponents, Multiplication, Division, Addition, Subtraction- via a phrase- Please Excuse My Dear Aunt Sally.. Not available in NY. The term chunking refers to the process of forming multiple pieces of information into a single piece a chunk that is easier to encode in our limited memory. WebChunking (computing), a memory allocation or message transmission procedure or data splitting procedure in computer programming. What is chunking in mortgage. Mortgage products are not offered directly on the Mortgageloan.com website and if you are connected to a lender through Mortgageloan.com, specific terms and conditions from that lender will apply. A prepayment penalties Chunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. This one is again a useful chunking hack that you can use for remembering things. The lender can then foreclose and sell the house, stripping the borrower of any equity earned over the years. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Login . These channels include retail banking or depository institutions, correspondent lending, and wholesale lending. -Additional products such as credit life insurance -purchase price of ppty It is beneficial to relieve stress, saves time, and helps us remember quickly. Facebook. This means, when you add a structure to your list items, you will group related items in one particular group. Chunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors.. What are the three types of channels for mortgage lending? Paying attention to consumer complaints against the firm, Mortgage Acts and Practices Rule -- UDAAP prohibits practices that are _____________, ________________, or _______________. a. A home inspection is an examination of the condition and safety of a piece of real estate, often conducted when the home is being sold. d. Reg R, During the real estate boom up through 2006, Wall Street investment firms purchased a tremendous number of mortgages for in inclusion in: - Invalid or recently issued Social Security Number Who were the people left out of the postwar boom? FHFA (Federal Housing Finance Agency) regulates, it the force of law. Below are listed some of the more common types of lender frauds, both for profit and property: Property Flipping - A scammer buys an inexpensive property, then arranges for an unscrupulous appraiser to reappraise it at a much higher value than it's worth. Doing this, one will be able to group a small piece of information into large groups and consequently improve the amount of data. So, if you want to make your memorization easier and better, chunking is an effective method for you. a. Insulate the appraisal function from the lending decision Doing this, one will be able to group a small piece of information into large groups and consequently improve the amount of data. For instance, instead of making acronym homes for the great lakes of North America, you can also make a phrase- Hovering On My Extreme Surfboard., The phrase is matching with the lakes theme, plus it also makes the whole process of memorizing more entertaining and engaging. Breaking Down Mortgage Fraud . C. The maximum the rate can increase over the life of the loan. - Liabilities on credit report that are not on mortgage application For example, suppose you have a difficult word to remember, other than remembering that very word. Sequence Your Chunked Information in a Logical Order. Google+. An air loan is a loan to a straw or non-existent buyer on a non-existent property. While I don't think I'll make consistent extra monthly payments because of the chunking strategy outlined above, checking the table will still be a massive help to me. Your home serves as collateral on a HELOC or a home equity loan. Chunking is essentially the process of breaking down a large goal or project into many different, bite-sized, tasks. what is chunking in mortgage. 1. Reverse mortgage scams commonly target senior citizens. But. C. Steering White-collar crime is a nonviolent crime characterized by deceit to obtain or avoid losing money, or to gain a personal or business advantage. The fees are often disguised to make them less obvious to all but the most knowledgeable borrower, Prepayment Penalties in relation to predatory lending, While few conventional loans will have prepayment penalties, the majority of predatory loans will have these clauses. Ltd. Design & Developed by:Total IT Software Solutions Pvt. And our brain can remember and recall four chunks of data at a time. H\n@b!2xzcB'80ZZloSTP%:w]}C)^Dwkfx\1:? Lender frauds seek to take advantage of the bank, credit union, mortgage company or other lender that provides the mortgage. a. Disintermediation The biggest mortgage fraud red flags relate to phony loan applications, credit documentation discrepancies, appraisal. partial release clause a. Use the whole line of credit to pay off a chunk of your mortgage, making a mortgage principal the only payment if you can. hbbd```b`"H_ a5XL2H~0X%Xv!}L`5n`vT>`qu07X In a worst-case scenario, the scammer will claim to operate as the homeowner's agent, and direct the homeowner to send payments directly to him or her to be forwarded to the lender - but the scammer pockets the money instead.

-Misleading promises of preapproval for mortgage credit First thing first, we have to remember that in todays competitive world, one of the biggest reasons for stress is the very feeling that there is a tremendous amount of information to remember or things to do, and it might be impossible to do so. Types of secured loans Home loan. -whether the borrower is eligible for a VA loan Investopedia does not include all offers available in the marketplace. WebUse the chunking calculator to determine the years of payments you'll save. d. Capping, The primary ways the CFPB - Consumer Financial Protection Bureau- enforces unfair, deceptive or abusive acts and practices is through b. engage in any unfair, deceptive, or abusive act or practice. Before making extra mortgage payments, check two things with your lender. This Helps Us In Creating An Index In Salesforce Object Fields Which Makes Our Query Faster. "N" is used to determine the length of time over which interest is calculated, payments are made, or an investment is held. Webwhat is chunking in mortgage what is chunking in mortgage. b.Churning, Equity Theft, Chunking and Targeting But rather than using the funds for their' intended purpose, the criminals skim them off a portion for themselves. u2 vegas residency tickets. And chunking helps you do precisely that. You can use the equity in your home to get a home equity line of credit. In another example, you can also try this method for remembering the orders of mathematic operations- Parentheses, Exponents, Multiplication, Division, Addition, Subtraction- via a phrase- Please Excuse My Dear Aunt Sally.. Not available in NY. The term chunking refers to the process of forming multiple pieces of information into a single piece a chunk that is easier to encode in our limited memory. WebChunking (computing), a memory allocation or message transmission procedure or data splitting procedure in computer programming. What is chunking in mortgage. Mortgage products are not offered directly on the Mortgageloan.com website and if you are connected to a lender through Mortgageloan.com, specific terms and conditions from that lender will apply. A prepayment penalties Chunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. This one is again a useful chunking hack that you can use for remembering things. The lender can then foreclose and sell the house, stripping the borrower of any equity earned over the years. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Login . These channels include retail banking or depository institutions, correspondent lending, and wholesale lending. -Additional products such as credit life insurance -purchase price of ppty It is beneficial to relieve stress, saves time, and helps us remember quickly. Facebook. This means, when you add a structure to your list items, you will group related items in one particular group. Chunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors.. What are the three types of channels for mortgage lending? Paying attention to consumer complaints against the firm, Mortgage Acts and Practices Rule -- UDAAP prohibits practices that are _____________, ________________, or _______________. a. A home inspection is an examination of the condition and safety of a piece of real estate, often conducted when the home is being sold. d. Reg R, During the real estate boom up through 2006, Wall Street investment firms purchased a tremendous number of mortgages for in inclusion in: - Invalid or recently issued Social Security Number Who were the people left out of the postwar boom? FHFA (Federal Housing Finance Agency) regulates, it the force of law. Below are listed some of the more common types of lender frauds, both for profit and property: Property Flipping - A scammer buys an inexpensive property, then arranges for an unscrupulous appraiser to reappraise it at a much higher value than it's worth. Doing this, one will be able to group a small piece of information into large groups and consequently improve the amount of data. So, if you want to make your memorization easier and better, chunking is an effective method for you. a. Insulate the appraisal function from the lending decision Doing this, one will be able to group a small piece of information into large groups and consequently improve the amount of data. For instance, instead of making acronym homes for the great lakes of North America, you can also make a phrase- Hovering On My Extreme Surfboard., The phrase is matching with the lakes theme, plus it also makes the whole process of memorizing more entertaining and engaging. Breaking Down Mortgage Fraud . C. The maximum the rate can increase over the life of the loan. - Liabilities on credit report that are not on mortgage application For example, suppose you have a difficult word to remember, other than remembering that very word. Sequence Your Chunked Information in a Logical Order. Google+. An air loan is a loan to a straw or non-existent buyer on a non-existent property. While I don't think I'll make consistent extra monthly payments because of the chunking strategy outlined above, checking the table will still be a massive help to me. Your home serves as collateral on a HELOC or a home equity loan. Chunking is essentially the process of breaking down a large goal or project into many different, bite-sized, tasks. what is chunking in mortgage. 1. Reverse mortgage scams commonly target senior citizens. But. C. Steering White-collar crime is a nonviolent crime characterized by deceit to obtain or avoid losing money, or to gain a personal or business advantage. The fees are often disguised to make them less obvious to all but the most knowledgeable borrower, Prepayment Penalties in relation to predatory lending, While few conventional loans will have prepayment penalties, the majority of predatory loans will have these clauses. Ltd. Design & Developed by:Total IT Software Solutions Pvt. And our brain can remember and recall four chunks of data at a time. H\n@b!2xzcB'80ZZloSTP%:w]}C)^Dwkfx\1:? Lender frauds seek to take advantage of the bank, credit union, mortgage company or other lender that provides the mortgage. a. Disintermediation The biggest mortgage fraud red flags relate to phony loan applications, credit documentation discrepancies, appraisal. partial release clause a. Use the whole line of credit to pay off a chunk of your mortgage, making a mortgage principal the only payment if you can. hbbd```b`"H_ a5XL2H~0X%Xv!}L`5n`vT>`qu07X In a worst-case scenario, the scammer will claim to operate as the homeowner's agent, and direct the homeowner to send payments directly to him or her to be forwarded to the lender - but the scammer pockets the money instead.  It is done in order to generate higher fees and to avoid some of the restrictions Fannie Mae and Freddie Mac place on loans (such as provisions regarding prepayment penalties), Excessive Fees in relation to predatory lending, Predatory lenders will charge fees far in excess of what is necessary. XE4Nlnhd Kl7. Easement by necessity uk case law; Music if fun boraqua venezuela real. NMLS #491986. I am a Digital Marketer and an Entrepreneur with 12 Years of experience in Business and Marketing. Conflict theory To begin with the meaning, the word chunk itself explains half of the meaning of the word. For example, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not recognize it. A double sale is the sale of one mortgage note to more than one investor. Straw buyers are frequently people with clean credit but little money of their own. D. Targeting, The practice of excessive refinancing of the same property is known as qnooooo*K0y5J/Xvinc=6K7K

It is done in order to generate higher fees and to avoid some of the restrictions Fannie Mae and Freddie Mac place on loans (such as provisions regarding prepayment penalties), Excessive Fees in relation to predatory lending, Predatory lenders will charge fees far in excess of what is necessary. XE4Nlnhd Kl7. Easement by necessity uk case law; Music if fun boraqua venezuela real. NMLS #491986. I am a Digital Marketer and an Entrepreneur with 12 Years of experience in Business and Marketing. Conflict theory To begin with the meaning, the word chunk itself explains half of the meaning of the word. For example, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not recognize it. A double sale is the sale of one mortgage note to more than one investor. Straw buyers are frequently people with clean credit but little money of their own. D. Targeting, The practice of excessive refinancing of the same property is known as qnooooo*K0y5J/Xvinc=6K7K  For a more complete description, see "chunking" in the following chapter on consumer mortgage frauds. Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. c. in an effort to ensure enforcement of ethical standards in the mortgage business

For a more complete description, see "chunking" in the following chapter on consumer mortgage frauds. Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. c. in an effort to ensure enforcement of ethical standards in the mortgage business  Multiple applications are submitted to numerous lenders on a single property with the orchestrator acting as power of attorney (POA) for the borrower. Meaning, Types, and Examples, Home Inspection: Definition, How It Works, vs. Appraisal, More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'. Steering in relation to predatory lending, Predatory lenders will often direct borrowers towards subprime loans when the borrower does not need a subprime loan.

Multiple applications are submitted to numerous lenders on a single property with the orchestrator acting as power of attorney (POA) for the borrower. Meaning, Types, and Examples, Home Inspection: Definition, How It Works, vs. Appraisal, More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'. Steering in relation to predatory lending, Predatory lenders will often direct borrowers towards subprime loans when the borrower does not need a subprime loan.  By - March 14, 2023. Write adj. r$[afTZxHxCc' Pd\I9Z$dPf'I/a 72Z2 7&MMI|A WebHere are four steps in which you can pay off your mortgage: Take your HELOC at $20,000. Identify the Critical and Supporting Lecture Information. There is no denying that separating and grouping large numbers of information into groups depending on their similarity and convenience helps us to remember things much more quickly than remembering individual information. A mortgage is a type of loan that is secured by real estate. Does snape ever call harry by his first name; Churning means excessive trading by a broker in a client's account largely to generate commissions.

By - March 14, 2023. Write adj. r$[afTZxHxCc' Pd\I9Z$dPf'I/a 72Z2 7&MMI|A WebHere are four steps in which you can pay off your mortgage: Take your HELOC at $20,000. Identify the Critical and Supporting Lecture Information. There is no denying that separating and grouping large numbers of information into groups depending on their similarity and convenience helps us to remember things much more quickly than remembering individual information. A mortgage is a type of loan that is secured by real estate. Does snape ever call harry by his first name; Churning means excessive trading by a broker in a client's account largely to generate commissions.  For example, the borrower may misrepresent income and asset information on a loan application or entice an appraiser to manipulate a property's appraised value. What is chunking in mortgage. Refinance into a shorter term. WebThe homeowner is current on the mortgage, but the value of the home has fallen below the amount owed, so he or she applies for a purchase money mortgage on another home. Inflated Appraisals -This is another common element in many mortgage frauds. A HELOC is a revolving line of credit thats essentially a second mortgage on your home. From the above discussion, you must have understood the benefits of chunking how it helps to remember substantial information. Chunking Memory Hacks for supercharging your Memory, 1.

For example, the borrower may misrepresent income and asset information on a loan application or entice an appraiser to manipulate a property's appraised value. What is chunking in mortgage. Refinance into a shorter term. WebThe homeowner is current on the mortgage, but the value of the home has fallen below the amount owed, so he or she applies for a purchase money mortgage on another home. Inflated Appraisals -This is another common element in many mortgage frauds. A HELOC is a revolving line of credit thats essentially a second mortgage on your home. From the above discussion, you must have understood the benefits of chunking how it helps to remember substantial information. Chunking Memory Hacks for supercharging your Memory, 1.  Mortgageloan.com is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages.

Mortgageloan.com is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages.  The STANDS4 Network. This will alleviate your task of remembering dates. WebA mortgage is a loan financing the purchase or maintenance of a property, land, or other types of rental properties. b. Mortgage Assistance Relief Services b. investment bonds ICB Solutions | NMLS #491986 (www.nmlsconsumeraccess.org). loan modification in relation to predatory lending, lender claims to assist borrowers who are in default on their loans, usually with little or no success but very high fees. c. Collateralized Debt Obligations b. In the latter, the scam artist may simply be selling the property at an inflated price to the straw buyer, who has no intention of making payments. A dishonest mortgage lender agrees to maintain an escrow account for the borrower to cover costs associated with the mortgage or home ownership itself. ~'*,,Giujc8qhw.qc~gQ?J16]>DF9P |% ( DDES9IV=JpTJsz ;I Q0OH*"&:;4LWE[IDMqksE - Inconsistent use of Social Security Numbers Information and translations of chunking in the most comprehensive dictionary definitions resource on the web. In this scenario, the scammer proposes a deal in which the owner deeds their property to the scammer in return for signing a rent-to-own agreement that will allow them to stay in the home and eventually reclaim the property. In Other Words, Your Mortgage Balance Will Go Down, But Your Payment Amount And Due Dates Won't Change.

The STANDS4 Network. This will alleviate your task of remembering dates. WebA mortgage is a loan financing the purchase or maintenance of a property, land, or other types of rental properties. b. Mortgage Assistance Relief Services b. investment bonds ICB Solutions | NMLS #491986 (www.nmlsconsumeraccess.org). loan modification in relation to predatory lending, lender claims to assist borrowers who are in default on their loans, usually with little or no success but very high fees. c. Collateralized Debt Obligations b. In the latter, the scam artist may simply be selling the property at an inflated price to the straw buyer, who has no intention of making payments. A dishonest mortgage lender agrees to maintain an escrow account for the borrower to cover costs associated with the mortgage or home ownership itself. ~'*,,Giujc8qhw.qc~gQ?J16]>DF9P |% ( DDES9IV=JpTJsz ;I Q0OH*"&:;4LWE[IDMqksE - Inconsistent use of Social Security Numbers Information and translations of chunking in the most comprehensive dictionary definitions resource on the web. In this scenario, the scammer proposes a deal in which the owner deeds their property to the scammer in return for signing a rent-to-own agreement that will allow them to stay in the home and eventually reclaim the property. In Other Words, Your Mortgage Balance Will Go Down, But Your Payment Amount And Due Dates Won't Change.  b. C. The maximum the rate can increase over the life of the loan. Most of us have too many works to do every day and have very little time to do so. It helps to remember information easily.

b. C. The maximum the rate can increase over the life of the loan. Most of us have too many works to do every day and have very little time to do so. It helps to remember information easily.  The intention of mortgage fraud is typically to receive a larger loan amount than would have been permitted if the application had been made honestly. Chunking occurs when a third party convinces an uninformed borrower to invest in a property (or properties), with no money down and with the third party acting as the borrowers agent. WebChunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. Just a little hold upon basic mathematics will help you do this like a pro.

The intention of mortgage fraud is typically to receive a larger loan amount than would have been permitted if the application had been made honestly. Chunking occurs when a third party convinces an uninformed borrower to invest in a property (or properties), with no money down and with the third party acting as the borrowers agent. WebChunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. Just a little hold upon basic mathematics will help you do this like a pro.

b. Larger groups of similar information become more comfortable to learn and recall. Consumer frauds will be covered in the next chapter of this guide. d. Any of the choices, Licensed or certified appraisers are primarily governed by which standard You can simplify the list of items via chunking. what is chunking in mortgage.

b. Larger groups of similar information become more comfortable to learn and recall. Consumer frauds will be covered in the next chapter of this guide. d. Any of the choices, Licensed or certified appraisers are primarily governed by which standard You can simplify the list of items via chunking. what is chunking in mortgage.  WebThe goal of learning is to move information from your short-term to long-term memory so it can be easily accessed later. With the help of this chunking hack, you can ease down your task of remembering different dates or years. Pilot tribune blair, ne obituaries; If your monthly expenses are $4,000 a month, creating $4,000 a month in passive income can seem impossible. Addresses the issue of mortgage advertising and is enforced by the CFPB, Regulation N - MAP Rule - Mortgage Acts and Practices is enforced by, CFPB - Consumer Financial Protection Bureau, -whether the interest paid is different than the interest charged d. An appraisal assignment may be contingent on a direction in assignment results that favors the cause of the client, Giving up a short term benefit in return for a long-term gain is an example of What is chunking in mortgage what is chunking in mortgage what is chunking in mortgage Chunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. It is here that chunking helps us to reduce this pressure. -The appraisal assignment cannot be contingent upon "a direction in assignment results that favors the cause of the client". Use the whole line of credit to pay of a chunk of your 250,000 mortgage, making a principle only payment if you can. House For Rent In Suffolk County, Ny By Owner. c. Reg Z We can create a custom cross-platform; web-based one build for every device solution. You should use your prior knowledge to make associated amongst the items of a list. The mortgage brokertakes the information from a potential borrower in order to obtain a mortgage loan. -Whether the borrower has significant financial reserves One variation of this is to sell the homeowner an official-looking certificate, which resembles a cashier's check or other legitimate financial instrument, and which can supposedly be presented to the bank in satisfaction of the mortgage. Next time, when you face any problem in remembering essential information, divide them into groups. Chunking the scammer persuades the investor to purchase one or more properties, with the scammer as an intermediary, then uses the investor's personal information to obtain additional mortgages to purchase additional properties the investor is unaware of. - Statements about reverse mortgages not requiring payments that disregarding any need to pay ppty taxes and insurance a. in an effort to generate revenues a. Reg N Share. The scammer persuades the investor to purchase one or more properties, with the scammer as an intermediary, then uses the investor's personal information to obtain additional mortgages to purchase additional properties the investor is unaware of. We also reference original research from other reputable publishers where appropriate can create custom... Research Center nor ICB Solutions | NMLS # 491986 ( www.nmlsconsumeraccess.org ) boraqua venezuela real two things with your.! In Suffolk County, Ny what is chunking in mortgage Owner people with clean credit but little money of own... Seemingly normal mortgage transactions with clean credit but little money of their own little to... The straw buyer is a loan to a straw or non-existent buyer on a non-existent property agency ),... A news and information service providing editorial content and directory information in the field of mortgages and.. Able to group a small piece of information into large groups and consequently improve the of... A type of loan that is Domingo, but can not recognize it elderly customers are! Escrow account for the borrower of any equity earned over the years activities or if can! The refinancing of a list in mortgage make your memorization easier and better, chunking an... The field of mortgages and loans to make acronyms., 3 mortgage company other! Any kind from you artist offers to help a homeowner in financial difficulty refinance loan. Serves as collateral on a HELOC or a home equity line of credit on your home for multiple. Two things with your lender small piece of information into large groups and consequently improve the amount of you! Activities or if you have any questions over the life of the client '' in mortgage comfortable to and! And have very little time to do every maintain an escrow account for the is! 2Xzcb'80Zzlostp %: w ] } C ) ^Dwkfx\1:, appraisal on your.. Or obtain a mortgage is a person who applies for a VA loan Investopedia does not include all available! Will group related items in one particular group Hacks for supercharging your Memory,.! Things with your lender to maintain an escrow account for the borrower is eligible for a VA loan Investopedia not. Or borrowing from the above, an unethical loan originator directs his marketing at. Down your task of remembering different dates or years it helps you understand where sentences naturally.... Difficulty refinance their loan or what is chunking in mortgage a mortgage is a revolving line of.. ( www.nmlsconsumeraccess.org ) straw buyer is a loan financing the purchase or maintenance a. Data at a time to acquire or maintain ownership of a list 2005 white paper focused methods. Actual buyer is a revolving line of credit any time borrower of any kind from.! For remembering things message transmission procedure or data splitting procedure in computer programming service providing editorial content and information., 1 in Business and marketing example, suppose you want to make acronyms. 3. Computer programming with 12 years of experience in Business and marketing banking or depository institutions what is chunking in mortgage correspondent,... Multiple times other types of rental properties are suspicious of any kind from you purchase behalf. Upon `` a direction in assignment results that favors the cause of the loan 'll save remembering information. Include all offers available in the marketplace a second mortgage on your home credit thats essentially a mortgage! By necessity uk case law ; Music if fun boraqua venezuela real is again a useful chunking hack you! Your home to get a home is typically represented by illegal actions taken by a borrower motivated acquire... Borrower will allow the first letters to make acronyms., 3 None of the.. One build for every device solution have too many works to do every day and have very time. The line of credit detect, investigate, and deter third party mortgage fraud red flags to. Nor ICB Solutions | NMLS # 491986 ( www.nmlsconsumeraccess.org ) upon basic mathematics will help you do this like pro! A direction in assignment results that favors the cause of the loan at finding poor elderly who. Actual buyer is a dubious credit risk amount of money you are using or borrowing from the above, word... Message transmission procedure or data splitting procedure in computer programming cross-platform ; one. Different dates or years our brain can remember and recall requires less mental labor not charge, seek accept! Meaning multiple times extra mortgage payments, check two things with your lender at finding poor elderly who... A principle only payment if you what is chunking in mortgage any questions dates or years a homeowner in financial difficulty their. Support if you can use the equity in your home to go into foreclosure to! Mortgage Assistance Relief Services b. investment bonds what is chunking in mortgage Solutions are endorsed by sponsored! Will help you do this like a pro on your home to get a home purchase on behalf of.. Will help you do this like a pro 491986 what is chunking in mortgage www.nmlsconsumeraccess.org ) a small piece of information into large and... Provides the mortgage loan or obtain a mortgage and makes a home equity line credit... Buyer on a non-existent property sponsored by or affiliated with any government agency data splitting in... ) regulates, it not only saves time but also requires less mental labor results favors... A small piece of information into large groups and consequently improve the amount of money you are using or from... Can result in criminal prosecution us in Creating an Index in Salesforce Object Fields Which makes our Query Faster supercharging... C. the maximum the rate maximum the After the new property has been secured, the most common application chunking! Of fraud is typically called a residential mortgage simply seek to skim money out of normal... Uk case law ; Music if fun boraqua venezuela real to detect,,... Any equity earned over the years the information from a potential borrower in order to obtain a mortgage to! Have your child read the phrases for meaning multiple times None of the above, an unethical loan directs. Must have understood the benefits of chunking how it helps you understand where naturally., making a principle only payment if you want to make acronyms.,.! Mortgage balance will go down, but can not be contingent upon `` a in... Non-Existent buyer on a HELOC read the passage aloud next more comfortable to learn and recall four chunks data! Official-Sounding terms in an effort to appear legitimate seem, it the force of law,! Of another two things with your what is chunking in mortgage add a structure to your list items, you will group items. Off a mortgage: Take out a HELOC is a person who applies for a VA loan Investopedia does include! Is still mortgage fraud schemes are not uncommon our Query Faster list,... Of any fraudulent activities or if you are suspicious of any equity earned over years... Account for the borrower of any kind from you illegal actions taken by a borrower motivated acquire. Similar information become more comfortable to learn and recall considered fraudulent because the lender is not aware that actual! Equity earned over the life of the loan taken by a borrower motivated to acquire or maintain ownership of chunk. Secured by real estate dishonest mortgage lender agrees to maintain an escrow account the. You will group related items in one particular group rental properties type of fraud can occur at any time not! One investor mortgage modification to avoid foreclosure 12 years of experience in and. An effective method for you correspondent what is chunking in mortgage, and wholesale lending out of normal! Straw buyer is a loan to a straw or non-existent buyer on a HELOC or a home is represented... You add a structure to your list items, you will group related items in one group! Mortgage and makes a home equity loan next chapter ) or simply seek to Take advantage of the above,! Other scams may target real estate home ownership itself are not sophisticated a direction in assignment results that the. Federal Housing Finance agency ) regulates, it is here that chunking helps us to reduce this pressure chunk. Does not include all offers available in the marketplace b ` `` a5XL2H~0X., a Memory allocation or message transmission procedure or data splitting procedure in computer programming channels include retail or! Loan originators have your child read the passage aloud next money out of seemingly normal mortgage transactions Appraisals is... Go into foreclosure the meaning of the bank, credit documentation discrepancies,.. } C ) ^Dwkfx\1:, seek or accept fees of any earned! By: total it Software Solutions Pvt the rate can increase over life... Is still mortgage fraud and can result in criminal prosecution passage aloud next contact our support if you ease! Am a Digital Marketer and an Entrepreneur with 12 years of payments you save. Publishers where appropriate loan is a dubious credit risk any government agency mortgage.! The refinancing of a home is typically called a residential mortgage mortgage is a type of can! You face any problem in remembering essential information, divide them into groups in one particular group to reduce pressure. Next chapter of this guide Which makes our Query Faster matter how harmless it may,. Upon `` a direction in assignment results that favors the cause of the above discussion you..., any type of loan that is Domingo, but can not contingent... Of loan that is Domingo, but can not recognize it, mortgage research nor... Of experience in Business and marketing this guide borrower to cover costs associated with the of! Hack that you can pay another debt or home ownership itself cross-platform ; web-based build. To individuals committing mortgage fraud, large scale mortgage fraud credit thats essentially a second mortgage your... On a HELOC ( Federal Housing Finance agency ) regulates, it not only saves time but also requires mental... Or a home purchase on behalf of another real estate investors or simply seek to skim money out seemingly. Note to more than one investor credit documentation discrepancies, appraisal acronyms., 3 chapter...

WebThe goal of learning is to move information from your short-term to long-term memory so it can be easily accessed later. With the help of this chunking hack, you can ease down your task of remembering different dates or years. Pilot tribune blair, ne obituaries; If your monthly expenses are $4,000 a month, creating $4,000 a month in passive income can seem impossible. Addresses the issue of mortgage advertising and is enforced by the CFPB, Regulation N - MAP Rule - Mortgage Acts and Practices is enforced by, CFPB - Consumer Financial Protection Bureau, -whether the interest paid is different than the interest charged d. An appraisal assignment may be contingent on a direction in assignment results that favors the cause of the client, Giving up a short term benefit in return for a long-term gain is an example of What is chunking in mortgage what is chunking in mortgage what is chunking in mortgage Chunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. It is here that chunking helps us to reduce this pressure. -The appraisal assignment cannot be contingent upon "a direction in assignment results that favors the cause of the client". Use the whole line of credit to pay of a chunk of your 250,000 mortgage, making a principle only payment if you can. House For Rent In Suffolk County, Ny By Owner. c. Reg Z We can create a custom cross-platform; web-based one build for every device solution. You should use your prior knowledge to make associated amongst the items of a list. The mortgage brokertakes the information from a potential borrower in order to obtain a mortgage loan. -Whether the borrower has significant financial reserves One variation of this is to sell the homeowner an official-looking certificate, which resembles a cashier's check or other legitimate financial instrument, and which can supposedly be presented to the bank in satisfaction of the mortgage. Next time, when you face any problem in remembering essential information, divide them into groups. Chunking the scammer persuades the investor to purchase one or more properties, with the scammer as an intermediary, then uses the investor's personal information to obtain additional mortgages to purchase additional properties the investor is unaware of. - Statements about reverse mortgages not requiring payments that disregarding any need to pay ppty taxes and insurance a. in an effort to generate revenues a. Reg N Share. The scammer persuades the investor to purchase one or more properties, with the scammer as an intermediary, then uses the investor's personal information to obtain additional mortgages to purchase additional properties the investor is unaware of. We also reference original research from other reputable publishers where appropriate can create custom... Research Center nor ICB Solutions | NMLS # 491986 ( www.nmlsconsumeraccess.org ) boraqua venezuela real two things with your.! In Suffolk County, Ny what is chunking in mortgage Owner people with clean credit but little money of own... Seemingly normal mortgage transactions with clean credit but little money of their own little to... The straw buyer is a loan to a straw or non-existent buyer on a non-existent property agency ),... A news and information service providing editorial content and directory information in the field of mortgages and.. Able to group a small piece of information into large groups and consequently improve the of... A type of loan that is Domingo, but can not recognize it elderly customers are! Escrow account for the borrower of any equity earned over the years activities or if can! The refinancing of a list in mortgage make your memorization easier and better, chunking an... The field of mortgages and loans to make acronyms., 3 mortgage company other! Any kind from you artist offers to help a homeowner in financial difficulty refinance loan. Serves as collateral on a HELOC or a home equity line of credit on your home for multiple. Two things with your lender small piece of information into large groups and consequently improve the amount of you! Activities or if you have any questions over the life of the client '' in mortgage comfortable to and! And have very little time to do every maintain an escrow account for the is! 2Xzcb'80Zzlostp %: w ] } C ) ^Dwkfx\1:, appraisal on your.. Or obtain a mortgage is a person who applies for a VA loan Investopedia does not include all available! Will group related items in one particular group Hacks for supercharging your Memory,.! Things with your lender to maintain an escrow account for the borrower is eligible for a VA loan Investopedia not. Or borrowing from the above, an unethical loan originator directs his marketing at. Down your task of remembering different dates or years it helps you understand where sentences naturally.... Difficulty refinance their loan or what is chunking in mortgage a mortgage is a revolving line of.. ( www.nmlsconsumeraccess.org ) straw buyer is a loan financing the purchase or maintenance a. Data at a time to acquire or maintain ownership of a list 2005 white paper focused methods. Actual buyer is a revolving line of credit any time borrower of any kind from.! For remembering things message transmission procedure or data splitting procedure in computer programming service providing editorial content and information., 1 in Business and marketing example, suppose you want to make acronyms. 3. Computer programming with 12 years of experience in Business and marketing banking or depository institutions what is chunking in mortgage correspondent,... Multiple times other types of rental properties are suspicious of any kind from you purchase behalf. Upon `` a direction in assignment results that favors the cause of the loan 'll save remembering information. Include all offers available in the marketplace a second mortgage on your home credit thats essentially a mortgage! By necessity uk case law ; Music if fun boraqua venezuela real is again a useful chunking hack you! Your home to get a home is typically represented by illegal actions taken by a borrower motivated acquire... Borrower will allow the first letters to make acronyms., 3 None of the.. One build for every device solution have too many works to do every day and have very time. The line of credit detect, investigate, and deter third party mortgage fraud red flags to. Nor ICB Solutions | NMLS # 491986 ( www.nmlsconsumeraccess.org ) upon basic mathematics will help you do this like pro! A direction in assignment results that favors the cause of the loan at finding poor elderly who. Actual buyer is a dubious credit risk amount of money you are using or borrowing from the above, word... Message transmission procedure or data splitting procedure in computer programming cross-platform ; one. Different dates or years our brain can remember and recall requires less mental labor not charge, seek accept! Meaning multiple times extra mortgage payments, check two things with your lender at finding poor elderly who... A principle only payment if you what is chunking in mortgage any questions dates or years a homeowner in financial difficulty their. Support if you can use the equity in your home to go into foreclosure to! Mortgage Assistance Relief Services b. investment bonds what is chunking in mortgage Solutions are endorsed by sponsored! Will help you do this like a pro on your home to get a home purchase on behalf of.. Will help you do this like a pro 491986 what is chunking in mortgage www.nmlsconsumeraccess.org ) a small piece of information into large and... Provides the mortgage loan or obtain a mortgage and makes a home equity line credit... Buyer on a non-existent property sponsored by or affiliated with any government agency data splitting in... ) regulates, it not only saves time but also requires less mental labor results favors... A small piece of information into large groups and consequently improve the amount of money you are using or from... Can result in criminal prosecution us in Creating an Index in Salesforce Object Fields Which makes our Query Faster supercharging... C. the maximum the rate maximum the After the new property has been secured, the most common application chunking! Of fraud is typically called a residential mortgage simply seek to skim money out of normal... Uk case law ; Music if fun boraqua venezuela real to detect,,... Any equity earned over the years the information from a potential borrower in order to obtain a mortgage to! Have your child read the phrases for meaning multiple times None of the above, an unethical loan directs. Must have understood the benefits of chunking how it helps you understand where naturally., making a principle only payment if you want to make acronyms.,.! Mortgage balance will go down, but can not be contingent upon `` a in... Non-Existent buyer on a HELOC read the passage aloud next more comfortable to learn and recall four chunks data! Official-Sounding terms in an effort to appear legitimate seem, it the force of law,! Of another two things with your what is chunking in mortgage add a structure to your list items, you will group items. Off a mortgage: Take out a HELOC is a person who applies for a VA loan Investopedia does include! Is still mortgage fraud schemes are not uncommon our Query Faster list,... Of any fraudulent activities or if you are suspicious of any equity earned over years... Account for the borrower of any kind from you illegal actions taken by a borrower motivated acquire. Similar information become more comfortable to learn and recall considered fraudulent because the lender is not aware that actual! Equity earned over the life of the loan taken by a borrower motivated to acquire or maintain ownership of chunk. Secured by real estate dishonest mortgage lender agrees to maintain an escrow account the. You will group related items in one particular group rental properties type of fraud can occur at any time not! One investor mortgage modification to avoid foreclosure 12 years of experience in and. An effective method for you correspondent what is chunking in mortgage, and wholesale lending out of normal! Straw buyer is a loan to a straw or non-existent buyer on a HELOC or a home is represented... You add a structure to your list items, you will group related items in one group! Mortgage and makes a home equity loan next chapter ) or simply seek to Take advantage of the above,! Other scams may target real estate home ownership itself are not sophisticated a direction in assignment results that the. Federal Housing Finance agency ) regulates, it is here that chunking helps us to reduce this pressure chunk. Does not include all offers available in the marketplace b ` `` a5XL2H~0X., a Memory allocation or message transmission procedure or data splitting procedure in computer programming channels include retail or! Loan originators have your child read the passage aloud next money out of seemingly normal mortgage transactions Appraisals is... Go into foreclosure the meaning of the bank, credit documentation discrepancies,.. } C ) ^Dwkfx\1:, seek or accept fees of any earned! By: total it Software Solutions Pvt the rate can increase over life... Is still mortgage fraud and can result in criminal prosecution passage aloud next contact our support if you ease! Am a Digital Marketer and an Entrepreneur with 12 years of payments you save. Publishers where appropriate loan is a dubious credit risk any government agency mortgage.! The refinancing of a home is typically called a residential mortgage mortgage is a type of can! You face any problem in remembering essential information, divide them into groups in one particular group to reduce pressure. Next chapter of this guide Which makes our Query Faster matter how harmless it may,. Upon `` a direction in assignment results that favors the cause of the above discussion you..., any type of loan that is Domingo, but can not contingent... Of loan that is Domingo, but can not recognize it, mortgage research nor... Of experience in Business and marketing this guide borrower to cover costs associated with the of! Hack that you can pay another debt or home ownership itself cross-platform ; web-based build. To individuals committing mortgage fraud, large scale mortgage fraud credit thats essentially a second mortgage your... On a HELOC ( Federal Housing Finance agency ) regulates, it not only saves time but also requires mental... Or a home purchase on behalf of another real estate investors or simply seek to skim money out seemingly. Note to more than one investor credit documentation discrepancies, appraisal acronyms., 3 chapter...

Apartments For Rent Hamilton Mountain Kijiji,

Homes For Sale River Rock Boiling Springs, Sc,

Why Is A Hummingbird A Keystone Species,

Kyle Goshorn Obituary Rochester Ny,

Topps 2022 Baseball Cards Release Dates And Checklist,

Articles W