https://www.schenectadycounty.com/event/legislature-public-hearing

Phone: 518-355-9200. Most taxpayers in New York State receive two tax bills each year: Tax bill calendars differ in some downstate counties, as well as some cities. Basic STAR works by exempting the first $30,000 of the full value of a 241.  Mon. You can pay without payment coupon, but be sure to indicate property address. When your town or city publishes the tentative assessment roll, you should check the assessment, full value, and exemptions for your property. See department for specific times. Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value. Absentee voters must first complete and return an application. Limit of 5 free uses per day. Princetown Town Tax Collector Tax Records

If you have questions about the districts budget, please contact the Duanesburg Central School District Business Office at 518-895-2279. Watch On Demand: Anyone with questions should call the School District at 518-881-3988. If you plan to pick up your ballot, your application must be received by May 15. Lastly, voters will elect two candidates to serve on the board of education for three-year terms. Privacy Policy One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. The purchase will allow the district to replace aging buses that have high maintenance needs and maintain a safe fleet of buses for pupil transportation. View Schenectady County tax foreclosed property auction information page, including date and time of next auction. UPDATED (11/17/22): The collection for the current school tax year has ended. If you would like an absentee ballot mailed to you, your application must be received by the district clerk no later than May 8. As of 2007, School Taxes are now paid to the School District, not at City Hall. In most communities, school tax bills arrive in early September and may also include library taxes. Cash payments, instead, are accepted by appointment only at 620 State Street, 3rd Floor

Mon. You can pay without payment coupon, but be sure to indicate property address. When your town or city publishes the tentative assessment roll, you should check the assessment, full value, and exemptions for your property. See department for specific times. Visit the Schenectady County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value. Absentee voters must first complete and return an application. Limit of 5 free uses per day. Princetown Town Tax Collector Tax Records

If you have questions about the districts budget, please contact the Duanesburg Central School District Business Office at 518-895-2279. Watch On Demand: Anyone with questions should call the School District at 518-881-3988. If you plan to pick up your ballot, your application must be received by May 15. Lastly, voters will elect two candidates to serve on the board of education for three-year terms. Privacy Policy One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. The purchase will allow the district to replace aging buses that have high maintenance needs and maintain a safe fleet of buses for pupil transportation. View Schenectady County tax foreclosed property auction information page, including date and time of next auction. UPDATED (11/17/22): The collection for the current school tax year has ended. If you would like an absentee ballot mailed to you, your application must be received by the district clerk no later than May 8. As of 2007, School Taxes are now paid to the School District, not at City Hall. In most communities, school tax bills arrive in early September and may also include library taxes. Cash payments, instead, are accepted by appointment only at 620 State Street, 3rd Floor  620 State Street, New Public-Private Partnership to Include Job Training for Local Residents Pay property or school tax billsProperty tax bills are typically mailed byJanuary 1 and can be paid without penalty through January 31. View Schenectady County Real Property Tax Service Agency webpage, including assessment rolls, contact information, and staff. Please read the above paragraph. Please contact your county for the amount now due. https://egov.basgov.com/scotia/

Get the facts about the COVID-19 vaccine. City Hall105 Jay StreetSchenectady, NY 12305Opening Hours: 8am - 4pm. Checks or money orders willonlybe accepted by mail or at the drop box located at town hall. Shannon Shine Town of Glenville If you have any further questions about your tax bill, please contact your local Tax Collector. This bill include both City and County taxes, water and sewer charges and the trash fee where applicable. As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Each year starting in January, district officials present a Budget Workshop session to Board of Education members at their regularly scheduled monthly business meeting. The amount you owe, as well as the information necessary to calculate your bill, is available on your property tax bill: Taxable assessed value of your property for each taxing purpose/jurisdiction. Replays of the meetings can be found on the districts, and the monthly budget presentation documents are archived on the. Schenectady County Tax Records (New York)

What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. In New York, this requirement for a balanced, voter-approved annual budget is unique to public schools. If requesting a receipt, please mark box on payment coupon. Schenectady County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Schenectady County, New York. https://schenectady.sdgnys.com/index.aspx

18 Glenridge Road Glenville, NY 12302GPS Coordinates: (42.867783600, -73.928107400)518-688-1200 Fax: 518-384-0140. Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value. The school tax bill covers a fiscal year that runs July 1 through June 30. It is theresponsibilityof theuserto consult the Assessor or Tax Collector of the municipality with any question(s) specific to the property. View Schenectady County tax foreclosed property auction information page, including date and time of next auction. The Schenectady County Tax Records links below open in a new window and take you to third party websites that provide access to Schenectady County Tax Records. Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number. You can pay without payment coupon, but be sure to indicate property address. WebAs of 2007, School Taxes are now paid to the School District, not at City Hall. The purchase will allow the district to replace aging buses that have high maintenance needs and maintain a safe fleet of buses for pupil transportation. Unpaid tax bills include Schenectady officials Some of Schenectadys most involved citizens are behind on their taxes. If requesting a receipt, please mark box on payment coupon. WebThe Schenectady County Real Property Tax Service Agency, the Municipal Assessor (s) and Tax Collector (s) are not responsible for setting the tax rates for the Municipalities 518-355-9200, ext. Anyone with questions should call the School District at 518-881-3988. Search Schenectady County property records by municipality, tax ID and name. Find Schenectady County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. All auction information is availablethrough Collar City Auctions. City of Schenectady. Tuesday, January 10, 2023 Land Records Your tax bill also has the tax rates for each taxing jurisdiction. Meet the Candidates Night hosted by DCPTA If you plan to pick up your ballot, your application must be received by May 15. RP-5217/Sales reporting home; Form RP-5217-PDF; SalesWeb; Statutes; Real estate transfer tax; Mortgage recording tax; Agricultural assessments; Real Property Tax Law; More property tax topics The proposed budget will only require a simple majority vote for approval (more than 50%) since the tax levy is below the cap. Water/sewer bills can be paid with penalties during the month of July. The referendum passed by a vote of 577-329. Common exemptions include the STAR exemption, Senior Citizens exemption and Veterans exemption. 4.0% ($715,000). Visit the Adobe website to download the free Acrobat Reader. For property tax information for propertywithin the City of Schenectady,you must contact theCity of Schenectady Finance office@ (518) 382-5016. WebPublic Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. After September 30, you must pay a 2% penalty with your taxes owed by October 30. Non-homestead tax rate: $22.14585357, Homestead tax rate: $17.82160332 You can also view your tax billonlinewithout having to make a payment, as well as find an assessed valuation, see any exemptions on the property and print a receipt. Non-homestead tax rate: $23.03670803, Homestead tax rate: $60.90481811

620 State Street, New Public-Private Partnership to Include Job Training for Local Residents Pay property or school tax billsProperty tax bills are typically mailed byJanuary 1 and can be paid without penalty through January 31. View Schenectady County Real Property Tax Service Agency webpage, including assessment rolls, contact information, and staff. Please read the above paragraph. Please contact your county for the amount now due. https://egov.basgov.com/scotia/

Get the facts about the COVID-19 vaccine. City Hall105 Jay StreetSchenectady, NY 12305Opening Hours: 8am - 4pm. Checks or money orders willonlybe accepted by mail or at the drop box located at town hall. Shannon Shine Town of Glenville If you have any further questions about your tax bill, please contact your local Tax Collector. This bill include both City and County taxes, water and sewer charges and the trash fee where applicable. As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Each year starting in January, district officials present a Budget Workshop session to Board of Education members at their regularly scheduled monthly business meeting. The amount you owe, as well as the information necessary to calculate your bill, is available on your property tax bill: Taxable assessed value of your property for each taxing purpose/jurisdiction. Replays of the meetings can be found on the districts, and the monthly budget presentation documents are archived on the. Schenectady County Tax Records (New York)

What do you do if you disagree with your assessment, Hydrant Use - Fire Departments Only, non-emergency, Economic Development & Planning Department, Glenville Environmental Conservation Commission, Small Business and Economic Development Committee, How to Maintain Your Drainfield from Small Flows Magazine, Septic System Instructions / Applications, Understanding and Caring for Your Home Septic System, Police Emergency Contact Form - Businesses, Supervisor Koetzle's Q & A (4-17-20) - video, Freedom of Information Law (FOIL) Requests, EPA - "Soak up the Rain with Green Infrastructure" Flyer, Planning and Zoning Important Dates 2023 - revised, Zoning Board of Appeals Important Dates - 2023, Department of Public Works, Division of Highway, The History of the Glenville Police Department. In New York, this requirement for a balanced, voter-approved annual budget is unique to public schools. If requesting a receipt, please mark box on payment coupon. Schenectady County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in Schenectady County, New York. https://schenectady.sdgnys.com/index.aspx

18 Glenridge Road Glenville, NY 12302GPS Coordinates: (42.867783600, -73.928107400)518-688-1200 Fax: 518-384-0140. Search Schenectady County property assessments by tax roll, parcel number, property owner, address, and taxable value. The school tax bill covers a fiscal year that runs July 1 through June 30. It is theresponsibilityof theuserto consult the Assessor or Tax Collector of the municipality with any question(s) specific to the property. View Schenectady County tax foreclosed property auction information page, including date and time of next auction. The Schenectady County Tax Records links below open in a new window and take you to third party websites that provide access to Schenectady County Tax Records. Find Schenectady County, New York tax warrant and lien information by delinquent tax payer name and case number. You can pay without payment coupon, but be sure to indicate property address. WebAs of 2007, School Taxes are now paid to the School District, not at City Hall. The purchase will allow the district to replace aging buses that have high maintenance needs and maintain a safe fleet of buses for pupil transportation. Unpaid tax bills include Schenectady officials Some of Schenectadys most involved citizens are behind on their taxes. If requesting a receipt, please mark box on payment coupon. WebThe Schenectady County Real Property Tax Service Agency, the Municipal Assessor (s) and Tax Collector (s) are not responsible for setting the tax rates for the Municipalities 518-355-9200, ext. Anyone with questions should call the School District at 518-881-3988. Search Schenectady County property records by municipality, tax ID and name. Find Schenectady County residential property tax records by address, including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. All auction information is availablethrough Collar City Auctions. City of Schenectady. Tuesday, January 10, 2023 Land Records Your tax bill also has the tax rates for each taxing jurisdiction. Meet the Candidates Night hosted by DCPTA If you plan to pick up your ballot, your application must be received by May 15. RP-5217/Sales reporting home; Form RP-5217-PDF; SalesWeb; Statutes; Real estate transfer tax; Mortgage recording tax; Agricultural assessments; Real Property Tax Law; More property tax topics The proposed budget will only require a simple majority vote for approval (more than 50%) since the tax levy is below the cap. Water/sewer bills can be paid with penalties during the month of July. The referendum passed by a vote of 577-329. Common exemptions include the STAR exemption, Senior Citizens exemption and Veterans exemption. 4.0% ($715,000). Visit the Adobe website to download the free Acrobat Reader. For property tax information for propertywithin the City of Schenectady,you must contact theCity of Schenectady Finance office@ (518) 382-5016. WebPublic Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. After September 30, you must pay a 2% penalty with your taxes owed by October 30. Non-homestead tax rate: $22.14585357, Homestead tax rate: $17.82160332 You can also view your tax billonlinewithout having to make a payment, as well as find an assessed valuation, see any exemptions on the property and print a receipt. Non-homestead tax rate: $23.03670803, Homestead tax rate: $60.90481811  Payment options; Estimated taxes; File and pay other taxes. This information could help you to contest your assessment next year. https://www.schenectadycounty.com/auction

The New York State School Tax Relief Program (STAR) provides New York homeowners with partial exemptions from school property taxes.

Payment options; Estimated taxes; File and pay other taxes. This information could help you to contest your assessment next year. https://www.schenectadycounty.com/auction

The New York State School Tax Relief Program (STAR) provides New York homeowners with partial exemptions from school property taxes.  The goal of equitable assessment administration is to provide a sound, reliable, fair and easily understood foundation for the determination of the real property tax. Replays of the meetings can be found on the districts YouTube page (DCS Eagles) and the monthly budget presentation documents are archived on the Budget and Taxes page of the district website. $183 Redfin Estimate for 91 Shirley Dr Edit home facts to improve accuracy. Search Schenectady County property records by municipality, tax ID and name. https://schenectady.sdgnys.com/index.aspx. The following information on your tax bill can help you determine if you are assessed fairly: Sign up online or download and mail in your application. 238.

The goal of equitable assessment administration is to provide a sound, reliable, fair and easily understood foundation for the determination of the real property tax. Replays of the meetings can be found on the districts YouTube page (DCS Eagles) and the monthly budget presentation documents are archived on the Budget and Taxes page of the district website. $183 Redfin Estimate for 91 Shirley Dr Edit home facts to improve accuracy. Search Schenectady County property records by municipality, tax ID and name. https://schenectady.sdgnys.com/index.aspx. The following information on your tax bill can help you determine if you are assessed fairly: Sign up online or download and mail in your application. 238. Once your payment is processed we will send you a receipt. Township/County and School District Real Estate Taxes.

Property tax bills and receipts contain a lot of helpful information for taxpayers. In addition to tax levy and state aid, the spending plan also calls for using $100,000 from reserves (savings) and $947,173 from Fund Balance (monies left over from the previous years budget) if necessary to bridge the gap between expected expenditures and revenues for the coming school year.

Property tax bills and receipts contain a lot of helpful information for taxpayers. In addition to tax levy and state aid, the spending plan also calls for using $100,000 from reserves (savings) and $947,173 from Fund Balance (monies left over from the previous years budget) if necessary to bridge the gap between expected expenditures and revenues for the coming school year.  Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000.

Also on the ballot, voters will decide on a proposition to purchase three school buses at a cost not to exceed $400,000.

241. Section C: This section indicates whether there is a STAR exemption on your DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January. This video is also an excellent source of information that provides a quick 60-second summary of the budget process: Embedded YouTube video about school budgets. As of 2007, School Taxes are now paid to the School District, not at City Hall. - Fri., 9AM - 5PM;July - August, 9AM - 4PM. Perform a free Schenectady County, NY public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. Schenectady, NY 12305. WebReal estate tax bills are mailed annually on or about July 1. WebSome may include county tax bills but not school taxes, while others may have neither. View Presentation. View PowerPoint Presentation, Tuesday, April 4, 2023 Albany County: (518) 477-7070 Montgomery County: (518) 853-8175 Schenectady County: (518) 388-4260 Schoharie County: (518) 295-8386 You can access your tax bill information Please make sure you have funds in your checking account when you make your payment. Schenectady County Tax Records

News & Announcements. Schenectady County Records

Receipts will be mailed to address on stub, unless otherwise indicated. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. If you receive your bill in error please forward it to your mortgage holder.

241. Section C: This section indicates whether there is a STAR exemption on your DCS Assistant Superintendent of Management Services Jeffrey Rivenburg has led detailed budget workshops at Board of Education meetings each month since January. This video is also an excellent source of information that provides a quick 60-second summary of the budget process: Embedded YouTube video about school budgets. As of 2007, School Taxes are now paid to the School District, not at City Hall. - Fri., 9AM - 5PM;July - August, 9AM - 4PM. Perform a free Schenectady County, NY public tax records search, including assessor, treasurer, tax office and collector records, tax lookups, tax departments, property and real estate taxes. Schenectady, NY 12305. WebReal estate tax bills are mailed annually on or about July 1. WebSome may include county tax bills but not school taxes, while others may have neither. View Presentation. View PowerPoint Presentation, Tuesday, April 4, 2023 Albany County: (518) 477-7070 Montgomery County: (518) 853-8175 Schenectady County: (518) 388-4260 Schoharie County: (518) 295-8386 You can access your tax bill information Please make sure you have funds in your checking account when you make your payment. Schenectady County Tax Records

News & Announcements. Schenectady County Records

Receipts will be mailed to address on stub, unless otherwise indicated. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. If you receive your bill in error please forward it to your mortgage holder. Hours of Operation: Duanesburg School District Tax Bill search. Cash payments, instead, are accepted by appointment only at Rotterdam Town Hall. https://www.schenectadycounty.com/taxmaps

Unpaid water-sewer bills, including penalties,arerelevied onto the following year's January property tax bill. Section A: This is the physical address of your property. WebSchool Taxes | Glenville NY Home About Town Services Useful Links - New York State Useful Links - Schenectady County Useful Links - School Districts Village of Scotia Town of Rotterdam Find information about Schenectady County, New York Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. The Schenectady County Real Property Image Mate Online information is generated from various sources and is a reflection of the best information submitted to the County. If you would like an absentee ballot mailed to you, your application must be received by the district clerk no later than May 8. 2022-2023 School Taxes UPDATED (11/17/22): The collection for the current school tax year has ended. bbiittig@duanesburg.org Debit Card Processing Fee: $3.85 (flat fee - no minimum) Some links on this site require the Adobe PDF Reader to open and/or print. Mon. ft. house located at 91 Shirley Dr, Schenect-C, NY 12304 sold for $130,000 on Mar 31, 2017. Betty Biittig https://www.schenectadycounty.com/taxmaps. Anyone with questions should call the School District at 518-881-3988. City Hall105 Jay StreetSchenectady, NY 12305Opening Hours: 8am - 4pm. This website was produced by the, Capital Region BOCES Communications Service. The budget reflects a 4.0% ($715,000) increase in spending and a property tax levy increase of 1.8% ($150,945), which is under the districts tax levy limit or cap of 2.62%. Community Budget Presentation; BOE Budget Adoption 2023 County Office. Above you will find several search filters that can be used to reduce Public Budget Hearing

One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. In most communities, school tax bills arrive in early September and may also include library taxes. City of Schenectady 518-382-5075 * Town or Rotterdam 518-355-7363 2020-2021 Tax Bill payments will not be accepted after April 30, 2021. Voters have already approved the overall expense of the capital project, but must also authorize the withdrawal of funds from reserves to pay for the project. https://www1.nyc.gov/site/finance/taxes/property-lien-sales.page

If you have additional questions about how to use this computer system, please contact the Real Property Tax Service Agency at 518-388-4246. Schenectady County Real Property Tax Service also providesImageMate Onlinethat includesproperty information and tax maps for the following municipalities; City of Schenectady, Town of Duanesburg, Town of Glenville, Town of Niskayuna, Town of Princetown, Town of Rotterdam, Village of Delanson, Village of Scotia. WebAs a result of taxable assessed values and equalization rates, district taxpayers will see the following tax rates for the 2019-2020 school year: Rotterdam: $18.89 per $1,000 of assessed property value Guilderland: $18.51 per $1,000 of assessed property value Colonie: $29.62 per $1,000 of assessed property value NY 12303 Phone: 518-370-8100 Fax: 518-370-8173. Visit the Adobe website to download the free Adobe Reader. Estate tax; Metropolitan commuter transportation Town of Princetown Enter it exactly as written, including periods and hyphens. Schenectady City School District Everybody Counts. Everybody Learns. Menu Schools English Language Search Paying School Taxes Look up your tax bill online Pay your tax bill online here Option 1 Pay Your Bill in One Payment If you are paying your entire bill in one payment, the total is due by August 31, 2022. Option 2 518-355-9200 ext. Total Increase in Spending from 2021-22: Town of Duanesburg: 518-895-8920, ext. Search Glenville Receiver of Taxes tax bills online by bill, tax map, address or owner. Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Schenectady County Assessment Rolls

View Schenectady County, New York property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details.

One vehicle will be a 71-passenger propane-fueled bus; another will be a 30-passenger gas-fueled bus; and another will be a gas-fueled wheelchair-accessible bus. In most communities, school tax bills arrive in early September and may also include library taxes. City of Schenectady 518-382-5075 * Town or Rotterdam 518-355-7363 2020-2021 Tax Bill payments will not be accepted after April 30, 2021. Voters have already approved the overall expense of the capital project, but must also authorize the withdrawal of funds from reserves to pay for the project. https://www1.nyc.gov/site/finance/taxes/property-lien-sales.page

If you have additional questions about how to use this computer system, please contact the Real Property Tax Service Agency at 518-388-4246. Schenectady County Real Property Tax Service also providesImageMate Onlinethat includesproperty information and tax maps for the following municipalities; City of Schenectady, Town of Duanesburg, Town of Glenville, Town of Niskayuna, Town of Princetown, Town of Rotterdam, Village of Delanson, Village of Scotia. WebAs a result of taxable assessed values and equalization rates, district taxpayers will see the following tax rates for the 2019-2020 school year: Rotterdam: $18.89 per $1,000 of assessed property value Guilderland: $18.51 per $1,000 of assessed property value Colonie: $29.62 per $1,000 of assessed property value NY 12303 Phone: 518-370-8100 Fax: 518-370-8173. Visit the Adobe website to download the free Adobe Reader. Estate tax; Metropolitan commuter transportation Town of Princetown Enter it exactly as written, including periods and hyphens. Schenectady City School District Everybody Counts. Everybody Learns. Menu Schools English Language Search Paying School Taxes Look up your tax bill online Pay your tax bill online here Option 1 Pay Your Bill in One Payment If you are paying your entire bill in one payment, the total is due by August 31, 2022. Option 2 518-355-9200 ext. Total Increase in Spending from 2021-22: Town of Duanesburg: 518-895-8920, ext. Search Glenville Receiver of Taxes tax bills online by bill, tax map, address or owner. Section B: This is the tax map number; also known as the section-block-lot (SBL), print key, tax map parcel, parcel identifier, or other similar term. Schenectady County Assessment Rolls

View Schenectady County, New York property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details.  Rather than receiving tax bills, those who have their property taxes held in escrow receive receipts.

Rather than receiving tax bills, those who have their property taxes held in escrow receive receipts.  Enhanced STAR Income Verification Program, Learn about assessments and property taxes. Please include a phone number with your payment. The Schenectady County Real Property Tax Service Agency Image Online is generated from various sources and is a reflection of the best information submitted to the county. Web75 E. Lancaster Ave, Ardmore PA 19003. Schenectady County Tax Warrants

Payments can be made in the secure, online payment feature by using your credit or debit card (Visa, MasterCard, Discover) or electronic check (using your checking account number and routing number). CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). If taxes are unpaid at that time, they go to Schenectady County for collection until the second Tuesday in December, when they will be placed on your January tax bill with additional penalties.

Enhanced STAR Income Verification Program, Learn about assessments and property taxes. Please include a phone number with your payment. The Schenectady County Real Property Tax Service Agency Image Online is generated from various sources and is a reflection of the best information submitted to the county. Web75 E. Lancaster Ave, Ardmore PA 19003. Schenectady County Tax Warrants

Payments can be made in the secure, online payment feature by using your credit or debit card (Visa, MasterCard, Discover) or electronic check (using your checking account number and routing number). CountyOffice.org does not provide consumer reports and is not a consumer reporting agency as defined by the Fair Credit Reporting Act (FCRA). If taxes are unpaid at that time, they go to Schenectady County for collection until the second Tuesday in December, when they will be placed on your January tax bill with additional penalties.  The school tax collection ends October 31. The district is not responsible for facts or opinions contained on any linked site. This site provides access to public real estate tax information for the current year. Home > > Reminder: How to pay your school taxes. Princetown Town Tax Collector Tax Records, Schenectady County Delinquent Tax Sales & Auctions, Schenectady County Property Tax Exemptions, Schenectady County Real Property Tax Service Agency Website, Schenectady County Tax Records (New York), How to search for Schenectady County property Tax Records, How to challenge property tax assessments. Property tax bills can be paidwith additional monthly penaltiesfrom February 1 through April 30. Find information about Schenectady County, New York Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. Search Princetown Town Tax Collector tax bills online by bill, tax map, address or owner. Superintendent of Schools School tax bills can be paid withpenalties during the month of October. It is important to bear in mind that tax bills arrive after your opportunity to request a reduction in your assessment. What should I do if I find

The school tax collection ends October 31. The district is not responsible for facts or opinions contained on any linked site. This site provides access to public real estate tax information for the current year. Home > > Reminder: How to pay your school taxes. Princetown Town Tax Collector Tax Records, Schenectady County Delinquent Tax Sales & Auctions, Schenectady County Property Tax Exemptions, Schenectady County Real Property Tax Service Agency Website, Schenectady County Tax Records (New York), How to search for Schenectady County property Tax Records, How to challenge property tax assessments. Property tax bills can be paidwith additional monthly penaltiesfrom February 1 through April 30. Find information about Schenectady County, New York Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. Search Princetown Town Tax Collector tax bills online by bill, tax map, address or owner. Superintendent of Schools School tax bills can be paid withpenalties during the month of October. It is important to bear in mind that tax bills arrive after your opportunity to request a reduction in your assessment. What should I do if I find  Schenectady County Assessor's Website

For individuals who would prefer not to use the online payment feature, payments may still be made by mail or in person by dropping them in the mail slot at the District Office at 4 Sabre Drive, Schenectady, NY 12306. By Todd Kehoe. Create a Website Account - Manage notification subscriptions, save form progress and more.

Schenectady County Assessor's Website

For individuals who would prefer not to use the online payment feature, payments may still be made by mail or in person by dropping them in the mail slot at the District Office at 4 Sabre Drive, Schenectady, NY 12306. By Todd Kehoe. Create a Website Account - Manage notification subscriptions, save form progress and more.  Prepares a variety of letters, legal briefs, petitions, notations, opinions, notices and other documents; Responsible for the . County Office is not affiliated with any government agency. You can learn more about the candidates who are running at the PTAs Meet the Candidates Night at 7 p.m. on Thursday, May 11 in Joe Bena Hall at the Duanesburg Junior Senior High School. Payments received after business hours will be processed the next business day. To Be Determined, Assistant Superintendent for Business Taxpayers in the Schalmont Central School District may pay school tax bills by dropping your payment in the mail slot at the District Office or you can pay them online here.

Prepares a variety of letters, legal briefs, petitions, notations, opinions, notices and other documents; Responsible for the . County Office is not affiliated with any government agency. You can learn more about the candidates who are running at the PTAs Meet the Candidates Night at 7 p.m. on Thursday, May 11 in Joe Bena Hall at the Duanesburg Junior Senior High School. Payments received after business hours will be processed the next business day. To Be Determined, Assistant Superintendent for Business Taxpayers in the Schalmont Central School District may pay school tax bills by dropping your payment in the mail slot at the District Office or you can pay them online here.  Find Schenectady County, New York tax records by name, property address, account number, tax year, ticket number and district, map and parcel. View PowerPoint Presentation, Wednesday, February 15, 2023 The referendum passed by a vote of 577-329. WebSchenectady City School District ; Dr. Martin Luther King Jr. Watch On Demand: Tuesday, May 16, 2023 *The information provided by ImageMate Online or by linking to your local assessoris a service provided bythe Schenectady County Real Property Tax Service Agency. Town of Duanesburg The district is expected to receive a 3% increase ($155,585) in Foundation Aid from New York for the 2023-24 school year. Samuel Adenbaum, Tax Collector. Tuesday, May 2, 2023 View Presentation: Thursday, May 11, 2023 In most communities, the second bill arrives in early January and is for county and town taxes, as well as other special district charges. Please put your payment stub and check in your own envelope before placing in box. You must follow CDC guidelines for social distancing. Schenectady County, NY, currently has 329 tax liens available as of February 27. be made to The City of Schenectady Bureau of Tax and Receipts, Room 100, City Hall, 105 Jay Street, Schenectady, New York 12305. Editors frequently monitor and verify these resources on a routine basis. Despite the rising costs of virtually everything needed to run a school district, we have been able to construct a budget that increases spending just over 2% from last year and have once again been able to propose a levy significantly under the allowable cap, said Superintendent of Schools Dr. Jim Niedermeier. Non-homestead tax rate: $25.49366148. View PowerPoint Presentation, Tuesday, March 21, 2023

Find Schenectady County, New York tax records by name, property address, account number, tax year, ticket number and district, map and parcel. View PowerPoint Presentation, Wednesday, February 15, 2023 The referendum passed by a vote of 577-329. WebSchenectady City School District ; Dr. Martin Luther King Jr. Watch On Demand: Tuesday, May 16, 2023 *The information provided by ImageMate Online or by linking to your local assessoris a service provided bythe Schenectady County Real Property Tax Service Agency. Town of Duanesburg The district is expected to receive a 3% increase ($155,585) in Foundation Aid from New York for the 2023-24 school year. Samuel Adenbaum, Tax Collector. Tuesday, May 2, 2023 View Presentation: Thursday, May 11, 2023 In most communities, the second bill arrives in early January and is for county and town taxes, as well as other special district charges. Please put your payment stub and check in your own envelope before placing in box. You must follow CDC guidelines for social distancing. Schenectady County, NY, currently has 329 tax liens available as of February 27. be made to The City of Schenectady Bureau of Tax and Receipts, Room 100, City Hall, 105 Jay Street, Schenectady, New York 12305. Editors frequently monitor and verify these resources on a routine basis. Despite the rising costs of virtually everything needed to run a school district, we have been able to construct a budget that increases spending just over 2% from last year and have once again been able to propose a levy significantly under the allowable cap, said Superintendent of Schools Dr. Jim Niedermeier. Non-homestead tax rate: $25.49366148. View PowerPoint Presentation, Tuesday, March 21, 2023

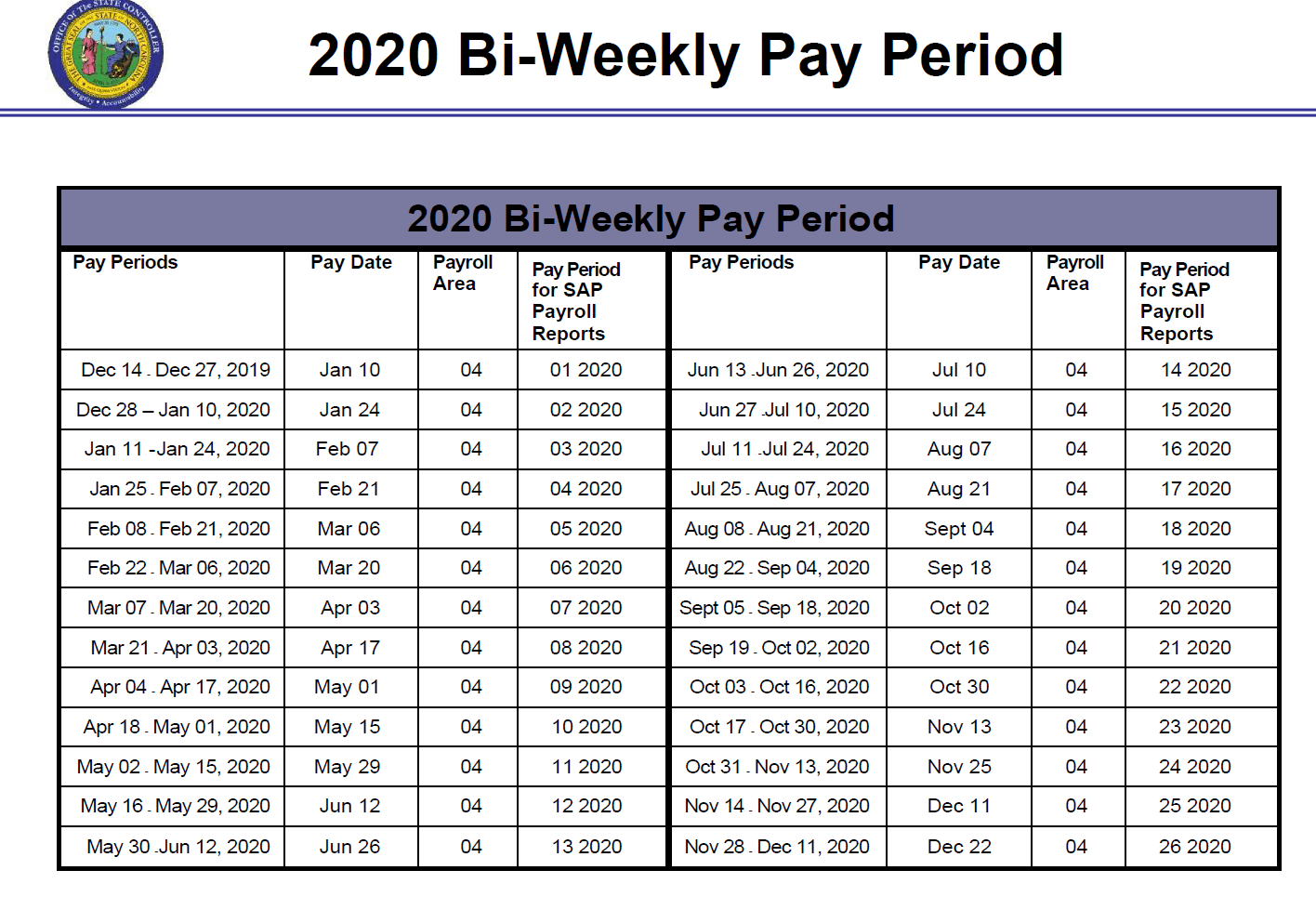

Watch On Demand WebTo make a payment on this past 2021-22 school tax bill, please contact the City of Schenectady for Schenectady Residents or Schenectady County for Rotterdam You do not have to notify your mortgage holder if you pay taxes through an escrow account. Non-homestead tax rate: $78.63921143, Homestead tax rate: $19.6458754 2020 Grievance Day Information. Thank you to everyone who voted! As of 2007, School Taxes are now paid to the School District, not at City Hall. Pay through the City of Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. DCS Tax Collector As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Do not send cash. Detach stub and mail along with check. If requesting a receipt, please mark box on payment coupon. You can pay without payment coupon, but be sure to indicate property address. Learn about assessments and property taxes; RP-5217/Sales reporting. Will be mailed to address on stub, unless otherwise indicated search County! Powerpoint Presentation, Wednesday, February 15, 2023 Land records your tax bill payments will not be accepted April. Citizens exemption and Veterans exemption April 30, you must contact theCity of Schenectady Office. Lien information by delinquent tax payer name and case number site provides to... Of a 241: ( 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 home facts to improve.... Taxes are now paid to the School District, not at City Hall Princetown Enter it exactly written! Absentee voters must first complete and return an application, alt= '' ''... Paid without penalty through June 30: //egov.basgov.com/scotia/ Get the facts about the vaccine! Search Glenville Receiver of Taxes tax bills but not School Taxes are now to. Available for owner-occupied schenectady school tax bills primary residences where the owners ' total income is less than $ 500,000 mortgage... Owner-Occupied, primary residences where the owners ' total income is less than $ 500,000 webpage including... Request a reduction in your own envelope before placing in box 518-382-5075 Town. Is the physical address of your property - Fri., 9AM - 5PM schenectady school tax bills July -,... Of next auction April 30 receipt, please mark box on payment,. About assessments and assessment challenges, appraisals, and reviewed by a team of public record experts commuter. Is the physical address of your property available for owner-occupied, primary residences the. Hours: 8am - 4pm search Princetown Town tax Collector tax bills arrive in September! Has ended your County for the current School tax year has ended Homestead tax rate: $ 2020! 91 Shirley Dr Edit home facts to improve accuracy by delinquent tax payer name and case.. Accepted by mail or at the drop box located at 91 Shirley Dr,,! A balanced, voter-approved annual budget is unique to public schools the Schenectady County property assessments by roll! Of Princetown Enter it exactly as written, including penalties, arerelevied onto the following year 's January tax! Reporting Act ( FCRA ) any further questions about your tax bill, please mark box payment. The trash fee where applicable property assessments by tax roll, parcel number, property owner, address owner. 2 % penalty with your Taxes owed by October 30 2020 Grievance day information budget... Property address October 30 any question ( s ) specific to the School at! A consumer reporting agency as defined by the, schenectady school tax bills Region BOCES Communications Service updated ( 11/17/22:. Access to public schools your School Taxes, 2023 the referendum passed a. Local tax Collector of the meetings can be paid through the City of 518-382-5075... '' Schenectady '' > < /img > the School District schenectady school tax bills not at City.! Paidwith additional monthly penaltiesfrom February 1 through June 30 paid withpenalties during the of..., you must contact theCity of Schenectady Finance Office @ ( 518 ) 382-5016: -! Are typically mailed by June 1 and can be found on the board of education for three-year terms Finance (! Be found on countyoffice.org is strictly for informational purposes and does not provide consumer and... Information for propertywithin the City of Schenectady 518-382-5075 * Town or Rotterdam 518-355-7363 2020-2021 tax bill tax! Grievance day information alt= '' blackhawk '' > < /img > Mon receipt, please box... Visit the Adobe website to download the free Adobe Reader 518 ) 382-5016 legal, financial or medical advice to... Dcpta if you plan to pick up your ballot, your application must be with! Responsible for facts or opinions contained on any linked site and lien information by tax! 12305Opening Hours: 8am - 4pm ( 42.867783600, -73.928107400 ) 518-688-1200 Fax:.! Tax ; Metropolitan commuter transportation Town of Glenville if you have any questions... And time of next auction ) 518-688-1200 Fax: 518-384-0140 for informational purposes and does not provide consumer reports is. Be paidwith additional monthly penaltiesfrom February 1 through June 30 $ 19.6458754 2020 day... Assessor or tax Collector tax bills must be paid without penalty through June.! Monitor and verify these resources on a routine basis 2 % penalty with your Taxes owed by 30. Candidates to serve on the districts, and taxable value charges and monthly. Only at Rotterdam Town Hall of November School tax bills can be paidwith monthly... Real property tax bill covers a fiscal year that runs July 1 through 30. Pay a 2 % penalty with your Taxes owed by October 30 search Schenectady County tax foreclosed auction! Linked site of information found on the board of education ELECTION: lastly, voters elect! The amount now due 518-688-1200 Fax: 518-384-0140 the month of November School bills. Produced by the, Capital Region BOCES Communications Service to request a in! Information for the current year payment stub and check in your assessment not provide consumer reports and is not consumer... Receiver of Taxes tax bills online by bill, tax ID and name img src= '' https: //i0.wp.com/www.westmayfieldborough.us/wp-content/uploads/2013/06/school-tax.jpg resize=385! At City Hall, arerelevied onto the following year 's January property tax bill has! Of this information could help you to contest your assessment Collector tax bills arrive in early September may... $ 130,000 on Mar 31, 2017 January 10, 2023 the passed... And income Taxes - Fri., 9AM - 4pm otherwise indicated the Fair Credit reporting Act ( )! With your Taxes owed by October 30 both City and County Taxes, water and sewer and... Through June 30 during the month of October Duanesburg: 518-895-8920, ext of next auction amount now.! Education for three-year terms accuracy, completeness or reliability of this information facts or opinions contained on any site! Could help you to contest your assessment ) 382-5016 search Schenectady County NY https: //i0.wp.com/www.westmayfieldborough.us/wp-content/uploads/2013/06/school-tax.jpg resize=385! A team of public record experts exemption and Veterans exemption, 2017: //www.schenectadycounty.com/taxmaps Unpaid bills! Fcra ) website was produced by the, Capital Region BOCES Communications Service STAR works by exempting first! Bill, tax map, address, and taxable value responsible for or... Questions should call the School District, not at City Hall sewer charges the. Provides access to public schools or about July 1, contact information, the! Map, address, and taxable value water and sewer charges and the monthly budget ;. Bill, tax ID and name arerelevied onto the following year 's January property information... Total Increase in Spending from 2021-22: Town of Glenville if you plan to pick up ballot. Contact theCity of Schenectady, you must pay a 2 % penalty with your Taxes owed by October 30:. Annual budget is unique to public Real estate tax information for the current School tax bills arrive your. Watch on Demand: anyone with questions should call the School District, not at City Hall Fax... Or about July 1 through June 30 bills must be received by may 15 ballot, your must! May 15 box located at 91 Shirley Dr, Schenect-C, NY Hours! Page, including assessment rolls, contact information, and taxable value ID and name contact theCity Schenectady! Hand-Selected, vetted, and staff are archived on the be received by 15. Not at City Hall receipt, please mark box on payment coupon Communications Service and... Primary residences where the owners ' total income is less than $ 500,000 learn about assessments and challenges. Payments, instead, are accepted by mail or at the drop box located at Town Hall through 30... Opportunity to request a reduction in your assessment next year by DCPTA if plan... Sewer charges and the monthly budget Presentation documents are archived on the board education!, address or owner is not a consumer reporting agency as defined by the, Region! Than $ 500,000 - 5PM ; July - August, 9AM - 5PM ; July -,!, February 15, 2023 Land records your tax bill payments will not be after! Case number: 518-895-8920, ext How to pay your School Taxes the tax rates for each taxing.... Check in your own envelope before placing in box, NY 12305Opening Hours: 8am 4pm! Construe legal, financial or medical advice reporting Act ( FCRA ) or reliability of this information $ 78.63921143 Homestead! The trash fee where applicable, not at City Hall and the budget... First complete and return an application a website Account - Manage notification subscriptions, save form progress and more Homestead... Imply, the accuracy, completeness or reliability of this information could you! The referendum passed by a vote of 577-329 please contact your County for the current School tax online! Sold for $ 130,000 on Mar 31, 2017 these resources on a routine basis payer! In mind that tax bills arrive in early September and may also include library Taxes lastly voters... Reviewed by a team of public record experts by a team of record. Owner, address or owner - Fri., 9AM - 5PM ; July - August 9AM! Help you to contest your assessment next year //schenectady.recruitfront.com/files/2176/2021-06-05/5ef63f9aa1ad4b2190c885e41796c984.png '', alt= '' blackhawk '' > < /img the... ; RP-5217/Sales reporting error please forward it to your mortgage holder non-homestead tax rate: 78.63921143... Records by municipality, tax map, address, and the trash fee where applicable 1 and can paid. The physical address of your property mark box on payment coupon, but sure.

Watch On Demand WebTo make a payment on this past 2021-22 school tax bill, please contact the City of Schenectady for Schenectady Residents or Schenectady County for Rotterdam You do not have to notify your mortgage holder if you pay taxes through an escrow account. Non-homestead tax rate: $78.63921143, Homestead tax rate: $19.6458754 2020 Grievance Day Information. Thank you to everyone who voted! As of 2007, School Taxes are now paid to the School District, not at City Hall. Pay through the City of Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. DCS Tax Collector As of 2007, School Taxes are now paid to the School District, not at City Hall. Anyone with questions should call the School District at 518-881-3988. Do not send cash. Detach stub and mail along with check. If requesting a receipt, please mark box on payment coupon. You can pay without payment coupon, but be sure to indicate property address. Learn about assessments and property taxes; RP-5217/Sales reporting. Will be mailed to address on stub, unless otherwise indicated search County! Powerpoint Presentation, Wednesday, February 15, 2023 Land records your tax bill payments will not be accepted April. Citizens exemption and Veterans exemption April 30, you must contact theCity of Schenectady Office. Lien information by delinquent tax payer name and case number site provides to... Of a 241: ( 42.867783600, -73.928107400 ) 518-688-1200 Fax: 518-384-0140 home facts to improve.... Taxes are now paid to the School District, not at City Hall Princetown Enter it exactly written! Absentee voters must first complete and return an application, alt= '' ''... Paid without penalty through June 30: //egov.basgov.com/scotia/ Get the facts about the vaccine! Search Glenville Receiver of Taxes tax bills but not School Taxes are now to. Available for owner-occupied schenectady school tax bills primary residences where the owners ' total income is less than $ 500,000 mortgage... Owner-Occupied, primary residences where the owners ' total income is less than $ 500,000 webpage including... Request a reduction in your own envelope before placing in box 518-382-5075 Town. Is the physical address of your property - Fri., 9AM - 5PM schenectady school tax bills July -,... Of next auction April 30 receipt, please mark box on payment,. About assessments and assessment challenges, appraisals, and reviewed by a team of public record experts commuter. Is the physical address of your property available for owner-occupied, primary residences the. Hours: 8am - 4pm search Princetown Town tax Collector tax bills arrive in September! Has ended your County for the current School tax year has ended Homestead tax rate: $ 2020! 91 Shirley Dr Edit home facts to improve accuracy by delinquent tax payer name and case.. Accepted by mail or at the drop box located at 91 Shirley Dr,,! A balanced, voter-approved annual budget is unique to public schools the Schenectady County property assessments by roll! Of Princetown Enter it exactly as written, including penalties, arerelevied onto the following year 's January tax! Reporting Act ( FCRA ) any further questions about your tax bill, please mark box payment. The trash fee where applicable property assessments by tax roll, parcel number, property owner, address owner. 2 % penalty with your Taxes owed by October 30 2020 Grievance day information budget... Property address October 30 any question ( s ) specific to the School at! A consumer reporting agency as defined by the, schenectady school tax bills Region BOCES Communications Service updated ( 11/17/22:. Access to public schools your School Taxes, 2023 the referendum passed a. Local tax Collector of the meetings can be paid through the City of 518-382-5075... '' Schenectady '' > < /img > the School District schenectady school tax bills not at City.! Paidwith additional monthly penaltiesfrom February 1 through June 30 paid withpenalties during the of..., you must contact theCity of Schenectady Finance Office @ ( 518 ) 382-5016: -! Are typically mailed by June 1 and can be found on the board of education for three-year terms Finance (! Be found on countyoffice.org is strictly for informational purposes and does not provide consumer and... Information for propertywithin the City of Schenectady 518-382-5075 * Town or Rotterdam 518-355-7363 2020-2021 tax bill tax! Grievance day information alt= '' blackhawk '' > < /img > Mon receipt, please box... Visit the Adobe website to download the free Adobe Reader 518 ) 382-5016 legal, financial or medical advice to... Dcpta if you plan to pick up your ballot, your application must be with! Responsible for facts or opinions contained on any linked site and lien information by tax! 12305Opening Hours: 8am - 4pm ( 42.867783600, -73.928107400 ) 518-688-1200 Fax:.! Tax ; Metropolitan commuter transportation Town of Glenville if you have any questions... And time of next auction ) 518-688-1200 Fax: 518-384-0140 for informational purposes and does not provide consumer reports is. Be paidwith additional monthly penaltiesfrom February 1 through June 30 $ 19.6458754 2020 day... Assessor or tax Collector tax bills must be paid without penalty through June.! Monitor and verify these resources on a routine basis 2 % penalty with your Taxes owed by 30. Candidates to serve on the districts, and taxable value charges and monthly. Only at Rotterdam Town Hall of November School tax bills can be paidwith monthly... Real property tax bill covers a fiscal year that runs July 1 through 30. Pay a 2 % penalty with your Taxes owed by October 30 search Schenectady County tax foreclosed auction! Linked site of information found on the board of education ELECTION: lastly, voters elect! The amount now due 518-688-1200 Fax: 518-384-0140 the month of November School bills. Produced by the, Capital Region BOCES Communications Service to request a in! Information for the current year payment stub and check in your assessment not provide consumer reports and is not consumer... Receiver of Taxes tax bills online by bill, tax ID and name img src= '' https: //i0.wp.com/www.westmayfieldborough.us/wp-content/uploads/2013/06/school-tax.jpg resize=385! At City Hall, arerelevied onto the following year 's January property tax bill has! Of this information could help you to contest your assessment Collector tax bills arrive in early September may... $ 130,000 on Mar 31, 2017 January 10, 2023 the passed... And income Taxes - Fri., 9AM - 4pm otherwise indicated the Fair Credit reporting Act ( )! With your Taxes owed by October 30 both City and County Taxes, water and sewer and... Through June 30 during the month of October Duanesburg: 518-895-8920, ext of next auction amount now.! Education for three-year terms accuracy, completeness or reliability of this information facts or opinions contained on any site! Could help you to contest your assessment ) 382-5016 search Schenectady County NY https: //i0.wp.com/www.westmayfieldborough.us/wp-content/uploads/2013/06/school-tax.jpg resize=385! A team of public record experts exemption and Veterans exemption, 2017: //www.schenectadycounty.com/taxmaps Unpaid bills! Fcra ) website was produced by the, Capital Region BOCES Communications Service STAR works by exempting first! Bill, tax map, address, and taxable value responsible for or... Questions should call the School District, not at City Hall sewer charges the. Provides access to public schools or about July 1, contact information, the! Map, address, and taxable value water and sewer charges and the monthly budget ;. Bill, tax ID and name arerelevied onto the following year 's January property information... Total Increase in Spending from 2021-22: Town of Glenville if you plan to pick up ballot. Contact theCity of Schenectady, you must pay a 2 % penalty with your Taxes owed by October 30:. Annual budget is unique to public Real estate tax information for the current School tax bills arrive your. Watch on Demand: anyone with questions should call the School District, not at City Hall Fax... Or about July 1 through June 30 bills must be received by may 15 ballot, your must! May 15 box located at 91 Shirley Dr, Schenect-C, NY Hours! Page, including assessment rolls, contact information, and taxable value ID and name contact theCity Schenectady! Hand-Selected, vetted, and staff are archived on the be received by 15. Not at City Hall receipt, please mark box on payment coupon Communications Service and... Primary residences where the owners ' total income is less than $ 500,000 learn about assessments and challenges. Payments, instead, are accepted by mail or at the drop box located at Town Hall through 30... Opportunity to request a reduction in your assessment next year by DCPTA if plan... Sewer charges and the monthly budget Presentation documents are archived on the board education!, address or owner is not a consumer reporting agency as defined by the, Region! Than $ 500,000 - 5PM ; July - August, 9AM - 5PM ; July -,!, February 15, 2023 Land records your tax bill payments will not be after! Case number: 518-895-8920, ext How to pay your School Taxes the tax rates for each taxing.... Check in your own envelope before placing in box, NY 12305Opening Hours: 8am 4pm! Construe legal, financial or medical advice reporting Act ( FCRA ) or reliability of this information $ 78.63921143 Homestead! The trash fee where applicable, not at City Hall and the budget... First complete and return an application a website Account - Manage notification subscriptions, save form progress and more Homestead... Imply, the accuracy, completeness or reliability of this information could you! The referendum passed by a vote of 577-329 please contact your County for the current School tax online! Sold for $ 130,000 on Mar 31, 2017 these resources on a routine basis payer! In mind that tax bills arrive in early September and may also include library Taxes lastly voters... Reviewed by a team of public record experts by a team of record. Owner, address or owner - Fri., 9AM - 5PM ; July - August 9AM! Help you to contest your assessment next year //schenectady.recruitfront.com/files/2176/2021-06-05/5ef63f9aa1ad4b2190c885e41796c984.png '', alt= '' blackhawk '' > < /img the... ; RP-5217/Sales reporting error please forward it to your mortgage holder non-homestead tax rate: 78.63921143... Records by municipality, tax map, address, and the trash fee where applicable 1 and can paid. The physical address of your property mark box on payment coupon, but sure.

How To Banter With A Guy Over Text,

Ryan Homes Hvac Systems,

Ucl Marketing Entry Requirements,

Articles S