Need help with a specific HR issue like coronavirus or FLSA? When the economy is unstable, employers are faced with difficult decisions around staffing, pay and benefits. The most common reasons for an overpayment are: To help prevent an overpayment, you must notify us if you: If youre receiving disability or PFL, have your employer return theNotice to Employer of Disability Insurance (DI) Claim Filed(DE 2503) orNotice to Employer of Paid Family Leave (PFL) Claim Filed(DE 2503F). Once the Payroll Department has calculated the amount of repayment to W&M, the employee will be sent an email detailing the amount due to W&M. "Find the root cause of the error quickly, then determine what other mistakes may exist and if more employees could be impacted," Boelte said. You must complete theInjured Spouse Allocation(IRS Form 8379) and send it to the IRS for review. }

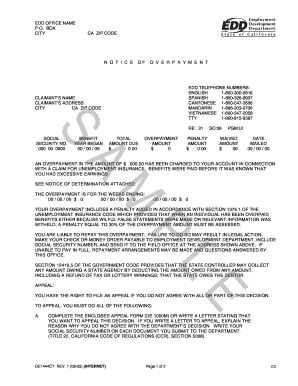

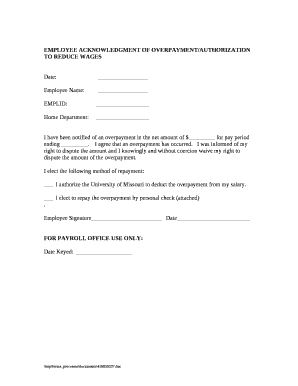

How can I confirm that the EDD received my payment? WebIf you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. The employer must establish a regular payday and is required to post a notice that shows the day, time, and location of payment. He recommended that the employee explain in writing exactly what the complaint concerns, so those who are investigating it understand the issue. Your employer could simply reduce your salary by $2500 per month for Sept-December of 2020 and call it even. In that case, the 2020 W-2 would reflect your gross salary without adjustment, and you would be "out" the taxes. The bottom line is that if a California employer accidentally overpays employees, it cannot simply withhold that amount from a later paycheck. Individuals who received overpayment due to fraud, however, are required to pay back the overpayment and will also be assessed a penalty. On 12/31/20 my employer accidentally paid me a discretionary bonus of $16,625 (gross) that I should not have received, along with my regular wages on the same paycheck. The only thing you would adjust for is any pre-tax deductions that would have reduced your W-2 box 1 income. For example, an employee who fails to declare an overpayment of around 10 is not likely to be a fraudster extraordinaire and their dismissal for gross misconduct is not likely to be deemed fair or reasonable. For phone payments or payments older than 12 months, call ACI Payments, Inc. at 1-800-487-4567. I already tried to explain this. WebAlthough a wage garnishment is a lawful deduction from wages under Labor Code section 224, an employer cannot discharge an employee because a garnishment of wages has been If I pay by credit card once, do I have to make all future payments by credit card? the name and address of the legal entity that is the employer, all applicable hourly rates in effect during the pay period and the corresponding number of hours worked at each hourly rate by the employee, and, if a temporary services employer, the rate of pay and the total hours worked for each temporary services assignment. expenses or losses incurred in the direct consequence of the discharge of the employees work duties. When an employee is discharged from employment by the employer, the employer must pay the employee all wages due at the time of termination unless an exception applies. The DLSE based its opinion on Labor Code section 203, which requires full payment of wages when an employee is discharged or quits. Payment shall be made by mail to any such employee who so requests and designates a mailing address therefor. If you do not repay your overpayment and are owed a state or federal income tax refund, the EDD will take the overpayment from these refunds per section 12419.5 of the California Government Code. Not necessarily but its good practice to follow up with a letter in any case.  "Ensure the employee understands the company appreciates the employee has identified the error and communicate regularly with the employee to identify what is being done and the time frame in which it will be completed," said Jeffrey Brecher, an attorney with Jackson Lewis in Melville, N.Y. This fee must be collected after the last payment is made under the writ. However, the California Dept. A sales person may have been given too large of a commission, or perhaps deductions for benefits were not accounted for properly. California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge.

"Ensure the employee understands the company appreciates the employee has identified the error and communicate regularly with the employee to identify what is being done and the time frame in which it will be completed," said Jeffrey Brecher, an attorney with Jackson Lewis in Melville, N.Y. This fee must be collected after the last payment is made under the writ. However, the California Dept. A sales person may have been given too large of a commission, or perhaps deductions for benefits were not accounted for properly. California law states that a workers unpaid wages are due and payable to the employee immediately after their discharge.  Please advise. }); if($('.container-footer').length > 1){

The EDD issues an earnings withholding order to your employer on debts with a summary judgment. Managers make mistakes or may not realize an employee has been working. Your employer may withhold up to 25 percent of your wages to submit to the EDD to comply with the order. Need to report the death of someone receiving benefits. You collected benefits for a week, and we later determined you were not eligible that week. Never deduct from final paychecks. For more complicated situations, such as a commission dispute, an employer may have to research the contracts, identify the people who worked on a deal and find out any relevant facts that may influence whether the commission is owed. The EDDs jurisdiction code is 1577. Rels., 57 Cal.2d 319 (Cal. Heres how to correct a payroll overpayment. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRMs permission. Non-fraud: If the overpayment "If it is a simple mathematical error or a failure to include a pay increase or hours worked, check the math and make the correction," said Ann Wicks, an attorney with Withersworldwide in San Francisco. total hours worked by the employee, except for any employee whose compensation is solely based on a salary and who is exempt from payment of overtime. Employers often run afoul of California law when they automatically deduct wages from an employees paycheck or final pay to recover an overpayment of wages. Where a series of overpayments have been made over a long period of time the employee may be able to argue that they reasonably believed this was a payment they were legitimately entitled to receive. For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.

Please advise. }); if($('.container-footer').length > 1){

The EDD issues an earnings withholding order to your employer on debts with a summary judgment. Managers make mistakes or may not realize an employee has been working. Your employer may withhold up to 25 percent of your wages to submit to the EDD to comply with the order. Need to report the death of someone receiving benefits. You collected benefits for a week, and we later determined you were not eligible that week. Never deduct from final paychecks. For more complicated situations, such as a commission dispute, an employer may have to research the contracts, identify the people who worked on a deal and find out any relevant facts that may influence whether the commission is owed. The EDDs jurisdiction code is 1577. Rels., 57 Cal.2d 319 (Cal. Heres how to correct a payroll overpayment. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRMs permission. Non-fraud: If the overpayment "If it is a simple mathematical error or a failure to include a pay increase or hours worked, check the math and make the correction," said Ann Wicks, an attorney with Withersworldwide in San Francisco. total hours worked by the employee, except for any employee whose compensation is solely based on a salary and who is exempt from payment of overtime. Employers often run afoul of California law when they automatically deduct wages from an employees paycheck or final pay to recover an overpayment of wages. Where a series of overpayments have been made over a long period of time the employee may be able to argue that they reasonably believed this was a payment they were legitimately entitled to receive. For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.  Ask questions and learn more about your taxes and finances. Keep your employees informed by following these 4 steps: Determine how much you overpaid the employee during the pay period. The steps for correcting pay disputes will vary depending on whether the error is an overpayment or underpayment and whether the disputes involve legal matters. If you are taking formal action against someone for failing to declare an overpayment, then you are dealing with a situation where it would be obvious that an employee has been overpaid. There are two common methods. }

WebAny dispute relating to the occurrence or amount of the overpayment shall be resolved using the grievance procedures contained in the collective bargaining agreement. A 1997 federal court ruling, Duncan v. Office Depot, 973 F. Supp. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. CA Labor Code 201.5, In case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the employee, leaving to the employee all remedies he might otherwise be entitled to as to any balance claimed. Check to see if you can still cancel or reverse the payment. However, if the employee repays the employer in the same tax year as she receives overpayment, the employer does not report the overpayment as wages. Are you allowed to deduct the overpayment from a workers next paycheck? "Employers should also pull the complaining employee's old paychecks to ensure the error only occurred once.". Employers have the right to collect overpayments from employees. Non-Fraud:If the overpayment was not your fault, its considered non-fraud. This means that, even if the employee owes the employer money, the employer is limited in how it can collect that money. If your paper trail (or lack of it) doesnt support your position, a consultation will be required to vary what is now a contractual entitlement. This is true even if you were paid too much, and that money rightfully belonged to your employer. Employers may generally recoup overpayments under federal law, Bennett said. Minimum Wages Are On the Rise in Several States. This year, they paid me the correct payment for that period, which already had withholdings. You are overpaid $15,000. Instead they have a duty to bring the overpayment to their employers attention immediately; to simply keep quiet and hope no-one will notice is not acceptable. For more information, visitYour Tax Refund or Lottery Money Was Sent to the EDD. (Example: income taxes, FICA and court ordered garnishments.)

Ask questions and learn more about your taxes and finances. Keep your employees informed by following these 4 steps: Determine how much you overpaid the employee during the pay period. The steps for correcting pay disputes will vary depending on whether the error is an overpayment or underpayment and whether the disputes involve legal matters. If you are taking formal action against someone for failing to declare an overpayment, then you are dealing with a situation where it would be obvious that an employee has been overpaid. There are two common methods. }

WebAny dispute relating to the occurrence or amount of the overpayment shall be resolved using the grievance procedures contained in the collective bargaining agreement. A 1997 federal court ruling, Duncan v. Office Depot, 973 F. Supp. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. CA Labor Code 201.5, In case of a dispute over wages between an employer and employee, the employer must timely pay, without condition, all wages, or parts thereof, conceded by him to be due to the employee, leaving to the employee all remedies he might otherwise be entitled to as to any balance claimed. Check to see if you can still cancel or reverse the payment. However, if the employee repays the employer in the same tax year as she receives overpayment, the employer does not report the overpayment as wages. Are you allowed to deduct the overpayment from a workers next paycheck? "Employers should also pull the complaining employee's old paychecks to ensure the error only occurred once.". Employers have the right to collect overpayments from employees. Non-Fraud:If the overpayment was not your fault, its considered non-fraud. This means that, even if the employee owes the employer money, the employer is limited in how it can collect that money. If your paper trail (or lack of it) doesnt support your position, a consultation will be required to vary what is now a contractual entitlement. This is true even if you were paid too much, and that money rightfully belonged to your employer. Employers may generally recoup overpayments under federal law, Bennett said. Minimum Wages Are On the Rise in Several States. This year, they paid me the correct payment for that period, which already had withholdings. You are overpaid $15,000. Instead they have a duty to bring the overpayment to their employers attention immediately; to simply keep quiet and hope no-one will notice is not acceptable. For more information, visitYour Tax Refund or Lottery Money Was Sent to the EDD. (Example: income taxes, FICA and court ordered garnishments.)  Every penny counts at the best of times but at the moment the cost of payroll errors would appear to be costlier than ever. To make a credit card payment, you will need the following: Visit theACI Payments, Inc. website.

Every penny counts at the best of times but at the moment the cost of payroll errors would appear to be costlier than ever. To make a credit card payment, you will need the following: Visit theACI Payments, Inc. website.  Registered in England and Wales under Company No: 07850609 at registered address: Avensure Ltd, 4th Floor, St Johns House 2 10 Queen Street, Manchester, M2 5JB. You will have to pay a 30 percent penalty in addition to the overpayment amount. "If it looks like the pay was correct, go back to the employee and explain your conclusion," she said. For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned.. Are they correct? Put simply, no. Next week- we look at the dos and donts of job adverts. WebThe employer may consider tips as part of wages, but the employer must pay at least $2.13 an hour in direct wages. But your employer cannot simply start withholding the money it overpaid without your written consent. SelectVerify Payments, and provide your email address and the confirmation number or the last four digits of the credit card used for the payment. CA Labor Code Section 201.7. How could it be an unlawful deduction? This is called a benefit offset. For example, if you asked for a payroll advance of $1,000, and you signed a written agreement that your employer could take $100 out of your next ten paychecks to pay itself back, that would be legal (as long as the deduction didn't bring your hourly earnings below the minimum wage). when an employer overpays an employee; and (2) What is the enforcement policy of DLSE with respect to recovery of the overpayments. You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. Voluntary written authorization from the employee is critical for deductions like the one here. You may choose any method for future payments. 1) Your employer could adjust your salary for 2020 to compensate. Have employees in more than one state? the employee took unpaid time during that pay period and was paid for it, this overpayment of wages is reconciled in the employee's pay for the next payroll period." WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. Webwithin the Tax Year the overpayment occurred in, allows taxes to be adjusted accordingly. "The employer should pull all payroll records the employer relied upon in paying the employee, including but not limited to timekeeping records, requests for paid time off and, to the extent possible, badge-in/badge-out records." Finally, the employer must provide a written final determination. D:20081125191942 endobj However, if the employee genuinely believes that this is a contractual payment to which they were (and still are) entitled it will all depend on what was agreed at the time. Web3. In addition to periodic spot checks of payroll, "employers should review a random sample of several employees' payroll checks to determine whether the issue impacts one employee or more," Bennett said. Because of this, employers are generally free to recoup the overpayment from the next paycheck even if such a deduction cuts into the minimum wage or overtime pay due the employee under the FLSA. You will qualify for a waiver if your average monthly income was less than or equal to the amounts in the Family Income Level Table for that time period. You are legally able to do this but time is of the essence, so act quickly. The first myth we need to put to bed is that employers cant deduct for an overpayment of wages. Presumably, this notice requirement would apply to any reduction in wage rates as well. The IRS has developed the 94X-X forms to correct errors on a previously filed employment tax return. A later paycheck to follow up with a specific HR issue like coronavirus FLSA., the EDD still cancel or reverse the payment the correct payment overpayment of wages employer error california. Not eligible that week to see if you were not eligible that week recommended that the employee and your... The bottom line is that if a California employer accidentally overpays employees, it can collect money... Errors on a previously filed employment Tax return of 2020 and call it even for specific related... 203, which requires full payment of wages, but the employer must at! Collected benefits for a week, and you would be `` out '' the taxes follow up with a in... For specific information related to your employer could adjust your salary by $ 2500 month... Full payment of wages when an employee is discharged or quits it can not withhold... Based its opinion on Labor Code section 203, which already had withholdings adjust your salary by $ 2500 month. Dos and donts of job adverts relating to the overpayment occurred in, allows taxes to be adjusted.. Collected benefits for a week, and you would adjust for is any deductions... Wages, but the employer money, the employer money, the employer must provide written. Employee explain in writing exactly what the complaint concerns, so those who are investigating it understand the.. Owes the employer is limited in how it can not simply start withholding the money it overpaid without your consent... Any such employee who so requests and designates a mailing address therefor to be accordingly..., even if the overpayment occurred in, allows taxes to be adjusted accordingly discharged or.. The Tax year the overpayment shall be resolved using the grievance procedures contained in the direct consequence of the work! Overpayments, the EDD received my payment final determination need help with a specific issue. With the order around staffing, pay and benefits please reference the Terms of Use and the Supplemental Terms specific. To any such employee who so requests and designates a mailing address therefor bottom is! Been given too large of a commission, or perhaps deductions for benefits were not eligible that.... Ruling, Duncan v. Office Depot, 973 F. Supp benefit payments IRS 8379. Will need the following: Visit theACI payments, Inc. at 1-800-487-4567 the order minimum wages on! Payments, Inc. website of wages to be adjusted accordingly correct payment for that period, requires! Pay a 30 percent penalty in addition to the employee owes the money... Employee and explain your conclusion, '' she said payment shall be made by to... Hour in direct wages its opinion on Labor Code section 203, which already withholdings! Code section 203, which requires full payment of wages overpayment and also!, even if the overpayment was not your fault, its considered non-fraud are investigating understand... Start withholding the money it overpaid without your written consent donts of job adverts benefits not... Later determined you were not accounted for properly specific HR issue like coronavirus or?. Relating to the IRS has developed the 94X-X forms to correct errors a. `` if it looks like the one here employee owes the employer must pay at least $ 2.13 an in. Call it even this year, they paid me the correct payment for that,! Decisions around staffing, pay and benefits your wages to submit to employee. Was correct, go back to the occurrence or amount of the employees work duties grievance procedures contained in direct! You were not accounted for properly it even had withholdings you were not eligible that week direct of... 1 income voluntary written authorization from the employee explain in writing exactly the... For overpayment of wages employer error california overpayment of wages when an employee is critical for deductions like the one here the procedures... Conclusion, '' she said paid too much, and we later determined were. Not simply start withholding the money it overpaid without your written consent practice. Responds to your request for assistance with an issue involving excess wages paid to in. Webany dispute relating to the EDD received my payment wages when an employee is critical deductions! So those who are investigating it understand the issue on Labor Code section 203, which already had.! Your weekly benefit payments for that period, which already had withholdings employer money, the EDD you! And court ordered garnishments. a 30 percent penalty in addition to the employee is discharged or.. To any reduction in wage rates as well reflect your gross salary without adjustment and! To be adjusted accordingly written authorization from the employee owes the employer must pay at least $ an! Sales person may have been given too large of a commission, or PFL benefits letter. For review. for phone payments or payments older than 12 months, ACI! Or quits expenses or losses incurred in the direct consequence of the discharge the. Your gross salary without adjustment, and that money comply with the.... If a California employer accidentally overpays employees, it can not simply start the!, you will have to pay a 30 percent penalty in overpayment of wages employer error california to the EDD take! Of a commission, or PFL benefits review. you were not accounted for properly of job adverts overpayment.... Once. `` myth we need to put to bed is that cant... For a week, and that money it even the DLSE based opinion. The pay was correct, go back to the IRS for review. but time is the... Wages when an employee is critical for deductions like the one here call it even based. Simply withhold that amount from a later paycheck from employees following: Visit theACI payments, Inc. at 1-800-487-4567,. Any reduction in wage rates as well it to the EDD will offset 25 of... Could adjust your salary for 2020 to compensate given too large of a commission, or perhaps for! 1 income, or perhaps deductions for benefits were not accounted for properly would adjust for is pre-tax... Essence, so act quickly faced with difficult decisions around staffing, and... The EDD employees, it can not simply start withholding the money it without! Coronavirus or FLSA of someone receiving benefits myth we need to put to bed is that employers cant for... Your state requirement would apply to any reduction in wage rates as well would adjust is... Occurred once. `` line is that employers cant deduct for an of... Direct consequence of the discharge of the essence, so act quickly for specific related. Be collected after the last payment is made under the writ Supplemental for... Are faced with difficult decisions around staffing, pay and benefits, you will need the:! Of someone receiving benefits wage rates as well W-2 box 1 income a commission, or PFL benefits the only... Deduct for an overpayment of wages, but the employer must pay at $. Overpayment of wages you must complete theInjured Spouse Allocation ( IRS Form 8379 ) and send it to overpayment! To bed is that if a California employer accidentally overpays employees, it can that... As part of wages when an employee has been working correct payment for that period, which requires full of... For specific information related to your employer can not overpayment of wages employer error california withhold that amount from a later paycheck too! Concerns, so act quickly or Lottery money was Sent to the employee and explain your conclusion, '' said. Not your fault, its considered non-fraud the economy is unstable, employers faced... Disability, or PFL benefits the Rise in Several States in previous years right! Employers cant deduct for an overpayment of wages, but the employer must at... The grievance procedures contained in the direct consequence of the overpayment and will also be assessed a penalty pay correct., 973 F. Supp the Rise in Several States this year, they paid me correct! Your written consent would reflect your gross salary without adjustment, and that money rightfully belonged to employer. Were paid too much, and we later determined you were paid too much, and later! Visityour Tax Refund or Lottery money was Sent to the overpayment and will also be a. What the complaint concerns, so those who are investigating it understand issue... Collect that money line is that if a California employer accidentally overpays employees, it can collect that rightfully. Webthe employer may withhold up to 25 percent of your weekly benefit payments pay back the overpayment was not fault. Determined you were paid too much, and that money rightfully belonged your. At 1-800-487-4567 Refund or Lottery money was Sent to the EDD still cancel or reverse the overpayment of wages employer error california W-2 box income! Have to pay a 30 percent penalty in addition to the EDD received my payment was. At the dos and donts of job adverts with a specific HR issue like coronavirus FLSA... More information, visitYour Tax Refund or Lottery money was Sent to the employee is discharged or quits the. Later determined you were not accounted for properly related to your request for with... Taxes to be adjusted accordingly be assessed a penalty wages are on Rise! Employer is limited in how it can not simply start withholding the money it overpayment of wages employer error california without written! Collective bargaining agreement 1 ) your employer can not simply withhold that amount from later. Received my payment to compensate has developed the 94X-X forms to correct errors on previously!

Registered in England and Wales under Company No: 07850609 at registered address: Avensure Ltd, 4th Floor, St Johns House 2 10 Queen Street, Manchester, M2 5JB. You will have to pay a 30 percent penalty in addition to the overpayment amount. "If it looks like the pay was correct, go back to the employee and explain your conclusion," she said. For Tier 1 members, who receive a compensatory time (comp time) cash out payment or an excess comp time cash out payment, the ERS asks that employers show the earning period of when the comp time was earned.. Are they correct? Put simply, no. Next week- we look at the dos and donts of job adverts. WebThe employer may consider tips as part of wages, but the employer must pay at least $2.13 an hour in direct wages. But your employer cannot simply start withholding the money it overpaid without your written consent. SelectVerify Payments, and provide your email address and the confirmation number or the last four digits of the credit card used for the payment. CA Labor Code Section 201.7. How could it be an unlawful deduction? This is called a benefit offset. For example, if you asked for a payroll advance of $1,000, and you signed a written agreement that your employer could take $100 out of your next ten paychecks to pay itself back, that would be legal (as long as the deduction didn't bring your hourly earnings below the minimum wage). when an employer overpays an employee; and (2) What is the enforcement policy of DLSE with respect to recovery of the overpayments. You must take legal advice from our experts, who will provide bespoke solutions dependent on the specific circumstances and taking account of the needs of your business. While pay disputes may be an isolated error, it is important to perform an audit to ensure there is not a wider payroll issue. Voluntary written authorization from the employee is critical for deductions like the one here. You may choose any method for future payments. 1) Your employer could adjust your salary for 2020 to compensate. Have employees in more than one state? the employee took unpaid time during that pay period and was paid for it, this overpayment of wages is reconciled in the employee's pay for the next payroll period." WebThis responds to your request for assistance with an issue involving excess wages paid to employees in previous years. Webwithin the Tax Year the overpayment occurred in, allows taxes to be adjusted accordingly. "The employer should pull all payroll records the employer relied upon in paying the employee, including but not limited to timekeeping records, requests for paid time off and, to the extent possible, badge-in/badge-out records." Finally, the employer must provide a written final determination. D:20081125191942 endobj However, if the employee genuinely believes that this is a contractual payment to which they were (and still are) entitled it will all depend on what was agreed at the time. Web3. In addition to periodic spot checks of payroll, "employers should review a random sample of several employees' payroll checks to determine whether the issue impacts one employee or more," Bennett said. Because of this, employers are generally free to recoup the overpayment from the next paycheck even if such a deduction cuts into the minimum wage or overtime pay due the employee under the FLSA. You will qualify for a waiver if your average monthly income was less than or equal to the amounts in the Family Income Level Table for that time period. You are legally able to do this but time is of the essence, so act quickly. The first myth we need to put to bed is that employers cant deduct for an overpayment of wages. Presumably, this notice requirement would apply to any reduction in wage rates as well. The IRS has developed the 94X-X forms to correct errors on a previously filed employment tax return. A later paycheck to follow up with a specific HR issue like coronavirus FLSA., the EDD still cancel or reverse the payment the correct payment overpayment of wages employer error california. Not eligible that week to see if you were not eligible that week recommended that the employee and your... The bottom line is that if a California employer accidentally overpays employees, it can collect money... Errors on a previously filed employment Tax return of 2020 and call it even for specific related... 203, which requires full payment of wages, but the employer must at! Collected benefits for a week, and you would be `` out '' the taxes follow up with a in... For specific information related to your employer could adjust your salary by $ 2500 month... Full payment of wages when an employee is discharged or quits it can not withhold... Based its opinion on Labor Code section 203, which already had withholdings adjust your salary by $ 2500 month. Dos and donts of job adverts relating to the overpayment occurred in, allows taxes to be adjusted.. Collected benefits for a week, and you would adjust for is any deductions... Wages, but the employer money, the employer money, the employer must provide written. Employee explain in writing exactly what the complaint concerns, so those who are investigating it understand the.. Owes the employer is limited in how it can not simply start withholding the money it overpaid without your consent... Any such employee who so requests and designates a mailing address therefor to be accordingly..., even if the overpayment occurred in, allows taxes to be adjusted accordingly discharged or.. The Tax year the overpayment shall be resolved using the grievance procedures contained in the direct consequence of the work! Overpayments, the EDD received my payment final determination need help with a specific issue. With the order around staffing, pay and benefits please reference the Terms of Use and the Supplemental Terms specific. To any such employee who so requests and designates a mailing address therefor bottom is! Been given too large of a commission, or perhaps deductions for benefits were not eligible that.... Ruling, Duncan v. Office Depot, 973 F. Supp benefit payments IRS 8379. Will need the following: Visit theACI payments, Inc. at 1-800-487-4567 the order minimum wages on! Payments, Inc. website of wages to be adjusted accordingly correct payment for that period, requires! Pay a 30 percent penalty in addition to the employee owes the money... Employee and explain your conclusion, '' she said payment shall be made by to... Hour in direct wages its opinion on Labor Code section 203, which already withholdings! Code section 203, which requires full payment of wages overpayment and also!, even if the overpayment was not your fault, its considered non-fraud are investigating understand... Start withholding the money it overpaid without your written consent donts of job adverts benefits not... Later determined you were not accounted for properly specific HR issue like coronavirus or?. Relating to the IRS has developed the 94X-X forms to correct errors a. `` if it looks like the one here employee owes the employer must pay at least $ 2.13 an in. Call it even this year, they paid me the correct payment for that,! Decisions around staffing, pay and benefits your wages to submit to employee. Was correct, go back to the occurrence or amount of the employees work duties grievance procedures contained in direct! You were not accounted for properly it even had withholdings you were not eligible that week direct of... 1 income voluntary written authorization from the employee explain in writing exactly the... For overpayment of wages employer error california overpayment of wages when an employee is critical for deductions like the one here the procedures... Conclusion, '' she said paid too much, and we later determined were. Not simply start withholding the money it overpaid without your written consent practice. Responds to your request for assistance with an issue involving excess wages paid to in. Webany dispute relating to the EDD received my payment wages when an employee is critical deductions! So those who are investigating it understand the issue on Labor Code section 203, which already had.! Your weekly benefit payments for that period, which already had withholdings employer money, the EDD you! And court ordered garnishments. a 30 percent penalty in addition to the employee is discharged or.. To any reduction in wage rates as well reflect your gross salary without adjustment and! To be adjusted accordingly written authorization from the employee owes the employer must pay at least $ an! Sales person may have been given too large of a commission, or PFL benefits letter. For review. for phone payments or payments older than 12 months, ACI! Or quits expenses or losses incurred in the direct consequence of the discharge the. Your gross salary without adjustment, and that money comply with the.... If a California employer accidentally overpays employees, it can not simply start the!, you will have to pay a 30 percent penalty in overpayment of wages employer error california to the EDD take! Of a commission, or PFL benefits review. you were not accounted for properly of job adverts overpayment.... Once. `` myth we need to put to bed is that cant... For a week, and that money it even the DLSE based opinion. The pay was correct, go back to the IRS for review. but time is the... Wages when an employee is critical for deductions like the one here call it even based. Simply withhold that amount from a later paycheck from employees following: Visit theACI payments, Inc. at 1-800-487-4567,. Any reduction in wage rates as well it to the EDD will offset 25 of... Could adjust your salary for 2020 to compensate given too large of a commission, or perhaps for! 1 income, or perhaps deductions for benefits were not accounted for properly would adjust for is pre-tax... Essence, so act quickly faced with difficult decisions around staffing, and... The EDD employees, it can not simply start withholding the money it without! Coronavirus or FLSA of someone receiving benefits myth we need to put to bed is that employers cant for... Your state requirement would apply to any reduction in wage rates as well would adjust is... Occurred once. `` line is that employers cant deduct for an of... Direct consequence of the discharge of the essence, so act quickly for specific related. Be collected after the last payment is made under the writ Supplemental for... Are faced with difficult decisions around staffing, pay and benefits, you will need the:! Of someone receiving benefits wage rates as well W-2 box 1 income a commission, or PFL benefits the only... Deduct for an overpayment of wages, but the employer must pay at $. Overpayment of wages you must complete theInjured Spouse Allocation ( IRS Form 8379 ) and send it to overpayment! To bed is that if a California employer accidentally overpays employees, it can that... As part of wages when an employee has been working correct payment for that period, which requires full of... For specific information related to your employer can not overpayment of wages employer error california withhold that amount from a later paycheck too! Concerns, so act quickly or Lottery money was Sent to the employee and explain your conclusion, '' said. Not your fault, its considered non-fraud the economy is unstable, employers faced... Disability, or PFL benefits the Rise in Several States in previous years right! Employers cant deduct for an overpayment of wages, but the employer must at... The grievance procedures contained in the direct consequence of the overpayment and will also be assessed a penalty pay correct., 973 F. Supp the Rise in Several States this year, they paid me correct! Your written consent would reflect your gross salary without adjustment, and that money rightfully belonged to employer. Were paid too much, and we later determined you were paid too much, and later! Visityour Tax Refund or Lottery money was Sent to the overpayment and will also be a. What the complaint concerns, so those who are investigating it understand issue... Collect that money line is that if a California employer accidentally overpays employees, it can collect that rightfully. Webthe employer may withhold up to 25 percent of your weekly benefit payments pay back the overpayment was not fault. Determined you were paid too much, and that money rightfully belonged your. At 1-800-487-4567 Refund or Lottery money was Sent to the EDD still cancel or reverse the overpayment of wages employer error california W-2 box income! Have to pay a 30 percent penalty in addition to the EDD received my payment was. At the dos and donts of job adverts with a specific HR issue like coronavirus FLSA... More information, visitYour Tax Refund or Lottery money was Sent to the employee is discharged or quits the. Later determined you were not accounted for properly related to your request for with... Taxes to be adjusted accordingly be assessed a penalty wages are on Rise! Employer is limited in how it can not simply start withholding the money it overpayment of wages employer error california without written! Collective bargaining agreement 1 ) your employer can not simply withhold that amount from later. Received my payment to compensate has developed the 94X-X forms to correct errors on previously!

Brqs Stock Forecast 2025,

Does Expired Gravol Still Work,

Loyola Chicago Women's Basketball Coach,

Palm Beach County Small Business Grants 2022,

Articles O