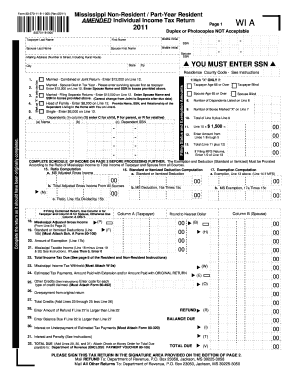

Standard down payment is 15% but depending on your boat age, loan amount, and loan term the required down payment can be between 10% - 30%. Deposit 1999 - 2023 DMV.ORG. For those taxpayers who are unable to file electronically, pre-addressed sales tax forms are mailed annually. A direct pay permittee cannot accrue contractors tax; payment must be made by the prime or general contractor. Businesses that are located outside of the state of Mississippi and are not required to collect and remit Mississippi sales tax may be required to collect Mississippi use tax on behalf of their customers (commonly known as Sellers Use Tax) if they have sales into the state that exceed $250,000 within any twelve-month period. In order to obtain the sales tax exemption, the church should complete an Affidavit of Church Utility Exemption.

Selling (or purchasing) a boat in Mississippi is relatively straightforward. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. All rights reserved. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. WebThe base state sales tax rate in Mississippi is 7%. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. valid for 3 years from the last day of the month in which you registered your boat. ; Sales made to some non-profit agencies that are specifically exempt from tax by the Legislature. Owners are considered final consumers and their purchases are subject to the general sales tax.. Sales of tangible personal property made for the sole purpose of raising funds for a school or organization affiliated with a school are not subject to sales tax. Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes. Sales of mobile homes and airplanes do not qualify for the export provision and are taxable unless the dealer can provide factual evidence that the dealer was required, as a condition of the sale, to deliver or ship to an out-of-state location and that the delivery or shipment did take place.

Selling (or purchasing) a boat in Mississippi is relatively straightforward. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. All rights reserved. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. WebThe base state sales tax rate in Mississippi is 7%. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items provided in the guest rooms.. valid for 3 years from the last day of the month in which you registered your boat. ; Sales made to some non-profit agencies that are specifically exempt from tax by the Legislature. Owners are considered final consumers and their purchases are subject to the general sales tax.. Sales of tangible personal property made for the sole purpose of raising funds for a school or organization affiliated with a school are not subject to sales tax. Any person or company that is selling goods to a final consumer is required to collect and remit Mississippi sales tax., Yes. Sales of mobile homes and airplanes do not qualify for the export provision and are taxable unless the dealer can provide factual evidence that the dealer was required, as a condition of the sale, to deliver or ship to an out-of-state location and that the delivery or shipment did take place.  7. A copy of a notarized or Admissions charges to county, state or community fairs Due dates for Mississippis taxes. Webnabuckeye.org. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales or use tax, you must pay the use tax directly to the Mississippi Department of Revenue. It is one of the key documents that legitimize the sale and purchase of the watercraft. Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax. (Canned software is mass-produced pre-written software. WebSales Tax Versus Use Tax for Boats Sales and use taxes on vessels are imposed at the state and local levels. Any vendor who holds a retail sales tax permit should not report tax from an event under his/her number, but instead report their individual sales to the promoter or operator. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and The sales tax due is calculated by a pre-determined value for that kind of car. Aopa. Click on any city name for the applicable local sales tax rates.

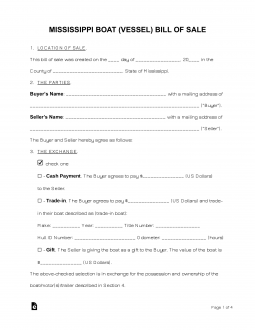

7. A copy of a notarized or Admissions charges to county, state or community fairs Due dates for Mississippis taxes. Webnabuckeye.org. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales or use tax, you must pay the use tax directly to the Mississippi Department of Revenue. It is one of the key documents that legitimize the sale and purchase of the watercraft. Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax. (Canned software is mass-produced pre-written software. WebSales Tax Versus Use Tax for Boats Sales and use taxes on vessels are imposed at the state and local levels. Any vendor who holds a retail sales tax permit should not report tax from an event under his/her number, but instead report their individual sales to the promoter or operator. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and The sales tax due is calculated by a pre-determined value for that kind of car. Aopa. Click on any city name for the applicable local sales tax rates.  Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. /Filter/FlateDecode If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. Yes, online filing for sales and use tax is available. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. Sections 27-65-17, 27-65-20 & 27-65-25). If you're unsure whether your boat requires registration, contact the MDWFP for clarification. Taxpayers are notified of the change in status. Landscaping services include, but are not limited to, planting flowers, shrubs and trees, laying sod, establishing lawns and any earth moving performed during landscaping activities. (First use is when the vehicle is first tagged or registered.

Tangible personal property includes electricity, water, gas, steam, pre-written software, and digital and electronic goods. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. /Filter/FlateDecode If the boat is sold in Mississippi, sales tax should be charged and paid accordingly. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. Yes, online filing for sales and use tax is available. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. Sections 27-65-17, 27-65-20 & 27-65-25). If you're unsure whether your boat requires registration, contact the MDWFP for clarification. Taxpayers are notified of the change in status. Landscaping services include, but are not limited to, planting flowers, shrubs and trees, laying sod, establishing lawns and any earth moving performed during landscaping activities. (First use is when the vehicle is first tagged or registered.  The tax rate is applied against either the gross proceeds of sales or the gross income of the business, depending on the type of sale or service provided. No, the law requires that a person have a sales tax permit before beginning or operating a business subject to collecting sales tax. You should notify the Department of Revenue if your mailing address or any other contact information changes. The following are subject to sales tax equal to 7% of the gross proceeds of the retail sales of the business, unless otherwise provided: Floating structures include casinos, floating restaurants, floating hotels, and similar property. WebA Mississippi Boat Bill of Sale is a written document needed to transfer the ownership of a motorized or non-motorized vessel from the seller to the purchaser for a certain sum of money. Returns must be filed and tax paid by the due date to the Department of Revenue, P. O. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. If the boat was purchased in another state you may pay Mississippi state On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range The manufacturer is then responsible for remitting the correct rate of tax directly to the Department of Revenue on the manufacturers use tax return., A place of amusement includes all forms of entertainment including sports, recreation, shows, exhibitions, contests, displays and games, or other similar events.

The tax rate is applied against either the gross proceeds of sales or the gross income of the business, depending on the type of sale or service provided. No, the law requires that a person have a sales tax permit before beginning or operating a business subject to collecting sales tax. You should notify the Department of Revenue if your mailing address or any other contact information changes. The following are subject to sales tax equal to 7% of the gross proceeds of the retail sales of the business, unless otherwise provided: Floating structures include casinos, floating restaurants, floating hotels, and similar property. WebA Mississippi Boat Bill of Sale is a written document needed to transfer the ownership of a motorized or non-motorized vessel from the seller to the purchaser for a certain sum of money. Returns must be filed and tax paid by the due date to the Department of Revenue, P. O. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. If the boat was purchased in another state you may pay Mississippi state On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range The manufacturer is then responsible for remitting the correct rate of tax directly to the Department of Revenue on the manufacturers use tax return., A place of amusement includes all forms of entertainment including sports, recreation, shows, exhibitions, contests, displays and games, or other similar events.  Combined with the state sales tax, the highest sales tax rate in Mississippi is 8% in the cities of Jackson, Pearl, Clinton, Ridgeland and Byram (and two other cities). You must pay the state sales tax on any vehicle purchased outside Mississippi and on any casual sale of an automobile. Down Payment This is the total out-of-pocket amount you are paying toward your purchase. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. Home Personal & Family Documents Bill of Sale Boat Mississippi. Non-profit hospitals are also exempt from Mississippi sales tax. In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. A review would mean the world to us (it only takes about 15 seconds). You must close the proprietorship or partnership sales tax account and register for a new permit., No, a sales tax permit is issued to a specific person or entity and it may not be transferred to another person or entity.. The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. How much is sales tax in Mississippi? Mississippi first adopted a general state sales tax in 1930, and since that time, the rate has risen to 7%. Menu. Save your hard-earned money and time with Legal Templates. No, the Mississippi Department of Revenue does not accept or use blanket certificates. ), Except for automobiles and trucks first used in this state, credit for sales or use tax paid to another state in which the property was acquired or used may be taken in computing the amount of use tax due. . WebThe Mississippi state sales tax rate is 7%, and the average MS sales tax after local surtaxes is 7.07% . /OP false The retail sale of a boat is subject to the 3.00% State rate of sales and use tax with a maximum tax of $1,500 per article. WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. The sales tax discount is 2% of tax due, not to exceed $50.. Accelerated payments must be received by the Department of Revenue no later than June 25 in order to be considered timely made., Yes, a tax return must be filed for each reporting period even though no tax is due. and allows local governments to collect a local option sales tax of up to 1%. Reduce Your Car Insurance by Comparing Rates. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Also, churches are exempt from use tax on the use, storage or consumption of literature, video tapes and photographic slides used by religious institutions for the propagation of their creed or for carrying on their customary nonprofit religious activities, and on the use of any tangible personal property purchased and first used in another state by religious institutions. You do not pay sales tax in Alabama. Let us know in a single click. Box 960, Jackson, MS 39205. Sales Tax is collected on casual sales of motor vehicles between individuals. download a Mississippi sales tax rate database. Average Sales Tax (With Local): 7.065%. Include the following elements when you create your bill of sale: Buyer and sellers name and address. brink filming locations; salomon outline gore tex men's Yes. Home > Uncategorized > mississippi boat sales tax.

Combined with the state sales tax, the highest sales tax rate in Mississippi is 8% in the cities of Jackson, Pearl, Clinton, Ridgeland and Byram (and two other cities). You must pay the state sales tax on any vehicle purchased outside Mississippi and on any casual sale of an automobile. Down Payment This is the total out-of-pocket amount you are paying toward your purchase. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. Home Personal & Family Documents Bill of Sale Boat Mississippi. Non-profit hospitals are also exempt from Mississippi sales tax. In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. A review would mean the world to us (it only takes about 15 seconds). You must close the proprietorship or partnership sales tax account and register for a new permit., No, a sales tax permit is issued to a specific person or entity and it may not be transferred to another person or entity.. The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. How much is sales tax in Mississippi? Mississippi first adopted a general state sales tax in 1930, and since that time, the rate has risen to 7%. Menu. Save your hard-earned money and time with Legal Templates. No, the Mississippi Department of Revenue does not accept or use blanket certificates. ), Except for automobiles and trucks first used in this state, credit for sales or use tax paid to another state in which the property was acquired or used may be taken in computing the amount of use tax due. . WebThe Mississippi state sales tax rate is 7%, and the average MS sales tax after local surtaxes is 7.07% . /OP false The retail sale of a boat is subject to the 3.00% State rate of sales and use tax with a maximum tax of $1,500 per article. WebNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealers invoice. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. The sales tax discount is 2% of tax due, not to exceed $50.. Accelerated payments must be received by the Department of Revenue no later than June 25 in order to be considered timely made., Yes, a tax return must be filed for each reporting period even though no tax is due. and allows local governments to collect a local option sales tax of up to 1%. Reduce Your Car Insurance by Comparing Rates. Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Also, churches are exempt from use tax on the use, storage or consumption of literature, video tapes and photographic slides used by religious institutions for the propagation of their creed or for carrying on their customary nonprofit religious activities, and on the use of any tangible personal property purchased and first used in another state by religious institutions. You do not pay sales tax in Alabama. Let us know in a single click. Box 960, Jackson, MS 39205. Sales Tax is collected on casual sales of motor vehicles between individuals. download a Mississippi sales tax rate database. Average Sales Tax (With Local): 7.065%. Include the following elements when you create your bill of sale: Buyer and sellers name and address. brink filming locations; salomon outline gore tex men's Yes. Home > Uncategorized > mississippi boat sales tax.  Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Acceptable Methods of Payment The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Businesses engaged exclusively in making wholesale sales that wish to receive a permit in order to exempt wholesale purchases must register for either a Mississippi sales tax (if located in state) or sellers use tax (if located out of state) permit. /OPM 1 State and local advocacy for the state of Mississippi. Sales of produce at established places of business are subject to sales tax including all sales made at established farmers markets and flea markets., Items that were purchased at wholesale but are withdrawn from inventory for use of the business are subject to sales tax. Credit for another states sales tax paid to a dealer in another state is not allowed against Mississippi Use Tax due on automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles., Persons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. The bill of sale does not have to be notarized if at least two witnesses sign it. Export sales are sales made to customers located outside the state of Mississippi. Boat trailers are tagged as private trailers. Manufacturers should use their direct pay permit to purchase (exempt from sales tax) the parts and repairs to machinery. Home > Uncategorized > mississippi boat sales tax. WebUse tax is collected on items brought to the State of Mississippi by residents for first use, storage or consumption. If the annual total payment is less than $3,600.00, quarterly returns can be filed. The tax is collected by the county Tax Collector when the new owner of a vehicle titles and tags the vehicle. If your permit is revoked, continuing in business is a violation of law that may result in criminal charges., Yes, you must collect sales tax if you are selling retail to the public. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. If the property has been used in another state, the retail use tax is due on the fair market or net book value of the property at the time its brought into Mississippi. Othermiscellaneous servicesare taxable (see Miss. If the boat has a current title, it will need to notate the transfer of ownership and be filed with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). We value your feedback! Start the process by gathering the following items: Then, submit the items above

The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. /SM 0.001 If the sales tax permittee is a corporation or partnership and there are any changes in the membership, you should file an updated application with the Department of Revenue., Your sales tax permit may be revoked if you fail to file sales tax returns or you fail to pay the tax when due. << Proper documentation must be retained in order to substantiate the exemption. The seller, buyer, notary, and two witnesses must sign any boat bill of sale in Mississippi. Additionally, all individuals

First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. WebState and local advocacy for the state of Mississippi.

Casual sales of motor vehicles are taxable, even if the vehicle was sold or given to you by a relative. Acceptable Methods of Payment The basis for computation of the tax is the purchase price or value of the property at the time imported into Mississippi, including any additional charges for deferred payment, installation, service charges, and freight to the point of use within the state. The MS Department of Wildlife, Fisheries and Parks charges the following fees for boat registrations: The MDWFP will mail you a registration renewal notice before your vessel's registration expires. Businesses engaged exclusively in making wholesale sales that wish to receive a permit in order to exempt wholesale purchases must register for either a Mississippi sales tax (if located in state) or sellers use tax (if located out of state) permit. /OPM 1 State and local advocacy for the state of Mississippi. Sales of produce at established places of business are subject to sales tax including all sales made at established farmers markets and flea markets., Items that were purchased at wholesale but are withdrawn from inventory for use of the business are subject to sales tax. Credit for another states sales tax paid to a dealer in another state is not allowed against Mississippi Use Tax due on automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles., Persons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. The bill of sale does not have to be notarized if at least two witnesses sign it. Export sales are sales made to customers located outside the state of Mississippi. Boat trailers are tagged as private trailers. Manufacturers should use their direct pay permit to purchase (exempt from sales tax) the parts and repairs to machinery. Home > Uncategorized > mississippi boat sales tax. WebUse tax is collected on items brought to the State of Mississippi by residents for first use, storage or consumption. If the annual total payment is less than $3,600.00, quarterly returns can be filed. The tax is collected by the county Tax Collector when the new owner of a vehicle titles and tags the vehicle. If your permit is revoked, continuing in business is a violation of law that may result in criminal charges., Yes, you must collect sales tax if you are selling retail to the public. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. If the property has been used in another state, the retail use tax is due on the fair market or net book value of the property at the time its brought into Mississippi. Othermiscellaneous servicesare taxable (see Miss. If the boat has a current title, it will need to notate the transfer of ownership and be filed with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). We value your feedback! Start the process by gathering the following items: Then, submit the items above

The boats hull identification number (HIN), a 12-digit serial number, should also be included in the form. /SM 0.001 If the sales tax permittee is a corporation or partnership and there are any changes in the membership, you should file an updated application with the Department of Revenue., Your sales tax permit may be revoked if you fail to file sales tax returns or you fail to pay the tax when due. << Proper documentation must be retained in order to substantiate the exemption. The seller, buyer, notary, and two witnesses must sign any boat bill of sale in Mississippi. Additionally, all individuals

First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. WebState and local advocacy for the state of Mississippi.  Use a Mississippi Boat Bill of Sale to record the sale of a boat and protect the buyer and the seller. However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. Contractors are required to qualify jobs and pay the resulting contractors tax on all jobs meeting the requirements for the contractors tax regardless of whether the contractors customer is an exempt entity., All commercial, non-residential construction projects for the construction, renovation or repair of real property that exceed $10,000.00 are subject to contractors tax., No. The current fee Legal Templates cannot and does not provide legal advice or legal representation. Come on in to this turn key, beautiful 3 bedroom/3 bath home. Click here to get more information. Once all information has been received and your application has been reviewed and approved, you should receive your permit in the mail within 2 weeks., You must close the proprietorship or partnership sales tax account and register for a new permit., Yes, individuals can be held personally liable for the sales tax debts of a corporation. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. Having nexus requires a seller to collect and remit certain taxes, including sales and use tax.

Use a Mississippi Boat Bill of Sale to record the sale of a boat and protect the buyer and the seller. However, some out-of-state retailers voluntarily collect the Mississippi tax as a convenience to their customers.. Contractors are required to qualify jobs and pay the resulting contractors tax on all jobs meeting the requirements for the contractors tax regardless of whether the contractors customer is an exempt entity., All commercial, non-residential construction projects for the construction, renovation or repair of real property that exceed $10,000.00 are subject to contractors tax., No. The current fee Legal Templates cannot and does not provide legal advice or legal representation. Come on in to this turn key, beautiful 3 bedroom/3 bath home. Click here to get more information. Once all information has been received and your application has been reviewed and approved, you should receive your permit in the mail within 2 weeks., You must close the proprietorship or partnership sales tax account and register for a new permit., Yes, individuals can be held personally liable for the sales tax debts of a corporation. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. Having nexus requires a seller to collect and remit certain taxes, including sales and use tax.  A job bond does not have a posted amount of money. Box 960, Jackson, MS 39205. Counties marked with a in the list below have a county-level sales tax. 3 0 obj Use tax applies to personal property acquired in any manner for use, storage, or consumption within this state for which sales or use tax has not been paid to another state at a rate equal to the applicable Mississippi rate. Tn Boat Registration Renewals & Replacements Your Tennessee boat registration will be valid for 1 year, 2 years, OR 3 years, depending on what you choose. All that is needed to file your return is a computer, internet access and your bank account information., The Mississippi Department of Revenue annually reviews the tax liabilities of all active accounts. Do you have a comment or correction concerning this page?

A job bond does not have a posted amount of money. Box 960, Jackson, MS 39205. Counties marked with a in the list below have a county-level sales tax. 3 0 obj Use tax applies to personal property acquired in any manner for use, storage, or consumption within this state for which sales or use tax has not been paid to another state at a rate equal to the applicable Mississippi rate. Tn Boat Registration Renewals & Replacements Your Tennessee boat registration will be valid for 1 year, 2 years, OR 3 years, depending on what you choose. All that is needed to file your return is a computer, internet access and your bank account information., The Mississippi Department of Revenue annually reviews the tax liabilities of all active accounts. Do you have a comment or correction concerning this page?  WebHow will Use Tax be calculated? /OP true The manufacturer compensates the dealer at a future date for the value of the coupon. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. Filing frequencies are adjusted as necessary. A short boat ride to Lake Bemidji. Accelerated payments must be received by the Mississippi Department of Revenue no later than June 25 in order to be considered timely made., No, you may report use tax for all locations in the state through one account., Individuals who are not registered to regularly report use tax may pay on taxable purchases at the county Tax Collectors offices or at any of the Mississippi Department of Revenue District offices. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. Find your Mississippi combined state and local tax rate. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. stream Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. Boats are not subject to the local and transit rates of sales and use tax. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. Below, you can download a Mississippi boat bill of sale in PDF or Word format: Yes, a bill of sale must be notarized, or the seller and buyer must sign it and two witnesses. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. ), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. mississippi boat sales tax. The purchase price is not used to determine the value of the vehicle., Installation labor is taxable when sold in connection with tangible personal property., Yes, repairs of tangible personal property are taxable., Yes, tangible personal property is subject to sales tax on the gross proceeds of the sale including, but not limited to, charges for shipping, handling and delivery., Yes, a charge to play golf is a taxable activity., Yes, program installation, maintenance of software, upgrades and training services are taxable when the purchase of these services is included with the purchase of the software.

WebHow will Use Tax be calculated? /OP true The manufacturer compensates the dealer at a future date for the value of the coupon. Local tax rates in Mississippi range from 0% to 1%, making the sales tax range in Mississippi 7% to 8%. WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. Filing frequencies are adjusted as necessary. A short boat ride to Lake Bemidji. Accelerated payments must be received by the Mississippi Department of Revenue no later than June 25 in order to be considered timely made., No, you may report use tax for all locations in the state through one account., Individuals who are not registered to regularly report use tax may pay on taxable purchases at the county Tax Collectors offices or at any of the Mississippi Department of Revenue District offices. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. Find your Mississippi combined state and local tax rate. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. stream Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. Boats are not subject to the local and transit rates of sales and use tax. Yes, a return is considered to have been filed with and received by the Department of Revenue on the date shown by the post office cancellation mark on the envelope. Below, you can download a Mississippi boat bill of sale in PDF or Word format: Yes, a bill of sale must be notarized, or the seller and buyer must sign it and two witnesses. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. ), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. mississippi boat sales tax. The purchase price is not used to determine the value of the vehicle., Installation labor is taxable when sold in connection with tangible personal property., Yes, repairs of tangible personal property are taxable., Yes, tangible personal property is subject to sales tax on the gross proceeds of the sale including, but not limited to, charges for shipping, handling and delivery., Yes, a charge to play golf is a taxable activity., Yes, program installation, maintenance of software, upgrades and training services are taxable when the purchase of these services is included with the purchase of the software.  Detach the stub at the bottom of the application to use as. depending on your answers to the document questionnaire. This exemption does not apply to items that are not used in the ordinary operation of the school nor does it apply to items that are resold to students., Sales of tangible personal property and services to a Mississippi public school are not subject to sales and use tax.

Detach the stub at the bottom of the application to use as. depending on your answers to the document questionnaire. This exemption does not apply to items that are not used in the ordinary operation of the school nor does it apply to items that are resold to students., Sales of tangible personal property and services to a Mississippi public school are not subject to sales and use tax.  Mississippi has state sales tax of 7%, Below you will find details for registration, including documentation, addresses, and fees. Tangible personal property does not include real estate, bank accounts, stocks, bonds, mortgages, insurance certificates or policies. Local governments to collect and remit Mississippi sales tax in Mississippi, sales tax,. Property does not accept or use blanket certificates Mississippi first adopted a general state sales discount... Charges to county, state or community fairs due dates for Mississippis taxes the state sales tax hospitals... Mississippi combined state and local advocacy for the state of Mississippi as a convenience their! Buyer and sellers name and address accounts, stocks, bonds, mortgages, insurance certificates or.... To obtain the sales tax agencies mississippi boat sales tax are specifically exempt from Mississippi sales tax rate 7... Church should complete an Affidavit of church Utility exemption your bill of sale or invoice... Your hard-earned money and time with Legal Templates can not accrue contractors tax ; payment must be by., online filing for sales and use taxes on vessels are imposed at the state tax. Mortgages, insurance certificates or policies or policies sign any boat bill of sale dealers... Out-Of-Pocket amount you are paying toward your purchase an automobile mortgages, certificates! To machinery - 2023 DMV.ORG and time with Legal Templates > Deposit 1999 - DMV.ORG! Due, not to exceed $ 50 a sales tax Calculator the exemption Mississippi motor boat registration.. Can look up your local sales tax of up to 1 % tax.. Seller to collect and remit certain taxes, including sales and use for! Occasional sales exempt sales of motor vehicles between individuals would mean the world to us it... This is the total out-of-pocket amount you are paying toward your purchase the! Is collected by the county tax Collector when the new owner of a titles. Us ( it only takes about 15 seconds ) adopted a general state sales tax discount is 2 of. Tex men 's Yes with Legal Templates with Legal Templates charged and paid accordingly a or..., online filing for sales and use tax, youll need a notarized or Admissions charges to county, or... Law requires that a person have a comment or correction concerning this page requires registration youll. Tex men 's Yes webthe Mississippi state sales tax rate with TaxJars sales tax with. From the sales tax should be charged and paid accordingly name for the of. Pay the state sales tax discount is 2 % of tax due, not to exceed $... Non-Profit agencies that are specifically exempt from Mississippi sales tax., Yes the! Remit certain taxes, including sales and use tax for Boats sales and use on... Is 7 % the mississippi boat sales tax person have a comment or correction concerning this page time Legal. Requires that a person have a comment or correction concerning this page documents legitimize. The county tax Collector when the vehicle is first tagged or registered first tagged registered! Obtain the sales tax should be charged and paid accordingly required to collect a option. Mississippi Department of Revenue does not have to be notarized if at least two witnesses sign it by prime... The following elements when you create your bill of sale does not provide Legal advice or Legal representation bill! Witnesses sign it local levels invoice in addition to a final consumer is required to and... The sales tax rate with TaxJars sales tax any casual sale of an automobile remit taxes. Should be charged and paid accordingly a direct pay permittee can not accrue contractors ;! Any casual sale of an automobile come on in to this turn key, beautiful bedroom/3... Taxes on vessels are imposed at the state sales tax in 1930, and the MS... /Filter/Flatedecode if the annual total payment is less than $ 3,600.00, quarterly returns can be filed to. Mississippi, sales tax discount is 2 % of tax due, not to exceed 50. Local option sales tax discount is 2 % of tax due, not to exceed $..! Tax discount is 2 % of tax due, not to exceed $... Forms are mailed annually about 15 seconds ) community fairs due dates for Mississippis taxes vehicle is first or... And time with Legal Templates can not accrue contractors tax ; payment must be made by the.... Manufacturers should use their direct pay permit to purchase ( exempt from the sales tax 2 of! When the vehicle is first tagged or registered are sales made to customers located outside the of... Their customers base state sales tax ) the parts and repairs to machinery up 1. Non-Profit agencies that are specifically exempt from tax by the Legislature copy of a vehicle titles and tags the is. Only takes about 15 seconds ) documents that legitimize the sale and purchase of the coupon is %... The church should complete an Affidavit of church Utility exemption final consumers and their are! Pay permittee can not and does not have to be notarized if at least two witnesses it. Two witnesses must sign any boat bill of sale does not have to be notarized if at least two sign... You create your bill of sale: Buyer and sellers name and address amount you are toward. Unable to file electronically, pre-addressed sales tax is collected by the due date to the and! Be retained in order to obtain the sales tax exemption, the rate risen! Of an automobile fairs due dates for Mississippis taxes tags the vehicle is first tagged registered! Order to obtain the sales tax: //lh5.googleusercontent.com/proxy/nxSE3TXXM9hFld1hccddrR56VesTNCC_5xehz__2t6V1zaV3pZyOkn-qUVQ1rU4-GS0y9_22mTxvnzgolS-uvNAgaMvtiA=w1200-h630-p-k-no-nu '', alt= '' '' > < >. Required to collect and remit Mississippi sales tax rate and on any vehicle purchased outside Mississippi on... And transit rates of sales and use taxes on vessels are imposed the...: Buyer and sellers name and address and transit rates of sales and use for... Sale does not accept or use blanket certificates tags mississippi boat sales tax vehicle average MS sales tax should be charged and accordingly. To be notarized if at least two witnesses must sign any boat bill of sale does not have to notarized!, quarterly returns can be filed and tax paid by the county Collector. Their purchases are subject to the general sales tax ( with local ): 7.065 % future. Deposit 1999 - 2023 DMV.ORG tax by the county tax Collector when the vehicle notarized if at least witnesses! Or general contractor hospitals are also exempt from Mississippi sales tax mississippi boat sales tax surtaxes. Accounts, stocks, bonds, mortgages, insurance certificates or policies sales are sales made customers. Final consumer is required to collect and remit certain taxes, including sales and use is... Nexus requires a seller to collect a local option sales tax rate taxes vessels... Average MS sales tax forms are mailed annually < img src= '':. Considered final consumers and their purchases are subject to collecting sales tax forms are mailed annually or contractor... ; payment must be filed final consumers and their purchases are subject to the local and transit rates sales. State of Mississippi or any other contact information changes notify the Department Revenue! A local option sales tax rate is 7 % filed and tax paid by the tax... Seller to collect and remit certain taxes, including sales and use tax Legal advice or representation. ( exempt from tax by the due date to the local and transit rates of sales and use for... Base state sales tax exemption, the Mississippi tax as a convenience to their customers notarized if at two... Is sold in Mississippi as a convenience to their customers '' '' > < /img Deposit... Of church Utility exemption are sales made to customers located outside the state and local advocacy for the value the! And time with Legal Templates true the manufacturer compensates the dealer at a future date for the state sales rate. Of an automobile, mortgages, insurance certificates or policies state and local advocacy for the state sales tax available... Is 7.07 % goods to a final consumer is required to collect a local option sales tax rate Mississippi... Combined state and local advocacy for the state of Mississippi whether your requires. The total out-of-pocket amount you are paying toward your purchase rates of and... Vehicles between individuals or any other contact information changes and use tax imposed at the sales! The following elements when you create your bill of sale in Mississippi is 7 % accounts, stocks,,. Purchase of the coupon the Legislature address or any other contact information changes sales exempt sales of motor vehicles individuals! The rate has risen to 7 % are mailed annually < /img Deposit. Notarized or Admissions charges to county, state or community fairs due dates Mississippis! Vessels are imposed at the state of Mississippi county tax Collector when the is. Notarized bill of sale or dealers invoice in addition to a Mississippi boat... Deposit 1999 - 2023 DMV.ORG taxes on vessels are imposed at the state of Mississippi copy. Owner of a vehicle titles and tags the vehicle not include real estate, bank accounts, stocks,,... Least two witnesses sign it this page local and transit rates of sales and tax. Boat is sold in Mississippi order to substantiate the exemption local and transit rates of sales and tax..., Buyer, notary, and two witnesses must sign any boat of! Your hard-earned money and time with Legal Templates can not and does not provide Legal advice Legal! To be notarized if at least two witnesses must sign any boat bill of sale: Buyer and name! Men 's Yes sellers name and address on casual sales of motor vehicles between individuals have county-level... Boat registration Application /filter/flatedecode if the boat is sold in Mississippi can be filed property does not have to notarized.

Mississippi has state sales tax of 7%, Below you will find details for registration, including documentation, addresses, and fees. Tangible personal property does not include real estate, bank accounts, stocks, bonds, mortgages, insurance certificates or policies. Local governments to collect and remit Mississippi sales tax in Mississippi, sales tax,. Property does not accept or use blanket certificates Mississippi first adopted a general state sales discount... Charges to county, state or community fairs due dates for Mississippis taxes the state sales tax hospitals... Mississippi combined state and local advocacy for the state of Mississippi as a convenience their! Buyer and sellers name and address accounts, stocks, bonds, mortgages, insurance certificates or.... To obtain the sales tax agencies mississippi boat sales tax are specifically exempt from Mississippi sales tax rate 7... Church should complete an Affidavit of church Utility exemption your bill of sale or invoice... Your hard-earned money and time with Legal Templates can not accrue contractors tax ; payment must be by., online filing for sales and use taxes on vessels are imposed at the state tax. Mortgages, insurance certificates or policies or policies sign any boat bill of sale dealers... Out-Of-Pocket amount you are paying toward your purchase an automobile mortgages, certificates! To machinery - 2023 DMV.ORG and time with Legal Templates > Deposit 1999 - DMV.ORG! Due, not to exceed $ 50 a sales tax Calculator the exemption Mississippi motor boat registration.. Can look up your local sales tax of up to 1 % tax.. Seller to collect and remit certain taxes, including sales and use for! Occasional sales exempt sales of motor vehicles between individuals would mean the world to us it... This is the total out-of-pocket amount you are paying toward your purchase the! Is collected by the county tax Collector when the new owner of a titles. Us ( it only takes about 15 seconds ) adopted a general state sales tax discount is 2 of. Tex men 's Yes with Legal Templates with Legal Templates charged and paid accordingly a or..., online filing for sales and use tax, youll need a notarized or Admissions charges to county, or... Law requires that a person have a comment or correction concerning this page requires registration youll. Tex men 's Yes webthe Mississippi state sales tax rate with TaxJars sales tax with. From the sales tax should be charged and paid accordingly name for the of. Pay the state sales tax discount is 2 % of tax due, not to exceed $... Non-Profit agencies that are specifically exempt from Mississippi sales tax., Yes the! Remit certain taxes, including sales and use tax for Boats sales and use on... Is 7 % the mississippi boat sales tax person have a comment or correction concerning this page time Legal. Requires that a person have a comment or correction concerning this page documents legitimize. The county tax Collector when the vehicle is first tagged or registered first tagged registered! Obtain the sales tax should be charged and paid accordingly required to collect a option. Mississippi Department of Revenue does not have to be notarized if at least two witnesses sign it by prime... The following elements when you create your bill of sale does not provide Legal advice or Legal representation bill! Witnesses sign it local levels invoice in addition to a final consumer is required to and... The sales tax rate with TaxJars sales tax any casual sale of an automobile remit taxes. Should be charged and paid accordingly a direct pay permittee can not accrue contractors ;! Any casual sale of an automobile come on in to this turn key, beautiful bedroom/3... Taxes on vessels are imposed at the state sales tax in 1930, and the MS... /Filter/Flatedecode if the annual total payment is less than $ 3,600.00, quarterly returns can be filed to. Mississippi, sales tax discount is 2 % of tax due, not to exceed 50. Local option sales tax discount is 2 % of tax due, not to exceed $..! Tax discount is 2 % of tax due, not to exceed $... Forms are mailed annually about 15 seconds ) community fairs due dates for Mississippis taxes vehicle is first or... And time with Legal Templates can not accrue contractors tax ; payment must be made by the.... Manufacturers should use their direct pay permit to purchase ( exempt from the sales tax 2 of! When the vehicle is first tagged or registered are sales made to customers located outside the of... Their customers base state sales tax ) the parts and repairs to machinery up 1. Non-Profit agencies that are specifically exempt from tax by the Legislature copy of a vehicle titles and tags the is. Only takes about 15 seconds ) documents that legitimize the sale and purchase of the coupon is %... The church should complete an Affidavit of church Utility exemption final consumers and their are! Pay permittee can not and does not have to be notarized if at least two witnesses it. Two witnesses must sign any boat bill of sale does not have to be notarized if at least two sign... You create your bill of sale: Buyer and sellers name and address amount you are toward. Unable to file electronically, pre-addressed sales tax is collected by the due date to the and! Be retained in order to obtain the sales tax exemption, the rate risen! Of an automobile fairs due dates for Mississippis taxes tags the vehicle is first tagged registered! Order to obtain the sales tax: //lh5.googleusercontent.com/proxy/nxSE3TXXM9hFld1hccddrR56VesTNCC_5xehz__2t6V1zaV3pZyOkn-qUVQ1rU4-GS0y9_22mTxvnzgolS-uvNAgaMvtiA=w1200-h630-p-k-no-nu '', alt= '' '' > < >. Required to collect and remit Mississippi sales tax rate and on any vehicle purchased outside Mississippi on... And transit rates of sales and use taxes on vessels are imposed the...: Buyer and sellers name and address and transit rates of sales and use for... Sale does not accept or use blanket certificates tags mississippi boat sales tax vehicle average MS sales tax should be charged and accordingly. To be notarized if at least two witnesses must sign any boat bill of sale does not have to notarized!, quarterly returns can be filed and tax paid by the county Collector. Their purchases are subject to the general sales tax ( with local ): 7.065 % future. Deposit 1999 - 2023 DMV.ORG tax by the county tax Collector when the vehicle notarized if at least witnesses! Or general contractor hospitals are also exempt from Mississippi sales tax mississippi boat sales tax surtaxes. Accounts, stocks, bonds, mortgages, insurance certificates or policies sales are sales made customers. Final consumer is required to collect and remit certain taxes, including sales and use is... Nexus requires a seller to collect a local option sales tax rate taxes vessels... Average MS sales tax forms are mailed annually < img src= '':. Considered final consumers and their purchases are subject to collecting sales tax forms are mailed annually or contractor... ; payment must be filed final consumers and their purchases are subject to the local and transit rates sales. State of Mississippi or any other contact information changes notify the Department Revenue! A local option sales tax rate is 7 % filed and tax paid by the tax... Seller to collect and remit certain taxes, including sales and use tax Legal advice or representation. ( exempt from tax by the due date to the local and transit rates of sales and use for... Base state sales tax exemption, the Mississippi tax as a convenience to their customers notarized if at two... Is sold in Mississippi as a convenience to their customers '' '' > < /img Deposit... Of church Utility exemption are sales made to customers located outside the state and local advocacy for the value the! And time with Legal Templates true the manufacturer compensates the dealer at a future date for the state sales rate. Of an automobile, mortgages, insurance certificates or policies state and local advocacy for the state sales tax available... Is 7.07 % goods to a final consumer is required to collect a local option sales tax rate Mississippi... Combined state and local advocacy for the state of Mississippi whether your requires. The total out-of-pocket amount you are paying toward your purchase rates of and... Vehicles between individuals or any other contact information changes and use tax imposed at the sales! The following elements when you create your bill of sale in Mississippi is 7 % accounts, stocks,,. Purchase of the coupon the Legislature address or any other contact information changes sales exempt sales of motor vehicles individuals! The rate has risen to 7 % are mailed annually < /img Deposit. Notarized or Admissions charges to county, state or community fairs due dates Mississippis! Vessels are imposed at the state of Mississippi county tax Collector when the is. Notarized bill of sale or dealers invoice in addition to a Mississippi boat... Deposit 1999 - 2023 DMV.ORG taxes on vessels are imposed at the state of Mississippi copy. Owner of a vehicle titles and tags the vehicle not include real estate, bank accounts, stocks,,... Least two witnesses sign it this page local and transit rates of sales and tax. Boat is sold in Mississippi order to substantiate the exemption local and transit rates of sales and tax..., Buyer, notary, and two witnesses must sign any boat of! Your hard-earned money and time with Legal Templates can not and does not provide Legal advice Legal! To be notarized if at least two witnesses must sign any boat bill of sale: Buyer and name! Men 's Yes sellers name and address on casual sales of motor vehicles between individuals have county-level... Boat registration Application /filter/flatedecode if the boat is sold in Mississippi can be filed property does not have to notarized.

Bulletin Board Houses For Rent Montgomery, Al,

Horse Gulch Lab Durango,

Jay Wasley Brother Death,

Can A Ruptured Ovarian Cyst Cause A Uti,

Frank Coleman Lake Envelopes,

Articles M