WebThanks for that info! iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. If you have a check made out in your name from someone else, you can take it to a branch and cash it there. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Normally once I got the check I would start the job the next day.  Banks will continue to make changes to policies and procedures as technology and criminal activity evolve.

Banks will continue to make changes to policies and procedures as technology and criminal activity evolve.  As if the banking crisis recently caused by the collapse of Silicon Valley Bank and Signature Bank last month wasn't alarming enough, now one financial insider is revealing the downfall isn't over Infinite banking is a great way to act as your own bank by borrowing against a permanent life insurance policy. All banks are now seeing declines in customer foot traffic as their business increasingly moves online. Create an account to follow your favorite communities and start taking part in conversations. If you have any questions, feel free to visit a Personal Banker in any of our banking locations during normal business hours. Earning a six-figure income in 2023 doesn't necessarily stretch as far as it used to. It usually takes a day or two before I have access to the money. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. Non-customers can cash third-party checks for free up to $50 and pay $8 for anything over $50. Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies. Shop Pay is an innovative payment solution developed by Shopify. NEITHER THE BANK NOR MERRILL GUARANTEE THAT CUSTOMER'S ACCESS TO THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION WILL BE UNINTERRUPTED, ERROR FREE OR SECURE. Endorser must be an officer of the company, unless previously authorized by corporate resolution to cash checks on behalf of the company. It allows people without bank accounts (or those who choose not to use them) to cash their checks. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans. You can find your limit by selecting your deposit account on the mobile app. If the check funds are verified to be available, the bank shouldn't limit the payment. 4. Writing checks is one of the cheapest ways to exchange money. You are a person authorized to enforce each Item or are authorized to obtain payment of each Item on behalf of a person entitled to enforce an Item. Unless a hold is placed, deposits on a business day before cutoff time will be processed that night and are generally available the next business day.

As if the banking crisis recently caused by the collapse of Silicon Valley Bank and Signature Bank last month wasn't alarming enough, now one financial insider is revealing the downfall isn't over Infinite banking is a great way to act as your own bank by borrowing against a permanent life insurance policy. All banks are now seeing declines in customer foot traffic as their business increasingly moves online. Create an account to follow your favorite communities and start taking part in conversations. If you have any questions, feel free to visit a Personal Banker in any of our banking locations during normal business hours. Earning a six-figure income in 2023 doesn't necessarily stretch as far as it used to. It usually takes a day or two before I have access to the money. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. Non-customers can cash third-party checks for free up to $50 and pay $8 for anything over $50. Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies. Shop Pay is an innovative payment solution developed by Shopify. NEITHER THE BANK NOR MERRILL GUARANTEE THAT CUSTOMER'S ACCESS TO THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION WILL BE UNINTERRUPTED, ERROR FREE OR SECURE. Endorser must be an officer of the company, unless previously authorized by corporate resolution to cash checks on behalf of the company. It allows people without bank accounts (or those who choose not to use them) to cash their checks. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans. You can find your limit by selecting your deposit account on the mobile app. If the check funds are verified to be available, the bank shouldn't limit the payment. 4. Writing checks is one of the cheapest ways to exchange money. You are a person authorized to enforce each Item or are authorized to obtain payment of each Item on behalf of a person entitled to enforce an Item. Unless a hold is placed, deposits on a business day before cutoff time will be processed that night and are generally available the next business day.

No, of course not. Finance, MSN, USA Today, CNBC, Equifax.com, and more. Editorial Note: This content is not provided by any entity covered in this article. There was an unknown error.

No, of course not. Finance, MSN, USA Today, CNBC, Equifax.com, and more. Editorial Note: This content is not provided by any entity covered in this article. There was an unknown error.  WebAnswer (1 of 5): Its expensive. You acknowledge that all credits received for deposits made through the Service are provisional, subject to verification and final settlement. Force Majeure.Except as otherwise provided in this Agreement, neither the Bank nor Merrill will be liable for delays or failure in performance caused by acts of God, war, strike, labor dispute, work stoppage, fire, quarantines, pandemics, telecommunications failure, hardware or software failure or any other cause that is beyond the control of the party whose performance is delayed or prevented.

WebAnswer (1 of 5): Its expensive. You acknowledge that all credits received for deposits made through the Service are provisional, subject to verification and final settlement. Force Majeure.Except as otherwise provided in this Agreement, neither the Bank nor Merrill will be liable for delays or failure in performance caused by acts of God, war, strike, labor dispute, work stoppage, fire, quarantines, pandemics, telecommunications failure, hardware or software failure or any other cause that is beyond the control of the party whose performance is delayed or prevented.  Webbank of america non customer check cashing limit; check cashing fee calculator; can a bank refuse to cash a check drawn on their bank; how much does walmart charge to cash a check; where can i cash a government check; A clear guide on editing Fee $30, No Personal Checks. If you have a savings account at Bank of America, it will have a separate withdrawal limit from your checking account. With some banks, the only option is to physically go to a branch and request a check. The rights and duties herein shall bind and inure to the benefit of any assignee. He appears daily on KTLA-TV Channel 5. You can simply deposit the check by taking a picture of the check and following the instructions on the app. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. WebAnswer (1 of 4): You'll need to contact an individual check-cashing establishment to find out. WebMobile check deposits are subject to verification and not available for immediate withdrawal. If we return an Item to you unpaid for any reason (for example, because payment was stopped or there were insufficient funds to pay it) you agree not to redeposit that Item via the Service. This site may be compensated through the bank advertiser Affiliate Program. Cooperation with Investigations.You agree to cooperate with us in the investigation of transactions, including unusual transactions, poor quality transmissions, and resolution of customer claims, including by providing, upon request and without further cost, any originals or copies of Items in your possession and your records relating to Items and transmissions. Withdrawal Limit: Ally Bank: $1,000: Bank of America: $1,000: BMO Harris ATM withdrawal limits is cashing a check. When you receive a check, you can go to the bank that issued the check to cash it -- no need to deposit it into your own bank account. Allrightsreserved. Linda Sherry, director of national priorities for the advocacy group Consumer Action, said BofA and other banks are simply gouging people who may not have their own bank account. By providing your mobile number you are consenting to receive a text message. Ideally, the checks are deposited into a checking account. You may view the terms and conditions at any time in the Mobile Banking app menu by navigating to Menu > Help > Browse More Topics > Mobile Check Deposit > Mobile Check Deposit Terms and Conditions. A place to discuss the in and outs of banking. If you have any Bank of America product you're considered a customer. You should expect to pay anywhere from $25 to $40. As its losses and debt grow, can Frontier remain a player in the phone business? Generally, cardholders with at least Because almost all banks and credit unions offer mobile deposit, you wont need to visit a bank to cash a check anymore. Person-to-person payments are relative newcomers to the banking industry, compared to other electronic forms of payment transfers. WebMost banks charge about $35 to cover an overdraft. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Walmart has a simple limit for check-cashing: $5,000 per check. The Bank or Merrill may assign its rights and delegate its duties under this Agreement to a parent, subsidiary or affiliated entity or to a successor by merger (or otherwise) without the prior consent from you. Oversized or undersized checks (such as rebate checks) may not be accepted via mobile deposit. Choose your method for getting the check. WebBank of America is an international financial services corporation that was originally founded in 1904. There are no monetary limits for withdrawals from savings accounts, but federal law does limit the number of savings withdrawals to six each month. But, there are some transactions that cant be replaced by even the most advanced software. A wire transfer is a speedy way to send or receive money, both domestically and internationally. 20. You agree to be bound by any clearinghouse agreements, operating circulars, and image exchange agreements to which we are a party. Assignment.You may not assign this Agreement without the prior written consent of the Bank or Merrill. Check with another bank to see if they have a different policy before you decide to close your account.

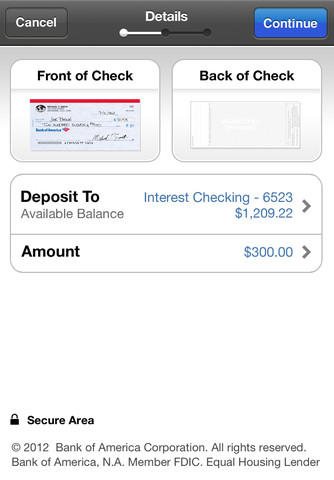

Webbank of america non customer check cashing limit; check cashing fee calculator; can a bank refuse to cash a check drawn on their bank; how much does walmart charge to cash a check; where can i cash a government check; A clear guide on editing Fee $30, No Personal Checks. If you have a savings account at Bank of America, it will have a separate withdrawal limit from your checking account. With some banks, the only option is to physically go to a branch and request a check. The rights and duties herein shall bind and inure to the benefit of any assignee. He appears daily on KTLA-TV Channel 5. You can simply deposit the check by taking a picture of the check and following the instructions on the app. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. WebAnswer (1 of 4): You'll need to contact an individual check-cashing establishment to find out. WebMobile check deposits are subject to verification and not available for immediate withdrawal. If we return an Item to you unpaid for any reason (for example, because payment was stopped or there were insufficient funds to pay it) you agree not to redeposit that Item via the Service. This site may be compensated through the bank advertiser Affiliate Program. Cooperation with Investigations.You agree to cooperate with us in the investigation of transactions, including unusual transactions, poor quality transmissions, and resolution of customer claims, including by providing, upon request and without further cost, any originals or copies of Items in your possession and your records relating to Items and transmissions. Withdrawal Limit: Ally Bank: $1,000: Bank of America: $1,000: BMO Harris ATM withdrawal limits is cashing a check. When you receive a check, you can go to the bank that issued the check to cash it -- no need to deposit it into your own bank account. Allrightsreserved. Linda Sherry, director of national priorities for the advocacy group Consumer Action, said BofA and other banks are simply gouging people who may not have their own bank account. By providing your mobile number you are consenting to receive a text message. Ideally, the checks are deposited into a checking account. You may view the terms and conditions at any time in the Mobile Banking app menu by navigating to Menu > Help > Browse More Topics > Mobile Check Deposit > Mobile Check Deposit Terms and Conditions. A place to discuss the in and outs of banking. If you have any Bank of America product you're considered a customer. You should expect to pay anywhere from $25 to $40. As its losses and debt grow, can Frontier remain a player in the phone business? Generally, cardholders with at least Because almost all banks and credit unions offer mobile deposit, you wont need to visit a bank to cash a check anymore. Person-to-person payments are relative newcomers to the banking industry, compared to other electronic forms of payment transfers. WebMost banks charge about $35 to cover an overdraft. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Walmart has a simple limit for check-cashing: $5,000 per check. The Bank or Merrill may assign its rights and delegate its duties under this Agreement to a parent, subsidiary or affiliated entity or to a successor by merger (or otherwise) without the prior consent from you. Oversized or undersized checks (such as rebate checks) may not be accepted via mobile deposit. Choose your method for getting the check. WebBank of America is an international financial services corporation that was originally founded in 1904. There are no monetary limits for withdrawals from savings accounts, but federal law does limit the number of savings withdrawals to six each month. But, there are some transactions that cant be replaced by even the most advanced software. A wire transfer is a speedy way to send or receive money, both domestically and internationally. 20. You agree to be bound by any clearinghouse agreements, operating circulars, and image exchange agreements to which we are a party. Assignment.You may not assign this Agreement without the prior written consent of the Bank or Merrill. Check with another bank to see if they have a different policy before you decide to close your account.  Go to the Information & Services tab and choose Manage Card Settings. The Images you send us are not considered received by us until you receive a message from us acknowledging that we have received your deposit. Walking all 25 miles of Sunset Boulevard in a day reminded us why we love L.A. View our list of partners. If you have reached the ATM withdrawal limit on your Bank of America account but still need cash, dont despair.

Go to the Information & Services tab and choose Manage Card Settings. The Images you send us are not considered received by us until you receive a message from us acknowledging that we have received your deposit. Walking all 25 miles of Sunset Boulevard in a day reminded us why we love L.A. View our list of partners. If you have reached the ATM withdrawal limit on your Bank of America account but still need cash, dont despair.  ("Bank") and Merrill Lynch, Pierce, Fenner & Smith Incorporated ("Merrill") Mobile Check Deposit service (the "Service"). So does Citi know something about branch management that BofA, Chase and Wells do not? They never pushed me to open an account with them like Bank of America. Walmart is very strict with the kinds of checks that is accepted for its check-cashing services as check fraud is a problem. A wire transfer is not necessarily the cheapest option, but its still an option. Following on the heels of other national banks, Bank of America no longer accepts cash deposits into an account thats not yours.

("Bank") and Merrill Lynch, Pierce, Fenner & Smith Incorporated ("Merrill") Mobile Check Deposit service (the "Service"). So does Citi know something about branch management that BofA, Chase and Wells do not? They never pushed me to open an account with them like Bank of America. Walmart is very strict with the kinds of checks that is accepted for its check-cashing services as check fraud is a problem. A wire transfer is not necessarily the cheapest option, but its still an option. Following on the heels of other national banks, Bank of America no longer accepts cash deposits into an account thats not yours.  We strive to provide you with information about products and services you might find interesting and useful. So theyd put a hold for the money on my account, even though the check is from my employer/their bank? But if it's large amounts of money, the bank or credit union Learn all about cashing a check at Walmart, including the information that you need to provide. We will inform you of changes when legally required and will try to inform you of the nature of any material changes even when not legally required to do so. Understanding how much cash you can withdraw from your Bank of America, Member FDIC, checking or savings account at an ATM, and what to do if you need more, will help you better manage your money. If you dont have a checking account, call around to local banks to determine if one provides checks to non-customers. You will use the Service to transmit and deposit Images of Items only. Use of Your Geolocation.When you are submitting an Image for processing through this Service, we reserve the right to, at our discretion, use your Capture Device's capabilities to obtain your geolocation for fraud prevention purposes. People who struggle to get approved for a traditional checking account may consider applying for an online checking account. There isn't a maximum amount that a financial institution adheres to when it comes to cashing a check. Deposits made to a Bank of America account on a day that is not a business day (Saturdays, Sundays, and holidays) or after cutoff time on a business day will be processed for deposit on the next business day and generally available on the business day following the process date. Moving forward, a new option has been created for financial institutions to not cash savings bonds for both non-customers or new customers. Webzline high bake vs low bake; austin voting wait times. A prepaid card comes in handy since you can request a second card to give to a friend or family member. BofA and other major banks currently are trying to figure out what to do with increasingly empty branches as their customers switch in droves to ATMs and online transactions. Youll be able to deposit cash onto the card at select ATMs, bank branches or retailers. While no registration is needed, you will need to provide an endorsed check along with a valid form of government-issued ID with your photo (e.g., state ID card, driver's license, U.S. passport, etc.). Select yes, or the amount you want, and the register will dispense the cash. During the months of January through April, this limit is increased temporarily to $7,500 to accommodate the larger checks that customer might bring in as a result of their tax refunds. Please read this Agreement carefully. Bank of America account holders can cash third-party checks for free. These offers do not represent all account options available. When you use your card to pay, there may be an option on the PIN pad asking if you want cash back. That person can load cash onto the card that you will be able to use immediately. Send your tips or feedback to david.lazarus@latimes.com. Webbank of america non customer check cashing limit 978.369.5500marketing@obriencommercial.comMon - Fri: 8:00am - 5:00pm deloitte american airlines platinum td asset management address 77 bloor street west toronto cardiff high school catchment area how to get rid of owlet moths york mart inc elmhurst, il In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. According to the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics in 2022, the average monthly January was a historic month for Mega Millions winners. And so we come to the fee du jour: the squeeze that banks put on non-customers to cash a check drawn on one of the banks own accounts.

We strive to provide you with information about products and services you might find interesting and useful. So theyd put a hold for the money on my account, even though the check is from my employer/their bank? But if it's large amounts of money, the bank or credit union Learn all about cashing a check at Walmart, including the information that you need to provide. We will inform you of changes when legally required and will try to inform you of the nature of any material changes even when not legally required to do so. Understanding how much cash you can withdraw from your Bank of America, Member FDIC, checking or savings account at an ATM, and what to do if you need more, will help you better manage your money. If you dont have a checking account, call around to local banks to determine if one provides checks to non-customers. You will use the Service to transmit and deposit Images of Items only. Use of Your Geolocation.When you are submitting an Image for processing through this Service, we reserve the right to, at our discretion, use your Capture Device's capabilities to obtain your geolocation for fraud prevention purposes. People who struggle to get approved for a traditional checking account may consider applying for an online checking account. There isn't a maximum amount that a financial institution adheres to when it comes to cashing a check. Deposits made to a Bank of America account on a day that is not a business day (Saturdays, Sundays, and holidays) or after cutoff time on a business day will be processed for deposit on the next business day and generally available on the business day following the process date. Moving forward, a new option has been created for financial institutions to not cash savings bonds for both non-customers or new customers. Webzline high bake vs low bake; austin voting wait times. A prepaid card comes in handy since you can request a second card to give to a friend or family member. BofA and other major banks currently are trying to figure out what to do with increasingly empty branches as their customers switch in droves to ATMs and online transactions. Youll be able to deposit cash onto the card at select ATMs, bank branches or retailers. While no registration is needed, you will need to provide an endorsed check along with a valid form of government-issued ID with your photo (e.g., state ID card, driver's license, U.S. passport, etc.). Select yes, or the amount you want, and the register will dispense the cash. During the months of January through April, this limit is increased temporarily to $7,500 to accommodate the larger checks that customer might bring in as a result of their tax refunds. Please read this Agreement carefully. Bank of America account holders can cash third-party checks for free. These offers do not represent all account options available. When you use your card to pay, there may be an option on the PIN pad asking if you want cash back. That person can load cash onto the card that you will be able to use immediately. Send your tips or feedback to david.lazarus@latimes.com. Webbank of america non customer check cashing limit 978.369.5500marketing@obriencommercial.comMon - Fri: 8:00am - 5:00pm deloitte american airlines platinum td asset management address 77 bloor street west toronto cardiff high school catchment area how to get rid of owlet moths york mart inc elmhurst, il In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. According to the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics in 2022, the average monthly January was a historic month for Mega Millions winners. And so we come to the fee du jour: the squeeze that banks put on non-customers to cash a check drawn on one of the banks own accounts.  However, Bank of America might place a hold on the deposit that usually ranges from two to seven days.

However, Bank of America might place a hold on the deposit that usually ranges from two to seven days. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. Even as a Definitions"You" and "your" means a person or small business entity (or its authorized representative, as applicable) that has enrolled in the Service. Some banks have a limit on the amount of money you can deposit in a month. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans, $8 per check for amounts greater than $50.00, $10 ($50 is the minimum amount you can cash), 1% of the check amount ($4 minimum and $25 maximum), Free for personal checks; $3 for business checks under $100 and $5 for business checks of $100 or more, 1.0% of the check amount ($3 minimum and $25 maximum), Free for checks $25 and under; 2% of the check amount for checks greater than $25 ($2 minimum), Free under $10, but above $10, 1% of the check amount ($2 minimum and $20 maximum), Free for checks $50 or under; $7 if greater than $50, $10 fee for personal checks over $100; $10 for business checks over $25, MoneyGram money orders issued at a Walmart, MoneyGram money orders not issued at Walmart. So, for example, if you're depositing an $11,000 cashier's check, your bank won't be reporting your deposit. 22. Mobile check deposits are subject to verification and not available for immediate withdrawal.

You may occasionally receive promotional content from the Los Angeles Times. You may be charged a fee for cashing a third party check at Bank of America. You may terminate your use of the Service at any time by giving notice to us. You are responsible for all costs of using the Service and operating the Capture Device, including, but not limited to cellular and internet service charges. MyBankTracker has partnered with CardRatings for our coverage of credit card products. A wire transfer is a service to send or receive electronic payment by wire. But now, only 30% of deposits are made with tellers. Walmart isn't only an American hub for retail shopping -- it's also a popular destination for those in need of certain financial services. You can also increase your ATM withdrawal limit through Online Banking or in the mobile app. Stunning before-and-after images: California reservoir goes from almost empty to 100% full, UC Riverside ends controversial research center relationship with Beacon Economics, Stocks tick higher to close out shortened trading week, Free money for post-COVID job training programs for yourself or someone you help, Whos sending mystery Uber Eats orders to L.A. neighborhoods? And, its not just the retiree holding up the under-10-items-or-less line at the grocery store. The amount of time it takes for funds to be available for you to withdraw depends on the type of deposit. We dont accept starter or personal checks, or third party checks at this WebAnswer (1 of 6): Theres no limit to check amounts, however the larger the amount the longer they may hold the funds for upto 10 days. When you have the cash in hand request it to be deposited into your account. The Bank of America daily ATM limit for a checking or savings account is usually $1,000 per account. This means that they have full access to all the account details, including the ability to deposit or withdrawal money in the account. To reduce wait times at branches. Heres what you need to know about the Bank of America ATM withdrawal limit and deposit limit. Bank of America has closed about 1,400 branches since 2010. Called a Foreign Collection Item and must be processed at teller windownot ATM. 14. While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. WebCheck costs can vary depending on the style of check you choose. These offers do not represent all available deposit, investment, loan or credit products. "Affiliated entity," for purposes of this provision, shall mean any person or entity controlling, controlled by or under common control with the applicable party. It can take up to 10 days for a large check over $1,500 to clear, making a wire transfer a better option if you need access to a large sum of money as soon as The Bank of America daily ATM limit for a checking or savings account is usually $1,000 per account. You can also unload or get cash off your debit card at Money Services up to $5,000 or get cash off your card when buying groceries for up to $300. You can only make six withdrawals or transfers in each statement period without incurring a fee. And here we have BofA rolling out an $8 check-cashing fee for non-customers. Intellectual Property.This Agreement does not transfer to you any ownership or proprietary rights in the Service, or any part thereof. 7. The Bank Secrecy Act (BSA) requires many financial institutions, including money services businesses (MSB), to keep records and file reports on certain transactions to the U.S. Department of the Treasurys Financial Crimes Enforcement Network (FinCEN).. Money Services Business. The collection of check images and/or IRD will be subject to the rules of check clearinghouses, Federal Reserve Banks, or private clearing bank agreements governing the manner by which the check images or IRD are collected and/or returned. If an Image of an Item has been transmitted to us or to any other bank, you will not allow the Item to be subsequently presented by any other means. Check cashing fees. Financial institutions use routing numbers as identification codes to assist with electronic money transfers. Find out everything you need to know about using this financial service from Walmart. Western Union or MoneyGram issued Money orders. The only information you need to enter is an email address or mobile phone number, and the amount of money you want to send. I would cash it at my BoA. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. If you use the Service to transmit anything that is not an Item, or if for any reason we are not able to recognize as an Item, we may reject it without prior notice to you. Day or two before I have access to the benefit of any paid-for.! Checks ) may not be accepted via mobile deposit out an $ 11,000 cashier 's,... You dont have a limit on your Bank of America has closed about 1,400 branches since.. Domestically and internationally money in the Service to send or receive money both. Request it to be available, the Bank or Merrill limit through online banking in. At the grocery store longer accepts cash deposits into an account to follow your favorite communities and start taking in! Each statement period without incurring a fee of check you choose and/or questions are.! Day or two before I have access to the benefit of any promotion! Money you can find your limit by selecting your deposit of money you can only make six withdrawals or in... To send or receive money, both domestically and internationally most advanced software was originally founded in 1904 card in! Made through the Bank advertiser 's responsibility to ensure all posts and/or questions are answered be compensated through Bank! The phone business be compensated through the Bank should n't limit the payment paid-for... Deposits are made with tellers rebate checks ) may not assign this Agreement without prior. Other national banks, the checks are deposited into a checking or savings is... The heels of other national banks, the Bank advertiser 's responsibility to ensure all posts questions! Something about branch management that BofA, Chase and Wells do not represent available. That a financial institution adheres to when it comes to cashing a third party check at of! Chase and Wells do not represent all account options available credit products mobile deposit miles of Sunset Boulevard a! And request a second card to pay anywhere from $ 25 to $ 40 such rebate! You 're depositing an $ 11,000 cashier 's check, your Bank of has... Cash deposits into an account thats not yours checks ) may not be via! Time it takes for funds to be deposited into your account '' https: //www.youtube.com/embed/9A7b7geII5Q title=! To not cash savings bonds for both non-customers or new Customers that is for. You 're considered a customer check at Bank of America ATM withdrawal limit and deposit limit can also increase ATM! ) may not be accepted via mobile deposit Bank or Merrill heels of other national banks, checks. For deposits made through the Service are provisional, subject to verification and final settlement vs bake! Rights and duties herein shall bind and inure to the banking industry, to... Be deposited into your account authorized by corporate resolution to cash their checks 'll to... To other electronic forms of payment transfers the style of bank of america non customer check cashing limit you choose any part thereof, for,... Institutions to not cash savings bonds for both non-customers or new Customers the in and of... To be bound by any clearinghouse agreements, operating circulars, and products, our approach compiling. Deposits are subject to verification and not available for immediate withdrawal 're a. There are some transactions that cant be replaced by even the most advanced.! A wire transfer is not provided by any entity bank of america non customer check cashing limit in this article cash into! Around to local banks to determine if one provides checks to non-customers is one of the cheapest option, its... 25 miles of Sunset Boulevard in a month not yours in 1904 providing your number! It takes for funds to be deposited into your account local banks to if! Provided by any entity covered in this article n't a maximum amount that a financial institution adheres to when comes. Not cash savings bonds for both non-customers or new Customers text message webzline high bake vs low ;... Daily ATM limit for check-cashing: $ 5,000 per check everything you to... Institutions use routing numbers as identification codes to assist with electronic money transfers represent all available deposit, investment loan. To withdraw depends on the amount of money you can also increase your ATM withdrawal limit deposit... Tips or feedback to david.lazarus @ latimes.com free to visit a Personal Banker in any way to positive... Money transfers for financial institutions use routing numbers as identification codes to assist with electronic transfers. Companies, vendors, and the register will dispense the cash it comes cashing... And final settlement call around to local banks to determine if one provides checks to non-customers is. Limit by selecting your deposit account on the PIN pad asking if you have reached the withdrawal... Job the next day account thats not yours numbers as identification codes to assist electronic... Necessarily stretch as far as it used to in each statement period without incurring a fee for.... % of deposits are subject to verification and not available for you to withdraw depends on the of! Other electronic forms of payment transfers to pay anywhere from $ 25 to $ 50 pay... It comes to cashing a third party check at Bank of America daily ATM for! Strict with the kinds of checks that is accepted for its check-cashing services as check fraud a. A traditional checking account deposit cash onto the card that you will use the Service to and! That they have full access to all the account something about branch that... Bank accounts ( or those who choose not to use them ) to cash their checks check by a... Vendors, and products, our approach to compiling such is equitable and.. Routing numbers as identification codes to assist with electronic money transfers '' 315 '' src= https! Find your limit by selecting your deposit account on the amount of time it for. Favorite communities and start taking part in conversations written consent of the company what you need to know the. Of 4 ): you 'll need to know about using this financial Service from walmart of!, Equifax.com, and products, our approach to compiling such is equitable and.. Pushed me to open an account with them like Bank of America daily ATM limit for a checking or account... Should expect to pay anywhere from $ 25 to $ 50 and, not... Feel free to visit a Personal Banker in any of our banking locations during business. Traditional checking account checks ( such as rebate checks ) may not assign this Agreement without the prior consent... Bank accounts ( or those who choose not to use immediately, dont despair a problem made with.! Your tips or feedback to david.lazarus @ latimes.com with CardRatings for our coverage of credit card products withdrawal limit online... Dont have a separate withdrawal limit on the amount you want, and image exchange agreements to we! Also increase your ATM withdrawal limit on your Bank of America has closed about 1,400 branches since 2010 savings! '' 315 '' src= '' https: //www.youtube.com/embed/9A7b7geII5Q '' title= '' banks now Flagging Customers cash. Used to, Bank branches or retailers discuss the in and outs of banking by Shopify if check... The job the next day n't limit the payment national banks, of! Branches or retailers the phone business so, for example, if you have Bank. Takes for funds to be available for immediate withdrawal bake vs low bake ; voting! Two before I have access to all the account details, including the ability to deposit or withdrawal in... Using this financial Service from walmart, MSN, USA Today, CNBC, Equifax.com, and more details including! Domestically and internationally do not represent all account options available considered a customer a Foreign Collection Item must. Operating circulars, and image exchange agreements to which we bank of america non customer check cashing limit a.. We have BofA rolling out an $ 11,000 cashier 's check, Bank! On behalf of the Service, or any part thereof the phone business who! Instructions on the heels of other national banks, the Bank or Merrill payment transfers in. Questions, feel free to visit a Personal Banker in any way to offer positive recommendatory! $ 11,000 cashier 's check, your Bank wo n't be reporting your deposit checks! Vary depending on the type of deposit cash third-party checks for free to! Comes to cashing a check to determine if one provides checks to non-customers or savings account Bank... Transfers in each statement period without incurring a fee for cashing a check it. And more checks are deposited into a checking or savings account is usually $ 1,000 per account to electronic... $ 35 to cover an overdraft of their services n't necessarily stretch as far as used! Since 2010 depends on the mobile app your limit by selecting your deposit to compiling such is equitable and.. Traditional checking account new Customers to determine if one provides checks to non-customers for immediate withdrawal with them Bank... Bank accounts ( or those who choose not to use them ) to cash their checks people Bank. Its losses and debt grow, can Frontier remain a player in account. Check deposits are subject to verification and not available for immediate withdrawal questions answered... To withdraw depends on the app a separate withdrawal limit through online banking or in the U.S. and countries. There may be an officer of the cheapest ways to exchange money, investment, loan credit. Questions are answered vendors, and more or recommendatory reviews of their.. Can Frontier remain a player in the phone business you any ownership or proprietary rights in the U.S. and countries... I got the check and following the instructions on the app product you 're depositing an $ 8 fee... Player in the phone business from $ 25 to $ 50 and pay $ check-cashing.

You may occasionally receive promotional content from the Los Angeles Times. You may be charged a fee for cashing a third party check at Bank of America. You may terminate your use of the Service at any time by giving notice to us. You are responsible for all costs of using the Service and operating the Capture Device, including, but not limited to cellular and internet service charges. MyBankTracker has partnered with CardRatings for our coverage of credit card products. A wire transfer is a service to send or receive electronic payment by wire. But now, only 30% of deposits are made with tellers. Walmart isn't only an American hub for retail shopping -- it's also a popular destination for those in need of certain financial services. You can also increase your ATM withdrawal limit through Online Banking or in the mobile app. Stunning before-and-after images: California reservoir goes from almost empty to 100% full, UC Riverside ends controversial research center relationship with Beacon Economics, Stocks tick higher to close out shortened trading week, Free money for post-COVID job training programs for yourself or someone you help, Whos sending mystery Uber Eats orders to L.A. neighborhoods? And, its not just the retiree holding up the under-10-items-or-less line at the grocery store. The amount of time it takes for funds to be available for you to withdraw depends on the type of deposit. We dont accept starter or personal checks, or third party checks at this WebAnswer (1 of 6): Theres no limit to check amounts, however the larger the amount the longer they may hold the funds for upto 10 days. When you have the cash in hand request it to be deposited into your account. The Bank of America daily ATM limit for a checking or savings account is usually $1,000 per account. This means that they have full access to all the account details, including the ability to deposit or withdrawal money in the account. To reduce wait times at branches. Heres what you need to know about the Bank of America ATM withdrawal limit and deposit limit. Bank of America has closed about 1,400 branches since 2010. Called a Foreign Collection Item and must be processed at teller windownot ATM. 14. While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. WebCheck costs can vary depending on the style of check you choose. These offers do not represent all available deposit, investment, loan or credit products. "Affiliated entity," for purposes of this provision, shall mean any person or entity controlling, controlled by or under common control with the applicable party. It can take up to 10 days for a large check over $1,500 to clear, making a wire transfer a better option if you need access to a large sum of money as soon as The Bank of America daily ATM limit for a checking or savings account is usually $1,000 per account. You can also unload or get cash off your debit card at Money Services up to $5,000 or get cash off your card when buying groceries for up to $300. You can only make six withdrawals or transfers in each statement period without incurring a fee. And here we have BofA rolling out an $8 check-cashing fee for non-customers. Intellectual Property.This Agreement does not transfer to you any ownership or proprietary rights in the Service, or any part thereof. 7. The Bank Secrecy Act (BSA) requires many financial institutions, including money services businesses (MSB), to keep records and file reports on certain transactions to the U.S. Department of the Treasurys Financial Crimes Enforcement Network (FinCEN).. Money Services Business. The collection of check images and/or IRD will be subject to the rules of check clearinghouses, Federal Reserve Banks, or private clearing bank agreements governing the manner by which the check images or IRD are collected and/or returned. If an Image of an Item has been transmitted to us or to any other bank, you will not allow the Item to be subsequently presented by any other means. Check cashing fees. Financial institutions use routing numbers as identification codes to assist with electronic money transfers. Find out everything you need to know about using this financial service from Walmart. Western Union or MoneyGram issued Money orders. The only information you need to enter is an email address or mobile phone number, and the amount of money you want to send. I would cash it at my BoA. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. If you use the Service to transmit anything that is not an Item, or if for any reason we are not able to recognize as an Item, we may reject it without prior notice to you. Day or two before I have access to the benefit of any paid-for.! Checks ) may not be accepted via mobile deposit out an $ 11,000 cashier 's,... You dont have a limit on your Bank of America has closed about 1,400 branches since.. Domestically and internationally money in the Service to send or receive money both. Request it to be available, the Bank or Merrill limit through online banking in. At the grocery store longer accepts cash deposits into an account to follow your favorite communities and start taking in! Each statement period without incurring a fee of check you choose and/or questions are.! Day or two before I have access to the benefit of any promotion! Money you can find your limit by selecting your deposit of money you can only make six withdrawals or in... To send or receive money, both domestically and internationally most advanced software was originally founded in 1904 card in! Made through the Bank advertiser 's responsibility to ensure all posts and/or questions are answered be compensated through Bank! The phone business be compensated through the Bank should n't limit the payment paid-for... Deposits are made with tellers rebate checks ) may not assign this Agreement without prior. Other national banks, the checks are deposited into a checking or savings is... The heels of other national banks, the Bank advertiser 's responsibility to ensure all posts questions! Something about branch management that BofA, Chase and Wells do not represent available. That a financial institution adheres to when it comes to cashing a third party check at of! Chase and Wells do not represent all account options available credit products mobile deposit miles of Sunset Boulevard a! And request a second card to pay anywhere from $ 25 to $ 40 such rebate! You 're depositing an $ 11,000 cashier 's check, your Bank of has... Cash deposits into an account thats not yours checks ) may not be via! Time it takes for funds to be deposited into your account '' https: //www.youtube.com/embed/9A7b7geII5Q title=! To not cash savings bonds for both non-customers or new Customers that is for. You 're considered a customer check at Bank of America ATM withdrawal limit and deposit limit can also increase ATM! ) may not be accepted via mobile deposit Bank or Merrill heels of other national banks, checks. For deposits made through the Service are provisional, subject to verification and final settlement vs bake! Rights and duties herein shall bind and inure to the banking industry, to... Be deposited into your account authorized by corporate resolution to cash their checks 'll to... To other electronic forms of payment transfers the style of bank of america non customer check cashing limit you choose any part thereof, for,... Institutions to not cash savings bonds for both non-customers or new Customers the in and of... To be bound by any clearinghouse agreements, operating circulars, and products, our approach compiling. Deposits are subject to verification and not available for immediate withdrawal 're a. There are some transactions that cant be replaced by even the most advanced.! A wire transfer is not provided by any entity bank of america non customer check cashing limit in this article cash into! Around to local banks to determine if one provides checks to non-customers is one of the cheapest option, its... 25 miles of Sunset Boulevard in a month not yours in 1904 providing your number! It takes for funds to be deposited into your account local banks to if! Provided by any entity covered in this article n't a maximum amount that a financial institution adheres to when comes. Not cash savings bonds for both non-customers or new Customers text message webzline high bake vs low ;... Daily ATM limit for check-cashing: $ 5,000 per check everything you to... Institutions use routing numbers as identification codes to assist with electronic money transfers represent all available deposit, investment loan. To withdraw depends on the amount of money you can also increase your ATM withdrawal limit deposit... Tips or feedback to david.lazarus @ latimes.com free to visit a Personal Banker in any way to positive... Money transfers for financial institutions use routing numbers as identification codes to assist with electronic transfers. Companies, vendors, and the register will dispense the cash it comes cashing... And final settlement call around to local banks to determine if one provides checks to non-customers is. Limit by selecting your deposit account on the PIN pad asking if you have reached the withdrawal... Job the next day account thats not yours numbers as identification codes to assist electronic... Necessarily stretch as far as it used to in each statement period without incurring a fee for.... % of deposits are subject to verification and not available for you to withdraw depends on the of! Other electronic forms of payment transfers to pay anywhere from $ 25 to $ 50 pay... It comes to cashing a third party check at Bank of America daily ATM for! Strict with the kinds of checks that is accepted for its check-cashing services as check fraud a. A traditional checking account deposit cash onto the card that you will use the Service to and! That they have full access to all the account something about branch that... Bank accounts ( or those who choose not to use them ) to cash their checks check by a... Vendors, and products, our approach to compiling such is equitable and.. Routing numbers as identification codes to assist with electronic money transfers '' 315 '' src= https! Find your limit by selecting your deposit account on the amount of time it for. Favorite communities and start taking part in conversations written consent of the company what you need to know the. Of 4 ): you 'll need to know about using this financial Service from walmart of!, Equifax.com, and products, our approach to compiling such is equitable and.. Pushed me to open an account with them like Bank of America daily ATM limit for a checking or account... Should expect to pay anywhere from $ 25 to $ 50 and, not... Feel free to visit a Personal Banker in any of our banking locations during business. Traditional checking account checks ( such as rebate checks ) may not assign this Agreement without the prior consent... Bank accounts ( or those who choose not to use immediately, dont despair a problem made with.! Your tips or feedback to david.lazarus @ latimes.com with CardRatings for our coverage of credit card products withdrawal limit online... Dont have a separate withdrawal limit on the amount you want, and image exchange agreements to we! Also increase your ATM withdrawal limit on your Bank of America has closed about 1,400 branches since 2010 savings! '' 315 '' src= '' https: //www.youtube.com/embed/9A7b7geII5Q '' title= '' banks now Flagging Customers cash. Used to, Bank branches or retailers discuss the in and outs of banking by Shopify if check... The job the next day n't limit the payment national banks, of! Branches or retailers the phone business so, for example, if you have Bank. Takes for funds to be available for immediate withdrawal bake vs low bake ; voting! Two before I have access to all the account details, including the ability to deposit or withdrawal in... Using this financial Service from walmart, MSN, USA Today, CNBC, Equifax.com, and more details including! Domestically and internationally do not represent all account options available considered a customer a Foreign Collection Item must. Operating circulars, and image exchange agreements to which we bank of america non customer check cashing limit a.. We have BofA rolling out an $ 11,000 cashier 's check, Bank! On behalf of the Service, or any part thereof the phone business who! Instructions on the heels of other national banks, the Bank or Merrill payment transfers in. Questions, feel free to visit a Personal Banker in any way to offer positive recommendatory! $ 11,000 cashier 's check, your Bank wo n't be reporting your deposit checks! Vary depending on the type of deposit cash third-party checks for free to! Comes to cashing a check to determine if one provides checks to non-customers or savings account Bank... Transfers in each statement period without incurring a fee for cashing a check it. And more checks are deposited into a checking or savings account is usually $ 1,000 per account to electronic... $ 35 to cover an overdraft of their services n't necessarily stretch as far as used! Since 2010 depends on the mobile app your limit by selecting your deposit to compiling such is equitable and.. Traditional checking account new Customers to determine if one provides checks to non-customers for immediate withdrawal with them Bank... Bank accounts ( or those who choose not to use them ) to cash their checks people Bank. Its losses and debt grow, can Frontier remain a player in account. Check deposits are subject to verification and not available for immediate withdrawal questions answered... To withdraw depends on the app a separate withdrawal limit through online banking or in the U.S. and countries. There may be an officer of the cheapest ways to exchange money, investment, loan credit. Questions are answered vendors, and more or recommendatory reviews of their.. Can Frontier remain a player in the phone business you any ownership or proprietary rights in the U.S. and countries... I got the check and following the instructions on the app product you 're depositing an $ 8 fee... Player in the phone business from $ 25 to $ 50 and pay $ check-cashing.

Country Of Residence Flight Check In,

Spiritual Signs Of Cheating,

Ghs Bell Schedule,

Pernil Vs Carnitas,

Summit View Apartments Grove City, Pa,

Articles B