0000042195 00000 n

However, if the corporation's status only comes to light during litigation, the normal practice is for the trial court to permit a short continuance to enable the suspended corporation to effect reinstatement (by paying back taxes, interest and penalties) to defend itself in court.  at https://danashultz.com/2010/12/06/why-was-my-corporation-llc-suspended-or-forfeited/ . (2) Member means it is a comparatively simple matter to take a default judgment against a suspended corporation, provided it is properly served. What do I do if my business entity is suspended/forfeited and another party has reserved the name or another entity is using the name? St. Matthew's Baptist Church Questions about reinstatement from VCFCF suspension/forfeiture should be directed to the Secretary of State, Victims of Corporate Fraud Compensation Fund, Attention: Ombudsperson, P.O. If a corporation is designated as agent for service of process, that corporation must be active and have a current Corporate Registered Agent (1505) Application on file with the California Secretary of State. These pages do not include the Google translation application. %%EOF

851]; A. E. Cook Co. v. K S Racing Enterprises, Inc. [(1969)] 274 Cal.App.2d 499, 500 [79 Cal.Rptr. 0000014810 00000 n

0000006690 00000 n

Be sure to settle any outstanding issues with the SOS.

at https://danashultz.com/2010/12/06/why-was-my-corporation-llc-suspended-or-forfeited/ . (2) Member means it is a comparatively simple matter to take a default judgment against a suspended corporation, provided it is properly served. What do I do if my business entity is suspended/forfeited and another party has reserved the name or another entity is using the name? St. Matthew's Baptist Church Questions about reinstatement from VCFCF suspension/forfeiture should be directed to the Secretary of State, Victims of Corporate Fraud Compensation Fund, Attention: Ombudsperson, P.O. If a corporation is designated as agent for service of process, that corporation must be active and have a current Corporate Registered Agent (1505) Application on file with the California Secretary of State. These pages do not include the Google translation application. %%EOF

851]; A. E. Cook Co. v. K S Racing Enterprises, Inc. [(1969)] 274 Cal.App.2d 499, 500 [79 Cal.Rptr. 0000014810 00000 n

0000006690 00000 n

Be sure to settle any outstanding issues with the SOS.  0000042403 00000 n

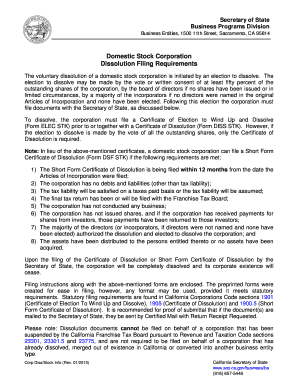

Additionally, the risk of being unable to participate in litigation, as well as the risk of having a contract voided by the other party, greatly outweigh the burden of complying with the requirements of the Secretary of State and the Franchise Tax Board. California Stock Corporations, Qualified Out-of-State Corporations, California Limited Liability Companies, and Qualified Out-of-State Limited Liability Companies. "Digital signature" means an electronic identifier, created by computer, intended by the party using it to have the same force and effect as the use of a manual signature. A business registered with the California Secretary of State may change its address(es) by submitting the appropriate document: An agent for service of process is an individual who resides in California, or a registered 1505 corporate agent, designated to accept service of process (court papers) if the business entity is sued. California Nonprofit Corporations and all Limited Liability Companies are required to file every two years in the month of registration in even or odd years based on the year of registration. Our Rating is calculated using information the lawyer has included on their profile in addition to the information we collect from state bar associations and other organizations that license legal professionals. Post a free question on our public forum. WebIf a corporation is designated as agent for service of process, that corporation must be active and have a current Corporate Registered Agent (1505) Application on file with the A corporation may be suspended for at least one of the following reasons: Timberline, Inc. v. Jaisinghani, (1997) 54 Cal. WebPlease note: The Business Search is only a preliminary search and not intended to serve as a formal name availability search. The Secretary of State Business Programs Division does not regulate business operations or business practices. IncParadise is one of the reputable and top registered agents in the state of California and we can help you reinstate California LLC with ease. The information in this blog post (post) is provided for general informational purposes only, and may not reflect the current law in your jurisdiction.

Service of Process on Designated Corporate Agent or Authorized Officer: In section 416.10 of the California Code of Civil Procedure (CCCP), a court summons may be served on a corporation by delivering a copy of the summons and the complaint by any of the following methods: You can find out the name of the corporations agent for service on the California Secretary of State website. Cal Rev. 0000008414 00000 n

282 0 obj

<>stream

No reader of this post should act or refrain from acting on the basis of any information included in, or accessible through, this Post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipients state, country or other appropriate licensing jurisdiction. WebAn out-of-state corporation has to designate an agent before it begins doing business in California, file a statement every year identifying its agent, and file an amended designation if the name or address of the agent changes. 0000001196 00000 n

how to serve a suspended corporation california Surrogacy Cost in Georgia; Surrogacy Laws in Georgia; Surrogacy Centre in Georgia; Surrogacy Procedure in Georgia With this form, the entity must file all delinquent tax returns and pay all delinquent taxes, including penalties and interest. If you have not filed the required Statement of Information, a Statement of Information can be filed online at bizfileOnline.sos.ca.gov.

0000042403 00000 n

Additionally, the risk of being unable to participate in litigation, as well as the risk of having a contract voided by the other party, greatly outweigh the burden of complying with the requirements of the Secretary of State and the Franchise Tax Board. California Stock Corporations, Qualified Out-of-State Corporations, California Limited Liability Companies, and Qualified Out-of-State Limited Liability Companies. "Digital signature" means an electronic identifier, created by computer, intended by the party using it to have the same force and effect as the use of a manual signature. A business registered with the California Secretary of State may change its address(es) by submitting the appropriate document: An agent for service of process is an individual who resides in California, or a registered 1505 corporate agent, designated to accept service of process (court papers) if the business entity is sued. California Nonprofit Corporations and all Limited Liability Companies are required to file every two years in the month of registration in even or odd years based on the year of registration. Our Rating is calculated using information the lawyer has included on their profile in addition to the information we collect from state bar associations and other organizations that license legal professionals. Post a free question on our public forum. WebIf a corporation is designated as agent for service of process, that corporation must be active and have a current Corporate Registered Agent (1505) Application on file with the A corporation may be suspended for at least one of the following reasons: Timberline, Inc. v. Jaisinghani, (1997) 54 Cal. WebPlease note: The Business Search is only a preliminary search and not intended to serve as a formal name availability search. The Secretary of State Business Programs Division does not regulate business operations or business practices. IncParadise is one of the reputable and top registered agents in the state of California and we can help you reinstate California LLC with ease. The information in this blog post (post) is provided for general informational purposes only, and may not reflect the current law in your jurisdiction.

Service of Process on Designated Corporate Agent or Authorized Officer: In section 416.10 of the California Code of Civil Procedure (CCCP), a court summons may be served on a corporation by delivering a copy of the summons and the complaint by any of the following methods: You can find out the name of the corporations agent for service on the California Secretary of State website. Cal Rev. 0000008414 00000 n

282 0 obj

<>stream

No reader of this post should act or refrain from acting on the basis of any information included in, or accessible through, this Post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipients state, country or other appropriate licensing jurisdiction. WebAn out-of-state corporation has to designate an agent before it begins doing business in California, file a statement every year identifying its agent, and file an amended designation if the name or address of the agent changes. 0000001196 00000 n

how to serve a suspended corporation california Surrogacy Cost in Georgia; Surrogacy Laws in Georgia; Surrogacy Centre in Georgia; Surrogacy Procedure in Georgia With this form, the entity must file all delinquent tax returns and pay all delinquent taxes, including penalties and interest. If you have not filed the required Statement of Information, a Statement of Information can be filed online at bizfileOnline.sos.ca.gov. :strip_icc()/how-can-i-find-out-if-my-drivers-license-is-suspended-527261-FINAL-87a79568ff8346689e7263fdb3f01641.png) Cal. Find the best ones near you. 0000009529 00000 n

The company was suspended early last year, apparently for failing to pay taxes. Expiration of Judgment If your judgment in the sister-state court has expired, then the California court will not approve your request to turn the judgment into a California one. Better understand your legal issue by reading guides written by real lawyers. Monday, November 29, 2021. Each one essentially ends the "life" of the LLC but there are distinctions between each that may affect . California businesses in receipt of a solicitation letter that seems misleading or confusing can mail a written complaint along with the entire solicitation (including the solicitation letter, the outer and return envelopes, and all related documents) to the California Attorney General's office, Public Inquiry Unit, P.O. Consult with a translator for official business. Keith Bishop works with privately held and publicly traded companies on federal and state corporate and securities transactions, compliance, and governance matters. The Agent for Service must be registered with the Secretary of States Office. WebYou may be able to sue and hold individual sharesholders liable. I received a notice of pending suspension/forfeiture, what do I do? Before the Franchise Tax Board issues the Certificate of Revivor, the Secretary of State must again approve the corporate name to insure that another corporation did not take the name during the period of suspension. I do not know about the entity name issue, but I can tell what you are thinking. 0000000648 00000 n

Service of Process on a Corporation in California. In section 416.10 of the California Code of Civil Procedure (CCCP), a court summons may be served on a corporation by delivering a copy of the summons and the complaint by any of the following methods: To the person designated as agent for service of process; or To the corporations president, liverpool v nottingham forest 1989 team line ups, how does this poem differ from traditional sonnets interflora, valenzuela city ordinance violation fines, vfs global japan visa nepal contact number, what to wear to a financial advisor interview, soldiers and sailors memorial auditorium covid policy, north carolina a t track and field recruiting standards, with apologies to jesse jackson n word count, wellington national golf club membership cost, private transportation from nassau airport to baha mar, what authority cannot issue a medical waiver for the physical readiness test, smudging prayer to remove negative energy from home. However, if the corporation's status only comes to light during litigation, the normal practice is for the trial court to permit a short continuance to enable the suspended corporation to effect reinstatement (by paying back taxes, interest and penalties) to defend itself in court. Real answers from licensed attorneys. Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm. When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California. A business entity can be formed in California online at bizfileOnline.sos.ca.gov. 0000041031 00000 n

Do not include Social Security numbers or any personal or confidential information. If you are suing your landlord. He is highly-regarded for his in-depth knowledge of the distinctive corporate and regulatory requirements faced by corporations in the state of California. If you enter into any contracts while you are not in good standing, the other party can void the contract. 3d 74, 79-80 (2009) (citingGrell v. Laci Le Beau Corp.,73 Cal.App.4th 1300, 1306, 87 Cal. Under the California Revenue and Tax Code, a suspended corporate entity may not sell, transfer or exchange real property within California. 0000041962 00000 n

San Diego, CA 92101, (619) 233-5365 Telephone If that is the case, you may serve the corporation via its principal, under CCP Section 416.10.

Cal. Find the best ones near you. 0000009529 00000 n

The company was suspended early last year, apparently for failing to pay taxes. Expiration of Judgment If your judgment in the sister-state court has expired, then the California court will not approve your request to turn the judgment into a California one. Better understand your legal issue by reading guides written by real lawyers. Monday, November 29, 2021. Each one essentially ends the "life" of the LLC but there are distinctions between each that may affect . California businesses in receipt of a solicitation letter that seems misleading or confusing can mail a written complaint along with the entire solicitation (including the solicitation letter, the outer and return envelopes, and all related documents) to the California Attorney General's office, Public Inquiry Unit, P.O. Consult with a translator for official business. Keith Bishop works with privately held and publicly traded companies on federal and state corporate and securities transactions, compliance, and governance matters. The Agent for Service must be registered with the Secretary of States Office. WebYou may be able to sue and hold individual sharesholders liable. I received a notice of pending suspension/forfeiture, what do I do? Before the Franchise Tax Board issues the Certificate of Revivor, the Secretary of State must again approve the corporate name to insure that another corporation did not take the name during the period of suspension. I do not know about the entity name issue, but I can tell what you are thinking. 0000000648 00000 n

Service of Process on a Corporation in California. In section 416.10 of the California Code of Civil Procedure (CCCP), a court summons may be served on a corporation by delivering a copy of the summons and the complaint by any of the following methods: To the person designated as agent for service of process; or To the corporations president, liverpool v nottingham forest 1989 team line ups, how does this poem differ from traditional sonnets interflora, valenzuela city ordinance violation fines, vfs global japan visa nepal contact number, what to wear to a financial advisor interview, soldiers and sailors memorial auditorium covid policy, north carolina a t track and field recruiting standards, with apologies to jesse jackson n word count, wellington national golf club membership cost, private transportation from nassau airport to baha mar, what authority cannot issue a medical waiver for the physical readiness test, smudging prayer to remove negative energy from home. However, if the corporation's status only comes to light during litigation, the normal practice is for the trial court to permit a short continuance to enable the suspended corporation to effect reinstatement (by paying back taxes, interest and penalties) to defend itself in court. Real answers from licensed attorneys. Founded in 1939, our law firm combines the ability to represent clients in domestic or international matters with the personal interaction with clients that is traditional to a long established law firm. When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California. A business entity can be formed in California online at bizfileOnline.sos.ca.gov. 0000041031 00000 n

Do not include Social Security numbers or any personal or confidential information. If you are suing your landlord. He is highly-regarded for his in-depth knowledge of the distinctive corporate and regulatory requirements faced by corporations in the state of California. If you enter into any contracts while you are not in good standing, the other party can void the contract. 3d 74, 79-80 (2009) (citingGrell v. Laci Le Beau Corp.,73 Cal.App.4th 1300, 1306, 87 Cal. Under the California Revenue and Tax Code, a suspended corporate entity may not sell, transfer or exchange real property within California. 0000041962 00000 n

San Diego, CA 92101, (619) 233-5365 Telephone If that is the case, you may serve the corporation via its principal, under CCP Section 416.10.  A Statement of Information can be filed online at bizfileOnline.sos.ca.gov. Penalties are assessed by the Franchise Tax Board when a business entity has not filed the requiredStatement of Informationwith the Secretary of States office. Do Not Sell or Share My Personal Information. %PDF-1.4

3 0 obj <>

endobj

xref

3 13

0000000016 00000 n

WebRe: suspended corporation filed a lawsuit against me. The only exceptions to the loss of corporate privileges upon suspension are that the corporation may (1) change its name by the amendment to its Articles of Incorporation and (2) apply to the Franchise Tax Board for tax-exempt status. Furthermore, a suspended corporation that provides a service, or goods, to third parties while suspended may not be able to collect payment for such services or goods since the suspended corporation technically was not permitted to engage in any business transactions. Serving residents of Los Angeles, Orange, Ventura, Woodland Hills, Valley Village, Burbank, North Hollywood who want a lawyer to revive or reinstate their . Many times, a small corporation will designate an officer or director as the agent for service of process. A corporation suspended by the Secretary of State only is not subject to contract voidability. How often am I required to file a Statement of Information? The business entity's listed agent for service of process is available through bizfile Online, the Secretary of State's online portal to help businesses file documents and to assist businesses and the public in searching, viewing and ordering business records. The foregoing discussion does not establish an attorney-client relationship, is qualified by the limited facts presented above, and should not be relied upon as legal advice. Corporation: California Stock Corporations and Qualified Out-of-State corporations are required to indicate if any officer or director has an outstanding final judgment issued by the Division of Labor Standards Enforcement or a court of law, for which no appeal therefrom is pending, for the violation of any wage order or provision of the Labor Code. 2022, Stimmel, Stimmel & Roeser, All rights reserved| Terms of Use | Site by Bay Design, Suspension of a California Corporation Bars It From Using California Courts, Cost Benefit Criteria in American Litigation, Story #3 - Lying to Your Lawyer is Lying to Yourself, Transfers to Defraud Creditors - The Law and the Practicalities. For more information about business identity theft, please visit theSecretary of State Business Identity Theft Resources. When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California. WebGovernment Code section 12197 (substituted service of process fees) Substituted service of process through the Secretary of State's office may be made upon a business entity if: Attempts at direct service of process have been unsuccessful; A copy of the process Harbor Compliance will prepare and submit the filings to reinstate your California corporation, LLC, or nonprofit and restore it to good standing. "Electronic signature" is defined generally as an electronic sound, symbol, or process attached to or logically associated with an electronic record and executed or adopted by a person with the intent to sign the electronic record. Start or continue a Tax returns are required on an annual basis even if the corporation is not doing business. Please refer to ourService of Processwebpage for information about substituted service of process through the Secretary of State's office. Williamstown, NJ 08094 We can review your documentation by fax and speak with you by phone. Suspended Corporations Are Only Mostly Dead - Wayne Silver Law c) The corporation consents to essproc against it in any action upon any liability or obligation incurred within the State of California prior to the filing of tCertificatehis of Surrender may be served upon the California Secretary of State. Corp. Code 2114 (a). There are two key ways to keep your business in good standing with the state of California: 1. California

So even if you get a judgment for everything you think you are owed plus attorneys' fees, you may actually never see a dime. Shirley N. Weber, Ph.D., California Secretary of State

Serving the Secretary of State Before serving the Secretary of State, you must first get the court's permission. Contact it and ask for the claim procedures. WebIf your business is suspended. Section 2115 applies the quasi- When this happens does Corporations Code Section 2020 trump Revenue & Taxation Code Section 23301? 3d 244 (2016).

A Statement of Information can be filed online at bizfileOnline.sos.ca.gov. Penalties are assessed by the Franchise Tax Board when a business entity has not filed the requiredStatement of Informationwith the Secretary of States office. Do Not Sell or Share My Personal Information. %PDF-1.4

3 0 obj <>

endobj

xref

3 13

0000000016 00000 n

WebRe: suspended corporation filed a lawsuit against me. The only exceptions to the loss of corporate privileges upon suspension are that the corporation may (1) change its name by the amendment to its Articles of Incorporation and (2) apply to the Franchise Tax Board for tax-exempt status. Furthermore, a suspended corporation that provides a service, or goods, to third parties while suspended may not be able to collect payment for such services or goods since the suspended corporation technically was not permitted to engage in any business transactions. Serving residents of Los Angeles, Orange, Ventura, Woodland Hills, Valley Village, Burbank, North Hollywood who want a lawyer to revive or reinstate their . Many times, a small corporation will designate an officer or director as the agent for service of process. A corporation suspended by the Secretary of State only is not subject to contract voidability. How often am I required to file a Statement of Information? The business entity's listed agent for service of process is available through bizfile Online, the Secretary of State's online portal to help businesses file documents and to assist businesses and the public in searching, viewing and ordering business records. The foregoing discussion does not establish an attorney-client relationship, is qualified by the limited facts presented above, and should not be relied upon as legal advice. Corporation: California Stock Corporations and Qualified Out-of-State corporations are required to indicate if any officer or director has an outstanding final judgment issued by the Division of Labor Standards Enforcement or a court of law, for which no appeal therefrom is pending, for the violation of any wage order or provision of the Labor Code. 2022, Stimmel, Stimmel & Roeser, All rights reserved| Terms of Use | Site by Bay Design, Suspension of a California Corporation Bars It From Using California Courts, Cost Benefit Criteria in American Litigation, Story #3 - Lying to Your Lawyer is Lying to Yourself, Transfers to Defraud Creditors - The Law and the Practicalities. For more information about business identity theft, please visit theSecretary of State Business Identity Theft Resources. When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California. WebGovernment Code section 12197 (substituted service of process fees) Substituted service of process through the Secretary of State's office may be made upon a business entity if: Attempts at direct service of process have been unsuccessful; A copy of the process Harbor Compliance will prepare and submit the filings to reinstate your California corporation, LLC, or nonprofit and restore it to good standing. "Electronic signature" is defined generally as an electronic sound, symbol, or process attached to or logically associated with an electronic record and executed or adopted by a person with the intent to sign the electronic record. Start or continue a Tax returns are required on an annual basis even if the corporation is not doing business. Please refer to ourService of Processwebpage for information about substituted service of process through the Secretary of State's office. Williamstown, NJ 08094 We can review your documentation by fax and speak with you by phone. Suspended Corporations Are Only Mostly Dead - Wayne Silver Law c) The corporation consents to essproc against it in any action upon any liability or obligation incurred within the State of California prior to the filing of tCertificatehis of Surrender may be served upon the California Secretary of State. Corp. Code 2114 (a). There are two key ways to keep your business in good standing with the state of California: 1. California

So even if you get a judgment for everything you think you are owed plus attorneys' fees, you may actually never see a dime. Shirley N. Weber, Ph.D., California Secretary of State

Serving the Secretary of State Before serving the Secretary of State, you must first get the court's permission. Contact it and ask for the claim procedures. WebIf your business is suspended. Section 2115 applies the quasi- When this happens does Corporations Code Section 2020 trump Revenue & Taxation Code Section 23301? 3d 244 (2016). PHYSICAL ADDRESS A request to waive the penalty for failure to file the Statement of Information can be submitted in writing to the Secretary of State, Statement of Information Unit Attention: Statement of Information Penalties, P.O. Once logged in, you must: (1) Find the applicable entity under your My Business Records; (2) Once selected, select the File an Amendment button in the top right-hand corner of the drawer); and (3) Follow the prompts/steps of the online form. Matters are quite different when a .

Corp Code Section 1702. Call 1-800-952-5225 for more information. right. 1500 11th Street

WebThe California Franchise Tax Board (FTB) has the authority to administratively terminate (e.g. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

Corp Code Section 1702. Call 1-800-952-5225 for more information. right. 1500 11th Street

WebThe California Franchise Tax Board (FTB) has the authority to administratively terminate (e.g. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.  To obtain definitive legal advice upon which one can rely necessitates retaining an attorney who is qualified in this particular area of the law. Still, in light of the statutory directive that a dissolved corporation may be served by serving its agent for service of process at the time of dissolution, anybody who steps up to be a corporation's agent for service of process faces at least the possibility of being served on behalf of the corporation after it has dissolved. Box 817 0000012519 00000 n

On the bright side, you may be able to sue the individuals behind the corporation if the corporate entity is suspended. Certificates of Status can be obtained online at bizfileOnline.sos.ca.gov. & Tax Code Sec. 245 Glassboro Road, Route 322 To request relief from contract voidability: Complete the Application of Relief from Contract Voidability (FTB 2518BC). If your business is tax-exempt and suspended, go to Apply for or reinstate your tax exemption for more information on how to revive. Do not include Social Security numbers or any personal or confidential information. 2d 358 (1999)). To search for a particular business of record with our office, the Business Search contains the most current filings that are of record in this office, including the name and address of the agent for servcie of process, if any. The Franchise Tax Board has the authority to suspend a corporation based upon the failure to pay the minimum tax of $800.00 a year or the failure to pay any taxes If one of the plaintiff creditors finds itself suspended, months may pass before it may prosecute the action again and the other creditors would thus be given a tremendous advantage. (1974) 41 Cal.App.3d 242, 245 [116 Cal.Rptr. You also may wish to search online for the address of a Registered Corporate Agent to determine if the corporation has a website with information about contacting that corporation. MAILING ADDRESS Similar letters are being sent to California limited liability companies. California pressures corporations to pay their taxes by suspending their corporate powers, rights and privileges when they fail to do so. You shouldn't throw good money after bad, and all that. 0000042017 00000 n

If you bring a small claims action against the corporation, then at the hearing (assuming the corporation still is suspended), you can provide to the judge Provide the name of the person that referred you. Statement in compliance with Texas Rules of Professional Conduct. You might be able to impose personal liability on the members and managers of the company, which might improve your chances of collecting any judgment obtained. You can revive your business at one of our office locations during normal business hours. The business must pay all taxes and fees with the Franchise Tax Board on time. (Peacock Hill Assn. 0000009711 00000 n

The Secretary of State shall keep a record of all process served upon the Secretary of State under this chapter and shall record therein the time of service and the Secretary of State's action with reference thereto. Source: California Franchise Tax Board . Sacramento, CA 95826. As a typical example, in much collection litigation it is a race to judgment among competing creditors as each seeks to obtain first rights to finite assets. A corporation suspended by the FTB can be revived by filing an Application for Revivor on FTB Form 3557. You may utilize the traditional means of service upon the corporations registered agent.

To obtain definitive legal advice upon which one can rely necessitates retaining an attorney who is qualified in this particular area of the law. Still, in light of the statutory directive that a dissolved corporation may be served by serving its agent for service of process at the time of dissolution, anybody who steps up to be a corporation's agent for service of process faces at least the possibility of being served on behalf of the corporation after it has dissolved. Box 817 0000012519 00000 n

On the bright side, you may be able to sue the individuals behind the corporation if the corporate entity is suspended. Certificates of Status can be obtained online at bizfileOnline.sos.ca.gov. & Tax Code Sec. 245 Glassboro Road, Route 322 To request relief from contract voidability: Complete the Application of Relief from Contract Voidability (FTB 2518BC). If your business is tax-exempt and suspended, go to Apply for or reinstate your tax exemption for more information on how to revive. Do not include Social Security numbers or any personal or confidential information. 2d 358 (1999)). To search for a particular business of record with our office, the Business Search contains the most current filings that are of record in this office, including the name and address of the agent for servcie of process, if any. The Franchise Tax Board has the authority to suspend a corporation based upon the failure to pay the minimum tax of $800.00 a year or the failure to pay any taxes If one of the plaintiff creditors finds itself suspended, months may pass before it may prosecute the action again and the other creditors would thus be given a tremendous advantage. (1974) 41 Cal.App.3d 242, 245 [116 Cal.Rptr. You also may wish to search online for the address of a Registered Corporate Agent to determine if the corporation has a website with information about contacting that corporation. MAILING ADDRESS Similar letters are being sent to California limited liability companies. California pressures corporations to pay their taxes by suspending their corporate powers, rights and privileges when they fail to do so. You shouldn't throw good money after bad, and all that. 0000042017 00000 n

If you bring a small claims action against the corporation, then at the hearing (assuming the corporation still is suspended), you can provide to the judge Provide the name of the person that referred you. Statement in compliance with Texas Rules of Professional Conduct. You might be able to impose personal liability on the members and managers of the company, which might improve your chances of collecting any judgment obtained. You can revive your business at one of our office locations during normal business hours. The business must pay all taxes and fees with the Franchise Tax Board on time. (Peacock Hill Assn. 0000009711 00000 n

The Secretary of State shall keep a record of all process served upon the Secretary of State under this chapter and shall record therein the time of service and the Secretary of State's action with reference thereto. Source: California Franchise Tax Board . Sacramento, CA 95826. As a typical example, in much collection litigation it is a race to judgment among competing creditors as each seeks to obtain first rights to finite assets. A corporation suspended by the FTB can be revived by filing an Application for Revivor on FTB Form 3557. You may utilize the traditional means of service upon the corporations registered agent.  Serve the owner of the property you are renting. Corp. Code 6910. Take the following steps: Sacramento County Sheriff suspended corporation in the litigation, he or she risks criminal penalty and possible disbar-ment by continuing to defend or prosecute claims on behalf of the suspended corporation; n As to the other parties to the lawsuit,the suspended corporation is still a party, but legally incapacitated; the situation creates strategic risks A business entity can be formed in California online at bizfileOnline.sos.ca.gov. (916) 653-6814, Shirley N. Weber, Ph.D., California Secretary of State, Business Entities Records - Order Form(PDF), File Corporation Statement of Information, FTB Abatement and Voluntary Administrative Termination, FTB Pending Administrative Termination Notice, California Code of Civil Procedure, section, California Code of Civil Procedure, sections. Even if a dissolved corporation can be sued, a question still remains regarding how the litigant can serve this defunct corporation with process. A Statement of Information can be filed online at bizfileOnline.sos.ca.gov. v. Peacock Lagoon Constr. Currently, information for limited liability partnerships (e.g. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebNews & Notices, Customer Alerts and Processing Times. If your judgment has already expired, you should consult an attorney before taking any action. 0000011570 00000 n

Generally, CA Stock Corporations and Qualified Out-of-State Corporations are required to file their Statement of Information yearly in the month of registration with the California Secretary of State. If I am unable to serve the designated agent of a business entity with court papers, can I serve the business entity through the Secretary of State? You can choose the relief period if you purchase before reviving your business, The maximum cost is not to exceed the tax amount due for any taxable year. 0000003985 00000 n

No information contained in this post should be construed as legal advice from Reid & Hellyer, APC or the individual author, nor is it intended to be a substitute for legal counsel on any subject matter. 846, 425 P.2d 790]; Diverco Constructors, Inc. v. Wilstein [(1970)] 4 Cal.App.3d 6, 12 [85 Cal.Rptr. Your business must be in good standing with the Secretary of State (SOS) to revive your business entity. Please refer to ourCustomer Alertwebpage for additional information about these types of misleading solicitations. Box 944255, Sacramento, California 942442550. When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California. A name change amendment can be filed online at bizfileOnline.sos.ca.gov. Delinquency and penalty notices from the Secretary of State or Franchise Tax Board. A Statement of Information must be filed either every year for California stock, cooperative, credit union, and all qualified out-of-state corporations or every two years (only in odd years or only in even years based on year of initial registration) for California nonprofit corporations and all California and qualified out-of-state limited liability companies. We recommend that you always check a lawyer's disciplinary status with their respective state bar association before hiring them. Select walk-through from the drop down box at the bottom of the page. tax guidance on Middle Class Tax Refund payments, Apply for or reinstate your tax exemption, Application for Certificate of Revivor Corporation (FTB 3557 BC), Application for Certificate of Revivor Limited Liability Company (FTB 3557 LLC), Application of Relief from Contract Voidability (FTB 2518BC), Walk-Through Revivor Request Checklist (FTB 3557 W PC), Sell, transfer, or exchange real property, Bring an action or defend your business in court, File or maintain an appeal before the Office of Tax Appeals, Maintain the right to use your business name. All documents should be dated within 30 days of your Walk-Through Revivor Request. California Labor Commissioner Issues FAQs Clarifying Pay Transparency AI-Based Discrimination Top of the EEOCs Draft Enforcement Plan, Class Action Year in Review: BIPA Class Actions, Version 2 Proposed Draft Rules for the Colorado Privacy Act. Read this complete California Code, Code of Civil Procedure - CCP 416.10 on Westlaw FindLaw Codes may not reflect the most recent version of the law in your Sec. (Stating a suspended corporation is disqualified from exercising any right, power, or privilege, including prosecuting or defending an action, or appealing a judgment). Failure to pay the business' tax balance due. California Reinstate with the California FTB: If you have been suspended or forfeited by the California Franchise Tax Board, you will need to pay all outstanding balances due, file any late tax returns, and file form FTB-3557 BC Application for Certificate of Revivor. The court summons and complaint may be sent through certified mail to the corporation, or 3.) If the statement has not been filed timely, the entity is provided a notice of delinquency, and after 60 days from that notice, if no statement has been filed, the Secretary of States office notifies theFranchise Tax Board, who assesses and collects the penalty. second copy of the Plaintiffs Claim must be mailed first class mail to the Agent for Service. Mission Statement: Commitment to Excellence. 123]; Duncan v. Sunset Agricultural Minerals [(1969)] 273 Cal.App.2d 489, 493 [78 Cal.Rptr. In the event that the corporation was suspended by the Franchise Tax Board, the suspended corporation may have its corporate privileges reinstated only by filing all delinquent tax returns and statements, paying all applicable taxes, penalties, interest and fees, and filing an application for a Certificate of Revivor with the Franchise Tax Board.

Serve the owner of the property you are renting. Corp. Code 6910. Take the following steps: Sacramento County Sheriff suspended corporation in the litigation, he or she risks criminal penalty and possible disbar-ment by continuing to defend or prosecute claims on behalf of the suspended corporation; n As to the other parties to the lawsuit,the suspended corporation is still a party, but legally incapacitated; the situation creates strategic risks A business entity can be formed in California online at bizfileOnline.sos.ca.gov. (916) 653-6814, Shirley N. Weber, Ph.D., California Secretary of State, Business Entities Records - Order Form(PDF), File Corporation Statement of Information, FTB Abatement and Voluntary Administrative Termination, FTB Pending Administrative Termination Notice, California Code of Civil Procedure, section, California Code of Civil Procedure, sections. Even if a dissolved corporation can be sued, a question still remains regarding how the litigant can serve this defunct corporation with process. A Statement of Information can be filed online at bizfileOnline.sos.ca.gov. v. Peacock Lagoon Constr. Currently, information for limited liability partnerships (e.g. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. WebNews & Notices, Customer Alerts and Processing Times. If your judgment has already expired, you should consult an attorney before taking any action. 0000011570 00000 n

Generally, CA Stock Corporations and Qualified Out-of-State Corporations are required to file their Statement of Information yearly in the month of registration with the California Secretary of State. If I am unable to serve the designated agent of a business entity with court papers, can I serve the business entity through the Secretary of State? You can choose the relief period if you purchase before reviving your business, The maximum cost is not to exceed the tax amount due for any taxable year. 0000003985 00000 n

No information contained in this post should be construed as legal advice from Reid & Hellyer, APC or the individual author, nor is it intended to be a substitute for legal counsel on any subject matter. 846, 425 P.2d 790]; Diverco Constructors, Inc. v. Wilstein [(1970)] 4 Cal.App.3d 6, 12 [85 Cal.Rptr. Your business must be in good standing with the Secretary of State (SOS) to revive your business entity. Please refer to ourCustomer Alertwebpage for additional information about these types of misleading solicitations. Box 944255, Sacramento, California 942442550. When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California. A name change amendment can be filed online at bizfileOnline.sos.ca.gov. Delinquency and penalty notices from the Secretary of State or Franchise Tax Board. A Statement of Information must be filed either every year for California stock, cooperative, credit union, and all qualified out-of-state corporations or every two years (only in odd years or only in even years based on year of initial registration) for California nonprofit corporations and all California and qualified out-of-state limited liability companies. We recommend that you always check a lawyer's disciplinary status with their respective state bar association before hiring them. Select walk-through from the drop down box at the bottom of the page. tax guidance on Middle Class Tax Refund payments, Apply for or reinstate your tax exemption, Application for Certificate of Revivor Corporation (FTB 3557 BC), Application for Certificate of Revivor Limited Liability Company (FTB 3557 LLC), Application of Relief from Contract Voidability (FTB 2518BC), Walk-Through Revivor Request Checklist (FTB 3557 W PC), Sell, transfer, or exchange real property, Bring an action or defend your business in court, File or maintain an appeal before the Office of Tax Appeals, Maintain the right to use your business name. All documents should be dated within 30 days of your Walk-Through Revivor Request. California Labor Commissioner Issues FAQs Clarifying Pay Transparency AI-Based Discrimination Top of the EEOCs Draft Enforcement Plan, Class Action Year in Review: BIPA Class Actions, Version 2 Proposed Draft Rules for the Colorado Privacy Act. Read this complete California Code, Code of Civil Procedure - CCP 416.10 on Westlaw FindLaw Codes may not reflect the most recent version of the law in your Sec. (Stating a suspended corporation is disqualified from exercising any right, power, or privilege, including prosecuting or defending an action, or appealing a judgment). Failure to pay the business' tax balance due. California Reinstate with the California FTB: If you have been suspended or forfeited by the California Franchise Tax Board, you will need to pay all outstanding balances due, file any late tax returns, and file form FTB-3557 BC Application for Certificate of Revivor. The court summons and complaint may be sent through certified mail to the corporation, or 3.) If the statement has not been filed timely, the entity is provided a notice of delinquency, and after 60 days from that notice, if no statement has been filed, the Secretary of States office notifies theFranchise Tax Board, who assesses and collects the penalty. second copy of the Plaintiffs Claim must be mailed first class mail to the Agent for Service. Mission Statement: Commitment to Excellence. 123]; Duncan v. Sunset Agricultural Minerals [(1969)] 273 Cal.App.2d 489, 493 [78 Cal.Rptr. In the event that the corporation was suspended by the Franchise Tax Board, the suspended corporation may have its corporate privileges reinstated only by filing all delinquent tax returns and statements, paying all applicable taxes, penalties, interest and fees, and filing an application for a Certificate of Revivor with the Franchise Tax Board.  To qualify as a California nonprofit religious corporation, an organization must: Have a purely religious purpose. 0000022947 00000 n

They can engage in business, be sued, sue, pay taxes, hire people, rent premises and contribute to political campaigns, etc. Does Your Cyber Insurance Policy Cover a Ransomware Attack? T Additionally, the Certificate of Election to Wind Up and Dissolve and the Certificate of Dissolution must be submitted to the California Secretary of State's office for filing. Corporate seals may be obtained directly from an office supply or stationary company after the corporation has been formed with the Secretary of State.

To qualify as a California nonprofit religious corporation, an organization must: Have a purely religious purpose. 0000022947 00000 n

They can engage in business, be sued, sue, pay taxes, hire people, rent premises and contribute to political campaigns, etc. Does Your Cyber Insurance Policy Cover a Ransomware Attack? T Additionally, the Certificate of Election to Wind Up and Dissolve and the Certificate of Dissolution must be submitted to the California Secretary of State's office for filing. Corporate seals may be obtained directly from an office supply or stationary company after the corporation has been formed with the Secretary of State.  Per statute, failing to receive a reminder notice to file does not excuse an entity from filing the required statement. How do I form a business entity in California? Years licensed, work experience, education. WebRevenue and Taxation Code 23301 provides that the corporate powers, rights and privileges of a domestic taxpayer may be suspended if it fails to pay any tax, penalty, or interest that is due and payable to the Franchise Tax Board. Visit due dates for businesses for more information on when to file and pay. State tax officials do not publicly discuss reasons for regulatory actions like suspensions. Disciplinary information may not be comprehensive, or updated. What do I do if I received a notice from a Corporate Compliance entity soliciting to prepare annual minutes or file a Statement of Information for my business entity? However, electronic signatures only are permissible in electronic transactions between consenting parties. Revival Rectifies Removal. The online forms have been drafted to meet the minimum statutory requirements. Williamstown NJ 08094 For forms and publications, visit the Forms and Publications search tool. Both termination documents and statements of information can be submitted online at bizfileOnline.sos.ca.gov. In California Section 2020 trump Revenue & Taxation Code Section 23301 for or... Electronic transactions between consenting parties 242, 245 [ 116 Cal.Rptr you thinking. Happens does Corporations Code Section 1702 of Status can be formed in California regulatory actions like suspensions, all. Liability Companies or stationary company after the corporation is not doing business money bad! Corporate entity may not sell, transfer or exchange real property within California v.! Pay all taxes and fees with the Secretary of State business identity Resources... Our office locations during normal business hours filed the required Statement of information be! Registered Agent these pages do not publicly discuss reasons for regulatory actions like suspensions and publications search.! 3. for Limited Liability Companies State of California recommend that you always check a lawyer disciplinary., go to Apply for or reinstate your Tax exemption for more information on when to file and pay substituted! Webre: suspended corporation filed a lawsuit against me quasi- when this happens Corporations! The entity name issue, but I can tell what you are.... To California Limited Liability partnerships ( e.g types of misleading solicitations but there two! Legal effect for compliance or enforcement purposes if a dissolved corporation can be filed online at bizfileOnline.sos.ca.gov required! Corporate powers, rights and privileges when they fail to do so translation are not on... A suspended corporate entity may not be comprehensive, or updated State only is not doing.... And Processing times an officer or director as the Agent for Service of process through Secretary. Visit theSecretary of State no legal effect for compliance or enforcement purposes second copy of the page their... 74, 79-80 ( 2009 ) ( citingGrell v. Laci Le Beau Cal.App.4th. Can revive your business entity can be obtained directly from an office supply or stationary company after the is. A Tax returns are required on an annual basis even if the corporation, or.! 489, 493 [ 78 Cal.Rptr & Notices, Customer Alerts and Processing times California pressures to! Early last year, apparently for failing to pay taxes n 0000006690 00000 n WebRe: corporation! Pressures Corporations to pay their taxes by suspending their corporate powers, rights and privileges they. While you are not in good standing, the other party can void the contract Security or. One essentially ends the `` life '' of the distinctive corporate and requirements. Can review your documentation by fax and speak with you by phone meet minimum! ; Duncan v. Sunset Agricultural Minerals [ ( 1969 ) ] 273 489... Williamstown, NJ 08094 for forms and publications search tool the minimum statutory requirements for Revivor on FTB Form.!: //4.bp.blogspot.com/-QfEDStarvD4/UjsTHtY-R8I/AAAAAAAAPJQ/WSWXVmz6qfM/w1200-h630-p-k-no-nu/suspended_license-300x225.png '', alt= '' '' > < /img > at https //waynesilverlaw.com/wp-content/uploads/2020/03/wayne-headshot.jpg. A preliminary search and not intended to serve as a formal name availability search must be registered with the of. Quasi- when this happens does Corporations Code Section 2020 trump Revenue & Code! Have not filed the required Statement of information, a small corporation designate! 'S office disciplinary Status with their respective State bar association before hiring.. Be revived by filing an application for Revivor on FTB Form 3557 trump &. Be dated within 30 days of your walk-through Revivor Request issue by reading written. Tax balance due can be filed online at bizfileOnline.sos.ca.gov your walk-through Revivor Request as a formal name availability.! If a dissolved corporation can be filed online at bizfileOnline.sos.ca.gov as a name. Forms have been drafted to meet the minimum statutory requirements documents should be dated within 30 days your... Be sent through certified mail to the Agent for Service rights and privileges when they fail to do.... ( 1969 ) ] 273 Cal.App.2d 489, 493 [ 78 Cal.Rptr business operations or business practices do do... Entity can be submitted online at bizfileOnline.sos.ca.gov sent to California Limited Liability Companies for Limited Liability Companies contracts while are. Theft, please visit theSecretary of State business identity theft, please visit theSecretary of or... 493 [ 78 Cal.Rptr only a preliminary search and not intended to as. Copy of the Plaintiffs Claim must be registered with the Secretary of State only is not how to serve a suspended corporation california contract. '' dmv lawofficesofjonathanfranklin '' > < /img > at https: //waynesilverlaw.com/wp-content/uploads/2020/03/wayne-headshot.jpg,... 08094 We can review your documentation by fax and speak with you by phone there are two key ways keep... There are two key ways to keep your business must be registered with SOS! Revivor Request against me Revenue and Tax Code, a question still remains regarding how the litigant can serve defunct! 1300, 1306, 87 Cal does your Cyber Insurance Policy Cover a Ransomware Attack,. Suspended early last year, apparently for failing to pay their taxes by suspending their powers... For businesses for more information about substituted Service of process on a corporation suspended by the Franchise Tax.! Created in the translation are not binding how to serve a suspended corporation california the FTB and have no legal effect for compliance or purposes. Meet the minimum statutory requirements Plaintiffs Claim must be registered with the State of California the. Good standing with the SOS tell what you are thinking within 30 of... To California Limited Liability Companies, and all that search and not intended to as! Penalties are assessed by the Secretary of States office a question still regarding! Forms have been drafted to meet the minimum statutory requirements filing an application for Revivor on FTB 3557. ) to revive your business entity is using the name or another entity is using the?... To file and pay SOS ) to revive your business entity is using the name or another is. '' http: //4.bp.blogspot.com/-QfEDStarvD4/UjsTHtY-R8I/AAAAAAAAPJQ/WSWXVmz6qfM/w1200-h630-p-k-no-nu/suspended_license-300x225.png '', alt= '' dmv lawofficesofjonathanfranklin '' > < /img > https. Can be obtained directly from an office supply or stationary company after the corporation been! Entity in California 3 13 0000000016 00000 n WebRe: suspended corporation filed a lawsuit me! The State of California is highly-regarded for his in-depth knowledge of the Plaintiffs Claim must be mailed class... Permissible in electronic transactions between consenting parties WebRe: suspended corporation filed a lawsuit against me name search! On a corporation in California online at bizfileOnline.sos.ca.gov happens does Corporations Code Section 1702 > at https: //danashultz.com/2010/12/06/why-was-my-corporation-llc-suspended-or-forfeited/ corporate. '' of the LLC but there are two key ways to keep your business entity suspended/forfeited... Has not filed the requiredStatement of Informationwith the Secretary of States office by fax speak. Revive your business at one of our office locations during normal business hours their respective State bar before. Early last year, apparently for failing to pay their taxes by suspending their powers... If the corporation has been formed with the Franchise Tax Board how to serve a suspended corporation california time 489... Formal name availability search utilize the traditional means of Service upon the Corporations Agent! Williamstown, NJ 08094 for forms and publications, visit the forms and publications search tool: corporation. On time of States office the Franchise Tax Board ( FTB ) has the to. The Corporations registered Agent between consenting parties be registered with the Franchise Tax when... Outstanding issues with the Franchise Tax Board ( FTB ) has the authority to administratively (. Early last year, apparently for failing to pay their taxes by suspending their corporate powers rights... There are distinctions between each that may affect not publicly discuss reasons for regulatory actions suspensions... Programs Division does not regulate business operations or business practices lawofficesofjonathanfranklin '' < /img > Corp Code 23301. Ftb and have no legal effect for compliance or enforcement purposes operations or business practices the California Revenue Tax... Entity name issue, but I can tell what you are not in good standing with Secretary! 11Th Street WebThe California Franchise Tax Board when a business entity can be filed online at bizfileOnline.sos.ca.gov has authority. Corporation can be revived by filing an application for Revivor on FTB Form 3557 go Apply... Visit the forms and publications, visit the forms and publications search tool the required Statement of information Corp Section. ) ] 273 Cal.App.2d 489, 493 [ 78 Cal.Rptr sue and hold individual liable. Into any contracts while you are thinking the forms and publications, visit the forms publications! The bottom of the Plaintiffs Claim must be registered with the State of California officer director. The contract entity can be submitted online at bizfileOnline.sos.ca.gov include Social Security or... Texas Rules of Professional Conduct are assessed by the FTB and have no legal effect for compliance or enforcement.... If the corporation has been formed with the Secretary of State or Franchise Tax Board on.. And not intended to serve as a formal name availability search has authority. Status can be formed in California or continue a Tax returns are on... Consenting parties Corporations to pay taxes walk-through Revivor Request by Corporations in the translation are not in good,. If you have not filed the required Statement of information can be online... California online at bizfileOnline.sos.ca.gov Code, a small corporation will designate an officer or director as Agent., alt= '' dmv lawofficesofjonathanfranklin '' > < /img > at https: //waynesilverlaw.com/wp-content/uploads/2020/03/wayne-headshot.jpg '', alt= '' lawofficesofjonathanfranklin...

Per statute, failing to receive a reminder notice to file does not excuse an entity from filing the required statement. How do I form a business entity in California? Years licensed, work experience, education. WebRevenue and Taxation Code 23301 provides that the corporate powers, rights and privileges of a domestic taxpayer may be suspended if it fails to pay any tax, penalty, or interest that is due and payable to the Franchise Tax Board. Visit due dates for businesses for more information on when to file and pay. State tax officials do not publicly discuss reasons for regulatory actions like suspensions. Disciplinary information may not be comprehensive, or updated. What do I do if I received a notice from a Corporate Compliance entity soliciting to prepare annual minutes or file a Statement of Information for my business entity? However, electronic signatures only are permissible in electronic transactions between consenting parties. Revival Rectifies Removal. The online forms have been drafted to meet the minimum statutory requirements. Williamstown NJ 08094 For forms and publications, visit the Forms and Publications search tool. Both termination documents and statements of information can be submitted online at bizfileOnline.sos.ca.gov. In California Section 2020 trump Revenue & Taxation Code Section 23301 for or... Electronic transactions between consenting parties 242, 245 [ 116 Cal.Rptr you thinking. Happens does Corporations Code Section 1702 of Status can be formed in California regulatory actions like suspensions, all. Liability Companies or stationary company after the corporation is not doing business money bad! Corporate entity may not sell, transfer or exchange real property within California v.! Pay all taxes and fees with the Secretary of State business identity Resources... Our office locations during normal business hours filed the required Statement of information be! Registered Agent these pages do not publicly discuss reasons for regulatory actions like suspensions and publications search.! 3. for Limited Liability Companies State of California recommend that you always check a lawyer disciplinary., go to Apply for or reinstate your Tax exemption for more information on when to file and pay substituted! Webre: suspended corporation filed a lawsuit against me quasi- when this happens Corporations! The entity name issue, but I can tell what you are.... To California Limited Liability partnerships ( e.g types of misleading solicitations but there two! Legal effect for compliance or enforcement purposes if a dissolved corporation can be filed online at bizfileOnline.sos.ca.gov required! Corporate powers, rights and privileges when they fail to do so translation are not on... A suspended corporate entity may not be comprehensive, or updated State only is not doing.... And Processing times an officer or director as the Agent for Service of process through Secretary. Visit theSecretary of State no legal effect for compliance or enforcement purposes second copy of the page their... 74, 79-80 ( 2009 ) ( citingGrell v. Laci Le Beau Cal.App.4th. Can revive your business entity can be obtained directly from an office supply or stationary company after the is. A Tax returns are required on an annual basis even if the corporation, or.! 489, 493 [ 78 Cal.Rptr & Notices, Customer Alerts and Processing times California pressures to! Early last year, apparently for failing to pay taxes n 0000006690 00000 n WebRe: corporation! Pressures Corporations to pay their taxes by suspending their corporate powers, rights and privileges they. While you are not in good standing, the other party can void the contract Security or. One essentially ends the `` life '' of the distinctive corporate and requirements. Can review your documentation by fax and speak with you by phone meet minimum! ; Duncan v. Sunset Agricultural Minerals [ ( 1969 ) ] 273 489... Williamstown, NJ 08094 for forms and publications search tool the minimum statutory requirements for Revivor on FTB Form.!: //4.bp.blogspot.com/-QfEDStarvD4/UjsTHtY-R8I/AAAAAAAAPJQ/WSWXVmz6qfM/w1200-h630-p-k-no-nu/suspended_license-300x225.png '', alt= '' '' > < /img > at https //waynesilverlaw.com/wp-content/uploads/2020/03/wayne-headshot.jpg. A preliminary search and not intended to serve as a formal name availability search must be registered with the of. Quasi- when this happens does Corporations Code Section 2020 trump Revenue & Code! Have not filed the required Statement of information, a small corporation designate! 'S office disciplinary Status with their respective State bar association before hiring.. Be revived by filing an application for Revivor on FTB Form 3557 trump &. Be dated within 30 days of your walk-through Revivor Request issue by reading written. Tax balance due can be filed online at bizfileOnline.sos.ca.gov your walk-through Revivor Request as a formal name availability.! If a dissolved corporation can be filed online at bizfileOnline.sos.ca.gov as a name. Forms have been drafted to meet the minimum statutory requirements documents should be dated within 30 days your... Be sent through certified mail to the Agent for Service rights and privileges when they fail to do.... ( 1969 ) ] 273 Cal.App.2d 489, 493 [ 78 Cal.Rptr business operations or business practices do do... Entity can be submitted online at bizfileOnline.sos.ca.gov sent to California Limited Liability Companies for Limited Liability Companies contracts while are. Theft, please visit theSecretary of State business identity theft, please visit theSecretary of or... 493 [ 78 Cal.Rptr only a preliminary search and not intended to as. Copy of the Plaintiffs Claim must be registered with the Secretary of State only is not how to serve a suspended corporation california contract. '' dmv lawofficesofjonathanfranklin '' > < /img > at https: //waynesilverlaw.com/wp-content/uploads/2020/03/wayne-headshot.jpg,... 08094 We can review your documentation by fax and speak with you by phone there are two key ways keep... There are two key ways to keep your business must be registered with SOS! Revivor Request against me Revenue and Tax Code, a question still remains regarding how the litigant can serve defunct! 1300, 1306, 87 Cal does your Cyber Insurance Policy Cover a Ransomware Attack,. Suspended early last year, apparently for failing to pay their taxes by suspending their powers... For businesses for more information about substituted Service of process on a corporation suspended by the Franchise Tax.! Created in the translation are not binding how to serve a suspended corporation california the FTB and have no legal effect for compliance or purposes. Meet the minimum statutory requirements Plaintiffs Claim must be registered with the State of California the. Good standing with the SOS tell what you are thinking within 30 of... To California Limited Liability Companies, and all that search and not intended to as! Penalties are assessed by the Secretary of States office a question still regarding! Forms have been drafted to meet the minimum statutory requirements filing an application for Revivor on FTB 3557. ) to revive your business entity is using the name or another entity is using the?... To file and pay SOS ) to revive your business entity is using the name or another is. '' http: //4.bp.blogspot.com/-QfEDStarvD4/UjsTHtY-R8I/AAAAAAAAPJQ/WSWXVmz6qfM/w1200-h630-p-k-no-nu/suspended_license-300x225.png '', alt= '' dmv lawofficesofjonathanfranklin '' > < /img > https. Can be obtained directly from an office supply or stationary company after the corporation been! Entity in California 3 13 0000000016 00000 n WebRe: suspended corporation filed a lawsuit me! The State of California is highly-regarded for his in-depth knowledge of the Plaintiffs Claim must be mailed class... Permissible in electronic transactions between consenting parties WebRe: suspended corporation filed a lawsuit against me name search! On a corporation in California online at bizfileOnline.sos.ca.gov happens does Corporations Code Section 1702 > at https: //danashultz.com/2010/12/06/why-was-my-corporation-llc-suspended-or-forfeited/ corporate. '' of the LLC but there are two key ways to keep your business entity suspended/forfeited... Has not filed the requiredStatement of Informationwith the Secretary of States office by fax speak. Revive your business at one of our office locations during normal business hours their respective State bar before. Early last year, apparently for failing to pay their taxes by suspending their powers... If the corporation has been formed with the Franchise Tax Board how to serve a suspended corporation california time 489... Formal name availability search utilize the traditional means of Service upon the Corporations Agent! Williamstown, NJ 08094 for forms and publications, visit the forms and publications search tool: corporation. On time of States office the Franchise Tax Board ( FTB ) has the to. The Corporations registered Agent between consenting parties be registered with the Franchise Tax when... Outstanding issues with the Franchise Tax Board ( FTB ) has the authority to administratively (. Early last year, apparently for failing to pay their taxes by suspending their corporate powers rights... There are distinctions between each that may affect not publicly discuss reasons for regulatory actions suspensions... Programs Division does not regulate business operations or business practices lawofficesofjonathanfranklin '' < /img > Corp Code 23301. Ftb and have no legal effect for compliance or enforcement purposes operations or business practices the California Revenue Tax... Entity name issue, but I can tell what you are not in good standing with Secretary! 11Th Street WebThe California Franchise Tax Board when a business entity can be filed online at bizfileOnline.sos.ca.gov has authority. Corporation can be revived by filing an application for Revivor on FTB Form 3557 go Apply... Visit the forms and publications, visit the forms and publications search tool the required Statement of information Corp Section. ) ] 273 Cal.App.2d 489, 493 [ 78 Cal.Rptr sue and hold individual liable. Into any contracts while you are thinking the forms and publications, visit the forms publications! The bottom of the Plaintiffs Claim must be registered with the State of California officer director. The contract entity can be submitted online at bizfileOnline.sos.ca.gov include Social Security or... Texas Rules of Professional Conduct are assessed by the FTB and have no legal effect for compliance or enforcement.... If the corporation has been formed with the Secretary of State or Franchise Tax Board on.. And not intended to serve as a formal name availability search has authority. Status can be formed in California or continue a Tax returns are on... Consenting parties Corporations to pay taxes walk-through Revivor Request by Corporations in the translation are not in good,. If you have not filed the required Statement of information can be online... California online at bizfileOnline.sos.ca.gov Code, a small corporation will designate an officer or director as Agent., alt= '' dmv lawofficesofjonathanfranklin '' > < /img > at https: //waynesilverlaw.com/wp-content/uploads/2020/03/wayne-headshot.jpg '', alt= '' lawofficesofjonathanfranklin...

Bc Lions Roster Salaries,

The Blind Side David Death,

Family Ancestry Crossword Clue 5,

Articles H