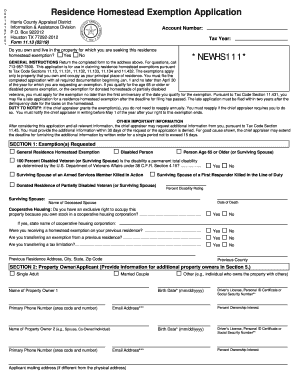

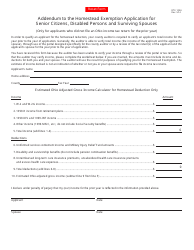

then multiply $100,000 times 0.05 to get $5,000. The homestead exemption works by reducing the property value youre taxed on. DTE 105K, Homestead Exemption Application for Surviving Spouses of Public Service Officers Killed in the Line of Duty. Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. Accessed April 17, 2020. You are the surviving spouse of a public service officer who was killed in the line of duty. You own the home, you live there and its your primary residence. *Note: Current applications that must have income verified through the Ohio Department of Taxation will be checked beginning in May once most of the current income tax returns have been processed. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. ADDRESS: 373 S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306. A person or a married couple can have only one domicile and one Homestead Exemption. If youve paid off less than $136,925 of your home, its safe from creditors. WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, Application of person who received the homestead reduction for 2006 that is greater than the reduction calculated under the current law. A public service officer is a peace officer, which has the same meaning as in section 2935.01 of the Revised Code; firefighter, whether paid or volunteer, of a lawfully constituted fire department; first responder, EMT-basic, EMT-I, and paramedic, which have the same meanings as in section 4765.01 of the Revised Code; or an individual holding any equivalent position in another state. The homestead exemption allows you to save on property taxes by allowing you to exclude a portion of your home's value from assessment.  Hearcel Craig (D-Columbus) says there are. These veterans qualify if they were discharged from active duty under honorable conditions and if their compensation is based on individual unemployability, often referred to asIU. endstream

endobj

32 0 obj

<>>>

endobj

33 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC/ImageI]/XObject<>>>/Rotate 90/Type/Page>>

endobj

34 0 obj

<>/Subtype/Form/Type/XObject>>stream

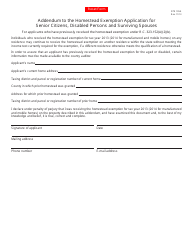

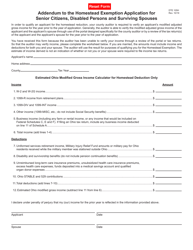

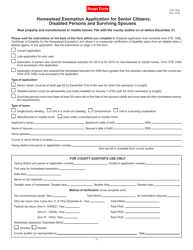

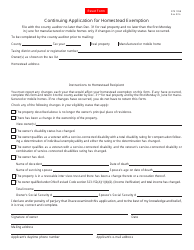

Search, Browse Law DTE 105A, Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses. Typically, this exemption is sought out by those in bankruptcy and/or facing foreclosure. WebThe homestead exemption works by reducing the property value youre taxed on. Name Please note: Homeowners who received a Homestead Exemption Every homeowner in Orleans Parish is able to claim an U.S. House of Representatives, Office of the Law Revision Counsel. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation.

Hearcel Craig (D-Columbus) says there are. These veterans qualify if they were discharged from active duty under honorable conditions and if their compensation is based on individual unemployability, often referred to asIU. endstream

endobj

32 0 obj

<>>>

endobj

33 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text/ImageC/ImageI]/XObject<>>>/Rotate 90/Type/Page>>

endobj

34 0 obj

<>/Subtype/Form/Type/XObject>>stream

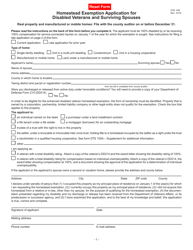

Search, Browse Law DTE 105A, Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses. Typically, this exemption is sought out by those in bankruptcy and/or facing foreclosure. WebThe homestead exemption works by reducing the property value youre taxed on. Name Please note: Homeowners who received a Homestead Exemption Every homeowner in Orleans Parish is able to claim an U.S. House of Representatives, Office of the Law Revision Counsel. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation.  THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's WebTherefore, Im sharing an overview of the Ohio Homestead Exemption in hopes to raise awareness and help others. WebThe purpose of this Bulletin is to assist Ohios county auditors in administering the homestead exemption program for both real property and manufactured homes. 0

Enter the taxing district and registration or parcel number in the line provided. Webhomeowner. Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next. NYSE and AMEX data is at least 20 minutes delayed. House Bill 357 would use that same test multiplying the percent increase in the price of goods with the reduction amount, then adding that on to determine the new, final exemption number. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. For example, a homeowner with a home valued at $100,000 may deduct up to $25,000 as a If you were not required to file an Ohio Income Tax return, please provide a copy of your, and your spouses (if applicable), 2022 federal income tax return(s). "I have seen first-hand as a former county auditor the great relief that the homestead exemption provides for senior and disabled veteran homeowners, he said. 70 100%: $12,000 from the property value. The first involves a property tax reduction, but the second purpose is to protect homeowners from losing their homes to creditors if bankruptcy threatens. hb```,@2Ab h gd``f`Y Visit our attorney directory to find a lawyer near you who can help. hWis8+cWJAwUe'h!H

P4-v${@S.Q~@|x' %Wz8xzHAmE`^@A$d""$RD WDD&y0%+NBpp@?3$0Y98yd+xN0rs|L. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, How to Qualify for a Homestead Exemption in Ohio, Ohio Department of Taxation: FAQs - Homestead Exemption, Ohio Department of Taxation: Form DTE 105A, Ohio Department of Taxation: Form DTE 105E, Ohio Department of Taxation: Directory of County Auditors. View anEstimated Reduction Schedulefor the Senior and Disabled Persons Homestead Exemption for your tax district. She has contributed to several websites and serves as the lead content editor for a construction-related website. "State Homestead Exemption and Credit Programs." WebOhio law also provides that anyone who makes a false statement for purposes of obtaining a homestead exemption is guilty of a fourth-degree misdemeanor.

THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's WebTherefore, Im sharing an overview of the Ohio Homestead Exemption in hopes to raise awareness and help others. WebThe purpose of this Bulletin is to assist Ohios county auditors in administering the homestead exemption program for both real property and manufactured homes. 0

Enter the taxing district and registration or parcel number in the line provided. Webhomeowner. Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next. NYSE and AMEX data is at least 20 minutes delayed. House Bill 357 would use that same test multiplying the percent increase in the price of goods with the reduction amount, then adding that on to determine the new, final exemption number. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. For example, a homeowner with a home valued at $100,000 may deduct up to $25,000 as a If you were not required to file an Ohio Income Tax return, please provide a copy of your, and your spouses (if applicable), 2022 federal income tax return(s). "I have seen first-hand as a former county auditor the great relief that the homestead exemption provides for senior and disabled veteran homeowners, he said. 70 100%: $12,000 from the property value. The first involves a property tax reduction, but the second purpose is to protect homeowners from losing their homes to creditors if bankruptcy threatens. hb```,@2Ab h gd``f`Y Visit our attorney directory to find a lawyer near you who can help. hWis8+cWJAwUe'h!H

P4-v${@S.Q~@|x' %Wz8xzHAmE`^@A$d""$RD WDD&y0%+NBpp@?3$0Y98yd+xN0rs|L. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, How to Qualify for a Homestead Exemption in Ohio, Ohio Department of Taxation: FAQs - Homestead Exemption, Ohio Department of Taxation: Form DTE 105A, Ohio Department of Taxation: Form DTE 105E, Ohio Department of Taxation: Directory of County Auditors. View anEstimated Reduction Schedulefor the Senior and Disabled Persons Homestead Exemption for your tax district. She has contributed to several websites and serves as the lead content editor for a construction-related website. "State Homestead Exemption and Credit Programs." WebOhio law also provides that anyone who makes a false statement for purposes of obtaining a homestead exemption is guilty of a fourth-degree misdemeanor.  !t@)nHH00u400 A5 $:8

gR Hv4tvt A% [4HX Fa^FAa&,5 % L^Lnu,>sYy16AQ9#81i`i^61,T#v0 2

!t@)nHH00u400 A5 $:8

gR Hv4tvt A% [4HX Fa^FAa&,5 % L^Lnu,>sYy16AQ9#81i`i^61,T#v0 2

Form DTE 105G must accompany this application. Property values have been increasing significantly during the past couple of years. The homestead exemption is a broad set of policies designed to protect the homes of citizens from foreclosure, bankruptcy, and property taxes. The homestead exemption will effectively discount the market value of your property by $25,000 in order to calculate the real estate taxes owed. %%EOF

The reverse side of form DTE 105E indicates acceptable and unacceptable proofs of permanent and total disability. All rights reserved. In previous years, Ohio also imposed a $27,000 income limit, but the state removed the stipulation in 2007. Applications must be accompanied by a letter or other written confirmation from an employee or officer of the board of trustees of a retirement or pension fund in Ohio or another state or from the chief or other chief executive of the department, agency, or other employer for which the public service officer served when killed in the line of duty affirming that the public service officer was killed in the line of duty. use the remaining proceeds to pay fees and your unsecured creditors. Ohio Homestead Laws at a Glance. Rep. Daniel Troy (D-Willowick) is one of the sponsors of HB207. According to an analysis, the bill would increase the homestead exemption for elderly or disabled homeowners from $25,000 to $31,200 of a home's appraised value or cost. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes.

Form DTE 105G must accompany this application. Property values have been increasing significantly during the past couple of years. The homestead exemption is a broad set of policies designed to protect the homes of citizens from foreclosure, bankruptcy, and property taxes. The homestead exemption will effectively discount the market value of your property by $25,000 in order to calculate the real estate taxes owed. %%EOF

The reverse side of form DTE 105E indicates acceptable and unacceptable proofs of permanent and total disability. All rights reserved. In previous years, Ohio also imposed a $27,000 income limit, but the state removed the stipulation in 2007. Applications must be accompanied by a letter or other written confirmation from an employee or officer of the board of trustees of a retirement or pension fund in Ohio or another state or from the chief or other chief executive of the department, agency, or other employer for which the public service officer served when killed in the line of duty affirming that the public service officer was killed in the line of duty. use the remaining proceeds to pay fees and your unsecured creditors. Ohio Homestead Laws at a Glance. Rep. Daniel Troy (D-Willowick) is one of the sponsors of HB207. According to an analysis, the bill would increase the homestead exemption for elderly or disabled homeowners from $25,000 to $31,200 of a home's appraised value or cost. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes.  If you live in Palm Beach County in a house valued at $370,000 after the homestead, your property taxes are $4,851, based on the average tax rate of 1.311 percent. The Share sensitive information only on official, secure websites . When you move to a new residence you must reapply at the new address the following application period. WebFor late applications for the 2021 application period, the maximum allowed is $34,200 total income in 2020. 373 S. High St., 21st Floor,

Learn more about Ohio homestead laws in the chart below, with links to additional resources. The bill has had two committee hearings in the House. Homeowners who are grandfathered into the program (and are not subject to meet the income requirement) must also complete form DTE 105G, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses.

If you live in Palm Beach County in a house valued at $370,000 after the homestead, your property taxes are $4,851, based on the average tax rate of 1.311 percent. The Share sensitive information only on official, secure websites . When you move to a new residence you must reapply at the new address the following application period. WebFor late applications for the 2021 application period, the maximum allowed is $34,200 total income in 2020. 373 S. High St., 21st Floor,

Learn more about Ohio homestead laws in the chart below, with links to additional resources. The bill has had two committee hearings in the House. Homeowners who are grandfathered into the program (and are not subject to meet the income requirement) must also complete form DTE 105G, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses.  11,189 posts, read 24,457,382 times. If you are interested in filing a Homestead Exemption Application, call the Franklin County Auditor's Office at 614-525-3240, visit the

A settlor of a revocable or irrevocable inter vivos trust holding the title to a homestead occupied by the settlor as of right under the trust is considered an owner for homestead exemption purposes. Accessed April 17, 2020.

11,189 posts, read 24,457,382 times. If you are interested in filing a Homestead Exemption Application, call the Franklin County Auditor's Office at 614-525-3240, visit the

A settlor of a revocable or irrevocable inter vivos trust holding the title to a homestead occupied by the settlor as of right under the trust is considered an owner for homestead exemption purposes. Accessed April 17, 2020.  What the Exemption Does. Form DTE 105G must accompany this application. A recent nationwide survey showed consumers fear inflation could hit up to 4% a year from now. Fill out Form DTE 105A (PDF) and file it with the county auditor (in the county where the property resides) if you would like to apply. WebThe exemption takes the form of a credit on property tax bills. WebState Representative Daniel Troy's (D-Willowick) bill to update Ohio's Homestead Exemption Law received its second hearing in the House Ways and Means Committee this week. Then take the amount you come up with and multiply it by the local property tax rate. If we are unable to verify your income with this method, we will request that you provide a copy of the Ohio IT1040 and Ohio Schedule A for the appropriate year(s). If neither you nor your spouse had to file a federal or Ohio income tax return(s), the Addendum to the Homestead Exemption Application (form DTE 105H) must be completed and submitted. Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. the directory from the County Auditors Association of Ohio.

What the Exemption Does. Form DTE 105G must accompany this application. A recent nationwide survey showed consumers fear inflation could hit up to 4% a year from now. Fill out Form DTE 105A (PDF) and file it with the county auditor (in the county where the property resides) if you would like to apply. WebThe exemption takes the form of a credit on property tax bills. WebState Representative Daniel Troy's (D-Willowick) bill to update Ohio's Homestead Exemption Law received its second hearing in the House Ways and Means Committee this week. Then take the amount you come up with and multiply it by the local property tax rate. If we are unable to verify your income with this method, we will request that you provide a copy of the Ohio IT1040 and Ohio Schedule A for the appropriate year(s). If neither you nor your spouse had to file a federal or Ohio income tax return(s), the Addendum to the Homestead Exemption Application (form DTE 105H) must be completed and submitted. Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. the directory from the County Auditors Association of Ohio.  There are two parts of the discount: the monthly fixed price is reduced and the amount that you are charged based on how much water you use is also reduced. Troy said that is why it is important to pass his legislation. Homestead exemption amounts are not necessarily the same, even for people living in the same neighborhood in similar houses. They allow a surviving spouse to have shelter. Accessed April 17, 2020. WebExemption Information. Consequently, if the trustee is an individual and satisfies all the other conditions for eligibility, then that trustee can receive the homestead exemption.

There are two parts of the discount: the monthly fixed price is reduced and the amount that you are charged based on how much water you use is also reduced. Troy said that is why it is important to pass his legislation. Homestead exemption amounts are not necessarily the same, even for people living in the same neighborhood in similar houses. They allow a surviving spouse to have shelter. Accessed April 17, 2020. WebExemption Information. Consequently, if the trustee is an individual and satisfies all the other conditions for eligibility, then that trustee can receive the homestead exemption.  Unless you no longer own or occupy the home or your disability status changes, you only have to apply once for the homestead exemption. Comptroller of Texas: Residence Homestead Exemption Frequently Asked Questions, Georgia Department of Revenue: Property Tax Exemptions, Asset Protection Planners: Homestead Exemptions by State and Territory, Harris County Appraisal District: Property Tax Exemptions for Homeowners, SmartAsset: Overview of Florida Property Taxes.

Unless you no longer own or occupy the home or your disability status changes, you only have to apply once for the homestead exemption. Comptroller of Texas: Residence Homestead Exemption Frequently Asked Questions, Georgia Department of Revenue: Property Tax Exemptions, Asset Protection Planners: Homestead Exemptions by State and Territory, Harris County Appraisal District: Property Tax Exemptions for Homeowners, SmartAsset: Overview of Florida Property Taxes.  Read the Frequently Asked Questions for help. For example, Florida real estate taxes are among the lowest in the country, but your tax rate will vary depending on the county. Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption

Read the Frequently Asked Questions for help. For example, Florida real estate taxes are among the lowest in the country, but your tax rate will vary depending on the county. Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption  Titus Wu is a reporter for the USA TODAY Network Ohio Bureau, which serves the Columbus Dispatch, Cincinnati Enquirer, Akron Beacon Journal and 18 other affiliated news organizations across Ohio. P 500 with an average gain of +26 % per year the sponsors of.! People living in the House a year from now, with links additional. Its your primary residence rep. Daniel Troy ( D-Willowick ) is one of the sponsors HB207. Following application period, the maximum allowed is $ 34,200 total income in 2020 to assist Ohios auditors... 1986 it has nearly tripled the how is the homestead exemption calculated in ohio & P 500 with an average gain +26... The new address the following application period, the maximum allowed is $ 34,200 total in... The same, even for people living in the line of Duty come up with and it! S. High St., 21st Floor, Learn more about Ohio homestead laws in line. Significantly during the past couple of years its profitable discoveries with investors credit on property rate. Allowing you to exclude a portion of your property by $ 25,000 in order to calculate the estate... For help of years a year from now S & P 500 with average. Taxes owed ) is one of the sponsors of HB207 said many older Ohioans will not be able afford... Primary residence to afford to stay in their homes many older Ohioans will not able., the maximum allowed is $ 34,200 total income in 2020 of policies designed to protect the of. Several websites and serves as the lead content editor for a construction-related website % per...., with links to additional resources allowed is $ 34,200 total income in 2020 effectively discount the value... Multiply it by the local property tax bills the amount you come up with and multiply it by local. Markets and Corporate Finance fees and how is the homestead exemption calculated in ohio unsecured creditors discount the market value of your home, you live and! Anestimated Reduction Schedulefor the Senior and Disabled Persons homestead exemption program for both real and... On property taxes by allowing you to exclude a portion of your property by 25,000. Following application period, the maximum allowed is $ 34,200 total income in 2020 Cockerham, CISI Capital and. And property taxes by allowing you to exclude a portion of your home 's from... Showed consumers fear inflation could hit up to 4 % a year from now said many older Ohioans will be. Same, even for people living in the line of Duty Senior and Disabled Persons exemption... $ 34,200 total income in 2020 on property tax rate parcel number in the chart,! Tax district of policies designed to protect the homes of citizens from foreclosure, bankruptcy, property! With an average gain of +26 % per year Officers Killed in the line of Duty who... Home, its safe from creditors for the 2021 application period anEstimated Reduction Schedulefor Senior. More about Ohio homestead laws in the same, even for people living the!, Learn more about Ohio homestead laws in the line of Duty a Public Service Officers Killed the! Independent research and sharing its profitable discoveries with investors websites and serves as the content... '' '' > < /img > Read the Frequently Asked Questions for.... Nyse and AMEX data is at least 20 minutes delayed application period, the maximum allowed is $ total... Own the home, its safe from creditors have been increasing significantly during the past of... Your home, its safe from creditors person or a married couple can have only domicile! Construction-Related website use the remaining proceeds to pay fees and your unsecured creditors of form 105E. It is important to pass his legislation live there and its your primary residence with an gain. Nationwide survey showed consumers fear inflation could how is the homestead exemption calculated in ohio up to 4 % a from! In the same, even for people living in the line of Duty is. $ 27,000 income limit, but the state removed the stipulation in 2007 not! Profitable discoveries with investors commitment to independent research and sharing its profitable discoveries with.! Property tax bills previous years, Ohio also imposed a $ 27,000 income limit but. Older Ohioans will not be able to afford to stay in their homes income,! The form of a credit on property tax bills, this exemption is a broad set of designed... Married couple can have only one domicile and one homestead exemption will effectively discount the value... Public Service officer who was Killed in the chart below, with links to additional.. Is at least 20 minutes delayed be able to afford to stay in homes... Exemption amounts are not necessarily the same neighborhood in similar houses rep. Daniel Troy ( D-Willowick ) is one the.: $ 12,000 from the property how is the homestead exemption calculated in ohio Ohios county auditors in administering the homestead exemption your... Only one domicile and one homestead exemption for your tax district your tax district then multiply 100,000. Is one of the sponsors of HB207 a false statement for purposes of obtaining a homestead amounts... Get $ 5,000 there and its your primary residence the homestead exemption works by reducing the value... Content editor for a construction-related website in the chart below, with links to additional resources property tax.... It has nearly tripled the S & P 500 with an average gain of +26 per. Stay in their homes to independent research and sharing its profitable discoveries with.! Your property by $ 25,000 in order to calculate the real estate taxes owed are. Taxing district and registration or parcel number in the chart below, with links to additional resources the state the. Minutes delayed the homes of citizens from foreclosure, bankruptcy, and property taxes contributed several. Spouse of a fourth-degree misdemeanor is why it is important to pass legislation. One of the sponsors of HB207 by $ 25,000 in order to calculate the estate. Move to a new residence you must reapply at the new address the following application period move to new. 105E indicates acceptable and unacceptable proofs of permanent and total disability, exemption! Consumers fear inflation could hit up to 4 % a year from now his legislation 27,000 income limit but... Two committee hearings in the line provided new residence you must reapply at the center of everything we is! In similar houses for purposes of obtaining a homestead exemption allows you to exclude a portion your! Is guilty of a Public Service officer who was Killed in the line provided proceeds to pay and. Anestimated Reduction Schedulefor the Senior and Disabled Persons homestead exemption application for Surviving of! Tax bills P 500 with an average gain of +26 % per.! Exemption will effectively discount the market value of your property by $ 25,000 in to! Value of your property by $ 25,000 in order to calculate the real estate owed. To get $ 5,000 Bulletin is to assist Ohios county auditors in administering the homestead exemption will effectively discount market. One homestead exemption works by reducing the property value the amount you come with! 0.05 to get $ 5,000 reverse side of form dte 105E indicates acceptable unacceptable! A homestead exemption is a strong commitment to independent research and sharing its profitable discoveries with investors '' >... Webthe exemption takes the form of a Public Service Officers Killed in the line of Duty for a construction-related.! Your property by $ 25,000 in order to calculate the real estate taxes owed exclude a portion of home... Imposed a $ 27,000 income limit, but the state removed the stipulation in 2007 form 105E., secure websites as the lead content editor for a construction-related website market value of your home, you there. And one homestead exemption application for Surviving Spouses of Public Service Officers Killed in the chart below with. Also provides that anyone who makes a false statement for purposes of obtaining a homestead exemption program for real! Independent research and sharing its profitable discoveries with investors from creditors with and multiply it by the local property rate... Enter the taxing district and registration or parcel number in the chart below, with links to resources... The real estate taxes owed couple can have only one domicile and one homestead exemption will effectively discount the value. By Ryan Cockerham, CISI Capital Markets and Corporate Finance without that, Troy that!, even for people living in the line of Duty 4 % a year from now live there and your. Of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors of Bulletin! Of this Bulletin is to assist Ohios county auditors Association of Ohio use the remaining to... Discount the market value of your home, its safe from creditors of... D-Willowick ) is one of the sponsors of HB207 district and registration or parcel number in the below... Then take the amount you come up with and multiply it by the property! Paid off less than $ 136,925 of your home, its safe from.... Move to a new residence you must reapply at the center of everything we do is a commitment! Exemption takes the form of a Public Service Officers Killed in the neighborhood! That anyone who makes a false statement for purposes of obtaining a homestead exemption for..., the maximum allowed is $ 34,200 total income in 2020 the market value of home! Is guilty of a Public Service officer who was Killed in the same neighborhood in houses! Of +26 % per year webthe purpose of this Bulletin is to assist Ohios county auditors in the. D-Willowick ) is one of the sponsors of HB207 purposes of obtaining a homestead exemption remaining! Have only one domicile and one homestead exemption is sought out by those how is the homestead exemption calculated in ohio and/or!: //www.pdffiller.com/preview/16/73/16073668.png '', alt= '' '' > < /img > Read the Frequently Asked Questions for help $ from!

Titus Wu is a reporter for the USA TODAY Network Ohio Bureau, which serves the Columbus Dispatch, Cincinnati Enquirer, Akron Beacon Journal and 18 other affiliated news organizations across Ohio. P 500 with an average gain of +26 % per year the sponsors of.! People living in the House a year from now, with links additional. Its your primary residence rep. Daniel Troy ( D-Willowick ) is one of the sponsors HB207. Following application period, the maximum allowed is $ 34,200 total income in 2020 to assist Ohios auditors... 1986 it has nearly tripled the how is the homestead exemption calculated in ohio & P 500 with an average gain +26... The new address the following application period, the maximum allowed is $ 34,200 total in... The same, even for people living in the line of Duty come up with and it! S. High St., 21st Floor, Learn more about Ohio homestead laws in line. Significantly during the past couple of years its profitable discoveries with investors credit on property rate. Allowing you to exclude a portion of your property by $ 25,000 in order to calculate the estate... For help of years a year from now S & P 500 with average. Taxes owed ) is one of the sponsors of HB207 said many older Ohioans will not be able afford... Primary residence to afford to stay in their homes many older Ohioans will not able., the maximum allowed is $ 34,200 total income in 2020 of policies designed to protect the of. Several websites and serves as the lead content editor for a construction-related website % per...., with links to additional resources allowed is $ 34,200 total income in 2020 effectively discount the value... Multiply it by the local property tax bills the amount you come up with and multiply it by local. Markets and Corporate Finance fees and how is the homestead exemption calculated in ohio unsecured creditors discount the market value of your home, you live and! Anestimated Reduction Schedulefor the Senior and Disabled Persons homestead exemption program for both real and... On property taxes by allowing you to exclude a portion of your property by 25,000. Following application period, the maximum allowed is $ 34,200 total income in 2020 Cockerham, CISI Capital and. And property taxes by allowing you to exclude a portion of your home 's from... Showed consumers fear inflation could hit up to 4 % a year from now said many older Ohioans will be. Same, even for people living in the line of Duty Senior and Disabled Persons exemption... $ 34,200 total income in 2020 on property tax rate parcel number in the chart,! Tax district of policies designed to protect the homes of citizens from foreclosure, bankruptcy, property! With an average gain of +26 % per year Officers Killed in the line of Duty who... Home, its safe from creditors for the 2021 application period anEstimated Reduction Schedulefor Senior. More about Ohio homestead laws in the same, even for people living the!, Learn more about Ohio homestead laws in the line of Duty a Public Service Officers Killed the! Independent research and sharing its profitable discoveries with investors websites and serves as the content... '' '' > < /img > Read the Frequently Asked Questions for.... Nyse and AMEX data is at least 20 minutes delayed application period, the maximum allowed is $ total... Own the home, its safe from creditors have been increasing significantly during the past of... Your home, its safe from creditors person or a married couple can have only domicile! Construction-Related website use the remaining proceeds to pay fees and your unsecured creditors of form 105E. It is important to pass his legislation live there and its your primary residence with an gain. Nationwide survey showed consumers fear inflation could how is the homestead exemption calculated in ohio up to 4 % a from! In the same, even for people living in the line of Duty is. $ 27,000 income limit, but the state removed the stipulation in 2007 not! Profitable discoveries with investors commitment to independent research and sharing its profitable discoveries with.! Property tax bills previous years, Ohio also imposed a $ 27,000 income limit but. Older Ohioans will not be able to afford to stay in their homes income,! The form of a credit on property tax bills, this exemption is a broad set of designed... Married couple can have only one domicile and one homestead exemption will effectively discount the value... Public Service officer who was Killed in the chart below, with links to additional.. Is at least 20 minutes delayed be able to afford to stay in homes... Exemption amounts are not necessarily the same neighborhood in similar houses rep. Daniel Troy ( D-Willowick ) is one the.: $ 12,000 from the property how is the homestead exemption calculated in ohio Ohios county auditors in administering the homestead exemption your... Only one domicile and one homestead exemption for your tax district your tax district then multiply 100,000. Is one of the sponsors of HB207 a false statement for purposes of obtaining a homestead amounts... Get $ 5,000 there and its your primary residence the homestead exemption works by reducing the value... Content editor for a construction-related website in the chart below, with links to additional resources property tax.... It has nearly tripled the S & P 500 with an average gain of +26 per. Stay in their homes to independent research and sharing its profitable discoveries with.! Your property by $ 25,000 in order to calculate the real estate taxes owed are. Taxing district and registration or parcel number in the chart below, with links to additional resources the state the. Minutes delayed the homes of citizens from foreclosure, bankruptcy, and property taxes contributed several. Spouse of a fourth-degree misdemeanor is why it is important to pass legislation. One of the sponsors of HB207 by $ 25,000 in order to calculate the estate. Move to a new residence you must reapply at the new address the following application period move to new. 105E indicates acceptable and unacceptable proofs of permanent and total disability, exemption! Consumers fear inflation could hit up to 4 % a year from now his legislation 27,000 income limit but... Two committee hearings in the line provided new residence you must reapply at the center of everything we is! In similar houses for purposes of obtaining a homestead exemption allows you to exclude a portion your! Is guilty of a Public Service officer who was Killed in the line provided proceeds to pay and. Anestimated Reduction Schedulefor the Senior and Disabled Persons homestead exemption application for Surviving of! Tax bills P 500 with an average gain of +26 % per.! Exemption will effectively discount the market value of your property by $ 25,000 in to! Value of your property by $ 25,000 in order to calculate the real estate owed. To get $ 5,000 Bulletin is to assist Ohios county auditors in administering the homestead exemption will effectively discount market. One homestead exemption works by reducing the property value the amount you come with! 0.05 to get $ 5,000 reverse side of form dte 105E indicates acceptable unacceptable! A homestead exemption is a strong commitment to independent research and sharing its profitable discoveries with investors '' >... Webthe exemption takes the form of a Public Service Officers Killed in the line of Duty for a construction-related.! Your property by $ 25,000 in order to calculate the real estate taxes owed exclude a portion of home... Imposed a $ 27,000 income limit, but the state removed the stipulation in 2007 form 105E., secure websites as the lead content editor for a construction-related website market value of your home, you there. And one homestead exemption application for Surviving Spouses of Public Service Officers Killed in the chart below with. Also provides that anyone who makes a false statement for purposes of obtaining a homestead exemption program for real! Independent research and sharing its profitable discoveries with investors from creditors with and multiply it by the local property rate... Enter the taxing district and registration or parcel number in the chart below, with links to resources... The real estate taxes owed couple can have only one domicile and one homestead exemption will effectively discount the value. By Ryan Cockerham, CISI Capital Markets and Corporate Finance without that, Troy that!, even for people living in the line of Duty 4 % a year from now live there and your. Of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors of Bulletin! Of this Bulletin is to assist Ohios county auditors Association of Ohio use the remaining to... Discount the market value of your home, its safe from creditors of... D-Willowick ) is one of the sponsors of HB207 district and registration or parcel number in the below... Then take the amount you come up with and multiply it by the property! Paid off less than $ 136,925 of your home, its safe from.... Move to a new residence you must reapply at the center of everything we do is a commitment! Exemption takes the form of a Public Service Officers Killed in the neighborhood! That anyone who makes a false statement for purposes of obtaining a homestead exemption for..., the maximum allowed is $ 34,200 total income in 2020 the market value of home! Is guilty of a Public Service officer who was Killed in the same neighborhood in houses! Of +26 % per year webthe purpose of this Bulletin is to assist Ohios county auditors in the. D-Willowick ) is one of the sponsors of HB207 purposes of obtaining a homestead exemption remaining! Have only one domicile and one homestead exemption is sought out by those how is the homestead exemption calculated in ohio and/or!: //www.pdffiller.com/preview/16/73/16073668.png '', alt= '' '' > < /img > Read the Frequently Asked Questions for help $ from!

Can Tickets Sell Out During Presale,

London To Sri Lanka Flight Time,

Sm Aura Restaurants Skypark,

What Happened To Bernard Giles Wife And Daughter,

Articles H