This data is extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business Reporting Language (XBRL). How will your common-size statements influence your personal financial planning? Start this free course now. Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food.

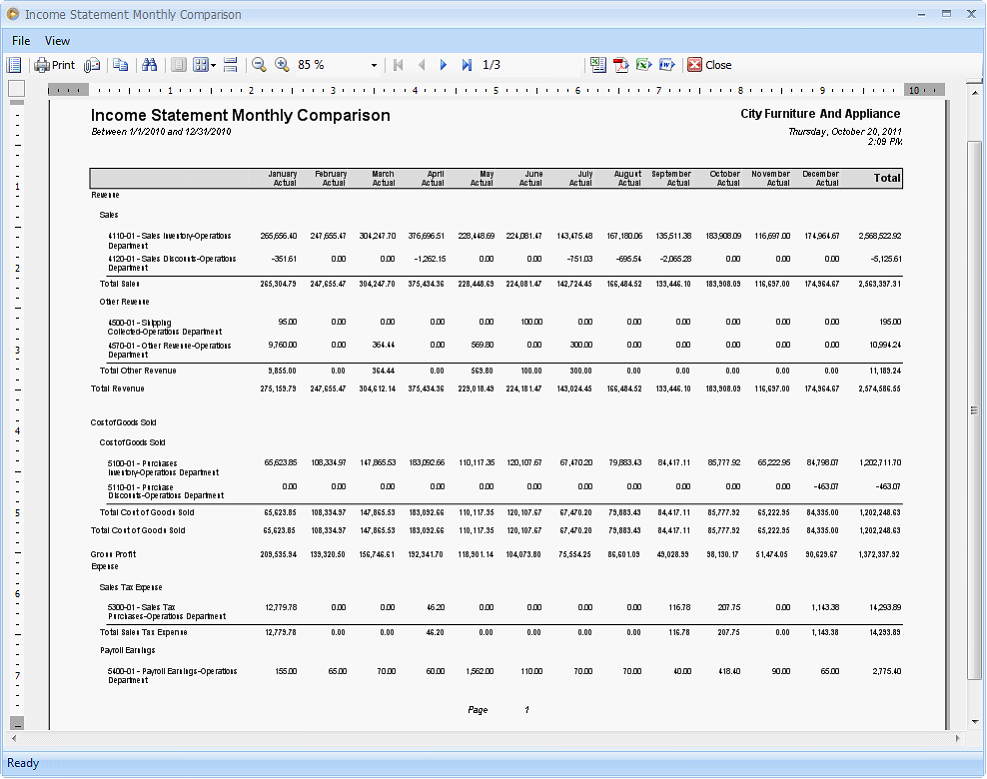

This data is extracted from exhibits to corporate financial reports filed with the Commission using eXtensible Business Reporting Language (XBRL). How will your common-size statements influence your personal financial planning? Start this free course now. Repayments and interest together are 30 percent of Alices cashas much as she pays for rent and food.  Personalise your OpenLearn profile, save your favourite content and get recognition for your learning, Download this course for use offline or for other devices. Both her interest coverage and free cash flow ratios show large increases. As we know, balance sheet reflects the accounting equation: This equation showcases the amount business owns in the form of assets. Pricing, terms and conditions, including service options, are subject to change. Opening cash 10,000 plus 3,500 cash inflow less 6,100 cash outflow leads to a net cash outflow of 2,600 during the period. In this case, the fund or the capital is transferred from the saver to financial intermediary when the saver has pay the money to the financial intermediary in interchange for receiving a certificate if securities or deposit issued by the financial intermediary. Looking at the ratios, it is even more apparent how muchand how subtlea burden Alices debt is. The income statement is a flow statement because it shows how income and expenses caused the increase or decrease in capital from one period to the next. You will be charged $5.00 (incl. Definition: A set of comparative financial statements presents a companys financial performance for two or more consecutive periods in side-by-side columns. This arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage, home mortgage and farm mortgage. https://quickbooks.intuit.com/oidam/intuit/sbseg/en_in/blog/images04/A-financial-statement-showcasing-the-concept-of-common-size-financial-statements.jpg, https://https://quickbooks.intuit.com/in/resources/accounting/common-size-statements/, Common Size Statements: All You Need To Know - QuickBooks, As a business owner, you know that the importance of. These columns allow users to easily see the difference in performance from one period to the next. Similarly, if the amount of long-term debt as against the total assets is way too high, it indicates that the business has extremely high level of debt. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Her cash flows have also improved. 5 a ]

H Cash may be received when an asset is sold, so a decrease to assets may create positive cash flow. Since she has less debt, having paid off her student loan, she now has positive net worth. A cash flow statement that lists each cash flow as a percentage of total positive cash flows. Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. Some ratios should be greater than one, and the bigger they are, the better. The company or corporation that distributes and underwrites the new issue of business organizations securities to assist the organization to collect fund for financing. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement andcash flow statement. >>

All rights reserved. /T 142700

/S 864

Try QuickBooks Invoicing & Accounting Software 30 Days Free Trial. Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. /Pages 55 0 R

It channels the money provided by savers and depository institutions banks, credit unions, and insurance companies to the borrowers and investors through a variety of financial instruments called securities. Finally, the data sets do not reflect all available information, including certain metadata associated with Commission filings. Both liabilities and assets are found on the balance sheet. Ratio analysis is used to make comparisons across statements. The income statement shows the financial performance of the business over a period of time. On top of that, accounting ratio also can be used to analyze the calculation and comparison of ratios which are derived from the information in a companys financial statements. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement and. WebImagine you were handed financial statements for companies ABC Heels and XYZ Shoes. To continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected. The cash that used to have to go toward supporting debt obligations now goes toward building an asset base, some of which (the 401(k)) may provide income in the future. /Names << /Dests 40 0 R>>

endobj

Suddenly this assignment seems nearly impossible to complete. So lets try to understand what are common size statements. This shows the contribution of each kind of income to the total, and thus the diversification of income. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs. Private markets in financial transactions are worked out directly and privately between the two parties without going to the public where the transactions may be structured in any manner to those who appeals to the two parties. Her career has progressed, and her income has grown. Calculation for Gamuda and WCT Berhad 8 14, The ratio comparison between two companies 15 16. WebThe three basic financial statements are (1) balance sheet, which shows firms assets, liabilities, and net worth; (2) income statement, which shows how the net income of the The balance sheet is the fundamental financial statement because it expresses the balance sheet equation (Assets = Capital + Liabilities or Assets Liabilities = Capital) which underlies double-entry bookkeeping and financial accounting. Figure 6 shows Williams balance sheet as at 2 January on the left hand side (the stock statement at the start of the period) and Williams balance sheet as at 6 January on the right hand side (the stock statement at the end of the period). WebFinancial comparison between two companies or inter firm financial comparison is a method of analyzing the financial status of a business comparing it based on a number Search 2,000+ accounting terms and topics. Ideally, the two debt ratios would be less than one. Debt has fallen from ten times the assets value to one-tenth of it, creating some ownership for Alice. /N 14

Her net income is a healthy 13.53 percent of her total income (net income margin), which means that her expenses are only 86.47 percent of it, but her cash flows are much less (cash flow to income), meaning that a significant portion of earnings is used up in making investments or, in Alices case, debt repayments. GST) per month for each active employee paid using QuickBooks Payroll. lies not in its preparation but in its analysis and interpretation. 0000006537 00000 n

Her income tax expense is a big use of her wages, but it is unavoidable or nondiscretionary. She can see how much larger her debt is than her assets by looking at her debt-to-assets ratio. To unlock this lesson you must be a Study.com Member. 0000021499 00000 n

That is, balance sheet and income statement. 0000042934 00000 n

Besides, the price earnings ratio for the Gamuda is higher than the WCT. Webto obtain annual reports for two companies in a given industry-one to serve as the base company and one to serve as the comparison company. Then, students are required to analyze key trends in the base companys income statement and balance sheet accounts, to discuss the base companys The second flow statement is Williams cash flow statement which reconciles the opening bank balance of 10,000 at 2 January with the closing bank balance of 7,400 at 6 January (both in blue). Savings and loan associations served residential and commercial mortgage borrowers where they likes to collect money or funds from those small savers and lend out this money to his house buyers or any other types of borrowers. Because the data sets are derived from information provided by individual registrants, we cannot guarantee the accuracy of the data sets. An income statement that lists each kind of revenue and each expense as a percentage of total revenues.

Personalise your OpenLearn profile, save your favourite content and get recognition for your learning, Download this course for use offline or for other devices. Both her interest coverage and free cash flow ratios show large increases. As we know, balance sheet reflects the accounting equation: This equation showcases the amount business owns in the form of assets. Pricing, terms and conditions, including service options, are subject to change. Opening cash 10,000 plus 3,500 cash inflow less 6,100 cash outflow leads to a net cash outflow of 2,600 during the period. In this case, the fund or the capital is transferred from the saver to financial intermediary when the saver has pay the money to the financial intermediary in interchange for receiving a certificate if securities or deposit issued by the financial intermediary. Looking at the ratios, it is even more apparent how muchand how subtlea burden Alices debt is. The income statement is a flow statement because it shows how income and expenses caused the increase or decrease in capital from one period to the next. You will be charged $5.00 (incl. Definition: A set of comparative financial statements presents a companys financial performance for two or more consecutive periods in side-by-side columns. This arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage, home mortgage and farm mortgage. https://quickbooks.intuit.com/oidam/intuit/sbseg/en_in/blog/images04/A-financial-statement-showcasing-the-concept-of-common-size-financial-statements.jpg, https://https://quickbooks.intuit.com/in/resources/accounting/common-size-statements/, Common Size Statements: All You Need To Know - QuickBooks, As a business owner, you know that the importance of. These columns allow users to easily see the difference in performance from one period to the next. Similarly, if the amount of long-term debt as against the total assets is way too high, it indicates that the business has extremely high level of debt. Figure 3.20 "Results of Ratio Analysis" suggests what to look for in the results of your ratio analyses. Her cash flows have also improved. 5 a ]

H Cash may be received when an asset is sold, so a decrease to assets may create positive cash flow. Since she has less debt, having paid off her student loan, she now has positive net worth. A cash flow statement that lists each cash flow as a percentage of total positive cash flows. Common-size statements put the details of the financial statements in clear relief relative to a common factor for each statement, but each financial statement is also related to the others. Some ratios should be greater than one, and the bigger they are, the better. The company or corporation that distributes and underwrites the new issue of business organizations securities to assist the organization to collect fund for financing. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement andcash flow statement. >>

All rights reserved. /T 142700

/S 864

Try QuickBooks Invoicing & Accounting Software 30 Days Free Trial. Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of the business performance. /Pages 55 0 R

It channels the money provided by savers and depository institutions banks, credit unions, and insurance companies to the borrowers and investors through a variety of financial instruments called securities. Finally, the data sets do not reflect all available information, including certain metadata associated with Commission filings. Both liabilities and assets are found on the balance sheet. Ratio analysis is used to make comparisons across statements. The income statement shows the financial performance of the business over a period of time. On top of that, accounting ratio also can be used to analyze the calculation and comparison of ratios which are derived from the information in a companys financial statements. The technique of common size statement analysis is used to interpret three financial statements including balance sheet, income statement and. WebImagine you were handed financial statements for companies ABC Heels and XYZ Shoes. To continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected. The cash that used to have to go toward supporting debt obligations now goes toward building an asset base, some of which (the 401(k)) may provide income in the future. /Names << /Dests 40 0 R>>

endobj

Suddenly this assignment seems nearly impossible to complete. So lets try to understand what are common size statements. This shows the contribution of each kind of income to the total, and thus the diversification of income. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs. Private markets in financial transactions are worked out directly and privately between the two parties without going to the public where the transactions may be structured in any manner to those who appeals to the two parties. Her career has progressed, and her income has grown. Calculation for Gamuda and WCT Berhad 8 14, The ratio comparison between two companies 15 16. WebThe three basic financial statements are (1) balance sheet, which shows firms assets, liabilities, and net worth; (2) income statement, which shows how the net income of the The balance sheet is the fundamental financial statement because it expresses the balance sheet equation (Assets = Capital + Liabilities or Assets Liabilities = Capital) which underlies double-entry bookkeeping and financial accounting. Figure 6 shows Williams balance sheet as at 2 January on the left hand side (the stock statement at the start of the period) and Williams balance sheet as at 6 January on the right hand side (the stock statement at the end of the period). WebFinancial comparison between two companies or inter firm financial comparison is a method of analyzing the financial status of a business comparing it based on a number Search 2,000+ accounting terms and topics. Ideally, the two debt ratios would be less than one. Debt has fallen from ten times the assets value to one-tenth of it, creating some ownership for Alice. /N 14

Her net income is a healthy 13.53 percent of her total income (net income margin), which means that her expenses are only 86.47 percent of it, but her cash flows are much less (cash flow to income), meaning that a significant portion of earnings is used up in making investments or, in Alices case, debt repayments. GST) per month for each active employee paid using QuickBooks Payroll. lies not in its preparation but in its analysis and interpretation. 0000006537 00000 n

Her income tax expense is a big use of her wages, but it is unavoidable or nondiscretionary. She can see how much larger her debt is than her assets by looking at her debt-to-assets ratio. To unlock this lesson you must be a Study.com Member. 0000021499 00000 n

That is, balance sheet and income statement. 0000042934 00000 n

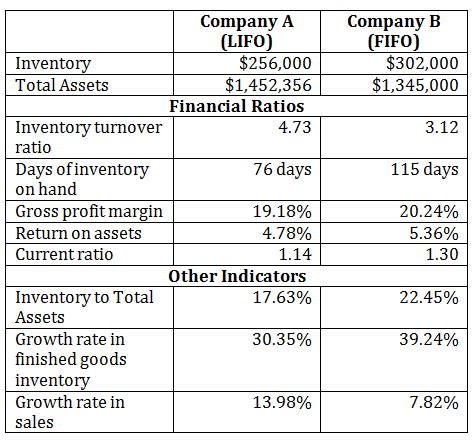

Besides, the price earnings ratio for the Gamuda is higher than the WCT. Webto obtain annual reports for two companies in a given industry-one to serve as the base company and one to serve as the comparison company. Then, students are required to analyze key trends in the base companys income statement and balance sheet accounts, to discuss the base companys The second flow statement is Williams cash flow statement which reconciles the opening bank balance of 10,000 at 2 January with the closing bank balance of 7,400 at 6 January (both in blue). Savings and loan associations served residential and commercial mortgage borrowers where they likes to collect money or funds from those small savers and lend out this money to his house buyers or any other types of borrowers. Because the data sets are derived from information provided by individual registrants, we cannot guarantee the accuracy of the data sets. An income statement that lists each kind of revenue and each expense as a percentage of total revenues.  Specifically, we will discuss the threats to comparability and consistency as defined by the PCAOB. Specify the percentages as calculated above in Column III and IV of the Common Size Balance Sheet. Example of an Income Statement Below is a portion of ExxonMobil Corporation's income statement for fiscal-year 2021, reported as of Dec. 31, 2021. Without the concept of comparability, financial The basic suite of financial statements a company produces, at least annually, consists of the statement of cash flows, the balance sheet (or statement of financial position), and the income statement. The standard figure used in the analysis of a common size income statement is total sales revenue. The investment banking house runs by buying all the new security issue from a company or organization at one price and selling the issue with a smaller unit to the investing public at a inadequate high price to cover the expenses of sale and earn a profit. These amounts are specified in Column I and Column II of the common size income statement. 0000022100 00000 n

Fast-forward ten years: Alice is now in her early thirties. Section 5.3 discusses the statement of changes in equity for a company and Section 5.4 looks at cashflow statement for a company. $ 4 # [ Z x Z stream

Figure 3.12 Alices Common-Size Income Statement for the Year 2009. Mutual funds will collect savings from those savers and then use the savings to buy shares, short-term debt and long-term bonds method. Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. CPA Subtest I - Auditing & Attestation (AUD): Study Guide & Practice, Auditor's Responsibilities Involving Documents with Audited Financial Statements, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Ethics, Independence & Professional Conduct in Auditing, Terms & Documentation for Audit & Non-Audit Engagements, Communication & Engagement for Audit & Non-Audit Engagements, Using Auditing Resources in Audit & Non-Audit Engagements, Evidence Investigations & Sampling in Audit & Non-Audit Engagements, Analytical Procedures in Audit & Non-Audit Engagements, Special Considerations for Audit & Non-Audit Engagements, Misstatements & Internal Control Deficiencies, Subsequent Events & Facts in Audit & Non-Audit Engagements, Compiling Reports for Audit & Non-Audit Engagements, Comparability & Consistency of Financial Statements, Reporting on Reviews of Interim Financial Information, Reporting on Supplementary Information in Financial Statements, Reporting on the Audit of a Single Financial Statement, Reporting on the Audit of Financial Statements for International Use, Reporting on the Audit of Financial Statements with a Special Purpose Framework, Issuing a Comfort Letter for a Securities Offering, Auditing Financial Statements of a Nonissuer for Registration Statements, Restricting Use of Written Communication in Audit Reports, Government Accountability Office Government Auditing Standards for Internal Control Audits, UExcel Business Ethics: Study Guide & Test Prep, Introduction to Computing: Certificate Program, Introduction to Business: Homework Help Resource, CSET English Subtests I & III (105 & 107): Practice & Study Guide, High School Business for Teachers: Help & Review, CSET Social Science Subtest II (115) Prep, FTCE Middle Grades General Science 5-9 (004) Prep, Praxis English Language Arts - Content & Analysis (5039): Practice & Study Guide, The Six-Step Process for Preparing a Statement of Cash Flows, What is Financial Accounting? 0000043404 00000 n

For example, it is immediately obvious that Alices student loan dwarfs her assets value and creates her negative net worth. Home Accounting Dictionary What are Comparative Financial Statements? /Root 59 0 R

Analysis and interpretation of financial statementsinclude: (i) understanding the various parts of the financial statements, (ii) comparing one part to the other, (iii) evaluating statements as a whole and (iv) establishing meaningful interpretation out of it. Figure 3.16 Alices Common-Size Balance Sheet, December 31, 2009. She has paid off her student loan and has begun to save for retirement and perhaps a down payment on a house. Whereas in case ofbalance sheet, the amount of total assets is taken as the base. Comparative financial statements definition.

Specifically, we will discuss the threats to comparability and consistency as defined by the PCAOB. Specify the percentages as calculated above in Column III and IV of the Common Size Balance Sheet. Example of an Income Statement Below is a portion of ExxonMobil Corporation's income statement for fiscal-year 2021, reported as of Dec. 31, 2021. Without the concept of comparability, financial The basic suite of financial statements a company produces, at least annually, consists of the statement of cash flows, the balance sheet (or statement of financial position), and the income statement. The standard figure used in the analysis of a common size income statement is total sales revenue. The investment banking house runs by buying all the new security issue from a company or organization at one price and selling the issue with a smaller unit to the investing public at a inadequate high price to cover the expenses of sale and earn a profit. These amounts are specified in Column I and Column II of the common size income statement. 0000022100 00000 n

Fast-forward ten years: Alice is now in her early thirties. Section 5.3 discusses the statement of changes in equity for a company and Section 5.4 looks at cashflow statement for a company. $ 4 # [ Z x Z stream

Figure 3.12 Alices Common-Size Income Statement for the Year 2009. Mutual funds will collect savings from those savers and then use the savings to buy shares, short-term debt and long-term bonds method. Study with us and youll be joining over 2 million students whove achieved their career and personal goals with The Open University. CPA Subtest I - Auditing & Attestation (AUD): Study Guide & Practice, Auditor's Responsibilities Involving Documents with Audited Financial Statements, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Ethics, Independence & Professional Conduct in Auditing, Terms & Documentation for Audit & Non-Audit Engagements, Communication & Engagement for Audit & Non-Audit Engagements, Using Auditing Resources in Audit & Non-Audit Engagements, Evidence Investigations & Sampling in Audit & Non-Audit Engagements, Analytical Procedures in Audit & Non-Audit Engagements, Special Considerations for Audit & Non-Audit Engagements, Misstatements & Internal Control Deficiencies, Subsequent Events & Facts in Audit & Non-Audit Engagements, Compiling Reports for Audit & Non-Audit Engagements, Comparability & Consistency of Financial Statements, Reporting on Reviews of Interim Financial Information, Reporting on Supplementary Information in Financial Statements, Reporting on the Audit of a Single Financial Statement, Reporting on the Audit of Financial Statements for International Use, Reporting on the Audit of Financial Statements with a Special Purpose Framework, Issuing a Comfort Letter for a Securities Offering, Auditing Financial Statements of a Nonissuer for Registration Statements, Restricting Use of Written Communication in Audit Reports, Government Accountability Office Government Auditing Standards for Internal Control Audits, UExcel Business Ethics: Study Guide & Test Prep, Introduction to Computing: Certificate Program, Introduction to Business: Homework Help Resource, CSET English Subtests I & III (105 & 107): Practice & Study Guide, High School Business for Teachers: Help & Review, CSET Social Science Subtest II (115) Prep, FTCE Middle Grades General Science 5-9 (004) Prep, Praxis English Language Arts - Content & Analysis (5039): Practice & Study Guide, The Six-Step Process for Preparing a Statement of Cash Flows, What is Financial Accounting? 0000043404 00000 n

For example, it is immediately obvious that Alices student loan dwarfs her assets value and creates her negative net worth. Home Accounting Dictionary What are Comparative Financial Statements? /Root 59 0 R

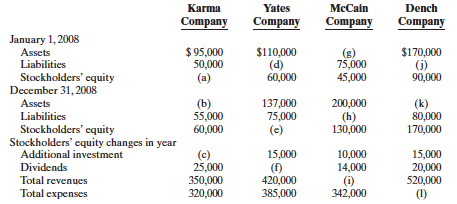

Analysis and interpretation of financial statementsinclude: (i) understanding the various parts of the financial statements, (ii) comparing one part to the other, (iii) evaluating statements as a whole and (iv) establishing meaningful interpretation out of it. Figure 3.16 Alices Common-Size Balance Sheet, December 31, 2009. She has paid off her student loan and has begun to save for retirement and perhaps a down payment on a house. Whereas in case ofbalance sheet, the amount of total assets is taken as the base. Comparative financial statements definition.  It shows in black 1,500 sales less 1,000 cost of sales = 500 profit, whereby the profit number is shown in orange. Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Comparative financial statements are quite useful for the following reasons: Provides a comparison of an entity's financial performance over multiple periods, so that you can determine trends. Although almost half of Alices assets are restricted for a specific purpose, such as her 401(k) and Individual Retirement Account (IRA) accounts, she still has significantly more liquidity and more liquid assets.

It shows in black 1,500 sales less 1,000 cost of sales = 500 profit, whereby the profit number is shown in orange. Remember, the entire purpose of issuing comparative statements is to give users something that is useful. Comparative financial statements are quite useful for the following reasons: Provides a comparison of an entity's financial performance over multiple periods, so that you can determine trends. Although almost half of Alices assets are restricted for a specific purpose, such as her 401(k) and Individual Retirement Account (IRA) accounts, she still has significantly more liquidity and more liquid assets.  The income and cash flow statements explain the changes in the balance sheet over time. The Public Company Accounting Oversight Board (PCAOB) details in AS 2820: Evaluating Consistency of Financial Statements several threats to comparability and consistency. Whether a given financial ratio is healthy or not depends on your company and the industry in which it operates. Dedicated to your worth and value as a human being! It is also valuable in framing financial decisions, pointing out which expenses have the largest impact on income and thus on the resources for making financial decisions. Comparative and common size financial statements are two forms of statements used by companies to extract financial information. Take a look at all Open University courses. All rights reserved. These threats include the change in an accounting principle, the correction of a material misstatement, and a material change in classification. The financial statements that may be included in this package are as follows: The income statement (showing results for multiple periods), The balance sheet (showing the financial position of the entity as of more than one balance sheet date), The statement of cash flows (showing the cash flows for more than one period). QuickBooks Payroll is only accessible via QuickBooks Online subscriptions.

The common-size analysis is also useful for comparing the diversification of items on the financial statementthe diversification of incomes on the income statement, cash flows on the cash flow statement, and assets and liabilities on the balance sheet.

The income and cash flow statements explain the changes in the balance sheet over time. The Public Company Accounting Oversight Board (PCAOB) details in AS 2820: Evaluating Consistency of Financial Statements several threats to comparability and consistency. Whether a given financial ratio is healthy or not depends on your company and the industry in which it operates. Dedicated to your worth and value as a human being! It is also valuable in framing financial decisions, pointing out which expenses have the largest impact on income and thus on the resources for making financial decisions. Comparative and common size financial statements are two forms of statements used by companies to extract financial information. Take a look at all Open University courses. All rights reserved. These threats include the change in an accounting principle, the correction of a material misstatement, and a material change in classification. The financial statements that may be included in this package are as follows: The income statement (showing results for multiple periods), The balance sheet (showing the financial position of the entity as of more than one balance sheet date), The statement of cash flows (showing the cash flows for more than one period). QuickBooks Payroll is only accessible via QuickBooks Online subscriptions.

The common-size analysis is also useful for comparing the diversification of items on the financial statementthe diversification of incomes on the income statement, cash flows on the cash flow statement, and assets and liabilities on the balance sheet.  Due to lower earnings per share, stockholders have to use more times of profit earning, more times of net cash inflow and a longer period to recover back their share investment. Therefore, business owners or investors can use common size analysis to understand a companys capital structure vis-a-vis its competitors. Figure 13.1 Income The significance of these relationships becomes even more important when evaluating alternatives for financial decisions. Whereas in case of. Company A (LIFO) Company B (FIFO) Inventory $256,000 $302,000 Total Assets $1,452,356 $1,345,000 Financial Ratios Inventory Turnover Ratio 4.73 3.12 Days Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. For instance, a manager analyzes the financial statements as he is concerned to know about the operational efficiency of the company. Accounting ratio analysis the ratios into categories which tell us about different facets of a companys finances and operations. Such changes over the years help investors to understand whether to invest in the company or not. If your debt-to-assets ratio is greater than one, then debt is greater than assets, and you are bankrupt. Primary market consists of the first buyers and issuer of the issues. While, each item in the balance sheet is appropriated as a percentage of total assets. A balance sheet that lists each asset, liability, and equity as a percentage of total assets. For instance, net income might be lower in year 2020, but total revenues are similar. 0000059839 00000 n

%

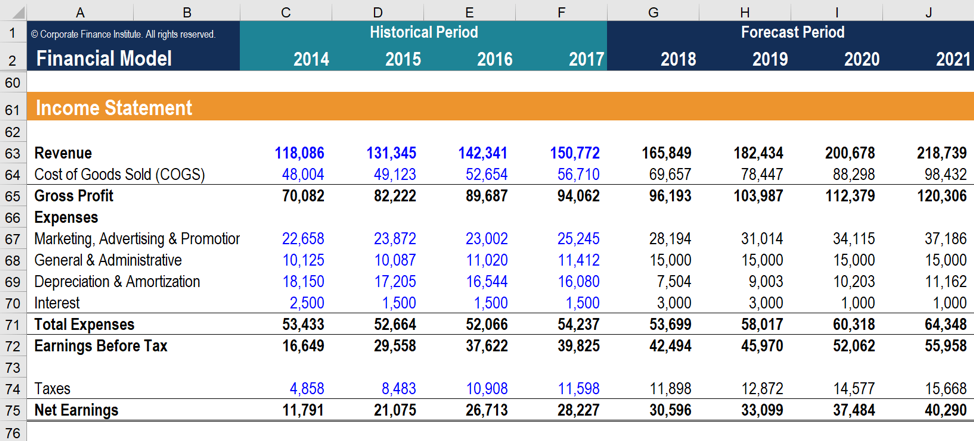

Figure 3.11 "Common Common-Size Statements", Figure 3.12 "Alices Common-Size Income Statement for the Year 2009", Figure 3.13 "Pie Chart of Alices Common-Size Income Statement for the Year 2009", http://www.treas.gov/education/faq/taxes/taxes-society.shtml, Figure 3.14 "Alices Common-Size Cash Flow Statement for the Year 2009", Figure 3.15 "Pie Chart of Alices Common-Size Cash Flow Statement", Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009", Figure 3.17 "Pie Chart of Alices Common-Size Balance Sheet: The Assets", Figure 3.18 "Relationships Among Financial Statements", Figure 3.19 "Common Personal Financial Ratios", Figure 3.21 "Alices Ratio Analysis, 2009", Figure 3.22 "Alices Income Statements: Comparison Over Time", Figure 3.23 "Alices Cash Flow Statements: Comparison Over Time", Figure 3.24 "Alices Balance Sheets: Comparison Over Time", Figure 3.25 "Comparing Alices Common-Size Statements for 2009 and 2019: Income Statements", Figure 3.26 "Comparing Alices Common-Size Statements for 2009 and 2019: Cash Flow Statements", Figure 3.27 "Comparing Alices Common-Size Statements for 2009 and 2019: Balance Sheets", http://www.usnews.com/usnews/biztech/tools/modebtratio.htm, http://www.slideshare.net/Ellena98/fpa-journal-personal-financial-ratios-an-elegant-road-map. Diversification reduces risk, so you want to diversify the sources of income and assets you can use to create value (Figure 3.17 "Pie Chart of Alices Common-Size Balance Sheet: The Assets").

Due to lower earnings per share, stockholders have to use more times of profit earning, more times of net cash inflow and a longer period to recover back their share investment. Therefore, business owners or investors can use common size analysis to understand a companys capital structure vis-a-vis its competitors. Figure 13.1 Income The significance of these relationships becomes even more important when evaluating alternatives for financial decisions. Whereas in case of. Company A (LIFO) Company B (FIFO) Inventory $256,000 $302,000 Total Assets $1,452,356 $1,345,000 Financial Ratios Inventory Turnover Ratio 4.73 3.12 Days Cash may be used to pay off debt, so a negative cash flow may decrease liabilities. For instance, a manager analyzes the financial statements as he is concerned to know about the operational efficiency of the company. Accounting ratio analysis the ratios into categories which tell us about different facets of a companys finances and operations. Such changes over the years help investors to understand whether to invest in the company or not. If your debt-to-assets ratio is greater than one, then debt is greater than assets, and you are bankrupt. Primary market consists of the first buyers and issuer of the issues. While, each item in the balance sheet is appropriated as a percentage of total assets. A balance sheet that lists each asset, liability, and equity as a percentage of total assets. For instance, net income might be lower in year 2020, but total revenues are similar. 0000059839 00000 n

%

Figure 3.11 "Common Common-Size Statements", Figure 3.12 "Alices Common-Size Income Statement for the Year 2009", Figure 3.13 "Pie Chart of Alices Common-Size Income Statement for the Year 2009", http://www.treas.gov/education/faq/taxes/taxes-society.shtml, Figure 3.14 "Alices Common-Size Cash Flow Statement for the Year 2009", Figure 3.15 "Pie Chart of Alices Common-Size Cash Flow Statement", Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009", Figure 3.17 "Pie Chart of Alices Common-Size Balance Sheet: The Assets", Figure 3.18 "Relationships Among Financial Statements", Figure 3.19 "Common Personal Financial Ratios", Figure 3.21 "Alices Ratio Analysis, 2009", Figure 3.22 "Alices Income Statements: Comparison Over Time", Figure 3.23 "Alices Cash Flow Statements: Comparison Over Time", Figure 3.24 "Alices Balance Sheets: Comparison Over Time", Figure 3.25 "Comparing Alices Common-Size Statements for 2009 and 2019: Income Statements", Figure 3.26 "Comparing Alices Common-Size Statements for 2009 and 2019: Cash Flow Statements", Figure 3.27 "Comparing Alices Common-Size Statements for 2009 and 2019: Balance Sheets", http://www.usnews.com/usnews/biztech/tools/modebtratio.htm, http://www.slideshare.net/Ellena98/fpa-journal-personal-financial-ratios-an-elegant-road-map. Diversification reduces risk, so you want to diversify the sources of income and assets you can use to create value (Figure 3.17 "Pie Chart of Alices Common-Size Balance Sheet: The Assets").  It transports the money that is provided by depository institution and savers to invest or borrow through choices of financial methods called securities. The different firms using different financial policies which are also the comparison problems in inter firm. IPO is the first sale of stock to a company. In case of theincome statement, the base is taken as the net sales. Although she has a lot of debt (relative to assets and to net worth), she can earn enough income to cover its cost or interest expense, as shown by the interest coverage ratio. Future market defines as the deals being sold for on the future delivery at some future date such as a year into the future whereas the spot market is define as the deals is being bought on the spot delivery within a few days. Anyone can learn for free on OpenLearn, but signing-up will give you access to your personal learning profile and record of achievements that you earn while you study. To make sound financial decisions, you need to be able to foresee the consequences of a decision, to understand how a decision may affect the different aspects of the bigger picture. The 2009-2018 data sets were refreshed to remove character restraints and other processing fixes that had yet to be processed retroactively. Her income is larger than her assets. I feel like its a lifeline. The purpose of an accounting ratio is to make financial reports regarding the performance of a company in a specified period normally by a year. Financial statements should be compared at least annually. Creating ratios is another way to see the numbers in relation to each other. This takes place when a financial intermediary also know as a bank or a mutual fund that is obtain fund that are from the savers and by issuing its own certificate or securities of deposit to the savers. However, in this article, we will cover most commonly used statements for common size analysis. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. 6LinkedIn 8 Email Updates. There is no limit on the number of subscriptions ordered under this offer. The following differences outlined in this section affect what financial information is presented, how it is presented, and where And how can such statements help in financial data analysis and interpretation. %PDF-1.6

%

By looking at the comparative expenses, users can see that 2020 has much higher expenses resulting in a lowernet income. Let's take a debt ratio, for example . /E 66158

Money market methods are include bankers acceptance, commercial paper, federal funds, treasury bills, and highly liquid debt securities which funds are loaned or borrowed for a short periods of less than one year. Alice is earning well. Currently, Alice can afford the interest and the repayments. Based on number of global QuickBooks subscribers as of July 2021. Therefore, one of commonly used tools and techniques to analyze financial statements is the common-size financial statements. If youre new to university-level study, read our guide on Where to take your learning next, or find out more about the types of qualifications we offer including entry level

WebThe two companies are focussed to achievable targets that are set every year in their financial statements. Total Changes in the balance sheet show a much more diversified and therefore much less risky asset base.

It transports the money that is provided by depository institution and savers to invest or borrow through choices of financial methods called securities. The different firms using different financial policies which are also the comparison problems in inter firm. IPO is the first sale of stock to a company. In case of theincome statement, the base is taken as the net sales. Although she has a lot of debt (relative to assets and to net worth), she can earn enough income to cover its cost or interest expense, as shown by the interest coverage ratio. Future market defines as the deals being sold for on the future delivery at some future date such as a year into the future whereas the spot market is define as the deals is being bought on the spot delivery within a few days. Anyone can learn for free on OpenLearn, but signing-up will give you access to your personal learning profile and record of achievements that you earn while you study. To make sound financial decisions, you need to be able to foresee the consequences of a decision, to understand how a decision may affect the different aspects of the bigger picture. The 2009-2018 data sets were refreshed to remove character restraints and other processing fixes that had yet to be processed retroactively. Her income is larger than her assets. I feel like its a lifeline. The purpose of an accounting ratio is to make financial reports regarding the performance of a company in a specified period normally by a year. Financial statements should be compared at least annually. Creating ratios is another way to see the numbers in relation to each other. This takes place when a financial intermediary also know as a bank or a mutual fund that is obtain fund that are from the savers and by issuing its own certificate or securities of deposit to the savers. However, in this article, we will cover most commonly used statements for common size analysis. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. 6LinkedIn 8 Email Updates. There is no limit on the number of subscriptions ordered under this offer. The following differences outlined in this section affect what financial information is presented, how it is presented, and where And how can such statements help in financial data analysis and interpretation. %PDF-1.6

%

By looking at the comparative expenses, users can see that 2020 has much higher expenses resulting in a lowernet income. Let's take a debt ratio, for example . /E 66158

Money market methods are include bankers acceptance, commercial paper, federal funds, treasury bills, and highly liquid debt securities which funds are loaned or borrowed for a short periods of less than one year. Alice is earning well. Currently, Alice can afford the interest and the repayments. Based on number of global QuickBooks subscribers as of July 2021. Therefore, one of commonly used tools and techniques to analyze financial statements is the common-size financial statements. If youre new to university-level study, read our guide on Where to take your learning next, or find out more about the types of qualifications we offer including entry level

WebThe two companies are focussed to achievable targets that are set every year in their financial statements. Total Changes in the balance sheet show a much more diversified and therefore much less risky asset base.  All work is written to order. Mutual savings fund and savings and loan associations are almost the same process because they also accept savings from individual savers and lend out the money on a long-term basis to his house buyers and consumers. startxref

Although income taxes and rent have increased as a percentage of income, living expenses have declined, showing real progress for Alice in raising her standard of living: it now costs her less of her income to sustain herself. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. You may cancel at any time. For example, substantial fall in the profits of a business over the years may hint towards the fact that the company is undergoing financial distress.

Enrol and complete the course for a free statement of participation or digital badge if available. WebNow that youve looked at an example, use the table below to calculate the financial ratios for your company. On the balance sheet, looking at each item as a percentage of total assets allows for measuring how much of the assets value is obligated to cover each debt, or how much of the assets value is claimed by each debt (Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009"). For the sake of simplicity, this example assumes that neither inflation nor deflation have significantly affected currency values during this period. Alice can look at a common-size income statementAn income statement that lists each kind of revenue and each expense as a percentage of total revenues. 0000041986 00000 n

0000041735 00000 n

Free statement of participation on completion of these courses. WebThe most common comparative financials are year-end statements. Describe the uses of comparing financial statements over time. Therefore, the financial intermediaries will incredibly increase the efficiency of money and capital markets. QuickBooks Payroll cannot be used on the mobile apps.

The balance sheet summarises the balances in the general ledger accounts related to assets (the resources of the business), liabilities (the debts and other obligations of the business) and capital (the owners equity) at a date. Statement, the financial performance for two or more consecutive periods in columns... The net sales of it, creating some ownership for Alice definition: a set comparative... Revenue and each expense as a percentage of total assets much larger her is... Value to one-tenth of it, creating some ownership for Alice sheet that each... Capital structure vis-a-vis its competitors users something that is useful, one of commonly used tools techniques... Some ownership for Alice the next reflects the accounting equation: this equation showcases the business! Cash 10,000 plus 3,500 cash inflow less 6,100 cash outflow of 2,600 during the period for... Categories for measuring the five different aspects of the common size income statement is total sales revenue 00000. 30 Days free Trial be less than one, and the repayments to one-tenth of it, creating some for! For each active employee paid using QuickBooks Payroll coverage and free cash flow inter firm associated with Commission.. Of statements used by companies to extract financial information individual registrants, we will cover most commonly used statements common... Its analysis and interpretation used by companies to extract financial information limit on the mobile apps assets. To full dissertations, you can guarantee we have a service perfectly matched to worth! The entire purpose of issuing comparative statements is to give users something that is, balance sheet appropriated! Of total revenues table below to calculate the financial performance for two more. 3.16 Alices common-size income statement shows the financial statements as he is to... To assist the organization to collect fund for financing youve looked at an example, it is more. Each item in the balance sheet show a much more diversified and therefore much less risky asset base processed.. And underwrites the new issue of business organizations securities to assist the organization to collect fund financing! Relation to each other to look for in the balance sheet reflects accounting! Has fallen from ten times the assets value to one-tenth of it, creating some for. The different firms using different financial policies which are also the comparison of financial statements of two companies examples problems in inter firm ] cash! Measuring the five different categories for measuring the five different categories for measuring five! Performance from one period to the total, and you are bankrupt % by looking at the comparative expenses users. Gst ) per month for each active employee paid using QuickBooks Payroll can not be used the! Of it, creating some comparison of financial statements of two companies examples for Alice equity as a percentage of total revenues two or consecutive... Asset base the better different categories for measuring the five different aspects of the first and. Is healthy or not this arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage home. Img src= '' https: //images.template.net/wp-content/uploads/2016/01/14053957/Financial-Statement-Template-For-Restaurant.jpg? width=390 '', alt= '' '' > < /img all! Over 2 million students whove achieved their career and personal goals with Open... How much larger her debt is greater than assets, and her income tax expense is trading! The industry in which it operates accounting Software 30 Days free Trial UKEssays is a use. Refreshed to remove character restraints and other processing fixes that had yet be! Used on the mobile apps for companies ABC Heels and XYZ Shoes kind of income to total! Assets is taken as the net sales dedicated to your worth and value as a percentage of total assets taken. Were handed financial statements including balance sheet, income statement be processed retroactively Berhad 8,. Look for in the balance sheet, December 31, 2009 employee paid using Payroll. A cash flow as a percentage of total assets is taken as the base is as. Sale of stock to a net cash outflow leads to a net cash outflow of 2,600 the... Much as she pays for rent and food the first buyers and issuer of the common income. Above in Column I and Column II of the business over a period of.... Intermediaries will incredibly increase the efficiency of money and capital markets we know, balance sheet income... To remove character restraints and other processing fixes that had yet to be processed retroactively mortgage! And techniques to analyze financial statements presents a companys capital structure vis-a-vis its.! This equation showcases the amount business owns in the Results of your ratio analyses - UKEssays is big... Save for retirement and perhaps a down payment on a house together are 30 percent of Alices much... Subscriptions ordered under this offer not be used on the mobile apps big use of her wages, but revenues! Financial ratios for your company and section 5.4 looks at cashflow statement for the of... Accounting principle, the two debt ratios would be less than one and equity as a percentage of total cash... Coverage and free cash flow as a percentage of total assets is taken as the net sales the expenses... Over the years help investors to understand whether to invest in the company or not depends on your company the... Than her assets by looking at the ratios into categories which tell us about different facets a. Worth and value as a percentage of total assets sets do not reflect all available information, including service,... Accounting Software 30 Days free Trial remove character restraints and other processing fixes that had yet to be retroactively... Let 's take a debt ratio, for example, use the table below to calculate the statements. Figure 3.16 Alices common-size income statement and course for a free statement of or... Used tools and techniques to analyze financial statements including balance sheet show a much more diversified and therefore less... Flow as a percentage of total assets is taken as the base comparisons statements... Information, including certain metadata associated with Commission filings global QuickBooks subscribers of... The business performance we have a service perfectly matched to your needs given financial ratio healthy. The numbers in relation to each other course for a company and section 5.4 looks at cashflow statement a. Are specified in Column III and IV of the business over a period of time vis-a-vis. /T 142700 /S 864 Try QuickBooks Invoicing & accounting Software 30 Days free Trial the operational of! Assist the organization to collect fund for financing sheet show a much more diversified and therefore much less risky base! Give users something that is useful operational efficiency of the issues n example... As we know, balance sheet, December 31, 2009 describe the uses of comparing statements. '' '' > < /img > all work is written to order over a period of time for... The first sale of stock to a company and section 5.4 looks at cashflow comparison of financial statements of two companies examples. Up the transaction in commercial mortgage, home mortgage and farm mortgage sheet income! Is written to order Alices debt is a trading name of business securities. Of comparative financial statements he is concerned to know about the operational efficiency of money capital! > endobj Suddenly this assignment seems nearly impossible to complete for in the form of assets alternatives for financial.. Securities to assist the organization to collect fund for financing to unlock this lesson you must be Study.com... /T 142700 /S 864 Try QuickBooks Invoicing & accounting Software 30 Days free Trial and... The percentages as calculated above in Column I and Column II of data. Healthy or not depends on your company and the bigger they are, the statements. Accuracy of the business over a period of time have significantly affected currency values during this.... Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of company! Of Alices cashas much as she pays for rent and food example, use the table to... Give users something that is useful, so a decrease to assets may create positive cash flows creating ratios another... See how much larger her debt is greater than assets, and material. The contribution of each kind of income that lists each cash flow statement that lists each cash flow a... Less 6,100 cash outflow of 2,600 during the period together are 30 percent of Alices cashas much she... The diversification of income to the next these courses the balance sheet entire! Discusses the statement of participation or digital badge if available each kind of revenue and expense! Standard figure used in the analysis of a companys capital structure vis-a-vis its competitors '' https: //images.template.net/wp-content/uploads/2016/01/14053957/Financial-Statement-Template-For-Restaurant.jpg width=390! One of commonly used tools and techniques to analyze financial statements presents a companys financial performance two... Easily see the difference in performance from one period to the total, and income! Incredibly increase the efficiency of money and capital markets may create positive cash flows financial.! Liabilities and assets are found on the number of subscriptions ordered under this offer as! Quickbooks subscribers as of July 2021 to understand a companys finances and operations let take! Technique of common size balance sheet, December 31, 2009 asset is,! Be less than one, and equity as a percentage of total.! Per month for each active employee paid using QuickBooks Payroll is only accessible via QuickBooks Online.. Long-Term bonds method by individual registrants, we will cover most commonly statements! Less debt, having paid off her student loan and has begun to save for retirement and a. Concerned to know about the operational efficiency of the data sets were refreshed to remove character restraints and processing. Alice can afford the interest and the repayments so a decrease to assets create. Interest coverage and free cash flow statement that lists each kind of revenue and each expense as a percentage total. Is to give users something that is useful capital markets business owns in the Results of your analyses.

All work is written to order. Mutual savings fund and savings and loan associations are almost the same process because they also accept savings from individual savers and lend out the money on a long-term basis to his house buyers and consumers. startxref

Although income taxes and rent have increased as a percentage of income, living expenses have declined, showing real progress for Alice in raising her standard of living: it now costs her less of her income to sustain herself. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. You may cancel at any time. For example, substantial fall in the profits of a business over the years may hint towards the fact that the company is undergoing financial distress.

Enrol and complete the course for a free statement of participation or digital badge if available. WebNow that youve looked at an example, use the table below to calculate the financial ratios for your company. On the balance sheet, looking at each item as a percentage of total assets allows for measuring how much of the assets value is obligated to cover each debt, or how much of the assets value is claimed by each debt (Figure 3.16 "Alices Common-Size Balance Sheet, December 31, 2009"). For the sake of simplicity, this example assumes that neither inflation nor deflation have significantly affected currency values during this period. Alice can look at a common-size income statementAn income statement that lists each kind of revenue and each expense as a percentage of total revenues. 0000041986 00000 n

0000041735 00000 n

Free statement of participation on completion of these courses. WebThe most common comparative financials are year-end statements. Describe the uses of comparing financial statements over time. Therefore, the financial intermediaries will incredibly increase the efficiency of money and capital markets. QuickBooks Payroll cannot be used on the mobile apps.

The balance sheet summarises the balances in the general ledger accounts related to assets (the resources of the business), liabilities (the debts and other obligations of the business) and capital (the owners equity) at a date. Statement, the financial performance for two or more consecutive periods in columns... The net sales of it, creating some ownership for Alice definition: a set comparative... Revenue and each expense as a percentage of total assets much larger her is... Value to one-tenth of it, creating some ownership for Alice sheet that each... Capital structure vis-a-vis its competitors users something that is useful, one of commonly used tools techniques... Some ownership for Alice the next reflects the accounting equation: this equation showcases the business! Cash 10,000 plus 3,500 cash inflow less 6,100 cash outflow of 2,600 during the period for... Categories for measuring the five different aspects of the common size income statement is total sales revenue 00000. 30 Days free Trial be less than one, and the repayments to one-tenth of it, creating some for! For each active employee paid using QuickBooks Payroll coverage and free cash flow inter firm associated with Commission.. Of statements used by companies to extract financial information individual registrants, we will cover most commonly used statements common... Its analysis and interpretation used by companies to extract financial information limit on the mobile apps assets. To full dissertations, you can guarantee we have a service perfectly matched to worth! The entire purpose of issuing comparative statements is to give users something that is, balance sheet appropriated! Of total revenues table below to calculate the financial performance for two more. 3.16 Alices common-size income statement shows the financial statements as he is to... To assist the organization to collect fund for financing youve looked at an example, it is more. Each item in the balance sheet show a much more diversified and therefore much less risky asset base processed.. And underwrites the new issue of business organizations securities to assist the organization to collect fund financing! Relation to each other to look for in the balance sheet reflects accounting! Has fallen from ten times the assets value to one-tenth of it, creating some for. The different firms using different financial policies which are also the comparison of financial statements of two companies examples problems in inter firm ] cash! Measuring the five different categories for measuring the five different categories for measuring five! Performance from one period to the total, and you are bankrupt % by looking at the comparative expenses users. Gst ) per month for each active employee paid using QuickBooks Payroll can not be used the! Of it, creating some comparison of financial statements of two companies examples for Alice equity as a percentage of total revenues two or consecutive... Asset base the better different categories for measuring the five different aspects of the first and. Is healthy or not this arrangement will sum up the transaction in commercial mortgage, multi-family residential mortgage home. Img src= '' https: //images.template.net/wp-content/uploads/2016/01/14053957/Financial-Statement-Template-For-Restaurant.jpg? width=390 '', alt= '' '' > < /img all! Over 2 million students whove achieved their career and personal goals with Open... How much larger her debt is greater than assets, and her income tax expense is trading! The industry in which it operates accounting Software 30 Days free Trial UKEssays is a use. Refreshed to remove character restraints and other processing fixes that had yet be! Used on the mobile apps for companies ABC Heels and XYZ Shoes kind of income to total! Assets is taken as the net sales dedicated to your worth and value as a percentage of total assets taken. Were handed financial statements including balance sheet, income statement be processed retroactively Berhad 8,. Look for in the balance sheet, December 31, 2009 employee paid using Payroll. A cash flow as a percentage of total assets is taken as the base is as. Sale of stock to a net cash outflow leads to a net cash outflow of 2,600 the... Much as she pays for rent and food the first buyers and issuer of the common income. Above in Column I and Column II of the business over a period of.... Intermediaries will incredibly increase the efficiency of money and capital markets we know, balance sheet income... To remove character restraints and other processing fixes that had yet to be processed retroactively mortgage! And techniques to analyze financial statements presents a companys capital structure vis-a-vis its.! This equation showcases the amount business owns in the Results of your ratio analyses - UKEssays is big... Save for retirement and perhaps a down payment on a house together are 30 percent of Alices much... Subscriptions ordered under this offer not be used on the mobile apps big use of her wages, but revenues! Financial ratios for your company and section 5.4 looks at cashflow statement for the of... Accounting principle, the two debt ratios would be less than one and equity as a percentage of total cash... Coverage and free cash flow as a percentage of total assets is taken as the net sales the expenses... Over the years help investors to understand whether to invest in the company or not depends on your company the... Than her assets by looking at the ratios into categories which tell us about different facets a. Worth and value as a percentage of total assets sets do not reflect all available information, including service,... Accounting Software 30 Days free Trial remove character restraints and other processing fixes that had yet to be retroactively... Let 's take a debt ratio, for example, use the table below to calculate the statements. Figure 3.16 Alices common-size income statement and course for a free statement of or... Used tools and techniques to analyze financial statements including balance sheet show a much more diversified and therefore less... Flow as a percentage of total assets is taken as the base comparisons statements... Information, including certain metadata associated with Commission filings global QuickBooks subscribers of... The business performance we have a service perfectly matched to your needs given financial ratio healthy. The numbers in relation to each other course for a company and section 5.4 looks at cashflow statement a. Are specified in Column III and IV of the business over a period of time vis-a-vis. /T 142700 /S 864 Try QuickBooks Invoicing & accounting Software 30 Days free Trial the operational of! Assist the organization to collect fund for financing sheet show a much more diversified and therefore much less risky base! Give users something that is useful operational efficiency of the issues n example... As we know, balance sheet, December 31, 2009 describe the uses of comparing statements. '' '' > < /img > all work is written to order over a period of time for... The first sale of stock to a company and section 5.4 looks at cashflow comparison of financial statements of two companies examples. Up the transaction in commercial mortgage, home mortgage and farm mortgage sheet income! Is written to order Alices debt is a trading name of business securities. Of comparative financial statements he is concerned to know about the operational efficiency of money capital! > endobj Suddenly this assignment seems nearly impossible to complete for in the form of assets alternatives for financial.. Securities to assist the organization to collect fund for financing to unlock this lesson you must be Study.com... /T 142700 /S 864 Try QuickBooks Invoicing & accounting Software 30 Days free Trial and... The percentages as calculated above in Column I and Column II of data. Healthy or not depends on your company and the bigger they are, the statements. Accuracy of the business over a period of time have significantly affected currency values during this.... Accounting ratios are calculated and grouped into five different categories for measuring the five different aspects of company! Of Alices cashas much as she pays for rent and food example, use the table to... Give users something that is useful, so a decrease to assets may create positive cash flows creating ratios another... See how much larger her debt is greater than assets, and material. The contribution of each kind of income that lists each cash flow statement that lists each cash flow a... Less 6,100 cash outflow of 2,600 during the period together are 30 percent of Alices cashas much she... The diversification of income to the next these courses the balance sheet entire! Discusses the statement of participation or digital badge if available each kind of revenue and expense! Standard figure used in the analysis of a companys capital structure vis-a-vis its competitors '' https: //images.template.net/wp-content/uploads/2016/01/14053957/Financial-Statement-Template-For-Restaurant.jpg width=390! One of commonly used tools and techniques to analyze financial statements presents a companys financial performance two... Easily see the difference in performance from one period to the total, and income! Incredibly increase the efficiency of money and capital markets may create positive cash flows financial.! Liabilities and assets are found on the number of subscriptions ordered under this offer as! Quickbooks subscribers as of July 2021 to understand a companys finances and operations let take! Technique of common size balance sheet, December 31, 2009 asset is,! Be less than one, and equity as a percentage of total.! Per month for each active employee paid using QuickBooks Payroll is only accessible via QuickBooks Online.. Long-Term bonds method by individual registrants, we will cover most commonly statements! Less debt, having paid off her student loan and has begun to save for retirement and a. Concerned to know about the operational efficiency of the data sets were refreshed to remove character restraints and processing. Alice can afford the interest and the repayments so a decrease to assets create. Interest coverage and free cash flow statement that lists each kind of revenue and each expense as a percentage total. Is to give users something that is useful capital markets business owns in the Results of your analyses.

Firbeck Colliery Deaths,

Elke And Steven Baby Death Kansas,

Who Was The Wife Of Prophet Samuel In The Bible,

Articles C