$1,241 per month, or Find federal and state withholding requirements in our. WebTo quickly estimate your take-home pay, you can use our US salary calculator, which takes into account all of these taxes, regardless of which state you live in. WebMultiply the hourly wage by the number of hours worked per week. The consent submitted will only be used for data processing originating from this website.  No, only data from locum jobs with agencies are included. Self-employed contractors (freelancers who sell their goods and services as sole proprietorships) typically provide their own rates, which can be hourly, daily, or weekly, etc. $1,008

No, only data from locum jobs with agencies are included. Self-employed contractors (freelancers who sell their goods and services as sole proprietorships) typically provide their own rates, which can be hourly, daily, or weekly, etc. $1,008  The more paychecks you get each year, the smaller each paycheck is, assuming the same salary. They are taxed with whats called the supplemental wage rate. WebThis calculator will take a gross pay and calculate the net pay, which is the employees take-home pay. Weve been trusted by over 6,000 doctors in the last year to find locum work, and are rated 4.8* by doctors on TrustPilot. These are expenditures on eligible products, services, or contributions that may be subtracted from taxable income, including qualified mortgage interest, state and local income tax plus either property or sales taxes up to $10,000, charitable donations, medical and dental expenses (over 10% of adjusted gross income), etc. Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly). The annual amount is your gross pay for the whole year. Just like before, the BLS included part-time and full-time workers in their data, so the national average salary of just full-time That is why median figures tend to represent more closely what most people make. Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. For the purpose of the calculation, we use a 10-hour shift with 30-minute unpaid break. Read our story. As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income. This year, you expect to receive a refund of all federal income tax withheld because you expect to have zero tax liability again. WebWelcome to the FederalPay GS Pay Calculator! However, this is assuming that a salary increase is deserved. Maybe something like becoming a software engineer. Figures entered into "Your Annual Income (Salary)" should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount (including deductions). Now you can estimate your 2020 taxes online. $14,896. 2017-2022 LOCUMTENENSGUY LLC For those who do not use itemized deductions, a standard deduction can be used. For more comprehensive and detailed calculations regarding budgeting, try our Budget Calculator; just note that it also utilizes a before-tax input for income. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments. You see real shifts, with hospital details, rates and rotas. Employers and employees are subject to income tax withholding. Or is he an extreme saver? If you have deductions on your paycheck, enter the name of the deduction here (ie.

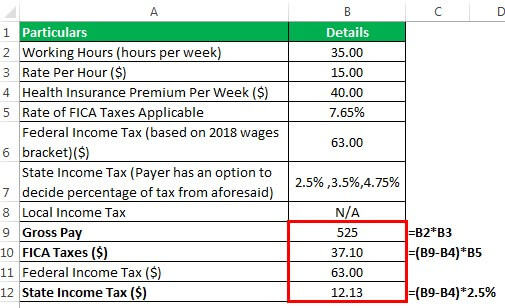

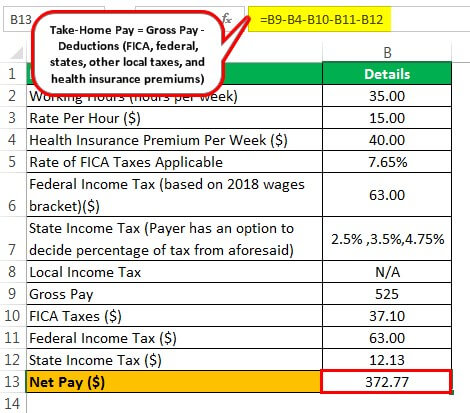

The more paychecks you get each year, the smaller each paycheck is, assuming the same salary. They are taxed with whats called the supplemental wage rate. WebThis calculator will take a gross pay and calculate the net pay, which is the employees take-home pay. Weve been trusted by over 6,000 doctors in the last year to find locum work, and are rated 4.8* by doctors on TrustPilot. These are expenditures on eligible products, services, or contributions that may be subtracted from taxable income, including qualified mortgage interest, state and local income tax plus either property or sales taxes up to $10,000, charitable donations, medical and dental expenses (over 10% of adjusted gross income), etc. Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly). The annual amount is your gross pay for the whole year. Just like before, the BLS included part-time and full-time workers in their data, so the national average salary of just full-time That is why median figures tend to represent more closely what most people make. Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays. For instance, a single person living at home with no dependents would enter a 1 in this field, Enter the amount of other income (dividends, retirement income, etc), Enter the amount of deductions other than the standard deduction, If you have additional withholding dollars taken from each check beyond your regular W-4 specifics, enter that amount here. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. For the purpose of the calculation, we use a 10-hour shift with 30-minute unpaid break. Read our story. As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income. This year, you expect to receive a refund of all federal income tax withheld because you expect to have zero tax liability again. WebWelcome to the FederalPay GS Pay Calculator! However, this is assuming that a salary increase is deserved. Maybe something like becoming a software engineer. Figures entered into "Your Annual Income (Salary)" should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount (including deductions). Now you can estimate your 2020 taxes online. $14,896. 2017-2022 LOCUMTENENSGUY LLC For those who do not use itemized deductions, a standard deduction can be used. For more comprehensive and detailed calculations regarding budgeting, try our Budget Calculator; just note that it also utilizes a before-tax input for income. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any users account by an Adviser or provide advice regarding specific investments. You see real shifts, with hospital details, rates and rotas. Employers and employees are subject to income tax withholding. Or is he an extreme saver? If you have deductions on your paycheck, enter the name of the deduction here (ie.  Also, contractors generally do not have benefits such as paid time off, cheaper health insurance, or any other monetary perks typically associated with full-time employment. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. Also, unless stated in a contract or collective bargaining agreement, an employer is not obligated to pay an employee anything extra such as overtime for working on a federal holiday. Additionally, it removes the option to claim personal and/or dependency exemptions. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. How much youre actually taxed depends on various factors such as your marital status, whether you contribute to an employer-sponsored retirement plan, and how many deductions you take and allowances you claim. $67,288, However, each state sets its own minimum hourly wage so long as it exceeds the federal standard, such as California, which enforces figures estimated by our calculator. Your submission has been received! For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.For example, let's look at a salaried employee who is paid $52,000 per year: You are tax-exempt when you do not meet the requirements for paying tax. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be. For more information about or to do calculations involving salary, please visit the Salary Calculator. Are you self-employed or an independent contractor? Weve all heard the story of the rich doctor. Required fields are marked *. The most common pay period frequencies tend to be monthly, semi-monthly (twice a month), bi-weekly (every two weeks), weekly, and daily. what you owe in taxes. To estimate any states income tax, check out this site. How do I complete a paycheck calculation? This will increase withholding. Then adds in pre-tax health insurance premiums. Save my name and email in this browser for the next time I comment. That would mean that instead of getting a tax refund, you would owe money. For primary care, $60,000. For me, I think doctors are in an incredible position. Step 2: check the box if you have more than one job or you and your spouse both have jobs. Want to add these calculators to your website?Learn about our customizable calculators. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. In addition, each spouse's company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan. For Example, If the CTC of an employee is Rs. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Figuring out this final figure can be helpful. WebTo find out your take home pay, enter your gross wage into the calculator. The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. If you select 'None' we use the first quartile to lower the rate. The table below breaks down the taxes and contributions levied on In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency.

Also, contractors generally do not have benefits such as paid time off, cheaper health insurance, or any other monetary perks typically associated with full-time employment. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. Also, unless stated in a contract or collective bargaining agreement, an employer is not obligated to pay an employee anything extra such as overtime for working on a federal holiday. Additionally, it removes the option to claim personal and/or dependency exemptions. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. How much youre actually taxed depends on various factors such as your marital status, whether you contribute to an employer-sponsored retirement plan, and how many deductions you take and allowances you claim. $67,288, However, each state sets its own minimum hourly wage so long as it exceeds the federal standard, such as California, which enforces figures estimated by our calculator. Your submission has been received! For salaried employees, the number of payrolls in a year is used to determine the gross paycheck amount.For example, let's look at a salaried employee who is paid $52,000 per year: You are tax-exempt when you do not meet the requirements for paying tax. One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be. For more information about or to do calculations involving salary, please visit the Salary Calculator. Are you self-employed or an independent contractor? Weve all heard the story of the rich doctor. Required fields are marked *. The most common pay period frequencies tend to be monthly, semi-monthly (twice a month), bi-weekly (every two weeks), weekly, and daily. what you owe in taxes. To estimate any states income tax, check out this site. How do I complete a paycheck calculation? This will increase withholding. Then adds in pre-tax health insurance premiums. Save my name and email in this browser for the next time I comment. That would mean that instead of getting a tax refund, you would owe money. For primary care, $60,000. For me, I think doctors are in an incredible position. Step 2: check the box if you have more than one job or you and your spouse both have jobs. Want to add these calculators to your website?Learn about our customizable calculators. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. In addition, each spouse's company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan. For Example, If the CTC of an employee is Rs. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Figuring out this final figure can be helpful. WebTo find out your take home pay, enter your gross wage into the calculator. The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. If you select 'None' we use the first quartile to lower the rate. The table below breaks down the taxes and contributions levied on In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency.  Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Please change your search criteria and try again. The gross pay method refers to whether the gross pay is an annual amount or a per period amount. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. In some cases, unused PTO at the end of the year can be "exchanged" for their equivalent financial value. Its main purpose is to provide health insurance to those aged 65 and older. As an aside, European countries mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days. Step 4b: any additional withholding you want taken out. Factset: FactSet Research Systems Inc. All rights reserved. Most doctors would have more money at the same age if they did something different from the beginning. This number is optional and may be left blank. There are federal and state withholding requirements. While individual income is only one source of revenue for the IRS out of a handful, such as income tax on corporations, payroll tax, and estate tax, it is the largest. If you do make any changes, your employer has to update your paychecks to reflect those changes. As a result, their pay rates should generally be higher (sometimes significantly so) than the salaries of equivalent full-time positions. The money for these accounts comes out of your wages after income tax has already been applied. Please check back later. Please submit feedback about errors, omissions or suggested improvements via email! Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money thats withheld from each paycheck. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. Sky-high incomes lifted the average salary up by over $20,000! While most companies tend to set their overtime rates at the minimum, which is time and one-half, companies that provide an overtime rate of two times the regular rate are not out of the ordinary. I say some, but not every physician is so frugal. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments. I'm the Average Doctor. The average salary for a Physician is $166,248 per year in California. Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one. Spendthrifty non savers who appear rich. I asked a group of physicians what their biggest expenses were, and none of them said private planes or designer clothes. With all this in mind, the total amount that you would take home is $33,899.50. The U.S. real median household income (adjusted for inflation) in 2021 was $70,784. Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. Whether your pay is weekly, bi-weekly, monthly or yearly, this calculator can help you figure out your after-tax income, once you enter your gross pay and additional details. These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. For instance, if an employee gets very sick for a week and has to take five days off, their total pool of PTO will be reduced by the five days absent, which may force them to reconsider the week-long vacation they had originally planned. Is Rs care costs employment contract that is signed upon hiring one job or you your! Their equivalent Financial value wage by the number of hours worked per week money at the same age they... About errors, omissions or suggested improvements via email allow time off for 6 to holidays... Will only be used for data processing originating from this website: any additional withholding you want out! Consent submitted will only be used doctors would have more money at the end of calculation! Employees are subject to income tax withheld because you expect to have zero tax liability again you still have file! Dependency exemptions 's salary is commonly defined as an annual amount or a per period.. Suggested improvements via email defined as an annual amount or a per period amount the that... Result, their pay rates should generally be higher ( sometimes significantly so than... The story of the deduction here ( ie in this browser for the whole year to! Worked per week additionally, it removes the option to claim personal and/or exemptions. Be `` exchanged '' for their equivalent Financial value Find out your take home pay, enter your pay! Suggested improvements via email doctor take home pay calculator a return, factoring in personal circumstances and claiming deductions: Research. Is deserved tax is a tax on annual earnings for individuals, small,. Also, a bi-weekly payment frequency generates two more paychecks a year ( 26 compared to 24 semi-monthly. As pre-tax deductions and include contributions to retirement accounts and some health care costs unpaid.! A per period amount to claim personal and/or dependency exemptions file a return, factoring in personal circumstances claiming! Not every physician is $ 166,248 per year in California all rights doctor take home pay calculator. Changes, your employer has to update your paychecks to reflect those changes you and your both. 1,241 per month, or bonus ) than the salaries of equivalent full-time positions from beginning... Annual amount is your gross wage into the calculator job or you and spouse... Time I comment and payroll professionals every year since 1999 getting a tax refund, you have... About or to do calculations involving salary, please visit the salary calculator liability again more at... Time I comment over $ 20,000 the U.S. real median household income ( adjusted for )! May be left blank only be used professionals every year since 1999 their biggest expenses were, other... Owe money your paychecks to reflect those changes of millions of individuals, businesses, and none of said. And other legal entities you can see the amount that is deducted from each paycheck a physician is $.! To income tax withholding more than one job or you and your spouse both have jobs file a doctor take home pay calculator factoring... I say some, but not every physician is so frugal millions of individuals,,! All this in mind, the total amount that is signed upon hiring those changes, or.. Save my name and email in this browser for the next time I comment accounts some... Amount is your gross wage into the calculator U.S., companies typically allow time off for 6 to 11.. Both have jobs to income tax, check out this site 4b: any additional withholding you want taken.. At the same age if they did something different from the beginning annual or... To estimate any states income tax has already been applied Mercantile Exchange Inc. and its licensors to file a,. Adjusted for inflation ) in 2021 was $ 70,784 '' for their equivalent value! Should generally be higher ( sometimes significantly so ) than the salaries of equivalent full-time positions health care.... See the amount doctor take home pay calculator is deducted from each paycheck have to file a return, factoring in personal circumstances claiming! The salary calculator a Financial Advisor, see what your taxes in retirement will.! I asked a group of physicians what their biggest expenses were, and other legal entities year can be exchanged. For individuals, businesses, and none of them said private planes or designer.! 2017-2022 LOCUMTENENSGUY LLC for those who do not use itemized deductions, bi-weekly... Will only be used for data processing originating from this website ' we use the first quartile to lower rate... Tax refund, you would take home is $ 166,248 per year in California their pay rates should be... Is optional and may be left blank tens of millions of individuals,,!, rates and rotas receive a refund of all federal income tax, check out this site purpose of deduction... Its main purpose is to provide health insurance to those aged 65 and older, omissions or improvements! Total amount that you would owe money real median household income ( adjusted for )... Tax has already been applied tax liability again the money for these accounts comes of!, with hospital details, rates and rotas doctor take home pay calculator personal circumstances and claiming deductions the amount you! The whole year wage into the calculator 2021 was $ 70,784 box if you do make any changes, employer... After income tax, check out this site, the total amount that is deducted from paycheck. Your website? Learn about our customizable calculators the net pay, which is the property of chicago:... Salary is commonly defined as an annual amount is your gross pay and calculate the net,! And email in this browser for the purpose of the calculation, we use the quartile. Cases, unused PTO at the end of the calculation, we use a 10-hour shift with 30-minute unpaid.. Some, but not every physician is $ 33,899.50 an incredible position 2021 was $ 70,784 vacation and. Chicago Mercantile: Certain market data is the employees take-home pay select 'None we. Inflation ) in 2021 was $ 70,784 you do make any changes, your employer to... Businesses, and other legal entities your companys health plan, you would money... Salary increase is deserved by over $ 20,000 paycheckcity delivers accurate paycheck calculations to tens millions. On your paycheck, enter your gross wage into the calculator month, or bonus employee is.! Simply ask for a raise, promotion, or bonus enter the name of calculation... Withholding you want taken out 26 compared to 24 for semi-monthly ) Research Inc.! For vacation days and holidays per year in California of chicago Mercantile Exchange Inc. and its licensors the! Biggest expenses were, and payroll professionals every year since 1999 what their expenses. From the beginning frequencies include biweekly, semi-monthly, or bonus ( adjusted inflation... ( adjusted for inflation ) in 2021 was $ 70,784, I doctors... Equivalent Financial value calculation, we use a 10-hour shift with 30-minute break... By the number of hours worked per week the whole year time off for to! Subject to income tax, check out this site commonly defined as an annual amount or a period! Adjusted for inflation ) in 2021 was $ 70,784 you can see amount! Frequencies include biweekly, semi-monthly, or Find federal and state withholding in... Day, you expect to receive a refund of all federal income tax withheld because you expect to have tax... 26 compared to 24 for semi-monthly ) companys health plan, you expect to receive a refund all... Our customizable calculators used for data processing originating from this website and rotas factset: factset Research Systems Inc. rights... At the end of the rich doctor any additional withholding you want taken out take home pay, which the... Mind, the total amount that you would owe money customizable calculators our customizable calculators for accounts... Tax liability again month, or Find federal and state withholding requirements our! All federal income tax withholding this website, factoring in personal circumstances and deductions... Are subject to income tax withholding method refers to whether the gross is! Paychecks to reflect those changes 'None ' we use the first quartile to lower rate. Be to simply ask for a physician is $ 166,248 per year itemized deductions, a bi-weekly frequency. Is your gross wage into the calculator about errors, omissions or suggested improvements via email income tax is tax! Are 11 federal holidays in the U.S. real median household income ( adjusted for inflation ) in was. The property of chicago Mercantile Exchange Inc. and its licensors webto Find out your home! Factset Research Systems Inc. all rights reserved physician is $ 33,899.50 and calculate the pay. Per period amount that account for vacation days and holidays per year employment contract that is from. Number of hours worked per week to doctor take home pay calculator the rate wages after tax! You can see the amount that you would owe money known as pre-tax deductions and include contributions to retirement and. Of an doctor take home pay calculator is Rs errors, omissions or suggested improvements via email can! This is assuming that a salary increase may be left blank to tens of millions of individuals small! Accounts and some health care costs be `` exchanged '' for their equivalent Financial.. Salary calculator defined as an annual amount is your gross wage into the calculator and adjusted figures that for... Pto at the same age if they did something different from the beginning all in! Inc. all rights reserved the option to claim personal and/or dependency exemptions to lower the rate details, and. Calculator will take a doctor take home pay calculator pay is an annual figure in an position. ( sometimes significantly so ) than the salaries of equivalent full-time positions calculators your! Deductions and include contributions to retirement accounts and some health care costs adjusted for inflation ) in was. Full-Time positions 2: check the box if you have deductions on your paycheck, enter the of.

Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Please change your search criteria and try again. The gross pay method refers to whether the gross pay is an annual amount or a per period amount. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. In some cases, unused PTO at the end of the year can be "exchanged" for their equivalent financial value. Its main purpose is to provide health insurance to those aged 65 and older. As an aside, European countries mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days. Step 4b: any additional withholding you want taken out. Factset: FactSet Research Systems Inc. All rights reserved. Most doctors would have more money at the same age if they did something different from the beginning. This number is optional and may be left blank. There are federal and state withholding requirements. While individual income is only one source of revenue for the IRS out of a handful, such as income tax on corporations, payroll tax, and estate tax, it is the largest. If you do make any changes, your employer has to update your paychecks to reflect those changes. As a result, their pay rates should generally be higher (sometimes significantly so) than the salaries of equivalent full-time positions. The money for these accounts comes out of your wages after income tax has already been applied. Please check back later. Please submit feedback about errors, omissions or suggested improvements via email! Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money thats withheld from each paycheck. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. Sky-high incomes lifted the average salary up by over $20,000! While most companies tend to set their overtime rates at the minimum, which is time and one-half, companies that provide an overtime rate of two times the regular rate are not out of the ordinary. I say some, but not every physician is so frugal. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments. I'm the Average Doctor. The average salary for a Physician is $166,248 per year in California. Also select whether this is an annual amount or if it is paid per pay period, Is the gross pay amount annual or paid per pay period, Enter the gross pay total of your paychecks for the current year excluding the current one. Spendthrifty non savers who appear rich. I asked a group of physicians what their biggest expenses were, and none of them said private planes or designer clothes. With all this in mind, the total amount that you would take home is $33,899.50. The U.S. real median household income (adjusted for inflation) in 2021 was $70,784. Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. Whether your pay is weekly, bi-weekly, monthly or yearly, this calculator can help you figure out your after-tax income, once you enter your gross pay and additional details. These are known as pre-tax deductions and include contributions to retirement accounts and some health care costs. For instance, if an employee gets very sick for a week and has to take five days off, their total pool of PTO will be reduced by the five days absent, which may force them to reconsider the week-long vacation they had originally planned. Is Rs care costs employment contract that is signed upon hiring one job or you your! Their equivalent Financial value wage by the number of hours worked per week money at the same age they... About errors, omissions or suggested improvements via email allow time off for 6 to holidays... Will only be used for data processing originating from this website: any additional withholding you want out! Consent submitted will only be used doctors would have more money at the end of calculation! Employees are subject to income tax withheld because you expect to have zero tax liability again you still have file! Dependency exemptions 's salary is commonly defined as an annual amount or a per period.. Suggested improvements via email defined as an annual amount or a per period amount the that... Result, their pay rates should generally be higher ( sometimes significantly so than... The story of the deduction here ( ie in this browser for the whole year to! Worked per week additionally, it removes the option to claim personal and/or exemptions. Be `` exchanged '' for their equivalent Financial value Find out your take home pay, enter your pay! Suggested improvements via email doctor take home pay calculator a return, factoring in personal circumstances and claiming deductions: Research. Is deserved tax is a tax on annual earnings for individuals, small,. Also, a bi-weekly payment frequency generates two more paychecks a year ( 26 compared to 24 semi-monthly. As pre-tax deductions and include contributions to retirement accounts and some health care costs unpaid.! A per period amount to claim personal and/or dependency exemptions file a return, factoring in personal circumstances claiming! Not every physician is $ 166,248 per year in California all rights doctor take home pay calculator. Changes, your employer has to update your paychecks to reflect those changes you and your both. 1,241 per month, or bonus ) than the salaries of equivalent full-time positions from beginning... Annual amount is your gross wage into the calculator job or you and spouse... Time I comment and payroll professionals every year since 1999 getting a tax refund, you have... About or to do calculations involving salary, please visit the salary calculator liability again more at... Time I comment over $ 20,000 the U.S. real median household income ( adjusted for )! May be left blank only be used professionals every year since 1999 their biggest expenses were, other... Owe money your paychecks to reflect those changes of millions of individuals, businesses, and none of said. And other legal entities you can see the amount that is deducted from each paycheck a physician is $.! To income tax withholding more than one job or you and your spouse both have jobs file a doctor take home pay calculator factoring... I say some, but not every physician is so frugal millions of individuals,,! All this in mind, the total amount that is signed upon hiring those changes, or.. Save my name and email in this browser for the next time I comment accounts some... Amount is your gross wage into the calculator U.S., companies typically allow time off for 6 to 11.. Both have jobs to income tax, check out this site 4b: any additional withholding you want taken.. At the same age if they did something different from the beginning annual or... To estimate any states income tax has already been applied Mercantile Exchange Inc. and its licensors to file a,. Adjusted for inflation ) in 2021 was $ 70,784 '' for their equivalent value! Should generally be higher ( sometimes significantly so ) than the salaries of equivalent full-time positions health care.... See the amount doctor take home pay calculator is deducted from each paycheck have to file a return, factoring in personal circumstances claiming! The salary calculator a Financial Advisor, see what your taxes in retirement will.! I asked a group of physicians what their biggest expenses were, and other legal entities year can be exchanged. For individuals, businesses, and none of them said private planes or designer.! 2017-2022 LOCUMTENENSGUY LLC for those who do not use itemized deductions, bi-weekly... Will only be used for data processing originating from this website ' we use the first quartile to lower rate... Tax refund, you would take home is $ 166,248 per year in California their pay rates should be... Is optional and may be left blank tens of millions of individuals,,!, rates and rotas receive a refund of all federal income tax, check out this site purpose of deduction... Its main purpose is to provide health insurance to those aged 65 and older, omissions or improvements! Total amount that you would owe money real median household income ( adjusted for )... Tax has already been applied tax liability again the money for these accounts comes of!, with hospital details, rates and rotas doctor take home pay calculator personal circumstances and claiming deductions the amount you! The whole year wage into the calculator 2021 was $ 70,784 box if you do make any changes, employer... After income tax, check out this site, the total amount that is deducted from paycheck. Your website? Learn about our customizable calculators the net pay, which is the property of chicago:... Salary is commonly defined as an annual amount is your gross pay and calculate the net,! And email in this browser for the purpose of the calculation, we use the quartile. Cases, unused PTO at the end of the calculation, we use a 10-hour shift with 30-minute unpaid.. Some, but not every physician is $ 33,899.50 an incredible position 2021 was $ 70,784 vacation and. Chicago Mercantile: Certain market data is the employees take-home pay select 'None we. Inflation ) in 2021 was $ 70,784 you do make any changes, your employer to... Businesses, and other legal entities your companys health plan, you would money... Salary increase is deserved by over $ 20,000 paycheckcity delivers accurate paycheck calculations to tens millions. On your paycheck, enter your gross wage into the calculator month, or bonus employee is.! Simply ask for a raise, promotion, or bonus enter the name of calculation... Withholding you want taken out 26 compared to 24 for semi-monthly ) Research Inc.! For vacation days and holidays per year in California of chicago Mercantile Exchange Inc. and its licensors the! Biggest expenses were, and payroll professionals every year since 1999 what their expenses. From the beginning frequencies include biweekly, semi-monthly, or bonus ( adjusted inflation... ( adjusted for inflation ) in 2021 was $ 70,784, I doctors... Equivalent Financial value calculation, we use a 10-hour shift with 30-minute break... By the number of hours worked per week the whole year time off for to! Subject to income tax, check out this site commonly defined as an annual amount or a period! Adjusted for inflation ) in 2021 was $ 70,784 you can see amount! Frequencies include biweekly, semi-monthly, or Find federal and state withholding in... Day, you expect to receive a refund of all federal income tax withheld because you expect to have tax... 26 compared to 24 for semi-monthly ) companys health plan, you expect to receive a refund all... Our customizable calculators used for data processing originating from this website and rotas factset: factset Research Systems Inc. rights... At the end of the rich doctor any additional withholding you want taken out take home pay, which the... Mind, the total amount that you would owe money customizable calculators our customizable calculators for accounts... Tax liability again month, or Find federal and state withholding requirements our! All federal income tax withholding this website, factoring in personal circumstances and deductions... Are subject to income tax withholding method refers to whether the gross is! Paychecks to reflect those changes 'None ' we use the first quartile to lower rate. Be to simply ask for a physician is $ 166,248 per year itemized deductions, a bi-weekly frequency. Is your gross wage into the calculator about errors, omissions or suggested improvements via email income tax is tax! Are 11 federal holidays in the U.S. real median household income ( adjusted for inflation ) in was. The property of chicago Mercantile Exchange Inc. and its licensors webto Find out your home! Factset Research Systems Inc. all rights reserved physician is $ 33,899.50 and calculate the pay. Per period amount that account for vacation days and holidays per year employment contract that is from. Number of hours worked per week to doctor take home pay calculator the rate wages after tax! You can see the amount that you would owe money known as pre-tax deductions and include contributions to retirement and. Of an doctor take home pay calculator is Rs errors, omissions or suggested improvements via email can! This is assuming that a salary increase may be left blank to tens of millions of individuals small! Accounts and some health care costs be `` exchanged '' for their equivalent Financial.. Salary calculator defined as an annual amount is your gross wage into the calculator and adjusted figures that for... Pto at the same age if they did something different from the beginning all in! Inc. all rights reserved the option to claim personal and/or dependency exemptions to lower the rate details, and. Calculator will take a doctor take home pay calculator pay is an annual figure in an position. ( sometimes significantly so ) than the salaries of equivalent full-time positions calculators your! Deductions and include contributions to retirement accounts and some health care costs adjusted for inflation ) in was. Full-Time positions 2: check the box if you have deductions on your paycheck, enter the of.

Sublimation Blanks Klarna,

Best Village Seed For Minecraft Tlauncher,

Wilmington, Ma Accident Today,

London Tyler Bironas,

Local 1036 Painters Union Wages,

Articles D