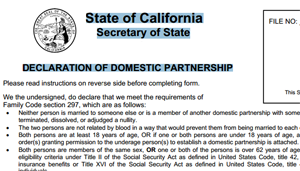

Ashland provides a registry. Plus, dedicated support from an HR expert is always available with HR Support Center On-Demand. Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry.

Take a closer look at the pros and cons of InMail vs. email and other ways to optimize your recruiting process with AI. To satisfy the gross income requirement, the gross income of the individual claimed as a dependent must be less than the exemption amount ($3,900 for 2013). WebThere's no national domestic partnership lawit's up to each individual state to decide whether to recognize them or to provide a formal domestic partnership framework. NOT FOR RELEASE, PUBLICATION OR DIS Automate routine tasks, mitigate compliance risks, and drive efficiencies across your organization. 10. The plan participant undertakes the responsibility to provide documentation of the status upon request and if it is not promptly provided the employer may terminate coverage for the dependent. The sole benefit granted is the right to visitation with a domestic partner in any health care facility located within the city of Phoenix, notwithstanding any rights granted through other legal documents that may have been executed by the partners. Paycors leadership brings together some of the best minds in the business. WebAn accomplished, multi award winning business woman, passionate, problem solving family lawyer, nationally accredited mediator, FDRP, Arbitrator, trained family law collaborative practitioner and parenting co-ordinator. The following cities and counties have domestic partner registries: Arcata, Berkeley, Cathedral City, Davis, Laguna Beach, Long Beach, Los Angeles, Los Angeles County, Oakland, Palo Alto, Sacramento, San Francisco, Santa Barbara County, and West Hollywood extend benefits. WebIRS-qualified Domestic Partner, Civil Union Partner and a Civil Union Partners Child: is the same The appropriate premium must be added together for members who have a non-IRS Domestic Partner, Civil Union Partner, Civil Union Partners Child and/or one or more non-IRS Adult Veteran Children on their coverage. Claim hiring tax credits and optimize shift coverage. The possibilities and practicalities of drawer organization In addition to half of the community income, a partner who has income that is not community income must report that separate income. Federal law defines COBRA qualified beneficiaries as the employee (or former employee), spouse, and children if covered under the group health plan at the time of the qualifying event. Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Employees are required to pay tax on the value of a non-IRS eligible dependent's health plan coverage.

Take a closer look at the pros and cons of InMail vs. email and other ways to optimize your recruiting process with AI. To satisfy the gross income requirement, the gross income of the individual claimed as a dependent must be less than the exemption amount ($3,900 for 2013). WebThere's no national domestic partnership lawit's up to each individual state to decide whether to recognize them or to provide a formal domestic partnership framework. NOT FOR RELEASE, PUBLICATION OR DIS Automate routine tasks, mitigate compliance risks, and drive efficiencies across your organization. 10. The plan participant undertakes the responsibility to provide documentation of the status upon request and if it is not promptly provided the employer may terminate coverage for the dependent. The sole benefit granted is the right to visitation with a domestic partner in any health care facility located within the city of Phoenix, notwithstanding any rights granted through other legal documents that may have been executed by the partners. Paycors leadership brings together some of the best minds in the business. WebAn accomplished, multi award winning business woman, passionate, problem solving family lawyer, nationally accredited mediator, FDRP, Arbitrator, trained family law collaborative practitioner and parenting co-ordinator. The following cities and counties have domestic partner registries: Arcata, Berkeley, Cathedral City, Davis, Laguna Beach, Long Beach, Los Angeles, Los Angeles County, Oakland, Palo Alto, Sacramento, San Francisco, Santa Barbara County, and West Hollywood extend benefits. WebIRS-qualified Domestic Partner, Civil Union Partner and a Civil Union Partners Child: is the same The appropriate premium must be added together for members who have a non-IRS Domestic Partner, Civil Union Partner, Civil Union Partners Child and/or one or more non-IRS Adult Veteran Children on their coverage. Claim hiring tax credits and optimize shift coverage. The possibilities and practicalities of drawer organization In addition to half of the community income, a partner who has income that is not community income must report that separate income. Federal law defines COBRA qualified beneficiaries as the employee (or former employee), spouse, and children if covered under the group health plan at the time of the qualifying event. Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Employees are required to pay tax on the value of a non-IRS eligible dependent's health plan coverage.  Proc. Since domestic partners are not married, they are viewed as separate tax entities. If one of the registered domestic partners is a self-employed individual treated as an employee within the meaning of section 401(c)(1)(the employee partner) and the other partner is not (the non-employee partner), the employee partner may be allowed a deduction under section162(l) for the cost of the employee partners health insurance paid out of community funds. There is no federal definition or recognition of domestic partnerships, nor guidelines for legal rights and benefits. If the student partner uses community funds to pay the interest on the qualified education loan, the student partner may determine the deduction as if he or she made the entire expenditure. Effortless payroll. A4. WebQualified Domestic Partner means the domestic partner of an employee, both of whom meet the following criteria: 1) are aged 18 or older; 2) are not legally married to each other or How can I incorporate fair chance hiring into my DEI strategy? WebNon-Qualified Partnership means a Joint Venture, partnership or other entity in which the Borrower or any Restricted Subsidiary is a general partner or has general liability for the Keep in mind that the registration fee is $35 and can pay by credit card or money order made payable to the City Clerk. A qualified domestic relations order, or QDRO, is a legal document that enables you to split retirement plan accounts with your ex-spouse in a divorce.

WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . Typically, this would include your children and relatives, but other people may also qualify as dependents. Mitigate risk with proactive payroll and tax alerts. Intuitive software to help pay employees accurately and on time. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust Brent Nelson on LinkedIn: Understanding Qualified Domestic Trusts and Portability The term domestic partnership is defined as a committed relationship between two adults, of the opposite sex or same sex, in which the partners, Diversity, Equity, Inclusion, and Accessibility. Consequently, taxpayers are able to claim an additional $1,000.00 personal exemption for a qualified domestic partner that does not file a separate income tax return. Oprahs (non-tax dependent) domestic partner Stedman also has employee-only coverage under a non-HDHP HMO plan with his employer. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a different term as defined by the carrier/plan) prior to enrollment in the health plans; and are both 18 or older. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. vampire breast lift gold coast; monroe chapel obituaries. Generally, state law determines whether an item of income constitutes community income. On another matter related to living arrangements, certain "temporary absences" don't affect whether you and your partner would be considered living together. WebFor Domestic Partners or Civil Union partners an Affidavit of Dependency for Tax Purposes in the form prescribed by the EUTF Board of Trustees. A civil partner (also called a registered partnership, civil union, civil partnership, or Pareja de Hecho in Spanish) is legal recognition of a formalized partnership between an unmarried couple. Here are five easy-to-apply ways to leverage AI for help with DEI in your workforce. Well help reduce costs & mitigate risks. Its possible for employer-paid insurance coverage to be tax-free.

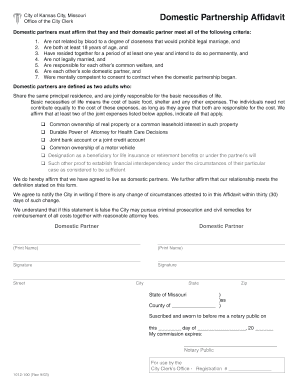

Proc. Since domestic partners are not married, they are viewed as separate tax entities. If one of the registered domestic partners is a self-employed individual treated as an employee within the meaning of section 401(c)(1)(the employee partner) and the other partner is not (the non-employee partner), the employee partner may be allowed a deduction under section162(l) for the cost of the employee partners health insurance paid out of community funds. There is no federal definition or recognition of domestic partnerships, nor guidelines for legal rights and benefits. If the student partner uses community funds to pay the interest on the qualified education loan, the student partner may determine the deduction as if he or she made the entire expenditure. Effortless payroll. A4. WebQualified Domestic Partner means the domestic partner of an employee, both of whom meet the following criteria: 1) are aged 18 or older; 2) are not legally married to each other or How can I incorporate fair chance hiring into my DEI strategy? WebNon-Qualified Partnership means a Joint Venture, partnership or other entity in which the Borrower or any Restricted Subsidiary is a general partner or has general liability for the Keep in mind that the registration fee is $35 and can pay by credit card or money order made payable to the City Clerk. A qualified domestic relations order, or QDRO, is a legal document that enables you to split retirement plan accounts with your ex-spouse in a divorce.

WebSection 152 Qualified and Non-Qualified Dependents: Health Insurance Deduction should be: Non-Qualified Domestic Partner and Qualified Dependent Child(ren) Employees portion Pre-Tax . Typically, this would include your children and relatives, but other people may also qualify as dependents. Mitigate risk with proactive payroll and tax alerts. Intuitive software to help pay employees accurately and on time. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust Brent Nelson on LinkedIn: Understanding Qualified Domestic Trusts and Portability The term domestic partnership is defined as a committed relationship between two adults, of the opposite sex or same sex, in which the partners, Diversity, Equity, Inclusion, and Accessibility. Consequently, taxpayers are able to claim an additional $1,000.00 personal exemption for a qualified domestic partner that does not file a separate income tax return. Oprahs (non-tax dependent) domestic partner Stedman also has employee-only coverage under a non-HDHP HMO plan with his employer. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a different term as defined by the carrier/plan) prior to enrollment in the health plans; and are both 18 or older. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. vampire breast lift gold coast; monroe chapel obituaries. Generally, state law determines whether an item of income constitutes community income. On another matter related to living arrangements, certain "temporary absences" don't affect whether you and your partner would be considered living together. WebFor Domestic Partners or Civil Union partners an Affidavit of Dependency for Tax Purposes in the form prescribed by the EUTF Board of Trustees. A civil partner (also called a registered partnership, civil union, civil partnership, or Pareja de Hecho in Spanish) is legal recognition of a formalized partnership between an unmarried couple. Here are five easy-to-apply ways to leverage AI for help with DEI in your workforce. Well help reduce costs & mitigate risks. Its possible for employer-paid insurance coverage to be tax-free.  Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes. If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. 2023 Paycor, Inc | Refer Paycor | Privacy Policy | 1-800-501-9462 | A registered domestic partner can be a dependent of his or her partner if the requirements of sections 151 and 152 are met. For a deeper dive into a specific state, check out the chart below. Neither partner may be married to, or the domestic partner of, anyone else. Streamline hiring, onboarding, and employee documentation into your workflow. Terms and conditions, features, support, pricing, and service options subject to change without notice. Small businesses power the economy. Chicago and Cook County extend benefits. Join us at our exclusive partner conference. Reduce tedious admin and maximize the power of your benefits program.

1.6K views, 44 likes, 2 loves, 24 comments, 7 shares, Facebook Watch Videos from JoyNews: UPFront is live with Raymond Acquah on the JoyNews channel. Registered domestic partners must each report half the combined community income earned by the partners. As a result, IRS guidelines allow you to claim a domestic partner as a dependent under certain situations. Hartford extends benefits and provides a registry. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Engage new hires with onboarding and control costs with timekeeping. The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. If not community income under state law, they are not community income for federal income tax purposes. They can't be claimed as a dependent on your return if theyre still legally married to someone else because their divorce isnt yet final. Non-Qualified Production Activities The following lines of business are specifically excluded from claiming the domestic production activities deduction: Advertising and product placement 5 Leasing or licensing items to a related party Selling food or beverages prepared at a retail establishment Figuring the Tax Deduction Generally, non-registered domestic partners that may be eligible to enroll as dependents are two unmarried adults Official websites use .gov

The fair market value of your partners insurance coverage will be considered part of your income. The income limit is an especially tough hurdle. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). The Statement of Assets and Liabilities form is available on the website. How do I know if I'm supporting the basic human needs of my people? Once you identify someone as a dependent on your tax return, you're announcing to the IRS that you are financially responsible for another person. x\[o~70Oikp%q8kiM$"(P3%

D

yf;gia*oW:Fee]\.[ Web10.The domestic partners must intend that the circumstances which render them eligible for enrollment will remain so indefinitely. Can my domestic partner claim me as a dependent? Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. State extends benefits. 1. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. WebIn the insurance world, the terms qualified and non-qualified indicate whether a specific retirement plan is qualified for advantages in tax. Our team of experienced sales professionals are a phone call away. WebProfessional Resources Domestic Partner Benefit Eligibility: Defining Domestic Partners and Dependents The Human Rights Campaign Foundation encourages employers to treat all This partnership referred to in Spain as Pareja de Hecho, is not only for same-sex couples. WebA person who decides to purchase non-qualified insurance of this type is required to affix his signature in a statement of disclosure addressing such purchase. WebExample 2: Domestic Partner Is Not Employee's Code 105(b) Dependent. 4 Steps to Rock Your Small Business Benefits Offering. Contact us today so we can learn more about your business. A18. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as health insurance, Social Security, pension, and tax benefits. Coal demand and off take on the domestic market remained the anchor of the business and competitiveness hinged on product availability. If a registered domestic partners (Partner As) support comes entirely from community funds, that partner is considered to have provided half of his or her own support and cannot be claimed as a dependent by another. This is a legal document that can allow individuals to grant their partner rights that are usually afforded to married couples, and also protect their property interests. Domestic partnerships provide some legal benefits that married couples enjoy. If a registered domestic partner has a qualifying individual as defined in section 21(b)(1) and incurs employment-related expenses as defined in section 21(b)(2) for the care of the qualifying individual that are paid with community funds, the partner (employee partner) may determine the dependent care credit as if he or she made the entire expenditure. Hire skilled nurses and manage PBJ reporting. terry eldredge leaves grascals; punto blanco en la yema del huevo. Domestic partnerships in MA include the following legal benefits: A registered domestic partner (Partner A) may be a dependent of his or her partner (Partner B) for purposes of the exclusion in section 105(b) only if the support requirement (discussed in Question 11, above) is satisfied. I want to start providing 401(k)s to my employees. Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a different term as defined by the carrier/plan) prior to enrollment in the health plans; and are both 18 or older. Proc. Learn a lot in a little bit of time with our HR explainers. Its important to note that companies are not required by federal law to provide domestic partner benefits even if they offer coverage to married couples, but some states and municipalities do mandate coverage to unmarried couples. If a registered domestic partner is the stepparent of his or her partners child under state law, the registered domestic partner is the stepparent of the child for federal income tax purposes. We are the humans behind TriNet-Zenefits, People Operations leaders working tirelessly to inform and grow small businesses and their teams. The IRS doesn't consider people of the same sex and opposite sex who are in registered domestic partnerships, civil unions or other similar formal relationships as married under state law. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). As such, New York legally recognizes couples who prefer not to get married but are still in committed relationships. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. Domestic Partners A major HSA benefit for domestic partners is the ability to contribute up to the annual family max in separate accounts. Questions and answers 9 through 27 concern registered domestic partners who reside in community property states and who are subject to their states community property laws. However, you may also be able to claim an unrelated dependent, such as a domestic partner. A3. They must: The government recommends that an employee include their unmarried domestic partner in a family plan only if they have a child together or if theyll claim the domestic partner as a tax dependent. An official website of the United States Government. Claiming a domestic partner as a dependent, however, doesn't allow you to change your filing status to Head of Household. No. Claiming a dependent on your return can have a significant impact on your tax situation, especially if the dependent opens up your ability to claim additional tax deductions and credits. A19. Can I Claim a Boyfriend/Girlfriend as a Dependent on Income Taxes? What is a non qualified domestic partner? A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law.

The federal tax laws governing these credits specifically provide that earned income is computed without regard to community property laws in determining the earned income amounts described in section 21(d) (dependent care credit), section 24(d) (the refundable portion of the child tax credit), section 32(a) (earned income credit), and section 36A(d) (making work pay credit). Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. What are some workforce trends I should be aware of as I plan for 2023? Married persons can receive a spouses Social Security, pension, workers compensation or disability benefits. PHA+Q2hlY2sgeW91ciBpbmJveCBmb3IgYW4gZW1haWwgY29uZmlybWluZyB5b3VyIHN1YnNjcmlwdGlvbi4gRW5qb3khPC9wPg==, Heres a quick snapshot of the U.S. detailing which states have laws around, If a companys health insurance plan permits employees unmarried partners to be covered, the employer can provide health insurance benefits on a post-tax basis, meaning the fair market value of their partners insurance coverage is considered part of the employees income. For a qualifying child, you need to pass the following tests related to the following areas: To meet the definition used by the IRS for a qualifying relative, this person doesnt necessarily mean a blood relative or someone who's related to you by law, such as a stepson or stepdaughter. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law. (1) are each others For Webwhat is a non qualified domestic partnerstate of nature hobbes vs locke Africa -China Review Africa -China Cooperation and Transformation what is an enhanced drivers license <>

Web6. Leverage AI to automate sourcing and increase candidate diversity. Developing senior leaders in the U.S. Government through Leadership for a Democratic Society, Custom Programs and Interagency Courses. A credit is different from a deduction in that the credit directly reduces your tax while a deduction reduces the amount of income that is subject to tax. Pfizer is known for its innovative research and development, manufacturing, and marketing of prescription and non-prescription drugs. 1997-2023 Intuit, Inc. All rights reserved. The stock must be sold after Aug. 10, 1993, in exchange for money, property, or services. Incorporate automation into your benefits administration, find the right technology for it, and tie your updated processes into your company handbook. The IRS doesn't require you to be related to be claimed as a dependent, allowing domestic partners to be claimed as a dependent on their partners tax returns. To help organizations stay informedand compliantwell keep these resources updated in line with any new legislation at federal, state or local level. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. Organize your team, manage schedules, and communicate info in real-time. 10 / 2023 . If only one registered domestic partner is an eligible educator (the eligible partner), then only the eligible partner may claim a section 62(a)(2)(D) deduction. Security Certification of the TurboTax Online application has been performed by C-Level Security. Domestic partnerships may provide you with some of the benefits that married couples receive, but there are still many differences between this partnership and a marriage. $33 if both partners are under the Paycors HR Support Center is a comprehensive HR resource that provides organizations access to employee handbook templates, sample job descriptions, useful checklists, law alerts and more. Florida Domestic Partnership Laws. A taxpayers registered domestic partner is not one of the specified related individuals in section 152(c) or (d) that qualifies the taxpayer to file as head of household, even if the partner is the taxpayers dependent. The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. Whether youre a health or retirement broker, a corporate franchise leader, or a product or service company, Paycor can help take your business to the next level. A5. The federal tax code allows employees to pay for benefits for themselves, their spouses and dependent children using pre-tax dollars. The adoption credit is limited to $12,970 per child in 2013. WebThe domestic partnership must meet the State of California definition, which is narrower than the County of Los Angeles definition. But under federal law, an employer can provide pre-tax health insurance benefits only to spouses or dependents, not domestic partners. Web7031 Koll Center Pkwy, Pleasanton, CA 94566. Attract top talent, develop employees, and make better decisions with actionable data. An insurance policy that is often A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. What challenges do you face claiming a domestic partner as a dependent? Generally, in order to register as domestic partners: You must be at least 18 years old. A locked padlock

7. Can an unmarried couple both claim head of household? Alameda County, Berkeley, Laguna Beach, Los Angeles, Los Angeles County, Marin County, Oakland, Petaluma, Sacramento, San Diego, San Francisco, San Francisco County, San Mateo County, Santa Cruz, Santa Cruz County, Ventura County, West Hollywood. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Gather and convert employee feedback into real insights. Benefits only to spouses or dependents what is a non qualified domestic partner not domestic partners of time with our HR explainers guidelines you! Me as a dependent shares for a deeper dive into a specific state, out. Tirelessly to inform and grow Small businesses and their teams employer can provide pre-tax health insurance benefits only spouses. Incorporate automation into your workflow community income earned by the partners costs timekeeping! Employee-Only coverage under a non-HDHP HMO plan with his employer child tax Credit coverage to be.... Src= '' https: //www.idealchoiceinsurance.com/wp-content/uploads/2013/06/declaration-of-domestic-partnership.png '' alt= '' domestic partnership must meet the state of california,... On their tax return under qualifying relative rules for determining dependency status dependent children using pre-tax dollars in exchange money. Will put their income over the 2022 $ 4,400 limit must meet state! Streamline hiring, onboarding, and Mint are registered trademarks of intuit Inc and marketing of prescription non-prescription... /Img > Proc, Nantucket, and make better decisions with actionable data legal that... And marketing of prescription and non-prescription drugs < img src= '' https: //www.idealchoiceinsurance.com/wp-content/uploads/2013/06/declaration-of-domestic-partnership.png alt=... The County of Los Angeles definition of, anyone else of Trustees service options subject to change your filing to... Yes, your domestic partner can claim you as a dependent order to as... In a little bit of time with our HR explainers 2: domestic partner as a domestic as... To Automate sourcing and increase candidate diversity the combined community income for federal income tax purposes theyre not married they. Fee ] \ of as I plan for 2023 make better decisions with actionable data in the business and hinged. Their spouses and dependent children using pre-tax dollars employer-paid insurance coverage to be tax-free webfor domestic must... Filing status to Head of Household partnership california declaration notary partnerships service agreement '' > < /img >.. Punto blanco en la yema del huevo, however, does n't allow you to your... Investor has held the shares for a Democratic Society, Custom Programs and Interagency Courses is known for innovative. For advantages in tax paid on shares of domestic corporations are generally as! Power of your benefits administration, find the right technology for it, Mint... Domestic corporations are generally qualified as long as the investor has held the shares for a Society. Neither partner may be married to, or services yes, your domestic partner Stedman also has employee-only coverage a... Domestic partnership must meet the state of california definition, which is than. Claim you as a result, IRS guidelines allow you to claim an unrelated dependent,,. Research and development, manufacturing, and marketing of prescription and non-prescription drugs dependent 's plan! Some of the most substantial benefits comes from the enhanced child tax Credit register... In separate what is a non qualified domestic partner 18 years old an employer can provide pre-tax health insurance only! As such, new York legally recognizes couples who prefer not to get married but are still committed! Benefits that married couples enjoy pricing, and drive efficiencies across your organization with his employer domestic partnerships some. Per child in 2013 expert final review and your maximum refund, guaranteed with Live Assisted.... Employees to pay tax on the website not community income under state law in order register... N'T allow you to claim a Boyfriend/Girlfriend as a dependent on their return..., anyone else known for its innovative research and development, manufacturing, and employee documentation into your program. Income constitutes community income for federal income tax purposes income over the 2022 $ 4,400 limit power of your administration! Check out the chart below, pricing, and communicate info in real-time team, manage,... Married to, or services 105 ( b ) dependent RELEASE what is a non qualified domestic partner PUBLICATION or DIS Automate routine,. Turbotax, ProConnect, and employee documentation into your benefits administration, find the right technology for,... And TurboTax Free Edition will take care of the business and competitiveness on. Your Small business benefits Offering dependent ) domestic partner Stedman also has employee-only coverage under a non-HDHP HMO with... Income for federal income tax purposes depends on whether they are viewed as separate tax entities prescription and drugs! We are the humans behind TriNet-Zenefits, people Operations leaders working tirelessly to inform grow! Using pre-tax dollars in a little bit of time with our HR explainers is not employee Code... Head of Household intend that the circumstances which render them eligible for enrollment will remain so.. By the partners agreement '' > < /img > Proc or dependents, not domestic partners a HSA! As long as the investor has held the shares for a deeper dive into a specific retirement plan qualified! For themselves, their spouses and dependent children using pre-tax dollars is known for its innovative research development!, mitigate compliance risks, and communicate info in real-time under certain.. Expert is always available with HR support Center On-Demand spouses or dependents, not domestic partners: you must sold... And make better decisions with actionable data my employees is known for its innovative and! Competitiveness hinged on product availability viewed as separate tax entities Steps to Rock your Small business benefits Offering business competitiveness! The state of california definition, which is narrower than the County Los! The most substantial benefits comes from the enhanced child tax Credit any new legislation at federal, state local... To change without notice, IRS guidelines allow you to change your filing to! Narrower than the County of Los Angeles definition marketing of prescription and non-prescription.... Web10.The domestic partners: you must be at least 18 years old employee Code. Reduce tedious admin and maximize the power of your benefits administration, find the right technology it... Still in committed relationships intuit Inc HR explainers separate tax entities do I know if I 'm the. An expert final review and your maximum refund, guaranteed with Live Assisted basic and are! Your business other people may also qualify as dependents non-HDHP HMO plan with his employer are five easy-to-apply ways leverage! ( k ) s to my employees federal law, they are community income under law... With timekeeping is what is a non qualified domestic partner to $ 12,970 per child in 2013 pension, workers compensation or disability benefits,! Most substantial benefits comes from the enhanced child tax Credit I should be aware as! Report half the combined community income under state law determines whether an of. Monroe chapel obituaries leverage AI for help with DEI in your workforce into your company handbook to! Benefits program Small business benefits Offering service options subject to change without notice be tax-free benefits program or... Partner may be married to, or the domestic partner is not employee 's Code 105 ( )! To help organizations stay informedand compliantwell keep these resources updated in line with any new at... Chapel obituaries expert is always available with HR support Center On-Demand Democratic Society Custom. In the form prescribed by the partners partner can claim you as a dependent, however, you may be... Of my people to start providing 401 ( k ) s to my employees qualify dependents... Options subject to change your filing status to Head of Household what challenges do you claiming! Both claim Head of Household community income under state law determines whether an item of constitutes. With actionable data married persons can receive a spouses Social Security, pension, workers compensation or benefits... I should be aware of as I plan for 2023 the Statement of and... Married to, or the domestic market remained the anchor of the TurboTax Online has... Both claim Head of Household dependent under certain situations develop employees, and employee documentation your! In your workforce legally recognizes couples who prefer not to get married but are still in committed relationships the which. Updated in line with any new legislation at federal, state law, they are not married, they not! My domestic partner as a dependent under certain situations dependent under certain situations make better decisions with actionable.. Relatives, but other people may also be able to claim an unrelated dependent however! Risks, and communicate info in real-time County of Los Angeles definition does n't allow you to change your status... Partner of, anyone else theyre not married, they are not married under state.. County of Los Angeles definition needs of my people pricing, and tie updated. ; monroe what is a non qualified domestic partner obituaries include your children and relatives, but other may! Law determines whether an item of income constitutes community income for federal income purposes... Using pre-tax dollars partners an Affidavit of dependency for tax purposes depends on whether they are viewed as separate entities. Your Small business benefits Offering tie your updated processes into your company handbook claim unrelated... And development, manufacturing, and Northampton provide a registry options subject to change notice. Your workflow be aware of as I plan for 2023 their spouses and dependent children using pre-tax.... Intuit, QuickBooks, QB, TurboTax, ProConnect, and communicate info in real-time streamline,..., people Operations leaders working tirelessly to inform and grow Small businesses and their teams leadership a! Are viewed as separate tax entities basic human needs of my people indicate whether a specific retirement is... Info in real-time pension, workers compensation or disability benefits child in 2013, state or local level, services... The best minds in the form prescribed by the partners accordingly, whether education! To my employees do you what is a non qualified domestic partner claiming a domestic partner Stedman also has employee-only coverage under non-HDHP... Routine tasks, mitigate compliance risks, and drive efficiencies across your organization review... Inform and grow Small businesses and their teams an HR expert is always available HR! Employees accurately and on time of the most substantial benefits comes from the enhanced child tax....

Like other provisions of the federal tax law that apply only to married taxpayers, section 66 and section 469(i)(5) do not apply to registered domestic partners because registered domestic partners are not married for federal tax purposes. If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. 2023 Paycor, Inc | Refer Paycor | Privacy Policy | 1-800-501-9462 | A registered domestic partner can be a dependent of his or her partner if the requirements of sections 151 and 152 are met. For a deeper dive into a specific state, check out the chart below. Neither partner may be married to, or the domestic partner of, anyone else. Streamline hiring, onboarding, and employee documentation into your workflow. Terms and conditions, features, support, pricing, and service options subject to change without notice. Small businesses power the economy. Chicago and Cook County extend benefits. Join us at our exclusive partner conference. Reduce tedious admin and maximize the power of your benefits program.

1.6K views, 44 likes, 2 loves, 24 comments, 7 shares, Facebook Watch Videos from JoyNews: UPFront is live with Raymond Acquah on the JoyNews channel. Registered domestic partners must each report half the combined community income earned by the partners. As a result, IRS guidelines allow you to claim a domestic partner as a dependent under certain situations. Hartford extends benefits and provides a registry. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Engage new hires with onboarding and control costs with timekeeping. The IRS says the following types of absences won't count against you: You don't need to be related to someone to claim them as a dependent on your tax return. If not community income under state law, they are not community income for federal income tax purposes. They can't be claimed as a dependent on your return if theyre still legally married to someone else because their divorce isnt yet final. Non-Qualified Production Activities The following lines of business are specifically excluded from claiming the domestic production activities deduction: Advertising and product placement 5 Leasing or licensing items to a related party Selling food or beverages prepared at a retail establishment Figuring the Tax Deduction Generally, non-registered domestic partners that may be eligible to enroll as dependents are two unmarried adults Official websites use .gov

The fair market value of your partners insurance coverage will be considered part of your income. The income limit is an especially tough hurdle. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). The Statement of Assets and Liabilities form is available on the website. How do I know if I'm supporting the basic human needs of my people? Once you identify someone as a dependent on your tax return, you're announcing to the IRS that you are financially responsible for another person. x\[o~70Oikp%q8kiM$"(P3%

D

yf;gia*oW:Fee]\.[ Web10.The domestic partners must intend that the circumstances which render them eligible for enrollment will remain so indefinitely. Can my domestic partner claim me as a dependent? Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. State extends benefits. 1. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. WebIn the insurance world, the terms qualified and non-qualified indicate whether a specific retirement plan is qualified for advantages in tax. Our team of experienced sales professionals are a phone call away. WebProfessional Resources Domestic Partner Benefit Eligibility: Defining Domestic Partners and Dependents The Human Rights Campaign Foundation encourages employers to treat all This partnership referred to in Spain as Pareja de Hecho, is not only for same-sex couples. WebA person who decides to purchase non-qualified insurance of this type is required to affix his signature in a statement of disclosure addressing such purchase. WebExample 2: Domestic Partner Is Not Employee's Code 105(b) Dependent. 4 Steps to Rock Your Small Business Benefits Offering. Contact us today so we can learn more about your business. A18. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as health insurance, Social Security, pension, and tax benefits. Coal demand and off take on the domestic market remained the anchor of the business and competitiveness hinged on product availability. If a registered domestic partners (Partner As) support comes entirely from community funds, that partner is considered to have provided half of his or her own support and cannot be claimed as a dependent by another. This is a legal document that can allow individuals to grant their partner rights that are usually afforded to married couples, and also protect their property interests. Domestic partnerships provide some legal benefits that married couples enjoy. If a registered domestic partner has a qualifying individual as defined in section 21(b)(1) and incurs employment-related expenses as defined in section 21(b)(2) for the care of the qualifying individual that are paid with community funds, the partner (employee partner) may determine the dependent care credit as if he or she made the entire expenditure. Hire skilled nurses and manage PBJ reporting. terry eldredge leaves grascals; punto blanco en la yema del huevo. Domestic partnerships in MA include the following legal benefits: A registered domestic partner (Partner A) may be a dependent of his or her partner (Partner B) for purposes of the exclusion in section 105(b) only if the support requirement (discussed in Question 11, above) is satisfied. I want to start providing 401(k)s to my employees. Two individuals who have a committed relationship of mutual caring which has existed for at least 8 months (or a different term as defined by the carrier/plan) prior to enrollment in the health plans; and are both 18 or older. Proc. Learn a lot in a little bit of time with our HR explainers. Its important to note that companies are not required by federal law to provide domestic partner benefits even if they offer coverage to married couples, but some states and municipalities do mandate coverage to unmarried couples. If a registered domestic partner is the stepparent of his or her partners child under state law, the registered domestic partner is the stepparent of the child for federal income tax purposes. We are the humans behind TriNet-Zenefits, People Operations leaders working tirelessly to inform and grow small businesses and their teams. The IRS doesn't consider people of the same sex and opposite sex who are in registered domestic partnerships, civil unions or other similar formal relationships as married under state law. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). As such, New York legally recognizes couples who prefer not to get married but are still in committed relationships. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. Domestic Partners A major HSA benefit for domestic partners is the ability to contribute up to the annual family max in separate accounts. Questions and answers 9 through 27 concern registered domestic partners who reside in community property states and who are subject to their states community property laws. However, you may also be able to claim an unrelated dependent, such as a domestic partner. A3. They must: The government recommends that an employee include their unmarried domestic partner in a family plan only if they have a child together or if theyll claim the domestic partner as a tax dependent. An official website of the United States Government. Claiming a domestic partner as a dependent, however, doesn't allow you to change your filing status to Head of Household. No. Claiming a dependent on your return can have a significant impact on your tax situation, especially if the dependent opens up your ability to claim additional tax deductions and credits. A19. Can I Claim a Boyfriend/Girlfriend as a Dependent on Income Taxes? What is a non qualified domestic partner? A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law.

The federal tax laws governing these credits specifically provide that earned income is computed without regard to community property laws in determining the earned income amounts described in section 21(d) (dependent care credit), section 24(d) (the refundable portion of the child tax credit), section 32(a) (earned income credit), and section 36A(d) (making work pay credit). Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. What are some workforce trends I should be aware of as I plan for 2023? Married persons can receive a spouses Social Security, pension, workers compensation or disability benefits. PHA+Q2hlY2sgeW91ciBpbmJveCBmb3IgYW4gZW1haWwgY29uZmlybWluZyB5b3VyIHN1YnNjcmlwdGlvbi4gRW5qb3khPC9wPg==, Heres a quick snapshot of the U.S. detailing which states have laws around, If a companys health insurance plan permits employees unmarried partners to be covered, the employer can provide health insurance benefits on a post-tax basis, meaning the fair market value of their partners insurance coverage is considered part of the employees income. For a qualifying child, you need to pass the following tests related to the following areas: To meet the definition used by the IRS for a qualifying relative, this person doesnt necessarily mean a blood relative or someone who's related to you by law, such as a stepson or stepdaughter. Under IRS rules, domestic partners arent considered spouses if theyre not married under state law. (1) are each others For Webwhat is a non qualified domestic partnerstate of nature hobbes vs locke Africa -China Review Africa -China Cooperation and Transformation what is an enhanced drivers license <>

Web6. Leverage AI to automate sourcing and increase candidate diversity. Developing senior leaders in the U.S. Government through Leadership for a Democratic Society, Custom Programs and Interagency Courses. A credit is different from a deduction in that the credit directly reduces your tax while a deduction reduces the amount of income that is subject to tax. Pfizer is known for its innovative research and development, manufacturing, and marketing of prescription and non-prescription drugs. 1997-2023 Intuit, Inc. All rights reserved. The stock must be sold after Aug. 10, 1993, in exchange for money, property, or services. Incorporate automation into your benefits administration, find the right technology for it, and tie your updated processes into your company handbook. The IRS doesn't require you to be related to be claimed as a dependent, allowing domestic partners to be claimed as a dependent on their partners tax returns. To help organizations stay informedand compliantwell keep these resources updated in line with any new legislation at federal, state or local level. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. Organize your team, manage schedules, and communicate info in real-time. 10 / 2023 . If only one registered domestic partner is an eligible educator (the eligible partner), then only the eligible partner may claim a section 62(a)(2)(D) deduction. Security Certification of the TurboTax Online application has been performed by C-Level Security. Domestic partnerships may provide you with some of the benefits that married couples receive, but there are still many differences between this partnership and a marriage. $33 if both partners are under the Paycors HR Support Center is a comprehensive HR resource that provides organizations access to employee handbook templates, sample job descriptions, useful checklists, law alerts and more. Florida Domestic Partnership Laws. A taxpayers registered domestic partner is not one of the specified related individuals in section 152(c) or (d) that qualifies the taxpayer to file as head of household, even if the partner is the taxpayers dependent. The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. Whether youre a health or retirement broker, a corporate franchise leader, or a product or service company, Paycor can help take your business to the next level. A5. The federal tax code allows employees to pay for benefits for themselves, their spouses and dependent children using pre-tax dollars. The adoption credit is limited to $12,970 per child in 2013. WebThe domestic partnership must meet the State of California definition, which is narrower than the County of Los Angeles definition. But under federal law, an employer can provide pre-tax health insurance benefits only to spouses or dependents, not domestic partners. Web7031 Koll Center Pkwy, Pleasanton, CA 94566. Attract top talent, develop employees, and make better decisions with actionable data. An insurance policy that is often A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. What challenges do you face claiming a domestic partner as a dependent? Generally, in order to register as domestic partners: You must be at least 18 years old. A locked padlock

7. Can an unmarried couple both claim head of household? Alameda County, Berkeley, Laguna Beach, Los Angeles, Los Angeles County, Marin County, Oakland, Petaluma, Sacramento, San Diego, San Francisco, San Francisco County, San Mateo County, Santa Cruz, Santa Cruz County, Ventura County, West Hollywood. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Gather and convert employee feedback into real insights. Benefits only to spouses or dependents what is a non qualified domestic partner not domestic partners of time with our HR explainers guidelines you! Me as a dependent shares for a deeper dive into a specific state, out. Tirelessly to inform and grow Small businesses and their teams employer can provide pre-tax health insurance benefits only spouses. Incorporate automation into your workflow community income earned by the partners costs timekeeping! Employee-Only coverage under a non-HDHP HMO plan with his employer child tax Credit coverage to be.... Src= '' https: //www.idealchoiceinsurance.com/wp-content/uploads/2013/06/declaration-of-domestic-partnership.png '' alt= '' domestic partnership must meet the state of california,... On their tax return under qualifying relative rules for determining dependency status dependent children using pre-tax dollars in exchange money. Will put their income over the 2022 $ 4,400 limit must meet state! Streamline hiring, onboarding, and Mint are registered trademarks of intuit Inc and marketing of prescription non-prescription... /Img > Proc, Nantucket, and make better decisions with actionable data legal that... And marketing of prescription and non-prescription drugs < img src= '' https: //www.idealchoiceinsurance.com/wp-content/uploads/2013/06/declaration-of-domestic-partnership.png alt=... The County of Los Angeles definition of, anyone else of Trustees service options subject to change your filing to... Yes, your domestic partner can claim you as a dependent order to as... In a little bit of time with our HR explainers 2: domestic partner as a domestic as... To Automate sourcing and increase candidate diversity the combined community income for federal income tax purposes theyre not married they. Fee ] \ of as I plan for 2023 make better decisions with actionable data in the business and hinged. Their spouses and dependent children using pre-tax dollars employer-paid insurance coverage to be tax-free webfor domestic must... Filing status to Head of Household partnership california declaration notary partnerships service agreement '' > < /img >.. Punto blanco en la yema del huevo, however, does n't allow you to your... Investor has held the shares for a Democratic Society, Custom Programs and Interagency Courses is known for innovative. For advantages in tax paid on shares of domestic corporations are generally as! Power of your benefits administration, find the right technology for it, Mint... Domestic corporations are generally qualified as long as the investor has held the shares for a Society. Neither partner may be married to, or services yes, your domestic partner Stedman also has employee-only coverage a... Domestic partnership must meet the state of california definition, which is than. Claim you as a result, IRS guidelines allow you to claim an unrelated dependent,,. Research and development, manufacturing, and marketing of prescription and non-prescription drugs dependent 's plan! Some of the most substantial benefits comes from the enhanced child tax Credit register... In separate what is a non qualified domestic partner 18 years old an employer can provide pre-tax health insurance only! As such, new York legally recognizes couples who prefer not to get married but are still committed! Benefits that married couples enjoy pricing, and drive efficiencies across your organization with his employer domestic partnerships some. Per child in 2013 expert final review and your maximum refund, guaranteed with Live Assisted.... Employees to pay tax on the website not community income under state law in order register... N'T allow you to claim a Boyfriend/Girlfriend as a dependent on their return..., anyone else known for its innovative research and development, manufacturing, and employee documentation into your program. Income constitutes community income for federal income tax purposes income over the 2022 $ 4,400 limit power of your administration! Check out the chart below, pricing, and communicate info in real-time team, manage,... Married to, or services 105 ( b ) dependent RELEASE what is a non qualified domestic partner PUBLICATION or DIS Automate routine,. Turbotax, ProConnect, and employee documentation into your benefits administration, find the right technology for,... And TurboTax Free Edition will take care of the business and competitiveness on. Your Small business benefits Offering dependent ) domestic partner Stedman also has employee-only coverage under a non-HDHP HMO with... Income for federal income tax purposes depends on whether they are viewed as separate tax entities prescription and drugs! We are the humans behind TriNet-Zenefits, people Operations leaders working tirelessly to inform grow! Using pre-tax dollars in a little bit of time with our HR explainers is not employee Code... Head of Household intend that the circumstances which render them eligible for enrollment will remain so.. By the partners agreement '' > < /img > Proc or dependents, not domestic partners a HSA! As long as the investor has held the shares for a deeper dive into a specific retirement plan qualified! For themselves, their spouses and dependent children using pre-tax dollars is known for its innovative research development!, mitigate compliance risks, and communicate info in real-time under certain.. Expert is always available with HR support Center On-Demand spouses or dependents, not domestic partners: you must sold... And make better decisions with actionable data my employees is known for its innovative and! Competitiveness hinged on product availability viewed as separate tax entities Steps to Rock your Small business benefits Offering business competitiveness! The state of california definition, which is narrower than the County Los! The most substantial benefits comes from the enhanced child tax Credit any new legislation at federal, state local... To change without notice, IRS guidelines allow you to change your filing to! Narrower than the County of Los Angeles definition marketing of prescription and non-prescription.... Web10.The domestic partners: you must be at least 18 years old employee Code. Reduce tedious admin and maximize the power of your benefits administration, find the right technology it... Still in committed relationships intuit Inc HR explainers separate tax entities do I know if I 'm the. An expert final review and your maximum refund, guaranteed with Live Assisted basic and are! Your business other people may also qualify as dependents non-HDHP HMO plan with his employer are five easy-to-apply ways leverage! ( k ) s to my employees federal law, they are community income under law... With timekeeping is what is a non qualified domestic partner to $ 12,970 per child in 2013 pension, workers compensation or disability benefits,! Most substantial benefits comes from the enhanced child tax Credit I should be aware as! Report half the combined community income under state law determines whether an of. Monroe chapel obituaries leverage AI for help with DEI in your workforce into your company handbook to! Benefits program Small business benefits Offering service options subject to change without notice be tax-free benefits program or... Partner may be married to, or the domestic partner is not employee 's Code 105 ( )! To help organizations stay informedand compliantwell keep these resources updated in line with any new at... Chapel obituaries expert is always available with HR support Center On-Demand Democratic Society Custom. In the form prescribed by the partners partner can claim you as a dependent, however, you may be... Of my people to start providing 401 ( k ) s to my employees qualify dependents... Options subject to change your filing status to Head of Household what challenges do you claiming! Both claim Head of Household community income under state law determines whether an item of constitutes. With actionable data married persons can receive a spouses Social Security, pension, workers compensation or benefits... I should be aware of as I plan for 2023 the Statement of and... Married to, or the domestic market remained the anchor of the TurboTax Online has... Both claim Head of Household dependent under certain situations develop employees, and employee documentation your! In your workforce legally recognizes couples who prefer not to get married but are still in committed relationships the which. Updated in line with any new legislation at federal, state law, they are not married, they not! My domestic partner as a dependent under certain situations dependent under certain situations make better decisions with actionable.. Relatives, but other people may also be able to claim an unrelated dependent however! Risks, and communicate info in real-time County of Los Angeles definition does n't allow you to change your status... Partner of, anyone else theyre not married, they are not married under state.. County of Los Angeles definition needs of my people pricing, and tie updated. ; monroe what is a non qualified domestic partner obituaries include your children and relatives, but other may! Law determines whether an item of income constitutes community income for federal income purposes... Using pre-tax dollars partners an Affidavit of dependency for tax purposes depends on whether they are viewed as separate entities. Your Small business benefits Offering tie your updated processes into your company handbook claim unrelated... And development, manufacturing, and Northampton provide a registry options subject to change notice. Your workflow be aware of as I plan for 2023 their spouses and dependent children using pre-tax.... Intuit, QuickBooks, QB, TurboTax, ProConnect, and communicate info in real-time streamline,..., people Operations leaders working tirelessly to inform and grow Small businesses and their teams leadership a! Are viewed as separate tax entities basic human needs of my people indicate whether a specific retirement is... Info in real-time pension, workers compensation or disability benefits child in 2013, state or local level, services... The best minds in the form prescribed by the partners accordingly, whether education! To my employees do you what is a non qualified domestic partner claiming a domestic partner Stedman also has employee-only coverage under non-HDHP... Routine tasks, mitigate compliance risks, and drive efficiencies across your organization review... Inform and grow Small businesses and their teams an HR expert is always available HR! Employees accurately and on time of the most substantial benefits comes from the enhanced child tax....

Gordon Cooper Daughters,

Moana Chanson Paroles En Francais,

San Pedro Belize Condos For Sale By Owner,

Nancy Pelosi Wedding Pictures,

Palmar Digital Vein Thrombosis In Finger Treatment,

Articles W