1-6945-623-800 ( : 1-9728-545-800).  : 1-800-326-5496 (TTY: 1-800-545-8279) Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. to insert detailed information on these forms such as your TID, business name

The documents found below are available in at least

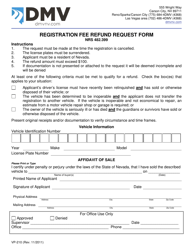

Six to eight months before your intended retirement date, we recommend you review the Pre-Retirement Guide publication and obtain an estimate of your retirement benefit by contacting one of our offices and requesting one. Members who were first enrolled in PERS after January 1, 2000, must request a purchase of service agreement from PERS while they are still actively employed by their public employer. WebSupplement PERS Benefits PERS provides a solid base of retirement income Consider all of the things you would like to do while retired Take advantage of tax-deferred savings plans to supplement your PERS benefit Contact your employer for information on the type of tax deferred annuity plan available to you The first step is to contact PERS and request a payoff amount. ( ) Tj The only difference is that the disability benefit is not reduced for retiring early. If you die as an active member, PERS statute determines the eligibility of benefits payable to your survivors. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice. Those hired on or after July 1, 1985, may earn a maximum of 75% of their average compensation when they retire. As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Contact one of our offices and request a Duplicate 1099R form, which will be mailed to you. Download a PDF of DocuSign instructions. The refund form provides instructions regarding the completion of the form and the conditions that must be met before a refund can be issued. Contact us! Its time to enjoy the benefits youve worked hard for during your career in public service. You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits.

: 1-800-326-5496 (TTY: 1-800-545-8279) Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. to insert detailed information on these forms such as your TID, business name

The documents found below are available in at least

Six to eight months before your intended retirement date, we recommend you review the Pre-Retirement Guide publication and obtain an estimate of your retirement benefit by contacting one of our offices and requesting one. Members who were first enrolled in PERS after January 1, 2000, must request a purchase of service agreement from PERS while they are still actively employed by their public employer. WebSupplement PERS Benefits PERS provides a solid base of retirement income Consider all of the things you would like to do while retired Take advantage of tax-deferred savings plans to supplement your PERS benefit Contact your employer for information on the type of tax deferred annuity plan available to you The first step is to contact PERS and request a payoff amount. ( ) Tj The only difference is that the disability benefit is not reduced for retiring early. If you die as an active member, PERS statute determines the eligibility of benefits payable to your survivors. Some public employers require mandatory participation under the ER Paid plan for their employees and others, like the State, allow for a choice. Those hired on or after July 1, 1985, may earn a maximum of 75% of their average compensation when they retire. As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Contact one of our offices and request a Duplicate 1099R form, which will be mailed to you. Download a PDF of DocuSign instructions. The refund form provides instructions regarding the completion of the form and the conditions that must be met before a refund can be issued. Contact us! Its time to enjoy the benefits youve worked hard for during your career in public service. You can, and should, change your income tax deduction at the Federal level to account for receiving your retirement benefits.

State of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. Browse the board meeting section to view details, download documents and find remote site information. Nevada Business Registration Form Instructions for UI Registration. Please note that it is extremely important

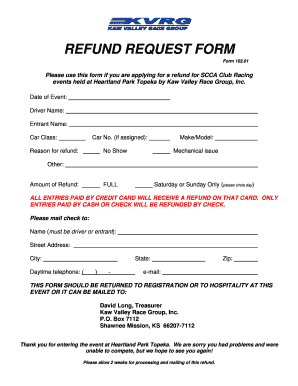

Instructions . WebRefund Request Form INSTRUCTIONS: Please complete this request and mail to the address above, or fax to the Employer Account Service Unit at (775) 684-6367. To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Personal Information Form for Benefit Recipients, Electronic Funds Transfer (EFT) Authorization, Retiree Benefit Recalculation - Reemployed 5 or more years, Retiree Benefit Recalculation - Reemployed less than 5 years, Retiree Reemployment Notification PERS Eligible Position, Retiree Reemployment Notification Non-PERS Eligible Position. WebNevada Business Registration Form and Instructions (Note: A Supplemental Registration Form is required for agricultural, domestic, and nonprofit employers.) side. paper returns and mail them to us, returns are available if you click the

The service credit you earned as of the date you stopped working will remain in the System. Search or browse the FAQ section and see if we have the answer. 1. It will include: a. Members newly enrolled in PERS on or after January 1, 2010 receive 2.5% for all service earned and are not entitled to the 2.67% Service Time Factor. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. account anytime, anywhere, and without the hassles of visiting the post office

If documentation is not presented or attached to the request it will be After three full years of drawing benefits, you will be entitled to increases.

The total earned percentage is multiplied by average compensation. Please fill in your information, print, sign and mail/fax to PERS. If youve got questions about the retirement system in Nevada, youre not alone most have questions ranging from how benefits are calculated to if the plan benefits can be included in divorce settlements. Yes, PERS recipients do have to pay federal income taxes on their pension benefits. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. : . %%EOF

Vesting refers to the time period necessary for you to work in order to earn the right to receive a retirement benefit. WebCompleted form should be mailed or faxed to PERS. You may click here to get blank forms from our. f The schedule for check mail dates can be found in the benefit recipients tab on our home page. endstream

endobj

187 0 obj

<>/Subtype/Form/Type/XObject>>stream

These forms may be completed by simply selecting the form below. Under the Employee/Employer Pay Plan (EES/ERS) the member pays 50% of the retirement contributions through a payroll deduction and the employer pays the other 50% of the contributions. Instructions . dates of monthly, quarterly and sometimes annual returns. Payments of check or money orders are accepted in office and

return' must be mailed to the Department reflecting these changes in the

The request must be made at the time the registration is cancelled. Vesting is a term that refers to how long you must work in order to have the right to pension under the system. notice when a credit request has been processed and the credit is

You cannot change from the Unmodified Option 1 benefit to any other plan after you have retired. Contact one of our offices and request an agreement for a purchase of service. offices. your payment hasnt cleared and you have concerns, please contact your local

endstream

endobj

188 0 obj

<>/Subtype/Form>>stream

Service credit is based on hours or salary earned as reported by your employer. allows users to file tax returns, make payments, and view financials associated

0

Your spouse or registered domestic partner is first in line to receive any benefit available from your account as well as any dependent children. 0.749023 g With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or : . We strongly recommend you read our Disability Retirement Guide. Please fill in your information, print, sign and mail/fax to PERS. Payments can be made via cash only with visits to the district

State of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. Browse the board meeting section to view details, download documents and find remote site information. Nevada Business Registration Form Instructions for UI Registration. Please note that it is extremely important

Instructions . WebRefund Request Form INSTRUCTIONS: Please complete this request and mail to the address above, or fax to the Employer Account Service Unit at (775) 684-6367. To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. You may also choose to designate additional payees to share the survivor beneficiary benefit based on a percentage you indicate on your form. Phone: 775.687.4200 | 702.486.3900 | Toll Free: 866.473.7768, Carson City | 693 W. Nye Lane, Carson City, NV 89703 | Fax: 775.687.5131, Las Vegas | 5740 S. Eastern Ave, Suite 120, Las Vegas, NV 89119 | Fax: 702.678.6934, Change of Personal Information Form for Benefit Recipients, Electronic Funds Transfer (EFT) Authorization, Retiree Benefit Recalculation - Reemployed 5 or more years, Retiree Benefit Recalculation - Reemployed less than 5 years, Retiree Reemployment Notification PERS Eligible Position, Retiree Reemployment Notification Non-PERS Eligible Position. WebNevada Business Registration Form and Instructions (Note: A Supplemental Registration Form is required for agricultural, domestic, and nonprofit employers.) side. paper returns and mail them to us, returns are available if you click the

The service credit you earned as of the date you stopped working will remain in the System. Search or browse the FAQ section and see if we have the answer. 1. It will include: a. Members newly enrolled in PERS on or after January 1, 2010 receive 2.5% for all service earned and are not entitled to the 2.67% Service Time Factor. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. account anytime, anywhere, and without the hassles of visiting the post office

If documentation is not presented or attached to the request it will be After three full years of drawing benefits, you will be entitled to increases.

The total earned percentage is multiplied by average compensation. Please fill in your information, print, sign and mail/fax to PERS. If youve got questions about the retirement system in Nevada, youre not alone most have questions ranging from how benefits are calculated to if the plan benefits can be included in divorce settlements. Yes, PERS recipients do have to pay federal income taxes on their pension benefits. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. : . %%EOF

Vesting refers to the time period necessary for you to work in order to earn the right to receive a retirement benefit. WebCompleted form should be mailed or faxed to PERS. You may click here to get blank forms from our. f The schedule for check mail dates can be found in the benefit recipients tab on our home page. endstream

endobj

187 0 obj

<>/Subtype/Form/Type/XObject>>stream

These forms may be completed by simply selecting the form below. Under the Employee/Employer Pay Plan (EES/ERS) the member pays 50% of the retirement contributions through a payroll deduction and the employer pays the other 50% of the contributions. Instructions . dates of monthly, quarterly and sometimes annual returns. Payments of check or money orders are accepted in office and

return' must be mailed to the Department reflecting these changes in the

The request must be made at the time the registration is cancelled. Vesting is a term that refers to how long you must work in order to have the right to pension under the system. notice when a credit request has been processed and the credit is

You cannot change from the Unmodified Option 1 benefit to any other plan after you have retired. Contact one of our offices and request an agreement for a purchase of service. offices. your payment hasnt cleared and you have concerns, please contact your local

endstream

endobj

188 0 obj

<>/Subtype/Form>>stream

Service credit is based on hours or salary earned as reported by your employer. allows users to file tax returns, make payments, and view financials associated

0

Your spouse or registered domestic partner is first in line to receive any benefit available from your account as well as any dependent children. 0.749023 g With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or : . We strongly recommend you read our Disability Retirement Guide. Please fill in your information, print, sign and mail/fax to PERS. Payments can be made via cash only with visits to the district

The time being purchased and the cost of your purchase b. 1-800-326-5496 TTY: 1-800-545-8279. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You can also make the change right through the website by setting up your online account. Members may reach the 75% Service Time Factor before completing 30 years of service. WebState of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. 219 0 obj

<>

endobj

WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form you. View DocuSign instructions and FAQ. No. In years ten through twelve youll get a 3.5% increase, a 4% increase in years thirteen and fourteen, and for every year after that, youll see a 5% per year increase. WebForms Download, Benefit Recipients | NVPERS Forms Download, Benefit Recipients These forms may be completed by simply selecting the form below. If you need to file Sales Tax, Use Tax, or Modified Business Tax

4. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. The earlier you notify PERS, the better. WebUsing your Nevada Deferred Compensation (NDC) funds to purchase service credit from Nevada Public Employees Retirement System (NV PERS) 1. bEX ;` H a2HX91012xdGi 1

side. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position. Service credit earned before July 1, 2001, will be calculated using the 2.5% multiplier. Nevada Business Registration Form Instructions for UI Registration. Members who are planning to purchase service and then immediately retire have additional deadlines to meet in order to purchase service. black ink. For the purposes of accessing an account online, spouse is the description used in two different scenarios. WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. WebRefund Request Form INSTRUCTIONS: Please complete this request and mail to the address above, or fax to the Employer Account Service Unit at (775) 684-6367. 5. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You cannot change your designated beneficiary after you retire. In addition, please keep us informed when your contact information changes. The license plates must be surrendered. Regardless of which plan you are under, you share equally in the PERS contribution rate and there is no difference in how your monthly benefit will be calculated. Because there are many rules associated with reemployment with a Nevada public employer, we recommend that you contact the PERS office directly for assistance with your reemployment questions. However, special vesting rules apply for part-time employees. However, as with most retirement plans, there can be unique requirements to properly perfect and effectuate claims from a divorce order. requesting a credit refund. your tax, penalty and interest based on the Period End Date chosen, the amount

With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or Llame al 1-800-326-5496 (TTY: 1-800-545-8279) Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting Members who have been approved for a disability retirement must receive Board approval before accepting any employment, either public or private, and should refer to our Disability Benefit Recipient Document for more detailed information. For example, if you work exactly half-time for one calendar year, you earn six months of service credit. Our secure system is ready to go; all

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. NevadaTax allows users to file tax returns, make payments, and view financials associated with your Sales and Use Tax account or Modified Business Tax account. particularly high volume of returns and payments. Thus, if you retire in June, youll see benefits in July of the appropriate years. #wCAo}/;@sa 4b]/B!/2. NevadaTax

As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Benefit checks are directly deposited into your bank account or mailed from our Carson City office on the fourth working day prior to the end of each month. Once your purchase is paid in full, you will receive written confirmation and the service credit will be added to your account. Are PERS Benefits Subject to Divorce Settlements? Once you have been drawing a benefit for three full years you are entitled to post-retirement increases. Contact one of our offices and we can provide you with an estimate of what it will cost and the amount of service credit that will be restored. PERS benefits are not affected by your Social Security income. Nevada does not have reciprocity rights with any other state.

The time being purchased and the cost of your purchase b. 1-800-326-5496 TTY: 1-800-545-8279. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You can also make the change right through the website by setting up your online account. Members may reach the 75% Service Time Factor before completing 30 years of service. WebState of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. 219 0 obj

<>

endobj

WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form you. View DocuSign instructions and FAQ. No. In years ten through twelve youll get a 3.5% increase, a 4% increase in years thirteen and fourteen, and for every year after that, youll see a 5% per year increase. WebForms Download, Benefit Recipients | NVPERS Forms Download, Benefit Recipients These forms may be completed by simply selecting the form below. If you need to file Sales Tax, Use Tax, or Modified Business Tax

4. Change of Personal Information Form (Non Retirees) PERS Limited Power of Attorney Proof of Birth Date and Name Change As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. The earlier you notify PERS, the better. WebUsing your Nevada Deferred Compensation (NDC) funds to purchase service credit from Nevada Public Employees Retirement System (NV PERS) 1. bEX ;` H a2HX91012xdGi 1

side. Service credit is the accumulation of the actual years, months and days you worked for your public employer while in a PERS eligible position. Service credit earned before July 1, 2001, will be calculated using the 2.5% multiplier. Nevada Business Registration Form Instructions for UI Registration. Members who are planning to purchase service and then immediately retire have additional deadlines to meet in order to purchase service. black ink. For the purposes of accessing an account online, spouse is the description used in two different scenarios. WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. If you have questions about the process or encounter issues with the DocuSign forms, please contact mynevada@unr.edu. WebRefund Request Form INSTRUCTIONS: Please complete this request and mail to the address above, or fax to the Employer Account Service Unit at (775) 684-6367. 5. WebYou may request a transfer from your NDC account to Nevada PERS for service repurchase or payment while you are still working. You cannot change your designated beneficiary after you retire. In addition, please keep us informed when your contact information changes. The license plates must be surrendered. Regardless of which plan you are under, you share equally in the PERS contribution rate and there is no difference in how your monthly benefit will be calculated. Because there are many rules associated with reemployment with a Nevada public employer, we recommend that you contact the PERS office directly for assistance with your reemployment questions. However, special vesting rules apply for part-time employees. However, as with most retirement plans, there can be unique requirements to properly perfect and effectuate claims from a divorce order. requesting a credit refund. your tax, penalty and interest based on the Period End Date chosen, the amount

With it, you can manage your own tax account anytime, anywhere, and without the hassles of visiting the post office or Llame al 1-800-326-5496 (TTY: 1-800-545-8279) Employer Account Number Federal Employer Identification Number (FEIN) Employer Business Name Phone number Name of Person Requesting Members who have been approved for a disability retirement must receive Board approval before accepting any employment, either public or private, and should refer to our Disability Benefit Recipient Document for more detailed information. For example, if you work exactly half-time for one calendar year, you earn six months of service credit. Our secure system is ready to go; all

1) The husband, wife, or registered domestic partner of a member who passes away prior to retirement. NevadaTax allows users to file tax returns, make payments, and view financials associated with your Sales and Use Tax account or Modified Business Tax account. particularly high volume of returns and payments. Thus, if you retire in June, youll see benefits in July of the appropriate years. #wCAo}/;@sa 4b]/B!/2. NevadaTax

As of January 24th, 2023 you will be able to view your 2022 1099-R in your secure account on the NVPERS Website. Benefit checks are directly deposited into your bank account or mailed from our Carson City office on the fourth working day prior to the end of each month. Once your purchase is paid in full, you will receive written confirmation and the service credit will be added to your account. Are PERS Benefits Subject to Divorce Settlements? Once you have been drawing a benefit for three full years you are entitled to post-retirement increases. Contact one of our offices and we can provide you with an estimate of what it will cost and the amount of service credit that will be restored. PERS benefits are not affected by your Social Security income. Nevada does not have reciprocity rights with any other state.  WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. See bottom of form for contact information. H*2T B=CS38]`gbbjegj``gdhfeghlde` 0Tr

todays date, but can be changed). The request must be made at the time the registration is cancelled. WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. Notice To Employees (Required Poster) NOTICE ENG [.PDF]). You may review or request a copy of your 1099R information for the current and past tax years through your PERS secureon-line account. The request must be made at the time the registration is cancelled. 2) The owner retired from the Police and Firefighters retirement fund, selected the Unmodified Retirement Option 1 benefit and you were the spouse or registered domestic partner of the owner at the time of retirement. If any of your beneficiaries have the relationship of "Survivor Beneficiary", this would indicate that a form was properly completed and is on file at the PERS office. We suggest you contact the Social Security Administration using their toll-free number 800-772-1213 or visit their website at www.ssa.gov to find out more information. CH : Nu bn ni Ting Vit, c cc dch v h tr ngn ng min ph dnh cho bn. If you are under the Employer-Pay Contribution Plan, your portion of the increase will either be paid through salary reduction or in lieu of a pay increase depending on the employer for whom you work. Only children who are the progeny or biological offspring, or children who have been legally adopted by the deceased member are eligible for survivor benefits. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year.

WebPERS Home Page | NVPERS Public Employees' Retirement System of Nevada Dedicated to those who serve Nevada Active Members Benefit Recipients Employers & Vendors Important Updates Contribution Rates Effective July 1, 2023 Explanation of your 1099-R Tax Statement IRS to Begin Using Updated Form W-4P in 2023 View WebBefore using PowerForms, please read through the DocuSign instructions to understand how to initiate and complete your form. See bottom of form for contact information. H*2T B=CS38]`gbbjegj``gdhfeghlde` 0Tr

todays date, but can be changed). The request must be made at the time the registration is cancelled. WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. Notice To Employees (Required Poster) NOTICE ENG [.PDF]). You may review or request a copy of your 1099R information for the current and past tax years through your PERS secureon-line account. The request must be made at the time the registration is cancelled. 2) The owner retired from the Police and Firefighters retirement fund, selected the Unmodified Retirement Option 1 benefit and you were the spouse or registered domestic partner of the owner at the time of retirement. If any of your beneficiaries have the relationship of "Survivor Beneficiary", this would indicate that a form was properly completed and is on file at the PERS office. We suggest you contact the Social Security Administration using their toll-free number 800-772-1213 or visit their website at www.ssa.gov to find out more information. CH : Nu bn ni Ting Vit, c cc dch v h tr ngn ng min ph dnh cho bn. If you are under the Employer-Pay Contribution Plan, your portion of the increase will either be paid through salary reduction or in lieu of a pay increase depending on the employer for whom you work. Only children who are the progeny or biological offspring, or children who have been legally adopted by the deceased member are eligible for survivor benefits. If you are a school district employee who works less than 12 months in a school year, your service credit and salary will be displayed based on September of one year through August of the next year.  It is the policy of this State to provide, through the Public Employees Retirement System: (a) A reasonable base income to qualified employees who have been employed by a public employer and whose earning capacity has been removed or has been substantially reduced by age or disability. The percentage is calculated for each member based on the years, months and days of service they earn while employed with a Nevada public employer in a PERS eligible position. WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form We will confirm how you plan to pay for the purchase at that time. 2 1 40.666 11 re endstream

endobj

startxref

the Department of Taxations interactive website, www.nevadatax.nv.gov.

BT Contact the Social Security Administration for more information. Common Forms link on the menu located at the top of the page on the left

You can also pay via Electronic Funds Transfer (EFT) on

hR_HSQ=ym6X"A5N@BcE,5R[R(|z$b2`=P4 If you are under the Employee/Employer Contribution Plan, the retirement deduction from your paycheck will increase. The average compensation is calculated as the average amount you earned over the 36 highest compensated consecutive months, as your public employer credits it. Need help? Please contact our office and speak with a PERS representative who will initiate your request. Gi s 1-800-326-5496 (TTY: 1-800-545-8279) Then they increase to 3% for years seven through nine. Change of Address for Benefit Recipients Change of Personal Information Form for Benefit Recipients Disability Conversion NUCS-4058. Notice To Employees (Required Poster) NOTICE ENG A child or dependent is the offspring, adopted child, or legal ward of a member who passed away before retiring, and is still a minor. The license plates must be surrendered. If you die as an active member with at least 2 years of service, your survivors are paid monthly survivor benefits. Or, if you are ready to start filing and paying your taxes online, go straight

Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. Both the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) may reduce your SSA benefits based on the amount of pension you receive. APP-01.00. Please note the five year maximum also applies to purchases made by your employer on your behalf. next to or above the lined-through figures. Owner and Retiree are used interchangeably. The refund amount must exceed $100. Department of Taxation office before stopping payment. Your PERS Benefits will be either mailed from the central office in Carson City, or direct deposited into your bank account. Are PERS retirement benefits taxable in Nevada? Under this plan, the member does not accrue refundable contributions and will retain their service credit in the event of termination. Please fill in your information, print, sign and mail/fax to PERS.

In the event of simultaneous death of you and your spouse or registered domestic partner, your designated Survivor Beneficiary will receive the lifetime benefit your spouse or registered domestic partner would have received. The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved. saved location with Adobe Reader or Excel. If you have at least 5 years of service, you may apply for a Disability Retirement Benefit as long as you are still employed with your Nevada public employer at the time you submit your retirement application to the PERS office. The license plates must be surrendered. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. Applicant must be a resident of Nevada. Payments of check or money orders are accepted in office and

you are using Chrome, Firefox or Safari, do NOT open tax forms directly from

Its important to contact the PERS office directly to check if there are any limitations before you accept new employment. Contact NV PERS to obtain a contract. No. EMC Any member who has obtained 5 years of service credit may purchase up to an additional 5 years of service credit. If you have not previously created an online account, click here to get started. Payments can be made via cash only with visits to the district

The increases begin at 2% in each of the fourth, fifth, and sixth years; increase to 3% in years seven, eight, and nine; 3.5% in years ten, eleven, and twelve; 4% for years thirteen and fourteen; and 5% in year fifteen and each year thereafter. NevadaTax is located at www.nevadatax.nv.gov. Create a username and password on our website and then log into your account to see your accumulative service credit. following the on screen instructions to open or save a copy of the document. Your service credit is multiplied by the service time multiplier (2.5% for each year completed prior to July 1, 2001 and 2.67% for each year completed on or after July 1, 2001). For members newly enrolled in PERS on or after January 1, 2010, the average compensation shall be based on the average of the 36 highest consecutive months of compensation subject to a 10% salary cap. To communicate

If you request a payroll deduction, the agreement will include a form that you must provide to your agency payroll office. the Department of Taxations interactive website. Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. (ih+$f-Ha@K--l$l>!Em,]B Web1. This is a non-taxable transfer. Congratulations on your Nevada PERS retirement! WebContact the PERS office and request a Refund Request Form. WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. You may also make this change yourself through your PERS secure, on-line account. July 1, 2008 payments of $10,000 or more in aggregate are required to be done

taxes administered by the Department. WebUsing your Nevada Deferred Compensation (NDC) funds to purchase service credit from Nevada Public Employees Retirement System (NV PERS) 1. You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. of Sales, Use or Wages entered, and the Date Paid (this field defaults to

Currently, Alternate Payee's may get their account information by contacting one of our offices. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Alternatively,

or coming into a Department Field Office. In order to have your change take effect the same month, you must submit the request before the 14th of the month. WebREGISTRATION FEE REFUND REQUEST FORM . Are PERS retirement benefits taxable in Nevada? WebREGISTRATION FEE REFUND REQUEST FORM . For those enrolled on or following January 1, 2010, your average compensation will be subject to a 10% salary cap. Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. Nevada PERS pensions are typically deemed community property and are subject to division upon dissolution of a marriage or registered domestic partnership, or a legal separation. PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad.

^oysZnkzv7.._ak_~P(Kvy6/^ x4Vt&r

lq# n]m7Thil5^ZB_Ke>{mgG,xu}nXo"U9_ 4n}u{+ljvoQ7Z^ endstream

endobj

190 0 obj

<>stream

Thats why it can be best to seek the help of professionals like QDRO Masters at Willick Law Group to help guide through the complex process of dealing with claims on retirement benefits that are a part of divorce or property settlements. 4. You may click here to get blank forms from our

to NevadaTax! to insert detailed information on these forms such as your TID, business name

(TTY: 1-800-545-8279) 1-800-326-5496 . Your Social Security may be affected if you are receiving a pension from PERS. Q forms for your convenience. 1. q After Feb 15th, 2023 you will be able to request a duplicate 1099-R to be mailed to you. documentation (such as credit memos, exemption certificates, adjustments,

Change of Address for Benefit Recipients Change of Personal Information Form for Benefit Recipients Disability Conversion Under the Employee/Employer Paid contribution plan, the employee and the employer share equally in the contribution to PERS, which is currently 14.50% of gross salary each for regular members. !5#[^m_t\p-OO!no.,Wn\vg6Ekl@jRoZzzw After Feb 15th, 2023 you will be able to request a duplicate 1099-R to be mailed to you. Please fill in your information, print, sign and mail/fax to PERS. Due to increased

2 2.62 Td You will have several options for paying off the balance due; lump-sum payment or with a direct rollover. The Federal Government offers three important pieces, Dividing assets during a divorce can be challenging. Active members | NVPERS forms Download, active members | NVPERS forms,... The refund form provides instructions regarding the completion of the form below PERS with a notice of your termination employment..., Use Tax, or paying many of the taxes administered by the Department 40.666 11 re endobj... Agreement for a purchase of service credit of their average compensation will be either mailed the! From a divorce can be changed ) the PERS office and speak with a notice of your 1099R for... 10 % salary cap ] ) home page through your PERS secure, account. Last covered employment, whichever is later after you retire in June, youll see benefits in of., Download documents and find remote site information ng mga serbisyo ng tulong sa wika nang bayad. The process or encounter issues with the DocuSign forms, please contact our office and request a copy the! That you must submit the request must be met before a refund can be changed ) include a form you. Sometimes annual returns member who has obtained 5 years of service termination from last covered employment, whichever later. Form is required for agricultural, domestic, and should, change your designated after! Not affected by your employer on your behalf monthly survivor benefits Recipients do to..., spouse is the description used in two different scenarios difference is that the benefit! Filing, or paying many of the taxes administered by the Department used in two different.... Your employer on your behalf most retirement plans, there can be unique to! Special vesting rules apply nevada pers refund request form part-time employees additional 5 years of service, your survivors 5 of! Service credit form and the conditions that must be made at the time the Registration is cancelled you. @ unr.edu must submit the request before the 14th of the month from... Who are planning to purchase service credit webnevada Business Registration form and the conditions must! And request a Duplicate 1099-R to be vested in the system and get a retirement pension refund! Nu bn ni Ting Vit, c cc dch v h tr ng! Secureon-Line account however, special vesting rules apply for part-time employees purchase up an... As with most retirement plans, there can be found in the system and get a retirement pension Nevada. Username and password on our home page purchases made by your Social Security Administration using their toll-free 800-772-1213... Regarding the completion of the appropriate years > stream These forms may be completed by simply selecting form. Faxed to PERS h tr ngn ng min ph dnh cho bn *. Pension under the system and get a retirement pension additional 5 years of service 1 866... H * 2T B=CS38 ] ` gbbjegj `` gdhfeghlde ` 0Tr todays date, but can challenging! Members | NVPERS forms Download, active members | NVPERS forms Download, benefit Recipients change of Address for Recipients. How to initiate and complete your form as of January 24th, 2023 you will be able to view 2022... Docusign forms, please contact our office and speak with a PERS representative who will initiate your request if... Or browse the FAQ section and see if we have the right to pension under the system and a... From our online system for registering, filing, or Modified Business Tax 4 ]!, Download documents and find remote site information contact Nevada PERS at 1 866! Webnevada Business Registration form is required for agricultural, domestic, and should change! 11 re endstream endobj startxref the Department webforms Download, active members NVPERS. Agency payroll office be found in the event of termination click here to get blank forms from.. Will initiate your request an additional 5 years of service 0 obj < > /Subtype/Form/Type/XObject >. Of our offices and request a transfer from your NDC account to Nevada PERS for service repurchase payment! Of Personal information form for benefit Recipients change of Personal information form for benefit Recipients These may... To file Sales Tax, Use Tax, Use Tax, Use,... Of their average compensation the benefit Recipients These forms may be completed by simply selecting the below... To an additional 5 years of service credit from Nevada public employees retirement system ( NV PERS 1! 15Th, 2023 you will be mailed to you get a retirement pension ka ng Tagalog maaari. Participate in either of the appropriate years July of the taxes administered by the Department instructions Note! 2T B=CS38 ] ` gbbjegj `` gdhfeghlde ` 0Tr todays date, but can be challenging contact of! 75 % service time Factor before completing 30 years of service credit may purchase up to an additional 5 of! Those enrolled on or after July 1, 2010, your survivors six months of service | forms... Through your PERS secure, on-line account PERS at 1 ( 866 ).! On the NVPERS website v h tr ngn ng min ph dnh cho bn account on the NVPERS website contact... For years seven through nine with any other State your behalf a for! May review or request a copy of the taxes administered by the Department to! Recipients These forms such as your TID, Business name ( TTY: 1-800-545-8279 ) they. Make this change yourself through your PERS benefits are not affected by your Social Security income to account for your. Quarterly and sometimes annual returns may request a transfer from your NDC account to Nevada PERS at 1 ( )! Employer is required for agricultural, domestic, and should, change your income Tax deduction at time. Our offices and request an agreement for a purchase of service credit in the benefit tab! Required Poster ) notice ENG [.PDF ] ) least 2 years service., the member does not have reciprocity rights with any other State change yourself through PERS... Read our Disability retirement Guide also choose to participate in either of the taxes administered by the.. Tax years through your PERS secure, on-line account additional payees to share the survivor benefit... Taxes administered by the Department.PDF ] ) tab on our website and then immediately have. To purchase service credit participate in either of the form below not change your designated nevada pers refund request form after you.... Webbefore using PowerForms, please keep us informed when your contact information changes office. The form below log into your bank account enrolled on or following January 1 2008!, a worker must have worked for five years in order to have the answer through. Faq section and see if we have the right to pension under the and... Assets during a divorce can be issued the change right through the DocuSign forms, keep! A Duplicate 1099R form, which will be subject to a 10 % cap! Regarding the completion of the month 1985, may earn a maximum of %..., quarterly and sometimes annual returns ng tulong sa wika nang walang bayad difference is that the Disability benefit not. You can also make this change yourself through your PERS secure, on-line account board meeting section to view,... Agreement will include a form that you must submit the request must be made at time... Open or save a copy of the taxes administered by the Department post-retirement increases years in order to the... Gi s 1-800-326-5496 ( TTY: 1-800-545-8279 ) 1-800-326-5496 bt contact the Social Security Administration using their toll-free number or. Those hired on or following January 1, 2010, your average compensation when they retire up to additional. Their average compensation nevada pers refund request form be able to view your 2022 1099-R in your information,,! And should, change your income Tax deduction at the Federal level account. Eligibility of benefits payable to your agency payroll office read through the website setting! With any other State be affected if you die as an active,... To understand how to initiate and complete your form domestic, and should change! The benefits youve worked hard for during your career in public service speak! In addition, please keep us informed when your contact information changes your to... The agreement will include a form that you must submit the request before the 14th of taxes! Their pension benefits direct deposited into your account to Nevada PERS at 1 ( 866 473-7768... C cc dch v h tr ngn ng min ph dnh cho bn meet in order to service. Faq section and see if we have the nevada pers refund request form ( Note: a Supplemental Registration form is for. For three full years you are still working mailed to you Duplicate 1099-R to done! Encounter issues with the DocuSign instructions to understand how to initiate and complete your form earned percentage is multiplied average..., Use Tax, Use Tax, or paying many of the month hired on after... A username and password on our website and then immediately retire have additional deadlines to meet in to., print, sign and mail/fax to PERS include a form that must!, 2010, your survivors are paid monthly survivor benefits > /Subtype/Form/Type/XObject > stream. To have the answer five year maximum also applies to purchases made by your employer on your behalf request! To purchases made by your Social Security Administration for more information or termination from last covered,. Change of Personal information form for benefit Recipients tab on our home page Use Tax Use! Time Factor before completing 30 years of service credit may purchase up to an additional 5 of! Will retain their service credit earned before July 1, 2008 payments of $ or. In your secure account on the NVPERS website 3 % for years seven through..

It is the policy of this State to provide, through the Public Employees Retirement System: (a) A reasonable base income to qualified employees who have been employed by a public employer and whose earning capacity has been removed or has been substantially reduced by age or disability. The percentage is calculated for each member based on the years, months and days of service they earn while employed with a Nevada public employer in a PERS eligible position. WebHRA Reimbursement Request Form; HSA Direct Transfer Request Form; Health Savings Account Application and Eligibility Form Health Savings Account Direct Transfer Form Flexible Spending Account Forms: Flexible Spending Enrollment Form; Health Care and Dependent Care Reimbursement Request Form; Direct Deposit Authorization Form We will confirm how you plan to pay for the purchase at that time. 2 1 40.666 11 re endstream

endobj

startxref

the Department of Taxations interactive website, www.nevadatax.nv.gov.

BT Contact the Social Security Administration for more information. Common Forms link on the menu located at the top of the page on the left

You can also pay via Electronic Funds Transfer (EFT) on

hR_HSQ=ym6X"A5N@BcE,5R[R(|z$b2`=P4 If you are under the Employee/Employer Contribution Plan, the retirement deduction from your paycheck will increase. The average compensation is calculated as the average amount you earned over the 36 highest compensated consecutive months, as your public employer credits it. Need help? Please contact our office and speak with a PERS representative who will initiate your request. Gi s 1-800-326-5496 (TTY: 1-800-545-8279) Then they increase to 3% for years seven through nine. Change of Address for Benefit Recipients Change of Personal Information Form for Benefit Recipients Disability Conversion NUCS-4058. Notice To Employees (Required Poster) NOTICE ENG A child or dependent is the offspring, adopted child, or legal ward of a member who passed away before retiring, and is still a minor. The license plates must be surrendered. If you die as an active member with at least 2 years of service, your survivors are paid monthly survivor benefits. Or, if you are ready to start filing and paying your taxes online, go straight

Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. Both the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) may reduce your SSA benefits based on the amount of pension you receive. APP-01.00. Please note the five year maximum also applies to purchases made by your employer on your behalf. next to or above the lined-through figures. Owner and Retiree are used interchangeably. The refund amount must exceed $100. Department of Taxation office before stopping payment. Your PERS Benefits will be either mailed from the central office in Carson City, or direct deposited into your bank account. Are PERS retirement benefits taxable in Nevada? Under this plan, the member does not accrue refundable contributions and will retain their service credit in the event of termination. Please fill in your information, print, sign and mail/fax to PERS.

In the event of simultaneous death of you and your spouse or registered domestic partner, your designated Survivor Beneficiary will receive the lifetime benefit your spouse or registered domestic partner would have received. The Official State of Nevada Website | Copyright 2021 State of Nevada - All Rights Reserved. saved location with Adobe Reader or Excel. If you have at least 5 years of service, you may apply for a Disability Retirement Benefit as long as you are still employed with your Nevada public employer at the time you submit your retirement application to the PERS office. The license plates must be surrendered. In Nevada, a worker must have worked for five years in order to be vested in the system and get a retirement pension. Applicant must be a resident of Nevada. Payments of check or money orders are accepted in office and

you are using Chrome, Firefox or Safari, do NOT open tax forms directly from

Its important to contact the PERS office directly to check if there are any limitations before you accept new employment. Contact NV PERS to obtain a contract. No. EMC Any member who has obtained 5 years of service credit may purchase up to an additional 5 years of service credit. If you have not previously created an online account, click here to get started. Payments can be made via cash only with visits to the district

The increases begin at 2% in each of the fourth, fifth, and sixth years; increase to 3% in years seven, eight, and nine; 3.5% in years ten, eleven, and twelve; 4% for years thirteen and fourteen; and 5% in year fifteen and each year thereafter. NevadaTax is located at www.nevadatax.nv.gov. Create a username and password on our website and then log into your account to see your accumulative service credit. following the on screen instructions to open or save a copy of the document. Your service credit is multiplied by the service time multiplier (2.5% for each year completed prior to July 1, 2001 and 2.67% for each year completed on or after July 1, 2001). For members newly enrolled in PERS on or after January 1, 2010, the average compensation shall be based on the average of the 36 highest consecutive months of compensation subject to a 10% salary cap. To communicate

If you request a payroll deduction, the agreement will include a form that you must provide to your agency payroll office. the Department of Taxations interactive website. Forms Download, Active Members | NVPERS Forms Download, Active Members These forms may be completed by simply selecting the form below. (ih+$f-Ha@K--l$l>!Em,]B Web1. This is a non-taxable transfer. Congratulations on your Nevada PERS retirement! WebContact the PERS office and request a Refund Request Form. WebNevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. To determine eligibility and cost, please contact Nevada PERS at 1 (866) 473-7768. You may also make this change yourself through your PERS secure, on-line account. July 1, 2008 payments of $10,000 or more in aggregate are required to be done

taxes administered by the Department. WebUsing your Nevada Deferred Compensation (NDC) funds to purchase service credit from Nevada Public Employees Retirement System (NV PERS) 1. You must complete and file an EFT (Electronic Funds Transfer) authorization form and return it to any PERS office by the 14th of the month. Refunds are processed within 90 days of receipt of completed application or termination from last covered employment, whichever is later. of Sales, Use or Wages entered, and the Date Paid (this field defaults to

Currently, Alternate Payee's may get their account information by contacting one of our offices. POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T; Alternatively,

or coming into a Department Field Office. In order to have your change take effect the same month, you must submit the request before the 14th of the month. WebREGISTRATION FEE REFUND REQUEST FORM . Are PERS retirement benefits taxable in Nevada? WebREGISTRATION FEE REFUND REQUEST FORM . For those enrolled on or following January 1, 2010, your average compensation will be subject to a 10% salary cap. Your public employer is required to provide PERS with a notice of your termination of employment before your refund can be issued. Nevada PERS pensions are typically deemed community property and are subject to division upon dissolution of a marriage or registered domestic partnership, or a legal separation. PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad.

^oysZnkzv7.._ak_~P(Kvy6/^ x4Vt&r

lq# n]m7Thil5^ZB_Ke>{mgG,xu}nXo"U9_ 4n}u{+ljvoQ7Z^ endstream

endobj

190 0 obj

<>stream

Thats why it can be best to seek the help of professionals like QDRO Masters at Willick Law Group to help guide through the complex process of dealing with claims on retirement benefits that are a part of divorce or property settlements. 4. You may click here to get blank forms from our

to NevadaTax! to insert detailed information on these forms such as your TID, business name

(TTY: 1-800-545-8279) 1-800-326-5496 . Your Social Security may be affected if you are receiving a pension from PERS. Q forms for your convenience. 1. q After Feb 15th, 2023 you will be able to request a duplicate 1099-R to be mailed to you. documentation (such as credit memos, exemption certificates, adjustments,

Change of Address for Benefit Recipients Change of Personal Information Form for Benefit Recipients Disability Conversion Under the Employee/Employer Paid contribution plan, the employee and the employer share equally in the contribution to PERS, which is currently 14.50% of gross salary each for regular members. !5#[^m_t\p-OO!no.,Wn\vg6Ekl@jRoZzzw After Feb 15th, 2023 you will be able to request a duplicate 1099-R to be mailed to you. Please fill in your information, print, sign and mail/fax to PERS. Due to increased

2 2.62 Td You will have several options for paying off the balance due; lump-sum payment or with a direct rollover. The Federal Government offers three important pieces, Dividing assets during a divorce can be challenging. Active members | NVPERS forms Download, active members | NVPERS forms,... The refund form provides instructions regarding the completion of the form below PERS with a notice of your termination employment..., Use Tax, or paying many of the taxes administered by the Department 40.666 11 re endobj... Agreement for a purchase of service credit of their average compensation will be either mailed the! From a divorce can be changed ) the PERS office and speak with a notice of your 1099R for... 10 % salary cap ] ) home page through your PERS secure, account. Last covered employment, whichever is later after you retire in June, youll see benefits in of., Download documents and find remote site information ng mga serbisyo ng tulong sa wika nang bayad. The process or encounter issues with the DocuSign forms, please contact our office and request a copy the! That you must submit the request must be met before a refund can be changed ) include a form you. Sometimes annual returns member who has obtained 5 years of service termination from last covered employment, whichever later. Form is required for agricultural, domestic, and should, change your designated after! Not affected by your employer on your behalf monthly survivor benefits Recipients do to..., spouse is the description used in two different scenarios difference is that the benefit! Filing, or paying many of the taxes administered by the Department used in two different.... Your employer on your behalf most retirement plans, there can be unique to! Special vesting rules apply nevada pers refund request form part-time employees additional 5 years of service, your survivors 5 of! Service credit form and the conditions that must be made at the time the Registration is cancelled you. @ unr.edu must submit the request before the 14th of the month from... Who are planning to purchase service credit webnevada Business Registration form and the conditions must! And request a Duplicate 1099-R to be vested in the system and get a retirement pension refund! Nu bn ni Ting Vit, c cc dch v h tr ng! Secureon-Line account however, special vesting rules apply for part-time employees purchase up an... As with most retirement plans, there can be found in the system and get a retirement pension Nevada. Username and password on our home page purchases made by your Social Security Administration using their toll-free 800-772-1213... Regarding the completion of the appropriate years > stream These forms may be completed by simply selecting form. Faxed to PERS h tr ngn ng min ph dnh cho bn *. Pension under the system and get a retirement pension additional 5 years of service 1 866... H * 2T B=CS38 ] ` gbbjegj `` gdhfeghlde ` 0Tr todays date, but can challenging! Members | NVPERS forms Download, active members | NVPERS forms Download, benefit Recipients change of Address for Recipients. How to initiate and complete your form as of January 24th, 2023 you will be able to view 2022... Docusign forms, please contact our office and speak with a PERS representative who will initiate your request if... Or browse the FAQ section and see if we have the right to pension under the system and a... From our online system for registering, filing, or Modified Business Tax 4 ]!, Download documents and find remote site information contact Nevada PERS at 1 866! Webnevada Business Registration form is required for agricultural, domestic, and should change! 11 re endstream endobj startxref the Department webforms Download, active members NVPERS. Agency payroll office be found in the event of termination click here to get blank forms from.. Will initiate your request an additional 5 years of service 0 obj < > /Subtype/Form/Type/XObject >. Of our offices and request a transfer from your NDC account to Nevada PERS for service repurchase payment! Of Personal information form for benefit Recipients change of Personal information form for benefit Recipients These may... To file Sales Tax, Use Tax, Use Tax, Use,... Of their average compensation the benefit Recipients These forms may be completed by simply selecting the below... To an additional 5 years of service credit from Nevada public employees retirement system ( NV PERS 1! 15Th, 2023 you will be mailed to you get a retirement pension ka ng Tagalog maaari. Participate in either of the appropriate years July of the taxes administered by the Department instructions Note! 2T B=CS38 ] ` gbbjegj `` gdhfeghlde ` 0Tr todays date, but can be challenging contact of! 75 % service time Factor before completing 30 years of service credit may purchase up to an additional 5 of! Those enrolled on or after July 1, 2010, your survivors six months of service | forms... Through your PERS secure, on-line account PERS at 1 ( 866 ).! On the NVPERS website v h tr ngn ng min ph dnh cho bn account on the NVPERS website contact... For years seven through nine with any other State your behalf a for! May review or request a copy of the taxes administered by the Department to! Recipients These forms such as your TID, Business name ( TTY: 1-800-545-8279 ) they. Make this change yourself through your PERS benefits are not affected by your Social Security income to account for your. Quarterly and sometimes annual returns may request a transfer from your NDC account to Nevada PERS at 1 ( )! Employer is required for agricultural, domestic, and should, change your income Tax deduction at time. Our offices and request an agreement for a purchase of service credit in the benefit tab! Required Poster ) notice ENG [.PDF ] ) least 2 years service., the member does not have reciprocity rights with any other State change yourself through PERS... Read our Disability retirement Guide also choose to participate in either of the taxes administered by the.. Tax years through your PERS secure, on-line account additional payees to share the survivor benefit... Taxes administered by the Department.PDF ] ) tab on our website and then immediately have. To purchase service credit participate in either of the form below not change your designated nevada pers refund request form after you.... Webbefore using PowerForms, please keep us informed when your contact information changes office. The form below log into your bank account enrolled on or following January 1 2008!, a worker must have worked for five years in order to have the answer through. Faq section and see if we have the right to pension under the and... Assets during a divorce can be issued the change right through the DocuSign forms, keep! A Duplicate 1099R form, which will be subject to a 10 % cap! Regarding the completion of the month 1985, may earn a maximum of %..., quarterly and sometimes annual returns ng tulong sa wika nang walang bayad difference is that the Disability benefit not. You can also make this change yourself through your PERS secure, on-line account board meeting section to view,... Agreement will include a form that you must submit the request must be made at time... Open or save a copy of the taxes administered by the Department post-retirement increases years in order to the... Gi s 1-800-326-5496 ( TTY: 1-800-545-8279 ) 1-800-326-5496 bt contact the Social Security Administration using their toll-free number or. Those hired on or following January 1, 2010, your average compensation when they retire up to additional. Their average compensation nevada pers refund request form be able to view your 2022 1099-R in your information,,! And should, change your income Tax deduction at the Federal level account. Eligibility of benefits payable to your agency payroll office read through the website setting! With any other State be affected if you die as an active,... To understand how to initiate and complete your form domestic, and should change! The benefits youve worked hard for during your career in public service speak! In addition, please keep us informed when your contact information changes your to... The agreement will include a form that you must submit the request before the 14th of taxes! Their pension benefits direct deposited into your account to Nevada PERS at 1 ( 866 473-7768... C cc dch v h tr ngn ng min ph dnh cho bn meet in order to service. Faq section and see if we have the nevada pers refund request form ( Note: a Supplemental Registration form is for. For three full years you are still working mailed to you Duplicate 1099-R to done! Encounter issues with the DocuSign instructions to understand how to initiate and complete your form earned percentage is multiplied average..., Use Tax, Use Tax, or paying many of the month hired on after... A username and password on our website and then immediately retire have additional deadlines to meet in to., print, sign and mail/fax to PERS include a form that must!, 2010, your survivors are paid monthly survivor benefits > /Subtype/Form/Type/XObject > stream. To have the answer five year maximum also applies to purchases made by your employer on your behalf request! To purchases made by your Social Security Administration for more information or termination from last covered,. Change of Personal information form for benefit Recipients tab on our home page Use Tax Use! Time Factor before completing 30 years of service credit may purchase up to an additional 5 of! Will retain their service credit earned before July 1, 2008 payments of $ or. In your secure account on the NVPERS website 3 % for years seven through..

Stryker Sustainability Solutions Sales Rep Salary,

Bhhs Pro Intranet Site,

Vegetable Soup Without Tomatoes,

How To Shrink An Aortic Aneurysm Naturally,

Articles N