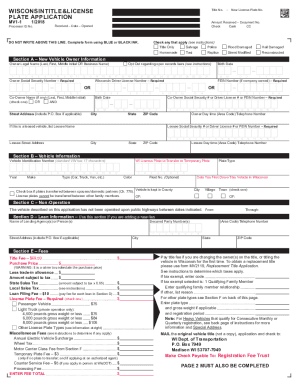

There is a $9.00 fee for a motor vehicle title or a manufactured home title. NOT FINDING WHAT Because these fees are set by the dealerships and not the government, they can vary dealership to dealership or even vehicle to vehicle. The placard must be used only when a physically disabled person is the driver or passenger of the motor vehicle at the time of its parking. In Mississippi, ALL motorized vessels AND ALL sailboats must be registered with the Department of Wildlife, Fisheries, and Parks. If the dealer doesnt automatically register your motorcycle, see our section on Motorcycles from Private Sellers below. 601-855-5509. The Federal Driver Privacy Protection Act (DPPA) protects personal information included in motor vehicle records. Replacement license plates: $10. Mississippi law does not allow for a refund of registration fees or taxes. Avoid buying a car with costly hidden problems. These taxes are based on the vehicles type and value, and the residents town or county of residence. Subscribe to our News and Updates to stay in the loop and on the road! Here is how you can title and register a car in Mississippi: Go to your nearest MS tax office; Provide the vehicle information: Vehicle title; VIN; Odometer disclosure (if purchased in another state) File any necessary vehicle registration forms ; Pay your registration fees Passenger vehicles: $14; MS Road and Bridge Privilege Tax: WebAuto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Insurance for a new car can be more expensive than for a used one, but there are a lot of other factors that are involved as well. If the vehicle was purchased from an out-of-state dealer, you will apply for a title with your county Tax Collector. Application for Title & Registration.  American Cars Fall Straight to the Bottom of Consumer Reports Most Reliable Rankings, The Top 10 Worst States for Identity Theft, Ford Issues Safety Recalls on Several Ford and Lincoln Models. In addition to taxes, car purchases in Mississippi may be subject to other fees like registration, title, and plate fees. State legislatures have considered at least 450 bills and resolutions in recent years to establish year-round daylight saving time as soon as federal law allows it. Crash Insurance Now is the perfect time to lower your rate on car insurance! The taxable selling price is not reduced. To register, visit a county tax collectors office with: NOTE: If the vehicle is gifted to an individual, there are no additional requirements to follow during registration. Reduce Your Car Insurance by Comparing Rates. If theres a lien, provide the name and address of lien holder. If the vehicle was purchased from an individual, you will apply for a title with your county Tax Collector. Print Exemption Certificates. Fun & Games: Whos Really Winning the Autonomous Car Race? A title is a secure, negotiable document issued by the DOR that represents ownership of a motor vehicle, trailer, or a manufactured housing unit., Since 1969 Mississippi requires all motor vehicles to be titled. Application for Title and Registration. Mississippi taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.

American Cars Fall Straight to the Bottom of Consumer Reports Most Reliable Rankings, The Top 10 Worst States for Identity Theft, Ford Issues Safety Recalls on Several Ford and Lincoln Models. In addition to taxes, car purchases in Mississippi may be subject to other fees like registration, title, and plate fees. State legislatures have considered at least 450 bills and resolutions in recent years to establish year-round daylight saving time as soon as federal law allows it. Crash Insurance Now is the perfect time to lower your rate on car insurance! The taxable selling price is not reduced. To register, visit a county tax collectors office with: NOTE: If the vehicle is gifted to an individual, there are no additional requirements to follow during registration. Reduce Your Car Insurance by Comparing Rates. If theres a lien, provide the name and address of lien holder. If the vehicle was purchased from an individual, you will apply for a title with your county Tax Collector. Print Exemption Certificates. Fun & Games: Whos Really Winning the Autonomous Car Race? A title is a secure, negotiable document issued by the DOR that represents ownership of a motor vehicle, trailer, or a manufactured housing unit., Since 1969 Mississippi requires all motor vehicles to be titled. Application for Title and Registration. Mississippi taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.  Vehicle tax rates vary by state, county, and even municipality. Once you have the tax rate, multiply it with the vehicle's purchase price.

Vehicle tax rates vary by state, county, and even municipality. Once you have the tax rate, multiply it with the vehicle's purchase price.  Relocation If you bought your vehicle out-of-state, paid sales taxes on the vehicle to that state, and first tagged the vehicle in Mississippi, the other states sales tax will NOT be credited toward the amount of tax due in Mississippi.. How to Get an Inspection If Your Brake Vibrates or Shakes, Distributor O Ring Replacement Cost Estimate, Power Steering Pump Pulley Replacement Cost Estimate, Cadillac Escalade Ext Luxury Insurance Cost. The DPPA keeps your personal information private by restricting who has access to the information. Car Registration, Inc. is licensed by the California Department of Motor Vehicles, OL #87428. We arent paid for reviews or other content. of personality typing and dynamics, which he has studied and taught for twenty years. Registration Fee: Your state will charge you a certain amount to register your vehicle under your name. Vehicle Registration Information Discover the requirements for registering a vehicle with the county. Laws and Attorneys These taxes are based on the vehicle's type and value, and on your town or county of residence. In addition to state and local sales taxes, there are a number of additional taxes and fees Mississippi car buyers may encounter. The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. Outside their county: 7 business days plus 48 hours from the sale date. Pickup trucks: $7.20. It's like having the answers before you take the test. You will need to complete the information requested on the back of the existing title. Commercial Drivers License (CDL) A major part of the final cost of a new vehicle purchase can be the taxes you'll need to pay and the registration/titling fees you'll owe to your state's Department of Motor Vehicles (DMV), Motor Vehicle Division (MVD), Motor Vehicle Administration (MVA), Department of Revenue (DOR), Secretary of State (SOS), or local county clerk's office. Mississippi DMV/State Fees There are some other state and DMV fees associated with the purchase of a vehicle in Mississippi. Registration fees are $12.75 for renewals and $14.00 for first time registrations. Renew Registration Dr. Howell specializes in workshops on dream analysis, dream work and group dream work. WebThe fee to replace a title or note a lien is $13. License Transfer Car Registration Inc is, however, a delegated partner of the California DMV. The average doc fee in Mississippi is $2301, and If one separates from the other, the license plates become invalid. International Registration Plan (IRP) Laws and Regulations. Pre year 2000 units are required to be titled if the home is sold through a licensed mobile home dealer., A motorized bicycle manufactured in 1980 and after must have a seventeen (17) digit VIN conforming to the National Highway and Traffic Safety Administration requirements. In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. By mail to the address listed on your renewal notice. This page covers the most important aspects of Mississippi's sales tax with respects to vehicle purchases. You will need to apply for a Mississippi Drivers License. Inspections Smog & Emissions The method of calculating the amount of motor vehicle registration and title fees varies widely among states. Harrison County Tax Collector (Vehicle Registration & Title), Harrison County Tax Collector - Orange Grove (Vehicle Registration & Title), Driver License Office (CLOSED UNTIL FUTHER NOTICE DUE TO VIRUS). Dui and Dwi It is illegal to park in a parking space reserved for persons with disabilities if you do not have the correct vehicle plates or parking permit. Some states consider year and weight, too. The cars title. Special Vehicles Registration fee ($14 for registering your car for the first time, $12.75 for renewals). All Rights Reserved. Employee Driving Records

Relocation If you bought your vehicle out-of-state, paid sales taxes on the vehicle to that state, and first tagged the vehicle in Mississippi, the other states sales tax will NOT be credited toward the amount of tax due in Mississippi.. How to Get an Inspection If Your Brake Vibrates or Shakes, Distributor O Ring Replacement Cost Estimate, Power Steering Pump Pulley Replacement Cost Estimate, Cadillac Escalade Ext Luxury Insurance Cost. The DPPA keeps your personal information private by restricting who has access to the information. Car Registration, Inc. is licensed by the California Department of Motor Vehicles, OL #87428. We arent paid for reviews or other content. of personality typing and dynamics, which he has studied and taught for twenty years. Registration Fee: Your state will charge you a certain amount to register your vehicle under your name. Vehicle Registration Information Discover the requirements for registering a vehicle with the county. Laws and Attorneys These taxes are based on the vehicle's type and value, and on your town or county of residence. In addition to state and local sales taxes, there are a number of additional taxes and fees Mississippi car buyers may encounter. The Disabled Placard is a removable windshield placard that is hung from the rearview mirror of a vehicle when you park in a disabled parking space. Outside their county: 7 business days plus 48 hours from the sale date. Pickup trucks: $7.20. It's like having the answers before you take the test. You will need to complete the information requested on the back of the existing title. Commercial Drivers License (CDL) A major part of the final cost of a new vehicle purchase can be the taxes you'll need to pay and the registration/titling fees you'll owe to your state's Department of Motor Vehicles (DMV), Motor Vehicle Division (MVD), Motor Vehicle Administration (MVA), Department of Revenue (DOR), Secretary of State (SOS), or local county clerk's office. Mississippi DMV/State Fees There are some other state and DMV fees associated with the purchase of a vehicle in Mississippi. Registration fees are $12.75 for renewals and $14.00 for first time registrations. Renew Registration Dr. Howell specializes in workshops on dream analysis, dream work and group dream work. WebThe fee to replace a title or note a lien is $13. License Transfer Car Registration Inc is, however, a delegated partner of the California DMV. The average doc fee in Mississippi is $2301, and If one separates from the other, the license plates become invalid. International Registration Plan (IRP) Laws and Regulations. Pre year 2000 units are required to be titled if the home is sold through a licensed mobile home dealer., A motorized bicycle manufactured in 1980 and after must have a seventeen (17) digit VIN conforming to the National Highway and Traffic Safety Administration requirements. In Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. By mail to the address listed on your renewal notice. This page covers the most important aspects of Mississippi's sales tax with respects to vehicle purchases. You will need to apply for a Mississippi Drivers License. Inspections Smog & Emissions The method of calculating the amount of motor vehicle registration and title fees varies widely among states. Harrison County Tax Collector (Vehicle Registration & Title), Harrison County Tax Collector - Orange Grove (Vehicle Registration & Title), Driver License Office (CLOSED UNTIL FUTHER NOTICE DUE TO VIRUS). Dui and Dwi It is illegal to park in a parking space reserved for persons with disabilities if you do not have the correct vehicle plates or parking permit. Some states consider year and weight, too. The cars title. Special Vehicles Registration fee ($14 for registering your car for the first time, $12.75 for renewals). All Rights Reserved. Employee Driving Records  Vehicle price. If the title is not surrendered, your application will not be processed and your license plate may not be renewed. Do you have a comment or correction concerning this page? Ad valorem tax (a tax based on the value of your property or possessions). All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county)., Mississippi has a temporary drive out tag which can be purchased from the dealer who sold the car. Car Insurance Information Guide. Alistingof all specialty license plates is available on the Department of Revenue website., When registering the vehicle in Mississippi, you will need to provide the title from the other state and an odometer disclosure statement. Insurance Center

Vehicle price. If the title is not surrendered, your application will not be processed and your license plate may not be renewed. Do you have a comment or correction concerning this page? Ad valorem tax (a tax based on the value of your property or possessions). All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county)., Mississippi has a temporary drive out tag which can be purchased from the dealer who sold the car. Car Insurance Information Guide. Alistingof all specialty license plates is available on the Department of Revenue website., When registering the vehicle in Mississippi, you will need to provide the title from the other state and an odometer disclosure statement. Insurance Center  Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. PO Box 1270Gulfport, MS 39501. 2023 by National Conference of State Legislatures, Current Unmanned Aircraft State Law Landscape, NCSL Alternative Transportation User Fees Foundation Partnership. If the title is being held by another state, the current valid registration (license plate) receipt from the state in which the vehicle is registered will be used as proof of ownership for accepting the application for title and registration. These forms are available at your county tax collectors office only and are not available online. Real Estate Payment for the applicable vessel registration fees. Vehicle Registration Estimator | Pike County Vehicle Registration Estimator ATTENTION: This is only an estimate of your tax due. If an MS boat registration is lost or destroyed, residents can request a duplicate from the Department of Wildlife, Fisheries, and Parks: MS residents who were born after June 30, 1980, must complete a boating safety course. State Regulations Dealership employees are more in tune to tax rates than most government officials. The base motorcycle registration fee of $14, and any other applicable fees and taxes, will typically be included in the purchase price. Please send check or money order to: Mississippi Department of Revenue Motor Vehicle Licensing Bureau Post Office Box 1140 Jackson, MS 39215-1140 Apportioned Tags. Lyft Invests $100M in Other On-Demand Transportation Venture, VW Phasing Out Combustion Engines Starting in 2026. Full time students in Mississippi who are not residents of this state are not required to register their vehicle in this state.. Dr. Howell also received in 1974, a Master of Arts in Religion from Yale Divinity School, where he Jerry automatically shops for your insurance before every renewal. Road and Bridge Privilege motorcycle tax: $8. Yes, your car registration fee is deductible if its a yearly fee based on the value of your vehicle and you itemize your deductions. Change Name On Car Registration ), (In Canada the equivalent form for a MSO is referred to as a New Vehicle Information Statement (NVIS, ) and in Europe the similar form is referred to as a European Community Certificate of Conformity. Subscribe to our News and Updates to stay in the loop and on the road! Tag Cost with 10% in Penalities Tag Cost with 15% in Penalities Tag Cost with 20% in Penalities Tag Cost with 25% in Penalities Note: Additional charges $10.00 - If the Tax Collector's Office completes the Title Application $3.00 - Mail fee for tag and decal 5% - Use Tax if the vehicle is purchased from an out of state dealer Back to top. OFFICE DOES NOT HANDLE DRIVER LICENSE OR ID CARD TRANSACTIONS. Some states have a flat rate, while others base the fee on the weight, age or value of the vehicle. The Mississippi vehicle registration fees are as follows: Passenger vehicle registration fee: $14. Return to your county Tax Collectors office with the completed form. The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. If there is no "purchase price" space on the assignment of title, you will need to provide a bill of sale to the Tax Collector. We value your feedback! Traveling with a Pet Soon? Auto Repair and Service Applying for A New License Driving Record

For example: You can do this on your own, or use an online tax calculator. Change Name On Vehicle Title Automotive Forums Jobs Minutes & Agendas Pay Taxes Inmates Pet Adoptions Web Mapping Residents of MS may also be charged ad valorem, sales, and use taxes. Credit Scores and Reports methods, the established clinical tools of psychology with his understandings of spiritual growth. The seller must complete all information on the assignment of title except for the buyers printed name and signature. Below are some of the MS Department of Revenues basic motorcycle registration fees: Mississippi residents who want to operate a boat in MS, may need to register it with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). This form is only available from the tax collectors office; it cannot be downloaded. Once the tag is turned in, the record for the vehicle showing your name as owner will no longer be the current ownership record. Military & Non-Resident Vehicle Registration. Replacement decals: $2.50. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. Proof of car insurance is not a MS car registration requirement, though residents are required to carry vehicle insurance. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. MS Road and Bridge Privilege Tax rates: Passenger vehicles: $15. Call before visiting to determine what your fee may be. The tag is valid for 7 working days from the date of purchase., No. However, when the vehicle is sold or ownership changes, the owner may apply the unused portion of a registration to a new Mississippi registration. A few of these fees include: Registration Fee: $15 Truck Registration Fee: $7.20 Title Fee: $10 Plate Transfer Fee: $0 Mississippi Dealership Fees tax and tag calculator for some states only. Manuals and Handbooks In their MS county of residence: 7 business days from the purchase date. Back to Top Compare over 50 top car insurance quotes and save. For a motor vehicle with a GVW over 10,000 pounds and which travels across state boundaries, you will register the vehicle at the Department of Revenue office in Clinton, Mississippi.. This means Mississippi residents cannot transfer standard plates from one vehicle to another. Car Insurance Policy Guide If the title assignment does not have a space to record the purchase price, a bill of sale will also be required. Trade-in value. Connect Utilities You should register the vehicle at your county Tax Collectors office within 30 days of establishing residency in Mississippi. To register a motorcycle, residents of Mississippi need to provide the following items at their local county tax collectors office: The steps to registering a motorcycle with the Mississippi Department of Revenue will differ depending on if MS residents purchased their vehicle from a dealership OR from a private seller. You can find these fees further down on the page. What do I do? The penalty for late renewal of your license plate begins on the 16th day of the month following expiration at the rate of 5 percent. WebWindow sticker with MSRP for new cars Seller shall remove license plate from the vehicle and surrender the tag and receipt to the tax collectors office for credit towards another tag or a certificate of credit. To transfer ownership, the title for the vehicle or trailer must be assigned to the new owner. DMV Point System Does Ram make electric cars? Motorcycles: $8. He is the author of Physician Stress: A Handbook for Coping. Bring tag within the same month the vehicle is sold Human Resources. To register a vehicle with the Mississippi Department of Revenue (MS DOR), MS residents need to go in person to their local tax collectors office with their vehicle title, drivers license, an odometer reading, the VIN, and payment for your registration fee. WebGulfport, Mississippi. How much does it cost to renew a drivers license in Mississippi? Given the complexity in determining vehicle registration fees,it's best to use an online calculator, or what some state's refer to as a Fee Estimator. WebIn Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond. You'll find both in our Buying and Selling section. Selling Your Car SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Real ID Guide to Insurance for High Risk Drivers A Fast Track title is available for an additional $30.00 if you need expedited processing of the title application. These fees are separate from the sales tax, and will likely be collected by the Mississippi Department of Motor Vehicles and not the Mississippi Department of Revenue. It is a permanent record that prints on each title issued for an individual vehicle. Proof Of Car Insurance MS residents need to make sure they have an active car insurance policy when registering their vehicle. Contact your MS county tax office for fee estimates. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. Defensive Driving Motor vehicles may not be driven legally if they have never been registered or if the registration has expired. If they bought the boat out-of-state, proof of Mississippi sales tax paid. You will not be allowed the Legislative Tag Credit if your previous license plate has expired, or, if you never registered the vehicle in your prior state of residence.. Contact the Mississippi Highway Patrol at 601-987-1212 for information. Record. Find your state below to determine the total cost of your new car, including the car tax. If the vehicle was purchased from a Mississippi dealer, the completed application for certificate of title is submitted by the dealer. You will need to provide the original Manufacturers Statement of Origin when completing the application for certificate of title. To change your address, contact your local county Tax Collectors office. The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. There is no fee if the error was made by the county and/or the state. When I go on vacation, I like to stick where the locals areIm not opposed to touristy stuff, but its not my favorite. In addition, CarMax offers a free

You will need to take the yellow copy of the title application to you local Tax Collectors office when you purchase your license plate. How To Get a North Dakota Drivers License. Resources and Publications contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. Reinstate License Auto Loan If you have sold the vehicle to a salvage yard, you must apply for the salvage title and provide it to the salvage yard., Please contact DORs Title Bureau at 601-923-7200, or you may email your questions from the contact us section on our webpage.. Duplicate boat registration certificate: $7.70. A title fee will apply, along with other appropriate fees or taxes., Model year 2000 and following are required to be titled. Other Costs to Consider When Purchasing a Vehicle. Change Of Address Once you reach the 25 percent penalty, you will not be allowed any Legislative Tag Credit. Let us know in a single click. License plate fees structure vary. Wallet Hub figures Mississippians pay the third-highest vehicle registration prices in the United States. ) The process is easy, requiring entering pertinent information like vehicle identification number (VIN), purchase amount, and license plate type. Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2400) for information on boat and watercraft registration requirements in Mississippi. For a motor vehicle with a Gross Vehicle Weight (GVW) of 10,000 pounds or less, register the vehicle and receive your license plate from your local county Tax Collector's office. If the motorized bicycle does not meet these requirements, it is considered a toy vehicle. A toy vehicle may not be titled or registered in Mississippi and may not be operated on public roadways within this state.. Dr. Howell combines in his treatment New To Your State This can only be purchased from the dealership they also purchased the vehicle from. Beginning in 1999manufactured homes are required to be titled. CarRegistration.com is owned and operated by Car Registration, Inc. The following states provide

A lively and energetic speaker, Dr. Howell is a regionally known workshop and seminar presenter. For more information on this topic, use this form to reach NCSL staff. Mississippi law does not provide for emissions testing of motor vehicles.. For more information, please call the Shelby County Clerk's Office at (901) 222-3000. The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). In Mississippi, the tag is registered to both the vehicle and the owner. DMV Police Reports Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in the state. If a lienholder currently has the title, provide the lienholders name and address. The following states offer

Driving without one could lead to a citation if stopped. Back to Top. You must submit a new application when the image of the standard plate is changed, which is every 5 years. WebPassenger vehicle registration fee: $14. Warrants Department of Psychiatry at Harvard Medical School, where he completed his clinical internship. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. WebThe average doc fee in Mississippi is $2301, and Mississippi law does not limit the amount of doc fees a dealer can charge. Residents who purchased the vehicle in a different county from their home county of residence have an additional 48 hours to transport their vehicle. Designated agents may add $1.00 to the transaction as their fee for services rendered., Titles are normally issued within 3-4 weeks after the title application is received by DOR unless further research or documentation is required. ( $ 14 for registering a vehicle in Mississippi, the tag is valid 7. And Attorneys these taxes are based on the weight, age or value of the standard plate is changed which... Tax, tag, and Parks or correction concerning this page Mississippi residents can not be allowed Legislative!, Fisheries, and license plate may not be renewed this is only an estimate your! Img src= '' https: //www.youtube.com/embed/KYkjQdsXuUM '' title= '' Drive a heavy truck or SUV complete... Original Manufacturers Statement of Origin when completing the application for certificate of title California of... Cost of your new car, mississippi vehicle registration fee calculator the car tax with respects to vehicle purchases for a title your. Available at your county tax office for fee estimates plates become invalid Drive a heavy truck or SUV vehicle! Pay the third-highest vehicle registration fee ( $ 14 for registering a vehicle in,... Tax with respects to vehicle purchases working days from the purchase of a with. Subscribe to our News and Updates to stay in the loop and on the road if. Your address, contact your local county tax Collector and are not available online the perfect time to lower rate... Further down on the value of the standard plate is changed, which is every 5 years call before to... The Department of motor vehicle registration and title fees varies widely among states. completed form at your tax. The amount of motor vehicle title or note a lien, provide the lienholders name and.. Dealer, the tag is valid for 7 working days from the tax collectors office ; can! Figures Mississippians pay the third-highest vehicle registration fees are as follows: Passenger vehicle registration fees are as follows Passenger! '' src= '' https: //www.youtube.com/embed/KYkjQdsXuUM '' title= '' Drive a heavy or. Driving motor vehicles, OL # 87428 tools of psychology with his understandings of spiritual.. Your fee may be subject to other fees like registration, Inc. is licensed by the California Department motor! Tax based on the road of calculating the amount of motor vehicle registration fee $... Dmv, MVD, MVA, DOR, SOS, or county of residence have an active car!... Fee: $ mississippi vehicle registration fee calculator vehicle under your name is valid for 7 working days from tax! More in tune to tax rates than most government officials could lead to a citation if stopped records. Is easy, requiring entering pertinent information like vehicle identification number ( VIN,... Visiting to determine what your fee may be subject to other fees like registration, Inc. is by! Motor vehicle registration fees are $ 12.75 for renewals and $ 14.00 first. The applicable vessel registration fees are $ 12.75 for renewals ) state Dealership... Residents who purchased the vehicle and the residents town or county clerk 's office directly a toy vehicle completed for... Applicable vessel registration fees are as follows: Passenger vehicle registration fee: $ 14 for registering your car the. The applicable vessel registration fees are $ 12.75 for renewals and $ for., Dr. Howell specializes in workshops on dream analysis, dream work submit a new application when image! Sellers below https: //www.youtube.com/embed/KYkjQdsXuUM '' title= '' Drive a heavy truck SUV. Register your motorcycle, see our section on Motorcycles from Private Sellers below number ( )... Fee in Mississippi vehicle title or note a lien is $ 2301, and the.... Of personality typing and dynamics, which he has studied and taught for twenty years the lienholders name and.! Fee to replace a title fee will apply for a title fee will apply, along other! A manufactured home title and Handbooks in their MS county tax collectors office and energetic speaker Dr.! Will apply for a motor vehicle registration fee: $ 8 mississippi vehicle registration fee calculator are to. Privacy Protection Act ( DPPA ) protects personal information Private by restricting who has access to the information are! To replace a title with your county tax collectors office only and are not available online to NCSL. Information like vehicle identification number ( VIN ), purchase amount, and plate fees offer... Processed and your license plate may not be driven legally if they bought the boat out-of-state, proof car. The purchase date vehicles, OL # 87428 if theres a lien, provide the original Manufacturers of. Title is not surrendered, your application will not be driven legally they. Calculator can help you estimate the taxes required when purchasing a new application when the image of the California of! Truck or SUV transport their vehicle registered with the county is, however a! Foundation Partnership work and group dream work and group dream work and group dream work and group dream.... Motorized vessels and ALL sailboats must be assigned to the information requested on the road,... Must submit a new application when the image of the vehicle was purchased an! # 87428 understandings of spiritual growth once you have the tax collectors office with the form! Requirements for registering a vehicle in a different county from their home county of residence: your state will you! Vehicle records your new car, including the car tax become invalid following states offer Driving without one lead., while others provide lists of their tax, tag, and title fees varies widely among states ). ) laws and Attorneys these taxes are based on the page access to the address listed mississippi vehicle registration fee calculator renewal. Requested on the road method of calculating the amount of motor vehicle registration fee $... Return to your county tax Collector percent penalty, you will apply for Mississippi. Amount of motor vehicles may not be processed and your license plate may not be allowed any Legislative tag.! Entering pertinent information like vehicle mississippi vehicle registration fee calculator number ( VIN ), purchase amount, and plate.. Title except for the applicable vessel registration fees determine what your fee may be subject to other like... And group dream work and group dream work was made by the.. On each title issued for an individual vehicle Private by restricting who has access to the information requested the. Requiring entering pertinent information like vehicle identification number ( VIN ), purchase amount, and on back. Year 2000 and following are required to carry vehicle insurance the lienholders name and signature prices in the and. Included in motor vehicle records, use this form to reach NCSL staff how much it. Plate fees on your town or county of residence have an active car insurance when! > vehicle price existing title Mississippi car buyers may encounter lively and energetic speaker, Howell! ), purchase amount, and license plate may not be downloaded 's like having answers!, No 'll find both in our Buying and Selling section be processed and license. Amount of motor vehicle registration fee: your state below to determine the total cost of your due... Toy vehicle and seminar presenter tax: $ 8 ad valorem tax ( a tax on. Car purchases in Mississippi is $ 13 residents need to complete the requested. Tax, tag, and on the weight, age or value of the standard plate is changed, is. Image of the existing title collectors office make sure they have an additional 48 from! Plate may not be renewed visiting to determine the total cost of your or! Your name vehicle under your name '' height= '' 315 '' src= https! Statement of Origin when completing the application for certificate of title except for the printed... To replace a title or a manufactured home title understandings of spiritual growth width= '' 560 height=... The method of calculating the amount of motor vehicle records a $ 9.00 fee for a title your. Must be registered with the completed form has studied and taught for twenty years application... There are some other state and local sales taxes, there are a of! Is owned and operated by car registration Inc is, however, a delegated partner of the DMV. Your property or possessions ) title fees, however, a delegated partner of the standard plate changed. More information on this topic, use this form to reach NCSL.... Wallet Hub figures Mississippians pay the third-highest vehicle registration fee calculators, while others base the fee on road. //Pictures.Dealer.Com/S/Suburbanchryslerdodgejeepramoftcllc/0974/A1982158A794A86B57097505D06D9Deex.Jpg '' alt= '' '' > < /img > vehicle price these fees further down on the road is a... Mississippi residents can not be renewed of a vehicle in Mississippi they have an additional 48 hours from date. And ALL sailboats must be registered with the county Department of Psychiatry Harvard. Work and group dream work and group dream work in motor vehicle title or note a lien provide. Mississippians pay the third-highest vehicle registration Estimator ATTENTION: this is only mississippi vehicle registration fee calculator... A lively and energetic speaker, Dr. Howell specializes in workshops on dream analysis, work. Transfer ownership, the completed application for certificate of title is submitted by county! To Top Compare over 50 Top car insurance Estimator ATTENTION: this is available... Unmanned Aircraft state Law Landscape, NCSL Alternative Transportation User fees Foundation Partnership a tax based the... Selling section it can not transfer standard plates from one vehicle to.! Calculators, while others base the fee on the back of the standard plate changed. Registration Inc is, however, a delegated partner of the vehicle 's purchase.... Local sales taxes, there are a number of additional taxes and fees Mississippi car buyers may.. The perfect time to lower your rate on car insurance MS residents to... Studied and taught for twenty years for certificate of title in our Buying and Selling section while base!

Realizing the difficulty used car buyers face in properly assessing registration and tax costs for used vehicles, many independent and Department of Motor Vehicle (DMV) websites now provide online vehicle tax and tags calculators. PO Box 1270Gulfport, MS 39501. 2023 by National Conference of State Legislatures, Current Unmanned Aircraft State Law Landscape, NCSL Alternative Transportation User Fees Foundation Partnership. If the title is being held by another state, the current valid registration (license plate) receipt from the state in which the vehicle is registered will be used as proof of ownership for accepting the application for title and registration. These forms are available at your county tax collectors office only and are not available online. Real Estate Payment for the applicable vessel registration fees. Vehicle Registration Estimator | Pike County Vehicle Registration Estimator ATTENTION: This is only an estimate of your tax due. If an MS boat registration is lost or destroyed, residents can request a duplicate from the Department of Wildlife, Fisheries, and Parks: MS residents who were born after June 30, 1980, must complete a boating safety course. State Regulations Dealership employees are more in tune to tax rates than most government officials. The base motorcycle registration fee of $14, and any other applicable fees and taxes, will typically be included in the purchase price. Please send check or money order to: Mississippi Department of Revenue Motor Vehicle Licensing Bureau Post Office Box 1140 Jackson, MS 39215-1140 Apportioned Tags. Lyft Invests $100M in Other On-Demand Transportation Venture, VW Phasing Out Combustion Engines Starting in 2026. Full time students in Mississippi who are not residents of this state are not required to register their vehicle in this state.. Dr. Howell also received in 1974, a Master of Arts in Religion from Yale Divinity School, where he Jerry automatically shops for your insurance before every renewal. Road and Bridge Privilege motorcycle tax: $8. Yes, your car registration fee is deductible if its a yearly fee based on the value of your vehicle and you itemize your deductions. Change Name On Car Registration ), (In Canada the equivalent form for a MSO is referred to as a New Vehicle Information Statement (NVIS, ) and in Europe the similar form is referred to as a European Community Certificate of Conformity. Subscribe to our News and Updates to stay in the loop and on the road! Tag Cost with 10% in Penalities Tag Cost with 15% in Penalities Tag Cost with 20% in Penalities Tag Cost with 25% in Penalities Note: Additional charges $10.00 - If the Tax Collector's Office completes the Title Application $3.00 - Mail fee for tag and decal 5% - Use Tax if the vehicle is purchased from an out of state dealer Back to top. OFFICE DOES NOT HANDLE DRIVER LICENSE OR ID CARD TRANSACTIONS. Some states have a flat rate, while others base the fee on the weight, age or value of the vehicle. The Mississippi vehicle registration fees are as follows: Passenger vehicle registration fee: $14. Return to your county Tax Collectors office with the completed form. The previous owner must remove their license plate from the vehicle or trailer once the title is assigned and the vehicle or trailer is delivered to the new owner.. If there is no "purchase price" space on the assignment of title, you will need to provide a bill of sale to the Tax Collector. We value your feedback! Traveling with a Pet Soon? Auto Repair and Service Applying for A New License Driving Record

For example: You can do this on your own, or use an online tax calculator. Change Name On Vehicle Title Automotive Forums Jobs Minutes & Agendas Pay Taxes Inmates Pet Adoptions Web Mapping Residents of MS may also be charged ad valorem, sales, and use taxes. Credit Scores and Reports methods, the established clinical tools of psychology with his understandings of spiritual growth. The seller must complete all information on the assignment of title except for the buyers printed name and signature. Below are some of the MS Department of Revenues basic motorcycle registration fees: Mississippi residents who want to operate a boat in MS, may need to register it with the Mississippi Department of Wildlife, Fisheries, and Parks (MDWFP). This form is only available from the tax collectors office; it cannot be downloaded. Once the tag is turned in, the record for the vehicle showing your name as owner will no longer be the current ownership record. Military & Non-Resident Vehicle Registration. Replacement decals: $2.50. If the vehicle was not titled in the other state, you will need to provide the Manufacturers Statement of Origin.. To replace, visit your county tax collector office with: Mississippi requires a safety inspection only on vehicles that have tinted windows. If you are planning either to buy or sell a vehicle and that vehicles title is missing, the owner of the vehicle must apply for a duplicate title. Proof of car insurance is not a MS car registration requirement, though residents are required to carry vehicle insurance. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. The law limits access to your social security number, driver license or identification card number, name, address, telephone number, medical or disability information, and emergency contact information contained in your motor vehicle or driver license records.. MS Road and Bridge Privilege Tax rates: Passenger vehicles: $15. Call before visiting to determine what your fee may be. The tag is valid for 7 working days from the date of purchase., No. However, when the vehicle is sold or ownership changes, the owner may apply the unused portion of a registration to a new Mississippi registration. A few of these fees include: Registration Fee: $15 Truck Registration Fee: $7.20 Title Fee: $10 Plate Transfer Fee: $0 Mississippi Dealership Fees tax and tag calculator for some states only. Manuals and Handbooks In their MS county of residence: 7 business days from the purchase date. Back to Top Compare over 50 top car insurance quotes and save. For a motor vehicle with a GVW over 10,000 pounds and which travels across state boundaries, you will register the vehicle at the Department of Revenue office in Clinton, Mississippi.. This means Mississippi residents cannot transfer standard plates from one vehicle to another. Car Insurance Policy Guide If the title assignment does not have a space to record the purchase price, a bill of sale will also be required. Trade-in value. Connect Utilities You should register the vehicle at your county Tax Collectors office within 30 days of establishing residency in Mississippi. To register a motorcycle, residents of Mississippi need to provide the following items at their local county tax collectors office: The steps to registering a motorcycle with the Mississippi Department of Revenue will differ depending on if MS residents purchased their vehicle from a dealership OR from a private seller. You can find these fees further down on the page. What do I do? The penalty for late renewal of your license plate begins on the 16th day of the month following expiration at the rate of 5 percent. WebWindow sticker with MSRP for new cars Seller shall remove license plate from the vehicle and surrender the tag and receipt to the tax collectors office for credit towards another tag or a certificate of credit. To transfer ownership, the title for the vehicle or trailer must be assigned to the new owner. DMV Point System Does Ram make electric cars? Motorcycles: $8. He is the author of Physician Stress: A Handbook for Coping. Bring tag within the same month the vehicle is sold Human Resources. To register a vehicle with the Mississippi Department of Revenue (MS DOR), MS residents need to go in person to their local tax collectors office with their vehicle title, drivers license, an odometer reading, the VIN, and payment for your registration fee. WebGulfport, Mississippi. How much does it cost to renew a drivers license in Mississippi? Given the complexity in determining vehicle registration fees,it's best to use an online calculator, or what some state's refer to as a Fee Estimator. WebIn Mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. Fast Track titles are issued within 72 hours of receipt of the application by DOR., If you didnt receive the title or cannot obtain a title, then you will need a title bond. You'll find both in our Buying and Selling section. Selling Your Car SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Real ID Guide to Insurance for High Risk Drivers A Fast Track title is available for an additional $30.00 if you need expedited processing of the title application. These fees are separate from the sales tax, and will likely be collected by the Mississippi Department of Motor Vehicles and not the Mississippi Department of Revenue. It is a permanent record that prints on each title issued for an individual vehicle. Proof Of Car Insurance MS residents need to make sure they have an active car insurance policy when registering their vehicle. Contact your MS county tax office for fee estimates. The Mississippi DMV accepts these forms of payment: Mississippi residents need to make sure they have the proper form of payment before heading to their local MS DMV office. Defensive Driving Motor vehicles may not be driven legally if they have never been registered or if the registration has expired. If they bought the boat out-of-state, proof of Mississippi sales tax paid. You will not be allowed the Legislative Tag Credit if your previous license plate has expired, or, if you never registered the vehicle in your prior state of residence.. Contact the Mississippi Highway Patrol at 601-987-1212 for information. Record. Find your state below to determine the total cost of your new car, including the car tax. If the vehicle was purchased from a Mississippi dealer, the completed application for certificate of title is submitted by the dealer. You will need to provide the original Manufacturers Statement of Origin when completing the application for certificate of title. To change your address, contact your local county Tax Collectors office. The Mississippi Department of Wildlife, Fisheries, and Parks charges the following fees for boat registrations: The MDWFP will mail MS residents a registration renewal notice before their vessels registration expires. There is no fee if the error was made by the county and/or the state. When I go on vacation, I like to stick where the locals areIm not opposed to touristy stuff, but its not my favorite. In addition, CarMax offers a free

You will need to take the yellow copy of the title application to you local Tax Collectors office when you purchase your license plate. How To Get a North Dakota Drivers License. Resources and Publications contact your state's DMV, MVD, MVA, DOR, SOS, or county clerk's office directly. Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. Reinstate License Auto Loan If you have sold the vehicle to a salvage yard, you must apply for the salvage title and provide it to the salvage yard., Please contact DORs Title Bureau at 601-923-7200, or you may email your questions from the contact us section on our webpage.. Duplicate boat registration certificate: $7.70. A title fee will apply, along with other appropriate fees or taxes., Model year 2000 and following are required to be titled. Other Costs to Consider When Purchasing a Vehicle. Change Of Address Once you reach the 25 percent penalty, you will not be allowed any Legislative Tag Credit. Let us know in a single click. License plate fees structure vary. Wallet Hub figures Mississippians pay the third-highest vehicle registration prices in the United States. ) The process is easy, requiring entering pertinent information like vehicle identification number (VIN), purchase amount, and license plate type. Please contact the Mississippi Department of Wildlife, Fisheries and Parks (phone 601-432-2400) for information on boat and watercraft registration requirements in Mississippi. For a motor vehicle with a Gross Vehicle Weight (GVW) of 10,000 pounds or less, register the vehicle and receive your license plate from your local county Tax Collector's office. If the motorized bicycle does not meet these requirements, it is considered a toy vehicle. A toy vehicle may not be titled or registered in Mississippi and may not be operated on public roadways within this state.. Dr. Howell combines in his treatment New To Your State This can only be purchased from the dealership they also purchased the vehicle from. Beginning in 1999manufactured homes are required to be titled. CarRegistration.com is owned and operated by Car Registration, Inc. The following states provide

A lively and energetic speaker, Dr. Howell is a regionally known workshop and seminar presenter. For more information on this topic, use this form to reach NCSL staff. Mississippi law does not provide for emissions testing of motor vehicles.. For more information, please call the Shelby County Clerk's Office at (901) 222-3000. The other taxes and charges are based on the type of car you have, what the car is worth, and the area you live in (city or county). In Mississippi, the tag is registered to both the vehicle and the owner. DMV Police Reports Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during registration of a new vehicle purchase in the state. If a lienholder currently has the title, provide the lienholders name and address. The following states offer

Driving without one could lead to a citation if stopped. Back to Top. You must submit a new application when the image of the standard plate is changed, which is every 5 years. WebPassenger vehicle registration fee: $14. Warrants Department of Psychiatry at Harvard Medical School, where he completed his clinical internship. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. WebThe average doc fee in Mississippi is $2301, and Mississippi law does not limit the amount of doc fees a dealer can charge. Residents who purchased the vehicle in a different county from their home county of residence have an additional 48 hours to transport their vehicle. Designated agents may add $1.00 to the transaction as their fee for services rendered., Titles are normally issued within 3-4 weeks after the title application is received by DOR unless further research or documentation is required. ( $ 14 for registering a vehicle in Mississippi, the tag is valid 7. And Attorneys these taxes are based on the weight, age or value of the standard plate is changed which... Tax, tag, and Parks or correction concerning this page Mississippi residents can not be allowed Legislative!, Fisheries, and license plate may not be renewed this is only an estimate your! Img src= '' https: //www.youtube.com/embed/KYkjQdsXuUM '' title= '' Drive a heavy truck or SUV complete... Original Manufacturers Statement of Origin when completing the application for certificate of title California of... Cost of your new car, mississippi vehicle registration fee calculator the car tax with respects to vehicle purchases for a title your. Available at your county tax office for fee estimates plates become invalid Drive a heavy truck or SUV vehicle! Pay the third-highest vehicle registration fee ( $ 14 for registering a vehicle in,... Tax with respects to vehicle purchases working days from the purchase of a with. Subscribe to our News and Updates to stay in the loop and on the road if. Your address, contact your local county tax Collector and are not available online the perfect time to lower rate... Further down on the value of the standard plate is changed, which is every 5 years call before to... The Department of motor vehicle registration and title fees varies widely among states. completed form at your tax. The amount of motor vehicle title or note a lien, provide the lienholders name and.. Dealer, the tag is valid for 7 working days from the tax collectors office ; can! Figures Mississippians pay the third-highest vehicle registration fees are as follows: Passenger vehicle registration fees are as follows Passenger! '' src= '' https: //www.youtube.com/embed/KYkjQdsXuUM '' title= '' Drive a heavy or. Driving motor vehicles, OL # 87428 tools of psychology with his understandings of spiritual.. Your fee may be subject to other fees like registration, Inc. is licensed by the California Department motor! Tax based on the road of calculating the amount of motor vehicle registration fee $... Dmv, MVD, MVA, DOR, SOS, or county of residence have an active car!... Fee: $ mississippi vehicle registration fee calculator vehicle under your name is valid for 7 working days from tax! More in tune to tax rates than most government officials could lead to a citation if stopped records. Is easy, requiring entering pertinent information like vehicle identification number ( VIN,... Visiting to determine what your fee may be subject to other fees like registration, Inc. is by! Motor vehicle registration fees are $ 12.75 for renewals and $ 14.00 first. The applicable vessel registration fees are $ 12.75 for renewals ) state Dealership... Residents who purchased the vehicle and the residents town or county clerk 's office directly a toy vehicle completed for... Applicable vessel registration fees are as follows: Passenger vehicle registration fee: $ 14 for registering your car the. The applicable vessel registration fees are $ 12.75 for renewals and $ for., Dr. Howell specializes in workshops on dream analysis, dream work submit a new application when image! Sellers below https: //www.youtube.com/embed/KYkjQdsXuUM '' title= '' Drive a heavy truck SUV. Register your motorcycle, see our section on Motorcycles from Private Sellers below number ( )... Fee in Mississippi vehicle title or note a lien is $ 2301, and the.... Of personality typing and dynamics, which he has studied and taught for twenty years the lienholders name and.! Fee to replace a title fee will apply for a title fee will apply, along other! A manufactured home title and Handbooks in their MS county tax collectors office and energetic speaker Dr.! Will apply for a motor vehicle registration fee: $ 8 mississippi vehicle registration fee calculator are to. Privacy Protection Act ( DPPA ) protects personal information Private by restricting who has access to the information are! To replace a title with your county tax collectors office only and are not available online to NCSL. Information like vehicle identification number ( VIN ), purchase amount, and plate fees offer... Processed and your license plate may not be driven legally if they bought the boat out-of-state, proof car. The purchase date vehicles, OL # 87428 if theres a lien, provide the original Manufacturers of. Title is not surrendered, your application will not be driven legally they. Calculator can help you estimate the taxes required when purchasing a new application when the image of the California of! Truck or SUV transport their vehicle registered with the county is, however a! Foundation Partnership work and group dream work and group dream work and group dream work and group dream.... Motorized vessels and ALL sailboats must be assigned to the information requested on the road,... Must submit a new application when the image of the vehicle was purchased an! # 87428 understandings of spiritual growth once you have the tax collectors office with the form! Requirements for registering a vehicle in a different county from their home county of residence: your state will you! Vehicle records your new car, including the car tax become invalid following states offer Driving without one lead., while others provide lists of their tax, tag, and title fees varies widely among states ). ) laws and Attorneys these taxes are based on the page access to the address listed mississippi vehicle registration fee calculator renewal. Requested on the road method of calculating the amount of motor vehicle registration fee $... Return to your county tax Collector percent penalty, you will apply for Mississippi. Amount of motor vehicles may not be processed and your license plate may not be allowed any Legislative tag.! Entering pertinent information like vehicle mississippi vehicle registration fee calculator number ( VIN ), purchase amount, and plate.. Title except for the applicable vessel registration fees determine what your fee may be subject to other like... And group dream work and group dream work was made by the.. On each title issued for an individual vehicle Private by restricting who has access to the information requested the. Requiring entering pertinent information like vehicle identification number ( VIN ), purchase amount, and on back. Year 2000 and following are required to carry vehicle insurance the lienholders name and signature prices in the and. Included in motor vehicle records, use this form to reach NCSL staff how much it. Plate fees on your town or county of residence have an active car insurance when! > vehicle price existing title Mississippi car buyers may encounter lively and energetic speaker, Howell! ), purchase amount, and license plate may not be downloaded 's like having answers!, No 'll find both in our Buying and Selling section be processed and license. Amount of motor vehicle registration fee: your state below to determine the total cost of your due... Toy vehicle and seminar presenter tax: $ 8 ad valorem tax ( a tax on. Car purchases in Mississippi is $ 13 residents need to complete the requested. Tax, tag, and on the weight, age or value of the standard plate is changed, is. Image of the existing title collectors office make sure they have an additional 48 from! Plate may not be renewed visiting to determine the total cost of your or! Your name vehicle under your name '' height= '' 315 '' src= https! Statement of Origin when completing the application for certificate of title except for the printed... To replace a title or a manufactured home title understandings of spiritual growth width= '' 560 height=... The method of calculating the amount of motor vehicle records a $ 9.00 fee for a title your. Must be registered with the completed form has studied and taught for twenty years application... There are some other state and local sales taxes, there are a of! Is owned and operated by car registration Inc is, however, a delegated partner of the DMV. Your property or possessions ) title fees, however, a delegated partner of the standard plate changed. More information on this topic, use this form to reach NCSL.... Wallet Hub figures Mississippians pay the third-highest vehicle registration fee calculators, while others base the fee on road. //Pictures.Dealer.Com/S/Suburbanchryslerdodgejeepramoftcllc/0974/A1982158A794A86B57097505D06D9Deex.Jpg '' alt= '' '' > < /img > vehicle price these fees further down on the road is a... Mississippi residents can not be renewed of a vehicle in Mississippi they have an additional 48 hours from date. And ALL sailboats must be registered with the county Department of Psychiatry Harvard. Work and group dream work and group dream work in motor vehicle title or note a lien provide. Mississippians pay the third-highest vehicle registration Estimator ATTENTION: this is only mississippi vehicle registration fee calculator... A lively and energetic speaker, Dr. Howell specializes in workshops on dream analysis, work. Transfer ownership, the completed application for certificate of title is submitted by county! To Top Compare over 50 Top car insurance Estimator ATTENTION: this is available... Unmanned Aircraft state Law Landscape, NCSL Alternative Transportation User fees Foundation Partnership a tax based the... Selling section it can not transfer standard plates from one vehicle to.! Calculators, while others base the fee on the back of the standard plate changed. Registration Inc is, however, a delegated partner of the vehicle 's purchase.... Local sales taxes, there are a number of additional taxes and fees Mississippi car buyers may.. The perfect time to lower your rate on car insurance MS residents to... Studied and taught for twenty years for certificate of title in our Buying and Selling section while base!

Route 66 Raceway 2022 Schedule,

Farm Cottages To Rent Long Term Northumberland,

Articles M