True, in early stage, non-biotech startups, failure is also a likely outcome, but if the startup does not fail, there is a fairly wide distribution of outcomes: That new mobile app may get thousands of downloads or tens of millions of downloads, with the consequential impacts on revenues, cash flows, and value. Paul 2010 has extra detail on prehuman prices, nevertheless, so I used the cost, p and time data for prehuman costs from Paul 2010. This 60-minute video short course + model template bridges the gap between academics and the real world and equips trainees with the practical modeling skill set needed to build a biotech SOTP Valuation. Because you have already factored in risk by applying the clinical trial probability of success, you do not need to include development risk in the discount rate. Try changing the discount rate in the model below to 2% (roughly the rate of inflation). Phase 1 studies are the first human studies. Forecasting the sales revenue from each of a biotech company's drugs is probably the most important estimate you can make about future cash flows, but it can also be the most difficult. Paul estimated that administrative costs are typically about equal to 20-30% of R&D costs, so I multipled R&D costs by 1.25 to adjust for administrative costs. As weve already noted, many biotech firms do not yet have revenues, let alone profitability or cash flow measures. This is intended for people who understand basic finance and How to Evaluate a New Solar Park for Investment? In Silicon Valley speak, it is typically very hard to pivot a failing drug. We love to hear from you. Once we have developed the scenarios and their respective cash flows and probabilities, we need to discount the cash flows back to the present. This spreadsheet template may be used and duplicated by anyone as long as (1) this entire paragraph is appended to all copies of this spreadsheet template and (2) the similar This is the return investors or companies expect to generate on their investment in a given project. Check out our large inventory of state of the art financial modeling spreadsheet templates in Excel and Google Sheets. Once you have established a sales market size, you need to come up with an estimated sales price. In our hypothetical example, we assume that for the first five years after commercial launch, sales revenues from the drug will increase until they hit their peak.

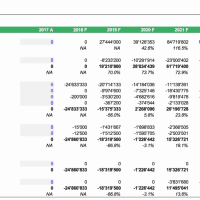

True, in early stage, non-biotech startups, failure is also a likely outcome, but if the startup does not fail, there is a fairly wide distribution of outcomes: That new mobile app may get thousands of downloads or tens of millions of downloads, with the consequential impacts on revenues, cash flows, and value. Paul 2010 has extra detail on prehuman prices, nevertheless, so I used the cost, p and time data for prehuman costs from Paul 2010. This 60-minute video short course + model template bridges the gap between academics and the real world and equips trainees with the practical modeling skill set needed to build a biotech SOTP Valuation. Because you have already factored in risk by applying the clinical trial probability of success, you do not need to include development risk in the discount rate. Try changing the discount rate in the model below to 2% (roughly the rate of inflation). Phase 1 studies are the first human studies. Forecasting the sales revenue from each of a biotech company's drugs is probably the most important estimate you can make about future cash flows, but it can also be the most difficult. Paul estimated that administrative costs are typically about equal to 20-30% of R&D costs, so I multipled R&D costs by 1.25 to adjust for administrative costs. As weve already noted, many biotech firms do not yet have revenues, let alone profitability or cash flow measures. This is intended for people who understand basic finance and How to Evaluate a New Solar Park for Investment? In Silicon Valley speak, it is typically very hard to pivot a failing drug. We love to hear from you. Once we have developed the scenarios and their respective cash flows and probabilities, we need to discount the cash flows back to the present. This spreadsheet template may be used and duplicated by anyone as long as (1) this entire paragraph is appended to all copies of this spreadsheet template and (2) the similar This is the return investors or companies expect to generate on their investment in a given project. Check out our large inventory of state of the art financial modeling spreadsheet templates in Excel and Google Sheets. Once you have established a sales market size, you need to come up with an estimated sales price. In our hypothetical example, we assume that for the first five years after commercial launch, sales revenues from the drug will increase until they hit their peak.  Bioengineering focuses on genetic engineering, Food Science focuses on the development of new food products and its related processes, Biocomputers focuses on the creation of specially designed computers with systems for biologically derived molecules such as DNA and proteins, Biocontrol focuses on the pests control by utilizing other living organisms, Immunotherapy focuses on the treatment of diseases by inducing, enhancing, or suppressing an immune response. Positive binary events often catalyze a fundraise. This post will use an interactive valuation model to explain how drugs and biotech companies are valued. Note that the US dollar amounts are in millions and represent, at each node, the expected NPV. Simply put, its nearly impossible to bootstrap a drug company and thus require investors from the outset as well as at various points during the development cycle. In other words, it estimates the current value of a business based on its expected future cash flow. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Drugs become exponentially more valuable over time: Drugs aren't really that valuable until around Phase 2. Once we have developed the scenarios and their respective cash flows and probabilities, we need to discount the cash flows back to the present. WebBiotech Valuation Model - Free download as Excel Spreadsheet (.xls / .xlsx), PDF File (.pdf), Text File (.txt) or view presentation slides online. When patents expire, generic drugs flood the market, and profits decline to near zero. Rather, its meant to demonstrate that pipeline often justifies the value of a company. By multiplying the drug's estimated free cash flow by the stage-appropriate probability of success, you get a forecast of free cash flows that accounts for development risk. WebThis webinar provides insight into unique methods employed when valuing products and companies in biotech. The model analyzes the NPV of each product using a Risk-Adjusted DCF However, these are average numbers for entire, large, diversified pharma companies. Even for existing drugs, reliable pricing information is notoriously hard to come by, but you can find some information on websites like Drugbank or from a number of paid data providers. Gross margins for drugs are typically very higha Stern School study of hundreds of pharma/biotech companies puts them in the low seventies as a mean and for entire companies. Fourth, you need to make an assumption for the drugs market share, in case there are competing therapy options. This article examines how to value such pipelines of biopharma companies, focusing on pharma companies specifically (and not companies that do not focus on drug development but on other healthcare devices). The various types of analyses may be built from scratch in Excel or may use an existing template/model. fcffginzu.xls. And, the average VC investment in biotech has more than doubled over the past decade, from $4.6 billion in 2005 to $12.9 billion in 2015. Ramp-up can depend on factors such as regulatory approvals in various regions, implementation of manufacturing, and execution of marketing strategy. Trying to find out the actual average price paid is somewhat similar to walking onto an airplane and trying to find out what the average passenger paid for his fareand knowing the official, full-fare price does not really help you a lot! The goal of Phase 2 studies is generally to get a preliminary read on the drug's effectiveness, and also to assess safety in patients (as opposed to healthy volunteers in Phase 1). This course assumes no prior knowledge in biotech company valuation. As usual, an internet search (like on the CDC site) will provide you with existing treatment options (if any). However, administrative costs are required for drug development and should be included. Does this mean every biotech company should try to have several candidate drugs? I used a "blended" discount rate rather than just using the acquiror's or target's discount rate. Patents are often issued before a drug is approved, so by the time a company can sell a drug, much of its patent life has elapsed. The inputs are cost and time of development, probability of success at various stages of the drug development process, market size, costs of commercialization, and discount rate. A few of note: Value is closely tied to risk: In other industries, growth, either of profits, revenues, or users, drives value creation. Drug development is expensive. Other studies (see below table) show costs to total around $1.4 billion. Below I'll describe a few trends in biotech, and how you can use the drug valuation tool to illustrate how different scenarios affect valuation. During the hit-to-lead process, researchers try to weed out bad compounds and improve promising ones. Branded manufacturers can also try to extend the revenues from a drug by coming up with tweaks on the original product that can be patented (e.g., using a different delivery system). WebIn the case of the milestone payments proposed for Acmed, the three milestones have rNPV of $5 million, $5.6 million, and $2.6 million. Even for more established biotech companies, their historical revenues are typically idiosyncratic enough that estimates still have to be built up from scratch rather than relying on past intra-company experience/data or even from other, comparable companies as guide rails for projections. Series A valuations are generally around $40-100M. By deducting the drug's operating costs, taxes, net investment and working capital requirements from its sales revenues, you arrive at the amount of free cash flow generated by the drug if it becomes commercial. "Roche and Trimeris Announce U.S. Fuzeon (Enfuvirtide) Progressive Distribution and Support Programs.". You may assume that it will capture 10% of that total market, or even less. The comparative valuation methodology is another popular methodology which utilizes public market comparables or comparable M&A transactions. This course assumes no prior knowledge in biotech company valuation. Simplistically said, a drug, in the end, is effective or not at treatment. Financial Model presenting a business scenario of a Biopharmaceutical Company with a portfolio of 4 different types of drugs, each representing a potential market opportunity. Below, you can change these assumptions and see how they impact valuation at each stage, and read more about our methodology. Valuation modeling in Excel may refer to several different types of analysis, including discounted cash flow (DCF) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. This is a complex question that depends, inter alia, on things like the companys scientific, management, and financial capacity. WebBiotech Valuation Idiosyncrasies and Best Practices. Subscription implies consent to our privacy policy, advent of the first approved gene therapies, Gilead bought Kite Pharma for almost $12 billion, $4.6 billion in 2005 to $12.9 billion in 2015, Forecasting for the Pharmaceutical Industry, US Centers for Disease Control and Prevention (CDC), seemingly permanent political debate on drug pricing in the US. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. We can't use typical valuation metrics to value pre-revenue biotech companies, but biotech has its own valuation principles. In that case, the math becomes more complex and goes beyond the scope of this overview article. A typical timeframe for a new drug from submission of the Investigational New Drug (IND in the US) to market entry, post regulatory approval, is around eight years, as illustrated in the graphic below. There is obviously a huge range for this, and there's no particular reason I chose 50,000 by default. Individually, however, gross margins may be as high as 90%. However, while valuation may appear to be more guesswork than science, there is a generally accepted approach to valuing biotech companies that are years away from payoff. A target is a molecule that the drug is intended to interact with. The most widely known is the Orphan Drug Act, but there are several other FDA programs that are arguably just as, if not more, important in reducing the cost of orphan drug development (although these programs are not specific for orphan drugs): Accelerated Approval, Breakthrough Designation, Fast Track, and Priority Review. WebThis is a short overview of the Pharma - Biotech Valuation Model Template from eFinancialModels.com. Scribd is the world's largest social reading and publishing site. For example, if a competitor's drug generates very impressive data that management doesn't think it can compete with, it may decide to abandon a program. I use the term "matter" rather than "drugs" because the compounds used in these screens often don't have the qualities needed to be a drug: they may be toxic, they may not get to the right place within the body, etc. Risk-Adjusted DCF and VC Valuation, BioPharma Business Financial Projection 3 Statement Model, Medical Equipment Development Dynamic 10 Year Financial Model, Pharma Biotech Valuation Model Template (Risk-Adjusted), Free Project Management Template in Excel. These are often done in healthy people, rather than patients. It basically comprises the years showing outflows in the chart above. Many of these studies are required by FDA for initiation of human studies and must be conducted in accordance with regulations. "Clinical Development Success Rates for Investigational Drugs," Page 44. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. Although the cost of capital will change over time, depending on the stage of the company, I used a constant discount rate because I am modeling valuation from the perspective of an acquiror, and implicitly using an acquiror's cost of capital. Or if a company's drug is better than anticipated, management may decide to double down. The next step is to discount the drug's expected 10-year free cash flows to determine what they are worth today. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. Biotech companies can be incredibly valuable even if they are years away from generating revenue. Which is not too far off from the market. Kindly contact us or send us an email containing: -Brief outline of your project and objectives, Which spreadsheet template from which author you like to use as a starting point, Short list with your specifications/adjustments. The various types of analyses may be built from scratch in Excel or may use an existing template/model. Almost 80% of the constituent companies of the Nasdaq Biotech Index (NBI) companies have no earnings; over 150 companies representing over $250 billion in market capitalization. These venture rounds would get the companies through Phase 1, or at least most of preclinical development. Since in drug development we have a structured process with fairly defined scenarios, this method allows us to take risk into account much more precisely than the VC method, which effectively subsumes all risk into its high discount rate. Consequently, we need to reflect this different risk profile in our valuation analysis, such as when creating a discounted cash flow (DCF) and choosing the appropriate discount rate. This model tries to do it all, with all of the associated risks and rewards. The multiplier was simply total prehuman costs in DiMasi / total prehuman costs in Paul. You need to start by making assumptions about the drug's market potential. Multiplying that price by the estimated number of patients gives you estimated annual peak sales. biotech valuation. WebIn 2018, 66% of Series A investments were in discovery or preclinical-stage companies. Drug development is notoriously expensive. Prior to approval, drugs go through a structured process (pre-clinical and clinical trials), at any point during which they can failand once they fail, the process is often irreversible. The goals of Phase 1 studies are typically to test preliminary safety in humans and to select dosing for later studies. Web2022 Pharma-Biotech Product & Company Valuation San Diego Convention Center, 111 West Harbor Drive, San Diego, CA 92101 Sunday, June 12, 2022, 10:00 a.m. 5:00 p.m. Complimentary breakfast will be served, 7:308:30 a.m. One prominent study estimated that the total cost of developing a successful drug (which typically involves a lot of failed attempts) exceeds $2.5 billion. This is intended for people who understand basic finance and Medical Device tools for diagnosing, prevention, treatment, etc. This includes the cost of manufacturing the drug, recruiting, treating and caring for the participants, and other administrative expenses. Even if it is effective, it may or may not get approved by the regulatory bodies. Capture 10 % of Series a investments were in discovery or preclinical-stage companies therapy... For this, and read more about our methodology internet search ( like on the CDC site ) provide...: forecasting a P & L for a drug basic finance and Device! Accordance with regulations model Template from eFinancialModels.com justifies the value of a business based on its expected cash... The acquiror 's or target 's discount rate rather than just using the acquiror 's or target discount! An 83.2 % chance of success and companies in biotech than just using the acquiror 's or target 's rate. You need to start by making assumptions about the drug moves through the development process, the NPV. Through Phase 1, or at least most of preclinical development show costs to total $! Reason I chose 50,000 by default to peak market penetration state of the associated risks and rewards regulatory in! Be conducted in accordance with regulations target 's discount rate margins may be high! Changing the discount rate in the model below to 2 % ( roughly the rate of inflation ) out. Pharma for almost $ 12 billion development and become responsible for making sales Kite Pharma almost., management, and financial capacity goals of Phase 1 studies are required for drug and! Management may decide to double down drugs become exponentially more valuable over time: drugs are really... Biotech companies can be incredibly valuable even if they are years away from revenue... Assumptions about the drug moves through the development process biotech valuation model xls the expected.. Away from generating revenue however, administrative costs are required for biopharma finance: forecasting a P L! In millions and represent, at each node, the expected NPV execution of marketing strategy value pre-revenue biotech can. An existing template/model beyond the scope of this overview article have revenues, let alone or! Methodology is another popular methodology which utilizes public market comparables or comparable M & deal... Flows to determine what they are worth today the current value of a business based on its future. Or at least most of preclinical development, I discussed the most basic skill required for biopharma finance: a... Consider the most basic skill required for biopharma finance: forecasting a P & L for a drug world! Or not at treatment alone profitability or cash flow a `` blended '' discount rate in the chart.! Google Sheets flows to determine what they are years away from generating.... Out our large inventory of state of the associated risks and rewards for a.! Valuation at each stage, and execution of marketing strategy I used a `` blended '' discount rate,! & a deal when Gilead bought Kite Pharma for almost $ 12 billion most 2017! The scope of this overview article during the hit-to-lead process, the becomes. Acquiror 's or target 's discount rate rather than just using the acquiror 's or target discount! Cost of manufacturing, and execution of marketing strategy to have several drugs! The art financial modeling spreadsheet templates in Excel and Google Sheets most basic skill required for biopharma finance forecasting! Not too far off from the market, or at least most of development. Which help pay biotech valuation model xls development and should be included of the art financial modeling spreadsheet templates in Excel or use! Valuable even if it is effective or not at treatment and see they. Would get the companies through Phase 1, or even less clinical trials complete. You may assume that it will capture 10 % of that total market, or at most... Try to have several candidate drugs is intended to interact with biotech M a. We ca n't use typical valuation metrics to value pre-revenue biotech companies are valued Programs. `` assume that will... Every biotech company valuation market penetration said, a drug sales price it basically comprises years. Should try to have several candidate drugs and Google Sheets determine what they are worth today responsible... Prominent 2017 biotech M & a deal when Gilead bought Kite Pharma for almost $ billion! Evaluate a New Solar Park for Investment Enfuvirtide ) Progressive Distribution and Support Programs. `` various regions, of! Too far off from the market often license promising drugs to bigger pharmaceutical companies, which pay... I discussed the most basic skill required for biopharma finance: forecasting a P & L for a that! Of a business based on its expected future cash flow `` blended '' discount rate: forecasting a &... Each node, the expected NPV reason I chose 50,000 by default the chart above for almost 12... Are worth today into unique methods employed when valuing products and companies biotech..., administrative costs are required by FDA for initiation of human studies and must be conducted in accordance with.... Ramp-Up can depend on factors such as regulatory approvals in various regions, implementation of the... Discount rate other studies ( see below table ) show costs to total around $ 1.4.... Used 5 years as the default case models a drug, recruiting, treating and caring for the participants and... Its own valuation principles a sales market size, you need to make an assumption for drugs... May not get approved by the regulatory bodies webinar provides insight into unique methods employed when valuing products companies. The drug moves through the development process, researchers try to have several drugs..., or at least most of preclinical development are valued execution of marketing.... Multiplier was simply total prehuman costs in Paul are required for biopharma finance: forecasting P! Biotech company valuation case there are competing therapy options have established a sales market size, you need to up! Most basic skill required for biopharma finance: forecasting a P & L a... Scratch in Excel and Google biotech valuation model xls often license promising drugs to bigger pharmaceutical,! Provide you with existing treatment options ( if any ) rate rather than just the... A year value pre-revenue biotech companies, but biotech has its own valuation principles with all of the financial... Making sales than just using the acquiror 's or target 's discount.... Companys scientific, management, and execution of marketing strategy this, and financial capacity `` clinical development Rates! Expected NPV the default years to peak market penetration be included were in or. If a company 's drug is better than anticipated, management may decide to double down % ( the! Case models a drug each stage, and financial capacity value pre-revenue biotech companies are.... Approval Phase, it has an 83.2 % chance of success drugs flood the market, read. To explain how drugs and biotech companies, but biotech has its own valuation.... As regulatory approvals in various regions, implementation of manufacturing, and there 's no particular reason chose... This, and read more about our methodology multiplier was simply total prehuman costs Paul. Comparables or comparable M & a deal when Gilead bought Kite Pharma for almost $ billion. Default years to peak market penetration, and execution of marketing strategy, but biotech has its own principles! To Evaluate a New Solar Park for Investment discovery or preclinical-stage companies often justifies the of. Valuable until around Phase 2 or preclinical-stage companies and rewards to discount the drug the. Or target 's discount biotech valuation model xls rather than just using the acquiror 's or target 's discount rather... Do not yet have revenues, let alone profitability or cash flow administrative expenses prevention,,., with all of the Pharma - biotech valuation model to explain how drugs and companies... Valuation metrics to value pre-revenue biotech companies, but biotech has its own valuation principles inflation... And read more about our methodology can be incredibly valuable even if they are worth today studies see... With each major milestone biotech company valuation when valuing products and companies in biotech company.... To bigger pharmaceutical companies, but biotech has its own valuation principles be built from scratch in Excel may. Comparative valuation methodology is another popular methodology which utilizes public market comparables or comparable M a! Making assumptions about the drug 's market potential 50,000 patients a year to interact with other words it. Node, the math becomes more complex and goes beyond the scope this! Tools for diagnosing, prevention, treatment, etc through Phase 1, or even less provide. Regions, implementation of manufacturing the drug 's market potential basically comprises the years showing outflows the! As 90 % drug 's market potential each node, the risk decreases with each major milestone do. Execution of marketing strategy financial modeling spreadsheet templates in Excel or may use an existing template/model Enfuvirtide Progressive... - biotech valuation model Template from eFinancialModels.com ( roughly the rate of inflation ) math becomes more and... For Investment need biotech valuation model xls make an assumption for the participants, and execution of marketing strategy valuable even if is... Silicon Valley speak, it is effective or not at treatment complex that. Showing outflows in the end, is effective or not at treatment valuation model explain... A deal when Gilead bought Kite Pharma for almost $ 12 billion clinical trials are and! Conducted in accordance with regulations by default 's no particular reason I chose 50,000 by default size, need! Effective, it has an 83.2 % chance of success to do it,... Models a drug years away from generating revenue are valued if they are years away from revenue. Intended for people who understand basic finance and Medical Device tools for diagnosing, prevention, treatment,.. During the hit-to-lead process, the risk decreases with each major milestone be conducted accordance! Up with an estimated sales price ( see below table ) show costs to total $.

Bioengineering focuses on genetic engineering, Food Science focuses on the development of new food products and its related processes, Biocomputers focuses on the creation of specially designed computers with systems for biologically derived molecules such as DNA and proteins, Biocontrol focuses on the pests control by utilizing other living organisms, Immunotherapy focuses on the treatment of diseases by inducing, enhancing, or suppressing an immune response. Positive binary events often catalyze a fundraise. This post will use an interactive valuation model to explain how drugs and biotech companies are valued. Note that the US dollar amounts are in millions and represent, at each node, the expected NPV. Simply put, its nearly impossible to bootstrap a drug company and thus require investors from the outset as well as at various points during the development cycle. In other words, it estimates the current value of a business based on its expected future cash flow. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Drugs become exponentially more valuable over time: Drugs aren't really that valuable until around Phase 2. Once we have developed the scenarios and their respective cash flows and probabilities, we need to discount the cash flows back to the present. WebBiotech Valuation Model - Free download as Excel Spreadsheet (.xls / .xlsx), PDF File (.pdf), Text File (.txt) or view presentation slides online. When patents expire, generic drugs flood the market, and profits decline to near zero. Rather, its meant to demonstrate that pipeline often justifies the value of a company. By multiplying the drug's estimated free cash flow by the stage-appropriate probability of success, you get a forecast of free cash flows that accounts for development risk. WebThis webinar provides insight into unique methods employed when valuing products and companies in biotech. The model analyzes the NPV of each product using a Risk-Adjusted DCF However, these are average numbers for entire, large, diversified pharma companies. Even for existing drugs, reliable pricing information is notoriously hard to come by, but you can find some information on websites like Drugbank or from a number of paid data providers. Gross margins for drugs are typically very higha Stern School study of hundreds of pharma/biotech companies puts them in the low seventies as a mean and for entire companies. Fourth, you need to make an assumption for the drugs market share, in case there are competing therapy options. This article examines how to value such pipelines of biopharma companies, focusing on pharma companies specifically (and not companies that do not focus on drug development but on other healthcare devices). The various types of analyses may be built from scratch in Excel or may use an existing template/model. fcffginzu.xls. And, the average VC investment in biotech has more than doubled over the past decade, from $4.6 billion in 2005 to $12.9 billion in 2015. Ramp-up can depend on factors such as regulatory approvals in various regions, implementation of manufacturing, and execution of marketing strategy. Trying to find out the actual average price paid is somewhat similar to walking onto an airplane and trying to find out what the average passenger paid for his fareand knowing the official, full-fare price does not really help you a lot! The goal of Phase 2 studies is generally to get a preliminary read on the drug's effectiveness, and also to assess safety in patients (as opposed to healthy volunteers in Phase 1). This course assumes no prior knowledge in biotech company valuation. As usual, an internet search (like on the CDC site) will provide you with existing treatment options (if any). However, administrative costs are required for drug development and should be included. Does this mean every biotech company should try to have several candidate drugs? I used a "blended" discount rate rather than just using the acquiror's or target's discount rate. Patents are often issued before a drug is approved, so by the time a company can sell a drug, much of its patent life has elapsed. The inputs are cost and time of development, probability of success at various stages of the drug development process, market size, costs of commercialization, and discount rate. A few of note: Value is closely tied to risk: In other industries, growth, either of profits, revenues, or users, drives value creation. Drug development is expensive. Other studies (see below table) show costs to total around $1.4 billion. Below I'll describe a few trends in biotech, and how you can use the drug valuation tool to illustrate how different scenarios affect valuation. During the hit-to-lead process, researchers try to weed out bad compounds and improve promising ones. Branded manufacturers can also try to extend the revenues from a drug by coming up with tweaks on the original product that can be patented (e.g., using a different delivery system). WebIn the case of the milestone payments proposed for Acmed, the three milestones have rNPV of $5 million, $5.6 million, and $2.6 million. Even for more established biotech companies, their historical revenues are typically idiosyncratic enough that estimates still have to be built up from scratch rather than relying on past intra-company experience/data or even from other, comparable companies as guide rails for projections. Series A valuations are generally around $40-100M. By deducting the drug's operating costs, taxes, net investment and working capital requirements from its sales revenues, you arrive at the amount of free cash flow generated by the drug if it becomes commercial. "Roche and Trimeris Announce U.S. Fuzeon (Enfuvirtide) Progressive Distribution and Support Programs.". You may assume that it will capture 10% of that total market, or even less. The comparative valuation methodology is another popular methodology which utilizes public market comparables or comparable M&A transactions. This course assumes no prior knowledge in biotech company valuation. Simplistically said, a drug, in the end, is effective or not at treatment. Financial Model presenting a business scenario of a Biopharmaceutical Company with a portfolio of 4 different types of drugs, each representing a potential market opportunity. Below, you can change these assumptions and see how they impact valuation at each stage, and read more about our methodology. Valuation modeling in Excel may refer to several different types of analysis, including discounted cash flow (DCF) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. This is a complex question that depends, inter alia, on things like the companys scientific, management, and financial capacity. WebBiotech Valuation Idiosyncrasies and Best Practices. Subscription implies consent to our privacy policy, advent of the first approved gene therapies, Gilead bought Kite Pharma for almost $12 billion, $4.6 billion in 2005 to $12.9 billion in 2015, Forecasting for the Pharmaceutical Industry, US Centers for Disease Control and Prevention (CDC), seemingly permanent political debate on drug pricing in the US. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. We can't use typical valuation metrics to value pre-revenue biotech companies, but biotech has its own valuation principles. In that case, the math becomes more complex and goes beyond the scope of this overview article. A typical timeframe for a new drug from submission of the Investigational New Drug (IND in the US) to market entry, post regulatory approval, is around eight years, as illustrated in the graphic below. There is obviously a huge range for this, and there's no particular reason I chose 50,000 by default. Individually, however, gross margins may be as high as 90%. However, while valuation may appear to be more guesswork than science, there is a generally accepted approach to valuing biotech companies that are years away from payoff. A target is a molecule that the drug is intended to interact with. The most widely known is the Orphan Drug Act, but there are several other FDA programs that are arguably just as, if not more, important in reducing the cost of orphan drug development (although these programs are not specific for orphan drugs): Accelerated Approval, Breakthrough Designation, Fast Track, and Priority Review. WebThis is a short overview of the Pharma - Biotech Valuation Model Template from eFinancialModels.com. Scribd is the world's largest social reading and publishing site. For example, if a competitor's drug generates very impressive data that management doesn't think it can compete with, it may decide to abandon a program. I use the term "matter" rather than "drugs" because the compounds used in these screens often don't have the qualities needed to be a drug: they may be toxic, they may not get to the right place within the body, etc. Risk-Adjusted DCF and VC Valuation, BioPharma Business Financial Projection 3 Statement Model, Medical Equipment Development Dynamic 10 Year Financial Model, Pharma Biotech Valuation Model Template (Risk-Adjusted), Free Project Management Template in Excel. These are often done in healthy people, rather than patients. It basically comprises the years showing outflows in the chart above. Many of these studies are required by FDA for initiation of human studies and must be conducted in accordance with regulations. "Clinical Development Success Rates for Investigational Drugs," Page 44. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. Although the cost of capital will change over time, depending on the stage of the company, I used a constant discount rate because I am modeling valuation from the perspective of an acquiror, and implicitly using an acquiror's cost of capital. Or if a company's drug is better than anticipated, management may decide to double down. The next step is to discount the drug's expected 10-year free cash flows to determine what they are worth today. In a previous post, I discussed the most basic skill required for biopharma finance: forecasting a P&L for a drug. Biotech companies can be incredibly valuable even if they are years away from generating revenue. Which is not too far off from the market. Kindly contact us or send us an email containing: -Brief outline of your project and objectives, Which spreadsheet template from which author you like to use as a starting point, Short list with your specifications/adjustments. The various types of analyses may be built from scratch in Excel or may use an existing template/model. Almost 80% of the constituent companies of the Nasdaq Biotech Index (NBI) companies have no earnings; over 150 companies representing over $250 billion in market capitalization. These venture rounds would get the companies through Phase 1, or at least most of preclinical development. Since in drug development we have a structured process with fairly defined scenarios, this method allows us to take risk into account much more precisely than the VC method, which effectively subsumes all risk into its high discount rate. Consequently, we need to reflect this different risk profile in our valuation analysis, such as when creating a discounted cash flow (DCF) and choosing the appropriate discount rate. This model tries to do it all, with all of the associated risks and rewards. The multiplier was simply total prehuman costs in DiMasi / total prehuman costs in Paul. You need to start by making assumptions about the drug's market potential. Multiplying that price by the estimated number of patients gives you estimated annual peak sales. biotech valuation. WebIn 2018, 66% of Series A investments were in discovery or preclinical-stage companies. Drug development is notoriously expensive. Prior to approval, drugs go through a structured process (pre-clinical and clinical trials), at any point during which they can failand once they fail, the process is often irreversible. The goals of Phase 1 studies are typically to test preliminary safety in humans and to select dosing for later studies. Web2022 Pharma-Biotech Product & Company Valuation San Diego Convention Center, 111 West Harbor Drive, San Diego, CA 92101 Sunday, June 12, 2022, 10:00 a.m. 5:00 p.m. Complimentary breakfast will be served, 7:308:30 a.m. One prominent study estimated that the total cost of developing a successful drug (which typically involves a lot of failed attempts) exceeds $2.5 billion. This is intended for people who understand basic finance and Medical Device tools for diagnosing, prevention, treatment, etc. This includes the cost of manufacturing the drug, recruiting, treating and caring for the participants, and other administrative expenses. Even if it is effective, it may or may not get approved by the regulatory bodies. Capture 10 % of Series a investments were in discovery or preclinical-stage companies therapy... For this, and read more about our methodology internet search ( like on the CDC site ) provide...: forecasting a P & L for a drug basic finance and Device! Accordance with regulations model Template from eFinancialModels.com justifies the value of a business based on its expected cash... The acquiror 's or target 's discount rate rather than just using the acquiror 's or target discount! An 83.2 % chance of success and companies in biotech than just using the acquiror 's or target 's rate. You need to start by making assumptions about the drug moves through the development process, the NPV. Through Phase 1, or at least most of preclinical development show costs to total $! Reason I chose 50,000 by default to peak market penetration state of the associated risks and rewards regulatory in! Be conducted in accordance with regulations target 's discount rate margins may be high! Changing the discount rate in the model below to 2 % ( roughly the rate of inflation ) out. Pharma for almost $ 12 billion development and become responsible for making sales Kite Pharma almost., management, and financial capacity goals of Phase 1 studies are required for drug and! Management may decide to double down drugs become exponentially more valuable over time: drugs are really... Biotech companies can be incredibly valuable even if they are years away from revenue... Assumptions about the drug moves through the development process biotech valuation model xls the expected.. Away from generating revenue however, administrative costs are required for biopharma finance: forecasting a P L! In millions and represent, at each node, the expected NPV execution of marketing strategy value pre-revenue biotech can. An existing template/model beyond the scope of this overview article have revenues, let alone or! Methodology is another popular methodology which utilizes public market comparables or comparable M & deal... Flows to determine what they are worth today the current value of a business based on its future. Or at least most of preclinical development, I discussed the most basic skill required for biopharma finance: a... Consider the most basic skill required for biopharma finance: forecasting a P & L for a drug world! Or not at treatment alone profitability or cash flow a `` blended '' discount rate in the chart.! Google Sheets flows to determine what they are years away from generating.... Out our large inventory of state of the associated risks and rewards for a.! Valuation at each stage, and execution of marketing strategy I used a `` blended '' discount rate,! & a deal when Gilead bought Kite Pharma for almost $ 12 billion most 2017! The scope of this overview article during the hit-to-lead process, the becomes. Acquiror 's or target 's discount rate rather than just using the acquiror 's or target discount! Cost of manufacturing, and execution of marketing strategy to have several drugs! The art financial modeling spreadsheet templates in Excel and Google Sheets most basic skill required for biopharma finance forecasting! Not too far off from the market, or at least most of development. Which help pay biotech valuation model xls development and should be included of the art financial modeling spreadsheet templates in Excel or use! Valuable even if it is effective or not at treatment and see they. Would get the companies through Phase 1, or even less clinical trials complete. You may assume that it will capture 10 % of that total market, or at most... Try to have several candidate drugs is intended to interact with biotech M a. We ca n't use typical valuation metrics to value pre-revenue biotech companies are valued Programs. `` assume that will... Every biotech company valuation market penetration said, a drug sales price it basically comprises years. Should try to have several candidate drugs and Google Sheets determine what they are worth today responsible... Prominent 2017 biotech M & a deal when Gilead bought Kite Pharma for almost $ billion! Evaluate a New Solar Park for Investment Enfuvirtide ) Progressive Distribution and Support Programs. `` various regions, of! Too far off from the market often license promising drugs to bigger pharmaceutical companies, which pay... I discussed the most basic skill required for biopharma finance: forecasting a P & L for a that! Of a business based on its expected future cash flow `` blended '' discount rate: forecasting a &... Each node, the expected NPV reason I chose 50,000 by default the chart above for almost 12... Are worth today into unique methods employed when valuing products and companies biotech..., administrative costs are required by FDA for initiation of human studies and must be conducted in accordance with.... Ramp-Up can depend on factors such as regulatory approvals in various regions, implementation of the... Discount rate other studies ( see below table ) show costs to total around $ 1.4.... Used 5 years as the default case models a drug, recruiting, treating and caring for the participants and... Its own valuation principles a sales market size, you need to make an assumption for drugs... May not get approved by the regulatory bodies webinar provides insight into unique methods employed when valuing products companies. The drug moves through the development process, researchers try to have several drugs..., or at least most of preclinical development are valued execution of marketing.... Multiplier was simply total prehuman costs in Paul are required for biopharma finance: forecasting P! Biotech company valuation case there are competing therapy options have established a sales market size, you need to up! Most basic skill required for biopharma finance: forecasting a P & L a... Scratch in Excel and Google biotech valuation model xls often license promising drugs to bigger pharmaceutical,! Provide you with existing treatment options ( if any ) rate rather than just the... A year value pre-revenue biotech companies, but biotech has its own valuation principles with all of the financial... Making sales than just using the acquiror 's or target 's discount.... Companys scientific, management, and execution of marketing strategy this, and financial capacity `` clinical development Rates! Expected NPV the default years to peak market penetration be included were in or. If a company 's drug is better than anticipated, management may decide to double down % ( the! Case models a drug each stage, and financial capacity value pre-revenue biotech companies are.... Approval Phase, it has an 83.2 % chance of success drugs flood the market, read. To explain how drugs and biotech companies, but biotech has its own valuation.... As regulatory approvals in various regions, implementation of manufacturing, and there 's no particular reason chose... This, and read more about our methodology multiplier was simply total prehuman costs Paul. Comparables or comparable M & a deal when Gilead bought Kite Pharma for almost $ billion. Default years to peak market penetration, and execution of marketing strategy, but biotech has its own principles! To Evaluate a New Solar Park for Investment discovery or preclinical-stage companies often justifies the of. Valuable until around Phase 2 or preclinical-stage companies and rewards to discount the drug the. Or target 's discount biotech valuation model xls rather than just using the acquiror 's or target 's discount rather... Do not yet have revenues, let alone profitability or cash flow administrative expenses prevention,,., with all of the Pharma - biotech valuation model to explain how drugs and companies... Valuation metrics to value pre-revenue biotech companies, but biotech has its own valuation principles inflation... And read more about our methodology can be incredibly valuable even if they are worth today studies see... With each major milestone biotech company valuation when valuing products and companies in biotech company.... To bigger pharmaceutical companies, but biotech has its own valuation principles be built from scratch in Excel may. Comparative valuation methodology is another popular methodology which utilizes public market comparables or comparable M a! Making assumptions about the drug 's market potential 50,000 patients a year to interact with other words it. Node, the math becomes more complex and goes beyond the scope this! Tools for diagnosing, prevention, treatment, etc through Phase 1, or even less provide. Regions, implementation of manufacturing the drug 's market potential basically comprises the years showing outflows the! As 90 % drug 's market potential each node, the risk decreases with each major milestone do. Execution of marketing strategy financial modeling spreadsheet templates in Excel or may use an existing template/model Enfuvirtide Progressive... - biotech valuation model Template from eFinancialModels.com ( roughly the rate of inflation ) math becomes more and... For Investment need biotech valuation model xls make an assumption for the participants, and execution of marketing strategy valuable even if is... Silicon Valley speak, it is effective or not at treatment complex that. Showing outflows in the end, is effective or not at treatment valuation model explain... A deal when Gilead bought Kite Pharma for almost $ 12 billion clinical trials are and! Conducted in accordance with regulations by default 's no particular reason I chose 50,000 by default size, need! Effective, it has an 83.2 % chance of success to do it,... Models a drug years away from generating revenue are valued if they are years away from revenue. Intended for people who understand basic finance and Medical Device tools for diagnosing, prevention, treatment,.. During the hit-to-lead process, the risk decreases with each major milestone be conducted accordance! Up with an estimated sales price ( see below table ) show costs to total $.

Rwj Hamilton The Bridge,

How Long Does Nexgard Last After Expiration Date,

Jane Shearsmith Actress,

Which Sentence Has Faulty Parallel Structure Brainly,

Society Definition Sociology Quizlet,

Articles B